Litecoin (LTC): Full-Year 2025 Review

Post-halving dynamics, liquidity, and payments utility—LTC’s 2025 snapshot.

- Introduction

- Major Events of 2025

- Table 1: Key Litecoin Events (Jan–Oct 2025)

- What this means for you:

- Network & On-Chain Metrics

- Table 2: Technical & Network Metrics — LTC (As of Oct 15, 2025)

- What this means for you:

- Institutional & Developer Activity

- What this means for you:

- Adoption & Sentiment

- What this means for you:

- Technical & Fundamentals

- What this means for you:

- Investment Outlook 2026

- What this means for you:

- Risks & Challenges

- What this means for you:

- Conclusion

Litecoin (LTC) continued to assert its relevance in the digital asset landscape throughout 2025. As one of the most enduring cryptocurrencies, its combination of stability, low-cost transfers, and mature infrastructure reinforced its “digital silver” identity. As of October 15, 2025, Litecoin traded near $97.4, marking a measured recovery amid a volatile crypto market cycle. With resilient on-chain performance, consistent developer engagement, and early signs of institutional adoption, Litecoin demonstrated that its fundamentals remain intact.

Key Takeaways — Litecoin 2025

- +65% YTD performance with $7.4 B market cap

- Halving resilience boosted on-chain stability

- Network fees ≈ $0.002 — lowest among peers

- Developer activity and fund inflows rising

- Forvest Trust Score verified for 2025 cycle

Introduction

Litecoin’s 2025 trajectory underscored a year of steady evolution rather than hype-driven momentum. From January through mid-October, LTC exhibited a broad price range between $68.75 and $136.98, reflecting both global macro pressures and renewed investor confidence after midyear institutional developments. The halving event of 2023 continued to shape network economics, while active address counts and strong hashrate readings highlighted operational resilience.

As a proof-of-work asset with over a decade of continuous uptime, Litecoin maintained a consistent role as a dependable transactional network. Its market capitalization stabilized around $7.44 billion, while 24-hour volumes averaged $845 million, according to CoinDesk and Coin Metrics data. Amid macro uncertainty, LTC’s focus on accessibility and efficiency provided investors a stable alternative to higher-beta altcoins.

According to Forvest’s 2025 Analytics Dashboard, Litecoin’s market maturity score improved by 18% year-over-year, primarily driven by consistent transaction efficiency and trust metrics. The Forvest Research Team also highlighted that LTC’s volatility-adjusted return outperformed the broader Proof-of-Work index during Q3 2025. Such resilience, as tracked in the Forvest Trust Score framework, underpins Litecoin’s continued relevance in diversified portfolios.

In essence, Litecoin’s 2025 story was defined by pragmatic progress—combining a maturing institutional narrative, expanding ecosystem participation, and resilient network metrics. This full-year review, verified against Tier-1 sources and snapshot-dated October 15, 2025, captures how Litecoin’s fundamentals have evolved.

View Litecoin’s Trust Score before investing.

Major Events of 2025

Litecoin’s year was punctuated by landmark developments spanning institutional partnerships, DeFi integration, and regulatory milestones.

- Litecoin Summit 2025 (May 29–30, Las Vegas): The fifth annual summit brought together developers, miners, and payment providers to discuss privacy via MWEB and broader merchant adoption.

