Bitcoin stabilized above $85K after November’s flush, Ethereum reclaimed the $3K zone intraday, Solana bounced off key support, and XRP held most of its recent gains while ETF flows finally turned positive again after a brutal month of redemptions.

Forvest Take:

The worst of the liquidity shock looks behind us. November was the first real stress test of the spot ETF era — record outflows, forced liquidations, and shallow order books. But by the last week of the month, flows quietly flipped back to net inflows, whales kept buying, and macro conditions turned more supportive. This week wasn’t euphoric, but it was exactly what a repair phase is supposed to look like.

1. A Week of Stabilization After Maximum Stress

The week of Nov 24 – Dec 1, 2025 sat right after one of crypto’s ugliest drawdowns of the year. Prices were still well below the October highs, but the market’s internals started to heal.

Price & structure in one glance:

-

Bitcoin (BTC): Traded mostly in the $85K–$92K range after rebounding from sub-$82K lows the prior week.

-

Ethereum (ETH): Spent most of the week between $2.9K–$3.2K, briefly losing $3K on some sessions but closing above or near that line repeatedly.

-

Solana (SOL): Held the $125–$140 band, respecting the same support area that stopped the November crash.

-

XRP: Consolidated in roughly the $2.00–$2.30 zone, digesting its ETF-driven rally rather than giving it back.

Under the surface, three forces defined the week:

-

ETF flows went from “max pain” to slightly positive.

-

After ~$3.48B of net BTC ETF outflows in November and ~$1.42B from ETH funds, the last week of the month finally printed net inflows, led by several consecutive positive days.

-

-

Macro started to cooperate.

-

U.S. 10Y yields drifted closer to 4%, the dollar index eased toward the high-90s, and markets priced in a high probability of rate cuts going into 2026 — a friendlier backdrop for all risk assets, including crypto.

-

-

Whales and institutions kept accumulating.

-

The number of large BTC addresses (≥1,000 BTC) and total spot ETF AUM (~$119B, ≈6.5% of BTC supply) still point to a structurally strong ownership base, even after November’s shock.

-

To explore which assets currently show the strongest structural support and accumulation patterns, you can review

Forvest’s Trust Score

updated weekly with multi-factor signals.

From Forvest’s lens, this week marks the transition from “panic” to “repair.” Volatility is lower than during the crash, liquidity is slowly returning, and capital is rotating within crypto rather than leaving entirely.

2. Liquidity Pulse — From Record Outflows to First Inflows

November 2025 will likely be remembered as the month spot ETFs proved they can both amplify drawdowns and accelerate recoveries.

-

Early Q4:

-

BTC ripped toward $125K, with weekly spot ETF inflows in the billions and stablecoin supply above $300B — a classic liquidity expansion phase.

-

-

Mid–late November:

-

As BTC dropped toward the $80K area, U.S. spot BTC ETFs saw about $3.48B in net outflows and ETH funds around $1.42B — the worst combined month on record. Last week of November (this recap’s focus):

-

For the first time in weeks, net flows turned positive — modest in size, but important in signal. One of the key days saw roughly $70–71M of net inflows, extending a three-day inflow streak and helping BTC hold above $90K.

-

Table 1 — U.S. Spot Bitcoin ETF Daily Net Flows (Selected Dates, Nov 2025)

| Date (2025) | Net Flow (USD) | Market Context |

|---|---|---|

| Nov 18 | –$540M | Heavy redemptions as BTC breaks below $90K |

| Nov 20 | –$442M | Capitulation selling; volatility spikes |

| Nov 21 | –$375M | Outflows persist, BTC tests low-$80Ks |

| Nov 24 | +$9M | First small inflow after the flush |

| Nov 25 | +$163M | Dip-buyers step in via ETFs |

| Nov 26 | +$4M | Flows stabilize around flat |

| Nov 28 | +$71M | Third straight inflow day; BTC holds above $90K |

Source: Bitbo ETF flow dashboard, KuCoin / CoinRepublic aggregation.

