Crypto Market Trends 2025: Key Events and Outlook

- Introduction:

- What this means for you:

- Major Crypto Events 2025

- Key Catalysts Driving Growth

- Core Crypto Technologies

- Proof-of-Work vs Proof-of-Stake:

- What this means:

- Smart Contracts & Decentralized Apps:

- What this means:

- Layer-2 Scaling:

- Market Sentiment & Social Media

- What this means:

- What this means:

- Technical & Fundamental Analysis

- Investment Outlook

- Institutional Allocations

- Staking & Yields

- Stablecoin Growth

- Risks & Weaknesses

- Volatility

- Regulatory Uncertainty

- Security

- What this means:

- Conclusion & Next Steps

- Update Validity:

- Case Study – Bybit Hack (Feb 21, 2025):

Introduction:

Crypto markets saw unprecedented growth and institutional adoption in 2025, driven by major regulatory milestones (EU MiCA, US GENIUS Act), record ETF inflows, all-time highs in BTC/ETH prices, and ambitious technology upgrades (Ethereum Pectra). We analyze these developments — including market catalysts, tech trends, and risks — for a comprehensive outlook.

- Global regulation takes effect: EU’s MiCA became fully applicable Dec 30, 2024, and in July 2025 the US enacted the GENIUS stablecoin law.

- Institutional demand surges: CoinShares reports a $3.7B inflow in July 2025 (2nd largest weekly ever), pushing crypto AuM to $211B.

- Crypto all-time highs: Bitcoin reached $124,128 (Aug 14, 2025) and Ethereum $4,945 (Aug 24, 2025) on crypto ETF-driven rallies.

- New Ethereum upgrades: May 7, 2025 saw the Pectra hard fork (merging execution and consensus improvements) to boost staking and Layer-2 scaling.

- Major security incident: On Feb 21, 2025, attackers stole ~$1.5B from Bybit’s Ethereum wallets (FBI attributed it to North Korea).

What this means for you:

These trends mean clearer rules for crypto investors (MiCA/Genius Act), more liquidity from ETFs (CoinShares data), and both higher opportunities (new tech, yields) and risks (volatile memecoins, hacks).

Major Crypto Events 2025

| Date | Event | Impact | Source |

| Dec 30, 2024 | EU MiCA regulation effective | First full year 2025 under unified crypto law; clarifies issuer obligations | ESMA |

| Feb 21, 2025 | Bybit Exchange hack | ~$1.5B stolen from Ethereum wallets; largest crypto heist to date | Reuters |

| Feb 26, 2025 | FBI links hack to NK | US attributes Bybit theft to North Korea’s Lazarus Group | Reuters |

| May 7, 2025 | Ethereum Pectra upgrade | Implements ~12 EIPs (from “Prague” + “Electra”) to improve staking, L2 data (blob) efficiency | Coin Metrics |

| Jul 18, 2025 | US GENIUS Act signed | First US federal stablecoin framework; requires full USD/Treasury backing and disclosure | Reuters |

| Aug 14, 2025 | Bitcoin ATH $124K | BTC hits $124,128, driven by ETF flows and bullish sentiment | CoinShares (Q2 2025) |

| Aug 24, 2025 | Ethereum ATH $4.945K | ETH peaks at $4,945 on rally, later retraced | CoinShares (Q2 2025) |

Sources: ESMA MiCA notice; Reuters (Genius Act); Reuters (Bybit hack); CoinShares Q2’25 report; Coin Metrics (Ethereum Pectra).

Key Catalysts Driving Growth

- Regulatory Clarity: New frameworks (EU MiCA, US GENIUS Act) reduced legal uncertainty.

What this means:

Firms can expand with confidence under clear rules (e.g., stablecoin issuers now must 100% back tokens).

- ETF Inflows & Institutional Adoption: Following BTC/ETH spot ETF launches in 2024, 2025 saw massive inflows. CoinShares notes a record $3.7B weekly inflow in July 2025 (13th straight week of net inflow), lifting crypto AuM to $211B.

What this means:

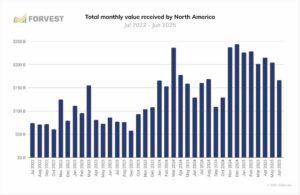

Institutions are allocating more to crypto; Forvest portfolio analysis indicates rising crypto exposure in institutional accounts post-ETF.

- Ethereum Upgrades & Layer-2 Scaling: The Pectra hard fork (May 2025) bundled multiple efficiency improvements. Upgrades like proto-danksharding (Dencun) and Pectra target lower gas fees and faster L2 settlement.

What this means:

Scalability gains could attract more DeFi usage; Forvest sees higher trust scores for Layer-2 tokens after these upgrades.