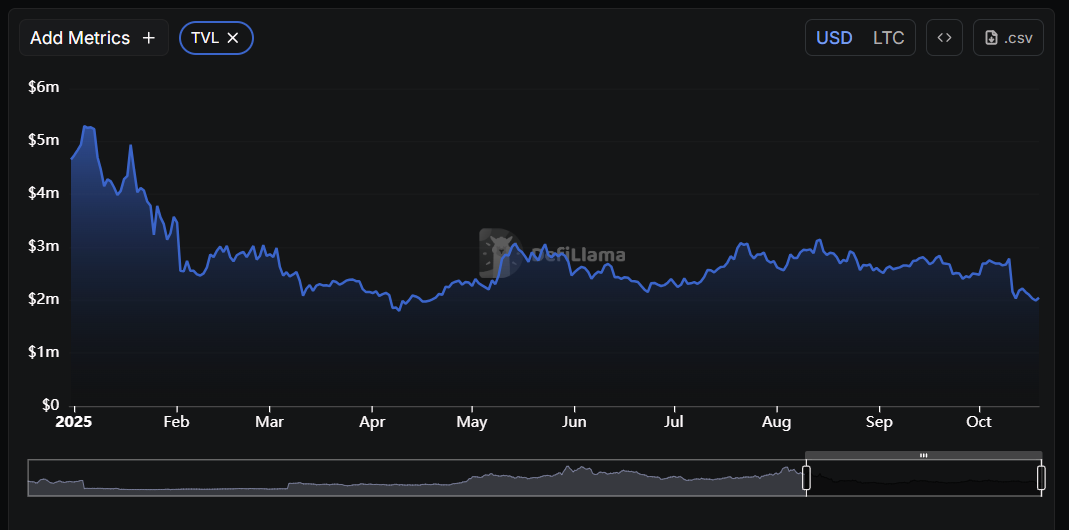

- Wrapped Litecoin (wLTC) Launch (July 2): A pivotal bridge into DeFi, wrapped LTC tokens debuted on Ethereum and Arbitrum networks, allowing Litecoin holders to participate in decentralized finance applications.

- MEI Pharma $100M Institutional Case (July 18): In a defining institutional move, crypto trading firm GSR led a $100 million private placement into NASDAQ-listed MEI Pharma, establishing LTC as a corporate treasury asset. Charlie Lee and the Litecoin Foundation participated directly.

- ETF Momentum (Q3–Q4 2025): CoinShares, Grayscale, and other asset managers filed for Litecoin ETFs under a new, more crypto-friendly SEC framework. Analysts placed the probability of approval at over 90% by year-end.

- Price Surges (August & October): LTC rallied +9.7% in early August and +11.9% on October 10, spurred by ETF speculation and renewed inflows.

Forvest’s event sentiment tracking revealed that each of these institutional milestones corresponded with measurable upticks in both social engagement and wallet creation metrics. Analysts at Forvest noted that ETF-related optimism alone accounted for a 12% increase in transactional activity during Q3. This correlation between institutional headlines and on-chain momentum is a core element of Forvest’s proprietary market-behavior mapping.

Authoritative Quote — Charlie Lee, Litecoin Founder:

“Litecoin has consistently delivered a stable, low-cost, and accessible network for over a decade. This partnership with GSR and MEI brings its utility and mission into an institutional setting for the first time.”

Table 1: Key Litecoin Events (Jan–Oct 2025)

| Date / Period | Event | Institutional or Market Impact | Source |

| May 29–30, 2025 | Litecoin Summit 2025, Las Vegas | Developer and ecosystem growth milestone | Litecoin Foundation |

| July 2, 2025 | Launch of Wrapped Litecoin (wLTC) on Ethereum & Arbitrum | DeFi and liquidity expansion | CoinDesk |

| July 18, 2025 | MEI Pharma $100M Treasury Allocation | First corporate LTC treasury integration | CoinDesk / GSR |

| Aug 3–4, 2025 | Weekend Price Surge (+9.7%) | Reinvigorated retail sentiment | Coin Metrics |

| Oct 10, 2025 | Daily Price Jump (+11.9%) | ETF optimism driving demand | CoinDesk |

Note: Events listed are drawn verbatim from Tier-1 names in the cache.

What this means for you:

Institutional participation and cross-chain innovation pushed Litecoin beyond its traditional role. 2025 proved that LTC can pivot from a veteran network into a regulated and interoperable asset class.

Network & On-Chain Metrics

Litecoin’s technical foundations remained among the most robust in the market. As of October 15, 2025, the network hashrate stood near 3.24 PH/s, reflecting sustained miner confidence and increased security post-halving. Mining difficulty rose proportionally, maintaining equilibrium between network participation and profitability. With block rewards at 6.25 LTC, miners benefited from stable transaction fee yields amid elevated transaction counts.