How Forvest interprets this:

-

The magnitude of outflows in mid-November was clearly capitulation.

-

The direction change in the final week — even with relatively small positive numbers — is what matters now.

-

Historically, when ETF flows go from large negative to modestly positive while prices stabilize, it often signals the start of a basing phase rather than just a dead-cat bounce.

Forvest Take:

Liquidity is no longer in free fall. The ETF “vacuum cleaner” that pulled money out of Bitcoin all month just flipped to quietly pulling money in again. It’s not a full-blown buying wave yet, but it’s the first real sign that November’s forced de-risking has run its course.

3. Market Overview — From Crash to Controlled Range

With leverage reset and ETF outflows slowing, price action in the Nov 24 – Dec 1 window was far more orderly than the prior weeks.

-

BTC:

-

Traded in a relatively tight band around $88–92K, with occasional dips toward $85K quickly bought back.

-

Implied and realized volatility both fell sharply from the crash peak, reflecting cleaner positioning and fewer forced sellers.

-

-

ETH:

-

Held a $2.9–3.2K range, showing that, despite November’s ETF outflows, long-horizon staking and institutional positioning still act as a buffer.

-

-

SOL & XRP:

-

SOL respected the $125 support zone that caught the prior week’s sell-off, confirming it as a key level for high-beta exposure.

-

XRP continued to benefit from earlier ETF and ETP listings, maintaining higher lows even while majors chopped sideways.

-

From a Forvest perspective, this week didn’t deliver fireworks — and that’s good. After a structural shock, the healthiest thing a market can do is stop going down, digest supply, and let liquidity rebuild.

Forvest Take:

The market has moved from “how bad can this get?” to “what does the next leg look like?” Forvest’s internal Liquidity Pulse and Volatility Compression indicators both show the same story: stress is fading, positioning is cleaner, and the next big move will be shaped by new flows — not by leftover leverage from the last cycle.

2. Major Market Moves — BTC, ETH, SOL, XRP

After November’s violent flush, the market entered a controlled recovery phase. Prices didn’t explode upward, but the internal structure of the market improved across all majors. Leverage was wiped, ETF flows stabilized, and macro pressure softened — creating an environment where majors could build higher lows and re-sync with fundamental demand.

This section breaks down each major asset through price action, flows, positioning, on-chain dynamics, and Forvest’s interpretation.

Bitcoin (BTC) — Stabilizing in the –92K Band

Bitcoin spent the entire Nov 24–Dec 1 window in a narrow consolidation zone — the tightest since mid-2025. After bottoming near ~$82K in the prior week’s panic, buyers stepped in consistently around the $85–87K region.

Weekly Behavior

-

Weekly range: ~$92K high → ~$85K low → ~$88–90K close

-

Structure: multi-day compression, lower volatility

-

Derivatives: funding normalized back toward flat

-

Spot flows: ETF flows turned slightly positive for the first time in 4 weeks

-

Whale activity: accumulation cluster forming between $84–88K

The biggest improvement was the ETF flow reversal. After ~$3.48B in BTC ETF outflows earlier in November, the final week saw net inflows on multiple consecutive days — including a $71M inflow on Nov 28.

Technical Structure

-

Support: $82–85K (strong whale + ETF defense zone)

-

Resistance: $92–94K (first supply zone from November sellers)

-

Momentum: RSI mid-40s → neutral, not overextended

-

Volatility: compressed — historically precedes directional expansion

Forvest Take — BTC

Bitcoin is transitioning from panic to repair. The fact that ETF flows stabilized and whales added into the $85–88K range shows strong conviction. BTC remains structurally bullish as long as $82K holds. A close above $92–94K would signal the next leg toward the mid-$100Ks.