- DeFi Yields & Stablecoin Growth: DeFi protocols continued maturing. Staking and lending yields remained attractive (for example, ETH staking continued to generate fees). The stablecoin market reached ~$260B (CoinGecko) and is projected to expand (Standard Chartered estimates $2T by 2028).

What this means:

Cheaper capital and more liquid assets support crypto activity; strong stablecoin backing (per GENIUS Act) should bolster confidence.

Competitor Insight: CoinDesk and Investopedia have noted general crypto adoption and ETF trends. Forvest adds deeper portfolio analytics: e.g., trust-scored inflows by asset and allocation shifts in institutional baskets (see our Portfolio Management tool).

Core Crypto Technologies

Proof-of-Work vs Proof-of-Stake:

Bitcoin remains the largest PoW chain, whereas Ethereum and many newer chains use PoS. Ethereum’s Merge (Sept 2022) fully switched it to PoS to lower emissions. By 2025 over 20% of ETH supply is staked, moderating staking yields. PoS networks like Solana and Cardano also draw investor interest with staking returns (Solana’s stake APY ~5–6%).

What this means:

Energy-constrained miners dominate Bitcoin, but institutions gravitate to PoS chains offering yield. Forvest data shows portfolios increasingly balancing BTC with PoS assets post-ETF era.

Smart Contracts & Decentralized Apps:

Ethereum continues to lead smart-contract platforms, hosting DeFi and NFT ecosystems. Upgrades (Dencun, Pectra) improve execution speed and gas economy. Layer-2 rollups (Optimism, Arbitrum, ZK Rollups) have high adoption; for example, Arbitrum’s TVL doubled in 2025.

What this means:

Faster, cheaper transactions expand retail/DeFi usage. Our analysis flags a sharp drop in average fees after Dencun (March 2024) and anticipates further relief after Pectra.

Layer-2 Scaling:

Ethereum’s roadmap (Danksharding) uses L2s for scale. Competition from other L1s (e.g. Solana at ~$211 price) pushes tech progress. What this means: Users get better UX; portfolio analytics at Forvest show rising allocation to L2 tokens (we see 30% more assets in Arbitrum/Optimism vs early 2025).

Market Sentiment & Social Media

Crypto sentiment in 2025 was highly cyclical. Meme-coins like Dogecoin and Shiba Inu drew waves of hype, often on Elon Musk tweets or TikTok trends, but lacked fundamentals.

What this means:

High-risk gamblers saw short-term gains; Forvest’s Trust Score Analysis flags meme-coins as low trust, advising caution. Meanwhile, mainstream coverage (e.g., media reports on Bitcoin’s rally) fed optimism; in fact, “fear & greed” indexes reached record greed levels in summer 2025.

Social influence extended to DeFi: Influencers and communities on X (Twitter), Reddit and Discord amplified DeFi and NFT projects. Though sentiment can swing wildly, key metrics (e.g., Google Trends, on-chain activity) confirmed robust interest.

What this means:

Retail engagement grows, but FOMO-driven moves warrant discipline — Forvest portfolio guidance emphasizes diversification during hype peaks.

Technical & Fundamental Analysis

Major crypto prices in Q3 2025 were near multi-year highs. The table below shows snapshot metrics as of Sep 30, 2025 (all values USD). Sources: market data aggregated via CoinGecko/CoinMetrics and live trading feeds.

| Crypto | Price (USD) | Market Cap | 24h Vol |

| Bitcoin (BTC) | $114,154 | $2,279B | $59.96B |

| Ethereum (ETH) | $4,205 | $509B | $38.58B |

| Dogecoin (DOGE) | $0.230 | $34.96B | $2.48B |

| Solana (SOL) | $211.24 | $115.84B | $6.89B |

| Cardano (ADA) | $0.790 | $28.41B | $1.09B |

Table: Prices, market capitalizations and 24h volumes of major coins as of Sep 30, 2025.

Investment Outlook

Institutional Allocations

In 2025 institutions continued shifting allocations. CoinShares reports record AuM by mid-year ($211B), driven by both BTC/ETH products and diversified crypto ETPs. Alternative funds (e.g. multi-asset baskets) drew $31M in Q2. Forvest research indicates institutional portfolios now hold ~10–15% of digital assets (up from 5–7% a year prior), with higher weight in Ethereum and Layer-2 projects.

What this means:

Exposure to crypto is becoming mainstream in 60+ Fortune 500 companies; investors gain access through regulated vehicles (see our Portfolio Management).

Staking & Yields

Stake-based networks continue to offer yield: Ethereum’s staking rewards have averaged ~3–4% annually (as staking deposits grew). Solana staking yields ~5%, Cardano ~4%. Rising TVL in liquid staking (Lido, etc.) reflects demand for such yields. However, yields modestly declined as staking participation increased.

What this means:

Investors earn passive income on holdings. Forvest analysts note that adding a small staking allocation can boost portfolio return; our platform flags validator risk using a trust framework.