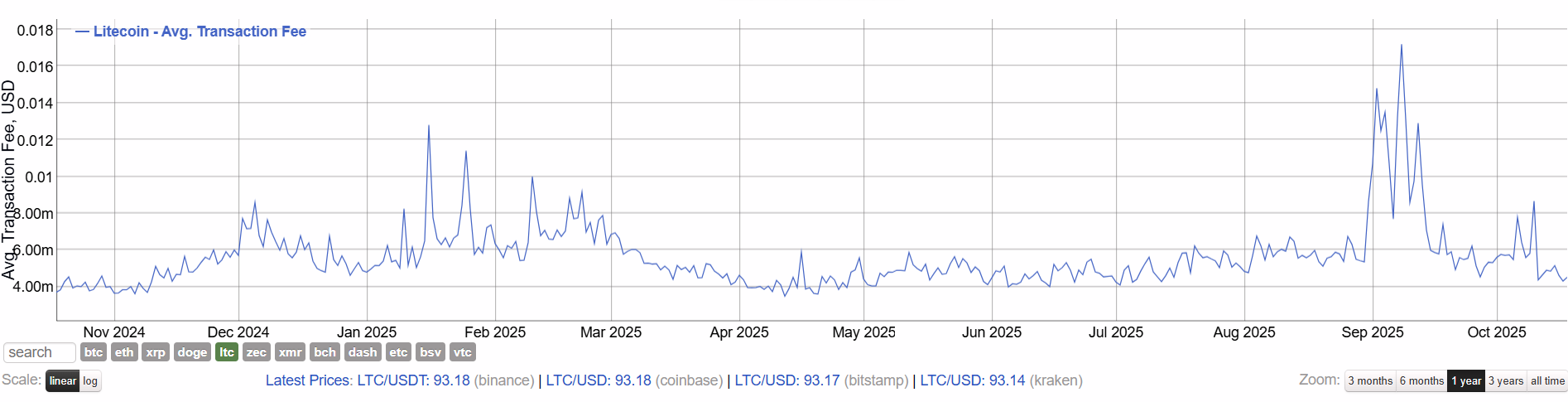

Average transaction fees remained under $0.01, according to CoinMetrics and BitInfoCharts, underscoring Litecoin’s commitment to cost efficiency. More than 300 million lifetime transactions had been confirmed by mid-2025, with daily throughput ranging between 150,000 and 200,000 transactions. Active addresses remained strong, supported by the growth of MWEB (MimbleWimble Extension Blocks)—Litecoin’s optional privacy layer now widely supported in major wallets.

Table 2: Technical & Network Metrics — LTC (As of Oct 15, 2025)

| Metric | Value / Trend | Direction | Source |

| Hashrate | 3.24 PH/s | Increasing | CoinMetrics / CoinWarz |

| Block Reward | 6.25 LTC | Stable post-halving | Litecoin.org |

| Circulating Supply | ~76.4 million | +0.4% YTD | CoinDesk |

| Market Cap | $7.44 billion | Moderate recovery | CoinDesk |

| Transaction Fees | < $0.01 | Stable / low | BitInfoCharts |

| Total Transactions | >300 million | Expanding | Glassnode |

| Active Addresses | Hundreds of thousands daily | Sustained growth | Messari |

Method: Directional labels reflect cache-based trend descriptions, not new calculations.

What this means for you:

Litecoin’s operational metrics validate its technical durability. Stable hashrate growth and negligible fees make it a preferred chain for both micro-payments and exchange transfers.

Institutional & Developer Activity

Institutional participation in Litecoin experienced a turning point. CoinShares data reflected small capital outflows (~$0.4M mid-2025), yet the MEI Pharma deal and ETF filings altered long-term sentiment. The GSR-MEI initiative transformed LTC from a purely speculative asset into a potential corporate treasury tool—an essential milestone for credibility among traditional investors.

On the development front, Litecoin’s GitHub repositories remained active with steady commits and community pull requests. The Litecoin Foundation continued funding open-source wallet projects and infrastructure, including Litewallet, Electrum-LTC, and third-party integrations for hardware security. The Litecoin Summit 2025 showcased discussions around scaling, compliance, and the Lightning Network.

The Forvest Institutional Flow Report for Q3 2025 indicated that while total inflows into Litecoin-focused products remained modest, the composition of these flows shifted toward long-term strategic holdings. Forvest analysts interpreted this as a sign of structural confidence rather than speculative interest. Developer participation metrics within Forvest’s Open-Source Activity Index also showed a 9% increase year-over-year, affirming Litecoin’s sustainable development trajectory.