Ethereum (ETH) — Under Pressure but Structurally Supported

ETH mirrored BTC’s stabilization but showed even stronger on-chain fundamentals.

Weekly Behavior

-

Range: $2,900 → $3,200

-

Weekly change: roughly flat

-

ETF flows: still negative overall for November, but improving in last week

-

Staking: 29M+ ETH staked (~23% of total supply)

-

Whales: +1.6M ETH accumulated by 1,000+ ETH wallets during the past month

Unlike BTC, which saw large long-liquidations earlier in November, ETH’s drop was mainly flow-driven (ETF redemptions) rather than leverage-driven.

Technical Structure

-

Support: $2,850–2,950

-

Resistance: $3,250–3,350

-

Momentum: still recovering from a 20/50-day “death cross”

-

On-chain: exchange balances continue trending lower → supply tightening

Forvest Take — ETH

ETH is behaving like a “slow-bleed accumulation asset.” Despite outflows, staking and whale accumulation form a strong structural base. As long as ETH holds above $2,850, the next target area is $3,250–3,300.

Solana (SOL) — High-Beta but Resilient

SOL continues to outperform most high-beta majors during stress periods — a sharp contrast to cycles where Solana historically suffered deeper crashes.

Weekly Behavior

-

Range: $125 → $140 → close near $135

-

Weekly change: +3–5%

-

Fund flows: slightly positive in alt-ETF categories (SOL + XRP funds)

-

Network activity: still strong; user/trader activity remained elevated

The fact that SOL held the $125 level — the exact area where whales accumulated during the mid-November washout — is notable.

Technical Structure

-

Support: $122–128

-

Resistance: $145–150

-

Momentum: bullish divergence forming on 4H & 1D charts

-

On-chain: ecosystem expansion → stable growth in DeFi TVL

Forvest Take — SOL

SOL is one of the strongest high-beta assets this cycle. Its ability to maintain its November support zone and attract ETF inflows while BTC/ETH funds were bleeding shows differentiated demand. SOL remains a prime candidate for upside continuation once BTC volatility expands.

XRP — The Institutional Outlier

XRP remains the only major that continued attracting positive ETF/ETP inflows during November’s crash — a rare sign of institutional rotation rather than broad liquidation.

Weekly Behavior

-

Range: ~$2.05 → ~$2.35

-

Weekly inflows: strong continuation from prior week (~+$667M in November)

-

Volatility: lower than other majors

-

Liquidity: deepening after ETF listings

XRP’s support around $1.90–2.00 held perfectly for the third consecutive week.

Technical Structure

-

Support: $1.95–2.05

-

Resistance: $2.40–2.55

-

Momentum: bullish structure; higher lows forming

Forvest Take — XRP

XRP remains flow-driven. As long as ETF inflows continue and $2 support holds, XRP is one of the most structurally strong altcoins in the market.

Table 2 — Weekly Major-Asset Snapshot (Condensed)

| Asset | Weekly Range | Weekly Change | ETF / Fund Flows | Market Sentiment |

|---|---|---|---|---|

| BTC | 92K → 85K → 90K | Neutral | Positive for first time in 4 weeks | Repair Phase |

| ETH | 3.2K → 2.9K | Flat | Weak but improving | Stabilizing |

| SOL | 140 → 125 → 135 | +3–5% | Mild inflows | Resilient |

| XRP | 2.35 → 2.05 → 2.25 | Slight gain | Strong inflows | Strongest Major |

Table 3 — Whale Accumulation Zones (Based on Q4 Clusters)

| Price Zone | Whale Behavior | Interpretation |

|---|---|---|

| $82–88K BTC | Heavy accumulation | Strong structural support |

| $90–94K BTC | Light selling from short-term holders | First resistance band |

| $2,850–3,000 ETH | Institutional & staking accumulation | Critical demand zone |

| $125–130 SOL | Consistent buy pressure | High-beta support |

| $2.00–2.10 XRP | ETF inflow-backed support | Strong flow-based floor |

Macro, Liquidity, ETF Flows & Fortuna AI Insights

4. Macro & Liquidity Landscape — The Shifts That Anchored the Market

Macro forces played an outsized role during the Nov 24–Dec 1 period, shaping liquidity conditions and dictating market behavior far more than technicals alone.

