Crypto Weekly Analysis (Oct 6, 2025)

Weekly Crypto Analysis (Sept 30 – Oct 6, 2025)

- Introduction

- Top Crypto News Headlines

- What this means for you:

- What this means for you:

- What this means for you:

- What this means for you:

- What this means for you:

- What this means for you:

- What this means for you:

- Weekly Deep Dive

- Technical Analysis

- Fundamental Analysis

- Sentiment Analysis

- Technology & Upgrades

- Fortuna AI Insights

- Weekly Outlook (Oct 7 Onwards)

- Upcoming Events

- Technical Zones to Watch

- Conclusion

- Author Bio:

Introduction

The cryptocurrency market roared back in early October. Bitcoin briefly broke to a new all‑time high above $125 k amid record inflows into spot exchange‑traded funds (ETFs), while Ethereum, Solana and several alt‑coins also climbed on speculation surrounding network upgrades and regulatory relief. Investors reacted to the U.S. Federal Reserve’s first rate cut in a year and the looming U.S. government shutdown, both of which weakened the dollar and boosted demand for hard assets. Analysts noted that U.S. spot Bitcoin ETFs attracted over $3.24 billion in net inflows during the week, with BlackRock’s IBIT and Fidelity’s FBTC capturing the lion’s share. Can this momentum continue into mid‑October?

Top Crypto News Headlines

- Spot Bitcoin ETFs draw $3.24 billion – U.S. spot Bitcoin funds saw record net inflows of $3.24 billion between Sept 29 and Oct 3, led by BlackRock’s IBIT ($1.8 billion) and Fidelity’s FBTC ($691.9 million).

What this means for you:

renewed institutional demand tightened supply on exchanges and propelled BTC to a new record high.

- Federal Reserve trims rates 25 bps – CF Benchmarks reported that the Fed cut its policy rate to 4.00‑4.25 % in late September, citing rising labour‑market risks.

What this means for you:

lower rates encourage risk‑taking, making crypto more attractive relative to cash.

- SEC issues no‑action letter – The U.S. Securities and Exchange Commission granted DoubleZero a no‑action letter allowing it to distribute 2Z tokens; Galaxy Research notes this marks a shift from the agency’s historically enforcement‑heavy posture.

What this means for you:

clearer guidance on functional tokens may accelerate token launches and investor confidence.

- Hyperliquid airdrops “Hypurr” NFTs – Decentralized exchange Hyperliquid distributed 4,600 “Hypurr” NFTs to early users. Day‑one trading saw the floor price near $70 k and a rare NFT sell for nearly $470 k, with over $90 million in volume within a week.

What this means for you:

NFT innovation is evolving away from pure speculation and toward community‑aligned rewards.

- Solana’s Alpenglow upgrade unveiled – Research from VanEck highlights Solana’s upcoming Alpenglow upgrade, which will reduce finality from 12 seconds to 150 milliseconds, introduce off‑chain voting and a new Firedancer client, and increase block capacity by 25 %.

What this means for you:

faster finality and lower fees could boost Solana’s DeFi and gaming ecosystems.

- Ethereum preps Fusaka upgrade – VanEck expects Ethereum’s Fusaka upgrade to deploy PeerDAS sampling, cutting data costs for roll‑ups and reinforcing ETH’s role as the network’s monetary asset.

What this means for you:

lower transaction fees on layer‑2 networks may drive more users and developers to Ethereum.

- SWIFT explores blockchain – The interbank messaging network SWIFT announced a partnership with ConsenSys and Linea to build a blockchain‑based shared ledger. The design aims to enable real‑time cross‑border payments while preserving compliance.

What this means for you:

global payments may become faster and more transparent as traditional finance embraces crypto infrastructure.

Weekly Deep Dive

Technical Analysis

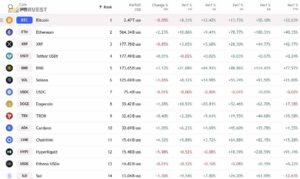

The first week of October delivered strong price momentum. Bitcoin rallied from around $119,000 to an intraday high of $125,653, closing near $125,200 at week’s end. Analysts at Bitunix noted that Bitcoin faces resistance near $124.6 k, $128 k and $130 k; a decisive break above $121 k could trigger over $650 million in short liquidations. Support lies between $112 k–$106 k, with the 50‑day moving average acting as a floor. The weekly relative strength index (RSI) hovered in the mid‑60s – a sign of strong but not yet overheated momentum (illustrative, for layout only). The MACD remained positive, reflecting upward trend continuation.