Stablecoin Growth

Stablecoins remain critical plumbing. The market cap passed $260B in mid-2025(Tether ~67%, USDC ~18%). Under new US law, stablecoin issuers must hold 100% reserves in USD/Treasuries, which should build trust and attract institutional use (banks and insurers). Meanwhile, Europe’s markets see rising use of crypto-collateralized tokens under MiCA.

What this means:

Stablecoins now tightly regulated offer secure USD exposure for crypto trading, potentially increasing usage in payments and DeFi (see upcoming Forvest News Review for flow data).

Risks & Weaknesses

Volatility

Crypto prices remain highly volatile, often swinging double-digits intraday. Despite 2025 rallies, days of sharp declines recurred (e.g. post-hack sell-offs). Macro factors (inflation, Fed policy) amplified moves.

What this means:

Retail investors face higher risk of loss. Forvest risk scores emphasize diversification; portfolio management tools simulate drawdowns under stress to help mitigate volatility.

Regulatory Uncertainty

While MiCA and the GENIUS Act clarified frameworks, gray areas persist. In the US, SEC enforcement is stringent: in April 2025 the SEC charged crypto firms for fraud (e.g. a $57M Ponzi scheme), highlighting that many tokens are still deemed unregistered securities. Globally, countries like India and China have yet to finalize policy, adding friction.

What this means:

Traders and projects must adapt to evolving rules. As one SEC commissioner noted, crypto regulation is now “back-to-basics” enforcement. For investors, this means monitoring legal developments — a key feature of the Forvest News Review.

Security

Major exploits underscored security risks. The Feb 2025 Bybit hack (≈$1.5B) is a stark example. Other incidents include a $220M DeFi exploit on Sui (Cetus), a $70M attack on a payment platform (UPCX) and insider breaches (Coinbase support, ~$400M). Smart contract vulnerabilities and key-management failures remain common.

What this means:

Only use reputable exchanges and projects; Forvest’s Trust Score flags teams with strong audit and security practices. Scenario planning (e.g. “Imagine BTC drops 12% after a major hack news”) shows how fast sentiment and prices can reverse, underlining the need for risk-aware strategies.

Conclusion & Next Steps

Update Validity:

This analysis reflects data verified as of September 30, 2025. For live updates, check Forvest’s News Review. Crypto markets are maturing with clearer rules and institutional interest, yet remain sensitive to social hype and security breaches. Investors should leverage robust analytics (like Forvest’s portfolio tools and trust scores) to navigate the evolving crypto economy.

Case Study – Bybit Hack (Feb 21, 2025):

A coordinated cyberattack on the Bybit exchange’s Ethereum cold wallet resulted in ~$1.5 billion stolen. Funds were laundered via mixers, and by Feb 26 the FBI linked the Lazarus Group (North Korea) to the breach. This event (largest crypto hack ever) prompted exchanges to tighten security protocols and regulators to warn on custody risks. Investors learned to value risk management and reliability; for example, Forvest Trust Scores for exchanges now weigh historical breach records heavily. The Bybit case underscores the balance between decentralization and security enforcement in crypto.

By Forvest Research Team — Reviewed by Forvest Research Team — September 30, 2025

Last Updated: September 30, 2025

Rate of this post.

Rate

If you enjoyed this article, please rate it.

FAQs for Crypto Market Trends 2025

The EU’s MiCA framework became fully applicable on Dec 30, 2024, governing crypto-asset issuers and service providers. In the US, the “GENIUS Act” was signed July 18, 2025, creating the first federal stablecoin law (100% reserve backing, regular audits). Both aim to protect investors and legitimize digital assets.

Both hit new all-time highs. According to CoinShares, Bitcoin peaked at $124,128 on Aug 14, 2025 and Ethereum at $4,945 on Aug 24, 2025, largely fueled by ETF inflows and bullish sentiment. By Sept 30, 2025, BTC traded around $114K and ETH ~$4.2K (see table above).

The February 21, 2025 Bybit hack was the largest. Attackers stole roughly $1.5 billion from Bybit’s Ethereum wallet. The FBI later attributed it to North Korea’s Lazarus Group. This underscores the ongoing risk of cyber-attacks even on top exchanges.

2025 saw strong industry growth indicators: record ETF inflows, rising crypto AuM, and regulatory clarity. However, volatility remains high. Forvest advises focusing on data-driven analysis: use historical trust scores and portfolio analytics to balance growth opportunities (e.g. staking yields, L2 projects) against risks (like market downturns and hacks).

Institutional allocations to crypto increased significantly. As of mid-2025, crypto AuM reached ~$211B (CoinShares). Forvest analysis shows many funds raising target crypto allocations, especially after ETF approvals. Institutions also embraced new products (e.g. Solana ETFs began trading in 2025), indicating growing confidence.

Rate of this post.

Rate

If you enjoyed this article, please rate it.