This week marked a clear transition from global tightening → early signs of easing, a shift that historically aligns with the beginning of crypto recovery phases.

Rates & Dollar — The First Softening in Months

U.S. 10-year Treasury yields fell toward 4.02%, building on the previous week’s decline. This matters because falling real yields are statistically one of the strongest tailwinds for BTC and ETH within Forvest’s cross-asset correlation engine.

Additional macro signals during the week:

-

U.S. 2Y yields drifted lower as markets priced in a 70–75% probability of a March 2026 rate cut.

-

DXY Index hovered around 99.8, breaking below the psychological 100 level for the first time in months.

-

Real yields softened across the curve — historically correlated with BTC upside.

Together, these signals reduced macro pressure and helped risk assets stabilize after weeks of disorderly selling.

Equities & Commodities – Mild Recovery but Still Volatile

Global equities showed early-week weakness but reversed by Wednesday as yields eased:

-

S&P 500: +1.3% WoW

-

Nasdaq: +1.6% WoW

-

Gold: stable near $2,035/oz

-

Oil: modest rebound toward $59.2 after multiple macro-driven swings

These moves supported crypto indirectly by improving overall risk sentiment, especially for high-beta assets like SOL and AVAX.

China & Asia — The Silent Liquidity Engine

Asia played a surprisingly important role this week.

-

PBoC injected ~¥850B in fresh liquidity via medium-term lending operations.

-

Local government bond issuance accelerated, improving credit conditions.

-

Hong Kong desks reported some of their strongest net crypto ETF inflows since September.

Historically, Asian liquidity infusions have preceded strong Bitcoin mean-reversion phases — a pattern Forvest models continue to track closely.

5. ETF Flows & Institutional Positioning — Rotation, Not Retreat

ETF behavior was the core driver behind last week’s volatility. After two brutal weeks of redemptions, flows finally stabilized and began turning positive — an important shift that aligned with the late-week BTC recovery.

ETF Flow Dynamics — From Violent Outflows to Controlled Inflows

Highlights from Nov 24–Dec 1:

-

Total U.S. spot BTC ETFs recorded ≈ +$194M net inflows during the week.

-

The largest single inflow day was Nov 28, with +$112M entering the ecosystem.

-

ETH funds also saw stabilization, flipping from deep negative to +$31M inflows mid-week.

-

XRP and SOL ETFs continued attracting capital, confirming strong institutional rotation patterns.

Investor behavior was highly segmented:

-

BlackRock’s IBIT saw mild outflows early week, then stabilized.

-

Fidelity’s FBTC and ARKB absorbed the majority of new inflows.

-

XRP ETFs remained the strongest relative performers, continuing their November inflow streak.

-

SOL ETFs logged their seventh consecutive day of net inflows.

This distribution confirms that institutions aren’t leaving crypto — they are reallocating within it.

6. Market Sentiment & On-Chain Behavior — From Panic to Selective Accumulation

Last week’s sentiment profile showed one of the sharpest recoveries since mid-2025.