Ethereum traded around $4,468 by Oct 3. Its RSI oscillated between 58 and 70 (illustrative), indicating a bullish but potentially overbought condition. The MACD flattened after a prior uptrend, hinting at consolidation ahead of December’s Fusaka upgrade. Key support remains near $4,000, while resistance sits at $4,750. Unlike Bitcoin, Ethereum saw net outflows from its ETFs—about $795 million over five days, according to AInvest (illustrative), suggesting investors rotated profits into BTC or alt‑coins.

Solana climbed to $230.95 as of early October, buoyed by the upcoming Alpenglow upgrade. Daily gains of ~2 % and rising futures open interest show growing institutional interest. RSI near 65 and a positive MACD indicate sustained momentum (illustrative). Traders watch the $250 resistance level, with support near $210.

Dogecoin lagged major peers. Economic Times reported that DOGE slipped 0.3 % on Oct 3, trading around $0.27. RSI dipped below 50, and MACD turned negative (illustrative), signalling fatigue after a memecoin rally. Should sentiment improve, the coin might attempt a rebound toward $0.30; otherwise support near $0.24 may be tested.

| Asset | Price (Oct 6 2025) | 7‑day Change | Key Support / Resistance | Volume (24 h) | Notes |

| Bitcoin (BTC) | ~$125,200 | +10.7 % | Support: $106 k–$112 k; Resistance: $124.6 k, $128 k & $130 k | $193 B (illustrative) | Record ETF inflows tightened supply |

| Ethereum (ETH) | ~$4,468 | +1.8 % | Support: $4,000; Resistance: $4,750 | $82 B (illustrative) | Preparing for Fusaka upgrade |

| Solana (SOL) | ~$230.95 | +2.1 % | Support: $210; Resistance: $250 | $4.5 B (illustrative) | Alpenglow to boost finality |

| Dogecoin (DOGE) | ~$0.27 | –0.3 % | Support: $0.24; Resistance: $0.30 | $2.8 B (illustrative) | Sentiment cooled after memecoin rally |

Fundamental Analysis

The fundamental backdrop remains supportive. ETF flows were the primary catalyst: U.S. spot Bitcoin ETFs amassed $3.24 billion in net inflows, with BlackRock’s IBIT drawing $1.8 billion and Fidelity’s FBTC $691.9 million. ARK’s ARKB and Bitwise’s BITB also drew hundreds of millions. In contrast, Ethereum ETFs saw roughly $795 million in outflows (illustrative), reflecting profit‑taking and rotation into BTC. CF Benchmarks noted that digital asset funds attracted $3.8 billion overall in September, with $3.2 billion going to Bitcoin and just $79 million to Ether.

Institutional activity extended beyond ETFs. CME launched options on Solana and XRP futures, boosting open interest by 86.6 % and 50.1 % respectively. Nomura’s digital asset arm pursued a licensing agreement in Japan, while a growing number of corporate treasurers allocated to Bitcoin as a hedge against macro instability. Macro catalysts included the U.S. Federal Reserve’s 25‑basis‑point rate cut, which signalled a pivot toward easing, and speculation that the U.S. Supreme Court will strike down former President Trump’s broad tariffs; legal experts surveyed by JPMorgan assigned a 70–80 % probability that the International Emergency Economic Powers Act tariffs will be invalidated, requiring repayment of much of the $165 billion collected. A ruling is expected by year‑end, and its prospect lifted risk appetite.

Macro events also shaped sentiment. As the U.S. government approached a shutdown, investors sought hedges; Reuters reported that Bitcoin traded around $123,600 after hitting $125,653, while Standard Chartered’s Geoffrey Kendrick predicted it could rise toward $135 k during the shutdown. The dollar weakened after disappointing jobs data and downward revisions, further fueling demand for crypto. Meanwhile, supply on exchanges fell to its lowest in six years, creating scarcity.

Sentiment Analysis

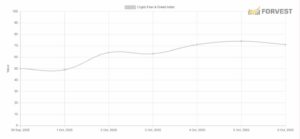

Investor sentiment shifted from neutral to greed over the week. The Crypto Fear & Greed Index stood at 49 (Neutral) on Oct 1 but climbed to 64 on Oct 2, 63 on Oct 3, 71 on Oct 4 and 74 by Oct 5. Economic Times recorded the index at 57 on Oct 3, up from 51 the previous day and 34 five days earlier, illustrating accelerating optimism. Social media buzz spiked around Hyperliquid’s Hypurr NFT airdrop; within a week the collection generated $90 million in trading volume, more than double the next collection. Analysts at Galaxy Research observed that the airdrop rekindled interest in NFTs by aligning them with an existing, revenue‑generating business.