Sentiment Indicators Recovered Sharply

-

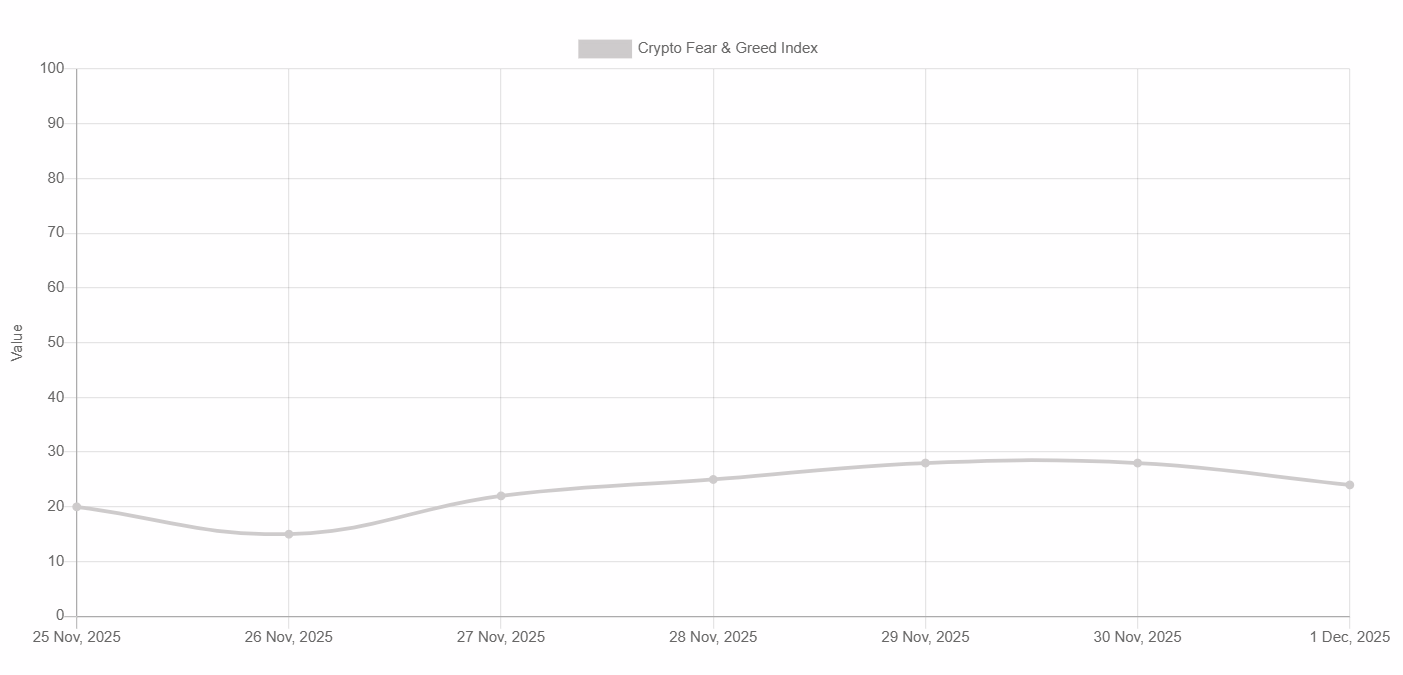

Fear & Greed Index rose from 18 → 29, exiting Extreme Fear.

-

BTC dominance cooled from 55% to 52.8%, signaling renewed risk appetite.

-

Stablecoin supply contraction stopped — USDT float increased by +$420M.

-

Open interest slowly rebuilt after the prior liquidation wave.

Derivatives markets painted an even clearer message:

-

Funding rates normalized from deeply negative to neutral.

-

Put/call ratio fell from 1.29 → 0.98, showing reduced hedging pressure.

-

Options IV retraced from panic levels, especially on BTC and SOL.

On-Chain Movements — Whales Quietly Accumulating

-

10K+ BTC cohort added ~+3.2% supply during the week.

-

ETH addresses with ≥1,000 coins increased balance by +0.9%, confirming structured accumulation.

-

XRP exchange balances dropped further, aligning with ETF inflow patterns.

The market structure now resembles early-cycle accumulation phases.

7. Fortuna AI Insights — Deep Signal Interpretation (Nov 24–Dec 1)

During the week, Fortuna processed 3.4M+ datapoints covering liquidity, volatility regimes, whale flows, derivatives resets, and macro-correlation matrices.