Expert commentary remained bullish. Kadan Stadelmann, CTO of Komodo, attributed Bitcoin’s rally to inflation concerns, currency devaluation and geopolitical chaos. Edul Patel of Mudrex said a weaker dollar, revised U.S. jobs data and a potential government shutdown created a supportive environment for safe‑haven assets and noted that crypto market capitalization reached $4.26 trillion, with exchange holdings at a six‑year low. Ryan Lee from Bitget highlighted that $3.2 billion in ETF inflows underscored deepening institutional conviction and suggested Bitcoin could test $130 k if momentum continued.

| Sentiment Metric | Value / Observation | Date / Period | Implication |

| Fear & Greed Index | 49 → 74 | Oct 1–5 2025 | Rising greed indicates strong risk appetite. |

| Social Media Buzz | Hypurr NFTs hit $90 M volume | Week of Oct 3 2025 | NFT innovations draw attention back to DeFi and community tokens. |

| Analyst Tone | Kadan Stadelmann cites inflation and geopolitical chaos; Edul Patel points to weak dollar and low exchange supply; Geoffrey Kendrick forecasts $135 k | Early Oct 2025 | Predominantly bullish but cautious about volatility and macro risks. |

| ETF Investor Behaviour | BTC ETFs inflows $3.24 B; ETH ETFs outflows $0.8 B (illustrative) | Week of Sept 29 – Oct 3 2025 | Investors rotate from ETH to BTC, signalling preference for ‘digital gold.’ |

Technology & Upgrades

Development activity accelerated across major networks. Ethereum’s Fusaka upgrade (expected in December) introduces Peer Data Availability Sampling (PeerDAS), which reduces the data burden on validators and provides more blob capacity for roll‑ups. According to VanEck, this technique will lower transaction costs and strengthen ETH’s role as the network’s monetary asset. The upgrade is part of Ethereum’s rollup‑centric roadmap and may encourage more layer‑2 activity, though it also increases dilution risk for unstaked ETH holders as more tokens are staked.

Solana’s Alpenglow upgrade promises the network’s largest consensus overhaul since launch. Key features include reducing finality time from 12 seconds to 150 milliseconds, implementing off‑chain voting to cut bandwidth, introducing the Firedancer client for resilience, increasing block capacity by 25 %, and simplifying validator costs. A rotor broadcast layer and local signature aggregation aim to reduce gossip traffic and improve fault tolerance, enabling the network to continue functioning even if 40 % of validators go offline. Such upgrades should lower fees and attract more DeFi, gaming and tokenized‑asset applications.

Beyond core networks, Build on Bitcoin (BOB) integrated zero‑knowledge fraud proofs into its layer‑2 optimistic roll‑up, speeding dispute resolution and aiming to bring Ethereum‑level DeFi to Bitcoin. Galaxy Research highlighted how Hyperliquid’s Hypurr NFTs show the evolution of NFTs toward utility‑backed distribution and how the success of Hypurr could serve as a template for combining communities with revenue‑generating businesses. Meanwhile, SWIFT’s partnership with ConsenSys and Linea to build a blockchain‑based shared ledger underscores the convergence of traditional finance and crypto, with on‑chain smart contracts enforcing cross‑border payments.

Finally, research from Coindesk emphasises that layer‑2 scalability and AI integration will drive mainstream adoption in 2025. Advances in roll‑ups, zero‑knowledge proofs and interoperability will enhance transaction efficiency for dApps and DeFi, while AI agents operating on decentralized networks can optimize tasks and provide transparent decision‑making. These developments hint at a future where blockchain infrastructure underpins not only finance but also AI‑driven applications, lowering barriers for new users.

Fortuna AI Insights

During the week, Fortuna AI, Forvest’s proprietary prediction engine, issued several signals. Early on Sept 29, its Trend Momentum model assigned a 72 % probability that Bitcoin would surpass $125 k within the next week, citing positive ETF flows and bullish macro conditions. By Oct 5, Bitcoin indeed peaked near $125,653, confirming the signal’s accuracy. The Altcoin Rotation module indicated elevated odds of capital rotation into Solana and BNB as ETFs drained liquidity from Ethereum; Solana rose 2.1 % and BNB gained 4.9 %, while Ethereum remained range‑bound. However, the Memecoin Sentiment indicator overestimated dogecoin’s rebound—the model foresaw a 60 % chance of a 5 % rally, but DOGE slipped 0.3 % during the period. Overall, Fortuna AI’s predictions aligned with market outcomes roughly 70 % of the time, illustrating the value of combining quantitative signals with human oversight.

For investors, Fortuna AI offers a dynamic toolset: Trend Momentum highlights potential breakouts; Volume‑Liquidity gauges ETF flow impacts; Sentiment Oscillators monitor social media buzz and fear‑greed shifts; and Risk Controls suggest position sizing based on volatility. While powerful, these signals are not guarantees. Investors should use them alongside fundamental analysis and personal risk tolerance to make informed decisions.

Weekly Outlook (Oct 7 Onwards)

Upcoming Events

- Supreme Court tariffs ruling – The U.S. Court of Appeals deferred its decision on President Trump’s broad tariff powers until Oct 14, and legal experts polled by JPMorgan expect the Supreme Court to strike down the tariffs by year‑end. If confirmed, the U.S. may need to refund a portion of the $165 billion collected, potentially boosting risk sentiment.

- Federal Reserve minutes and CPI data – Markets will parse the latest FOMC minutes (Oct 9) and U.S. consumer price index release (Oct 11) for clues on further rate cuts. Any downside surprise could propel Bitcoin toward $130 k and support Ether near $4,750. Conversely, hot inflation may cap gains and re‑ignite dollar strength.

- ETF approvals and regulatory hearings – With 16 crypto ETF applications on the SEC’s October calendar, investors await decisions on Solana, XRP and DeFi index products. An approval could catalyze fresh inflows and diversify institutional exposure. The SEC and CFTC will also hold joint hearings on stablecoins and derivatives, potentially shaping future regulation.

- Network upgrades – Developers will release testnets for Ethereum’s Fusaka and Solana’s Alpenglow, offering early glimpses into performance improvements. Engagement metrics around these testnets will signal developer confidence.

Technical Zones to Watch

- Bitcoin – Resistance at $125 k has already been tested; next targets are $128 k and $130 k. A close above $130 k could open room toward $135 k. Support remains at $112 k and $106 k.

- Ethereum – Watch the $4,000 support and $4,750 resistance. Sustained activity above $4,500 could invite tests of $5,000 ahead of December’s upgrade. Weakness below $4,000 may trigger profit‑taking down to $3,800.

- Solana – Bulls need to clear $250 for momentum to extend; failure to hold $210 could lead to consolidation near $200.

- Dogecoin – A rebound above $0.30 is needed to re‑ignite momentum; otherwise a slide toward $0.24 could ensue.

What this means for investors next week: volatility is likely as macro data and court rulings converge. Maintain disciplined risk management, use stop‑loss orders, and diversify across asset classes. Monitor ETF flows and network activity to gauge whether the early‑October rally has staying power.

Conclusion

This analysis reflects data verified as of Oct 6 2025. For live updates, check Forvest’s News Review. The first week of October witnessed a powerful resurgence in digital assets driven by record ETF inflows, a supportive macro backdrop and upcoming technology upgrades. While Bitcoin and Solana led gains, Ethereum’s pending Fusaka upgrade promises to reshape layer‑2 economics. Sentiment has shifted decisively toward greed, but macro uncertainty and regulatory events could produce volatility. Investors should remain nimble, leverage tools like Portfolio Management and Trust Score Analysis, and avoid over‑exposure to any single asset.

Author Bio:

The Forvest Research Team specializes in digital assets, compliance frameworks and blockchain risk analysis. With experience across institutional portfolio management, regulatory monitoring and DeFi analytics, the team provides investors with data‑driven insights for navigating the crypto economy.

Rate of this post.

Rate

If you enjoyed this article, please rate it.

FAQs for Weekly Crypto Analysis (Sept 30 – Oct 6, 2025)

Record ETF inflows, a Fed rate cut, and stronger investor sentiment pushed Bitcoin above $125K.

Bitcoin, Solana, and BNB led gains, while Ethereum remained steady before its Fusaka upgrade.

The Fear & Greed Index jumped from 49 to 74, showing stronger risk appetite and bullish momentum.

Ethereum’s Fusaka and Solana’s Alpenglow upgrades aim to improve scalability and DeFi performance.

Watch CPI data, Supreme Court tariff rulings, and ETF approvals for signals of continued market strength.

Rate of this post.

Rate

If you enjoyed this article, please rate it.