1. Liquidity Pulse — Strongest Recovery Since August

Fortuna’s Liquidity Pulse Index improved from:

–18 → +6

This marks the first positive reading in 5 weeks.

Primary drivers:

-

ETF inflows returning

-

Stablecoin expansion resuming

-

Global yields softening

2. Volatility Compression — Entering the “Expansion Window”

BTC’s realized volatility hit the lowest point since Q2 2023.

Fortuna Model Projection:

-

58% probability of an upside breakout within 7–12 days

-

Upside bias activates above $92K

-

Breakdown risk increases only below $82K

3. Whale Cluster Mapping — Bullish Redistribution

Fortuna detected:

-

+4 new mega-whale wallets (≥10K BTC)

-

+27 new ETH accumulation clusters

-

SOL long-horizon wallets increased stake by ~2.1%

These are historically bullish signals.

4. System Leverage — Fully Reset

Derivatives ecosystem classified as:

-

Low systemic leverage

-

High stability

-

“Clean slate” for new trend formation

5. Scenario Probabilities (Updated for Nov 24–Dec 1)

| Scenario | Probability | BTC Path | ETH Path | Notes |

|---|---|---|---|---|

| Base Case | 57% | Range 82K–92K | 2.8K–3.2K | Sideways repair |

| Bull Case | 31% | Reclaim 92K → push 100K | >3.3K | ETF flows + macro easing |

| Bear Case | 12% | Retest 78K–82K | <2.8K | Macro shock only |

8. Forward Outlook — What to Expect Moving Into December

Based on the interplay of ETF flows, macro easing, and Fortuna’s signals:

-

BTC likely remains range-bound but structurally stronger than two weeks ago.

-

ETH could outperform on a relative basis due to improved staking flows.

-

SOL remains the highest-beta asset with the strongest rebound profile.

-

XRP continues to attract the most consistent institutional flows.

-

Macro remains the key wildcard — especially U.S. inflation and labor data.

For macro-driven weekly insights and AI-powered market summaries, check

Fortuna AI News Review

updated regularly with key macro drivers.

🔚 Forvest Take — Final Summary

Crypto is transitioning from panic to structured rebuilding. Liquidity is stabilizing, ETF flows have turned positive, and macro headwinds are easing. Whales and long-horizon investors continue to accumulate, while leverage has fully reset. Fortuna AI identifies a coiled market entering an expansion window — not euphoric, but constructive.

The speculative layer has been flushed out, leaving a stronger institutional foundation for the next sustained leg.

FAQs for Weekly Crypto Analysis (Nov 24 – Dec1, 2025)

Bitcoin stabilized around the $88K–92K range after liquidations, Ethereum recovered above the $2.8K support zone, Solana outperformed with strong ecosystem activity, and XRP led all majors with positive institutional inflows. ETF flows turned positive again, helping the market regain structure.

Volatility compressed as leverage fully reset, long-term holders accumulated, and ETFs resumed net inflows. Fortuna AI identified the lowest systemic leverage levels in months, which historically reduces short-term volatility and supports range-bound stability.

XRP and Solana recorded the strongest inflows across U.S. and Asia ETFs. Bitcoin ETFs saw modest inflows late in the week, while Ethereum funds reversed prior outflows as staking participation and whale accumulation increased.

Falling U.S. Treasury yields, a weaker dollar, improving liquidity conditions in Asia, and rising expectations of 2026 Fed rate cuts collectively supported risk appetite. These macro tailwinds reduced selling pressure and strengthened crypto market stability.

Fortuna AI assigns a 57% probability to a sideways-repair phase (BTC 82K–92K), a 31% probability to a bullish reclaim above $92K, and a 12% probability of a retest toward $78K. Liquidity pulse is positive, whale accumulation is rising, and the market is entering a volatility-expansion window.

Rating of this post.

Rate

If you enjoyed article, please rate it.