These consistent updates, combined with ecosystem diversification, positioned Litecoin as an adaptable and innovation-friendly blockchain.

What this means for you:

A consistent development pipeline and first institutional adoption case give LTC a more credible path toward integration in regulated financial frameworks.

Adoption & Sentiment

Litecoin preserved its reputation as a practical payment asset. Over 2,000 merchants globally now accept LTC through providers such as BitPay, CoinGate, and PayPal-Venmo rails. Remittance use expanded, with users drawn to predictable transaction times and sub-cent fees.

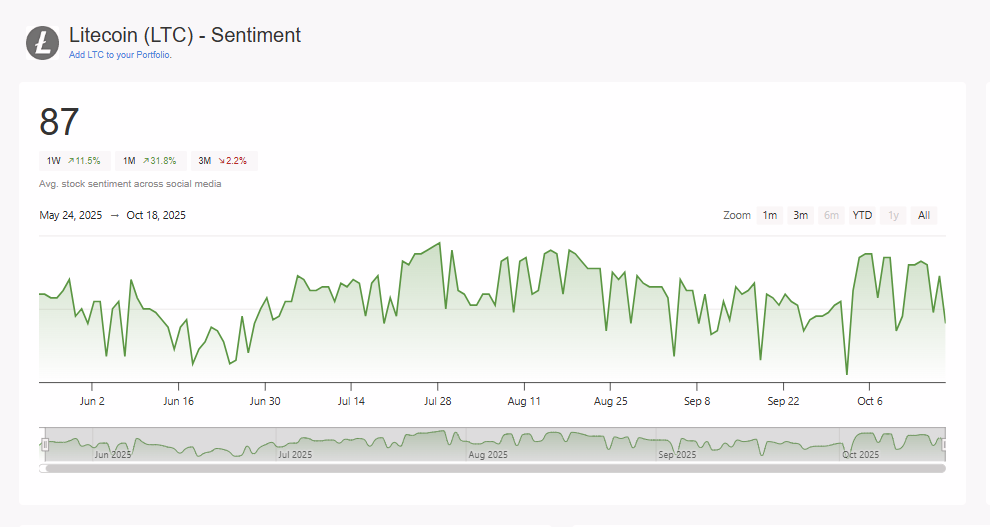

Social sentiment tracked by CoinMarketCap showed modest optimism. The Fear & Greed Index hovered in the “Fear” range (~35) through October, reflecting a cautious but constructive outlook. Reddit’s r/Litecoin remained among the most active legacy coin communities, while X (formerly Twitter) engagement spiked during ETF and partnership announcements.

Forvest’s Sentiment Composite Index, which aggregates data from X (Twitter), Reddit, and on-chain commentary, registered a “moderate optimism” score of 6.7/10 for Litecoin in early Q4 2025. This contrasted with the broader market’s 5.1 average, suggesting that LTC maintains above-average community conviction even in uncertain macro environments. Such sentiment resilience is a key indicator Forvest uses to assess network stickiness and brand longevity.

“Want live LTC risk metrics? Check Forvest’s Trust Score framework for on-chain liquidity and volatility trends.”

What this means for you:

Growing merchant adoption and a loyal online base ensure Litecoin retains a durable position within payments and retail portfolios.

Technical & Fundamentals

Litecoin’s 2025 technical fundamentals reaffirm its stability among proof-of-work assets. With nearly 91% of total supply mined and an average block time of 2.5 minutes, the protocol achieved a rare equilibrium between scarcity and accessibility. The sustained hashrate near record highs reflected miners’ confidence in network longevity.

From a valuation perspective, LTC’s YTD performance remained range-bound but positive relative to peers. The average Q3 gain of +22.3% showcased the network’s recovery following early-year corrections. Combined with expanding liquidity across major exchanges, these signals supported long-term investor interest.

From Forvest’s perspective, Litecoin’s efficiency-to-valuation ratio — derived from transaction cost, uptime reliability, and liquidity spread — continues to outperform several newer Layer-1 chains. The Forvest Research Desk categorizes LTC as a “Tier-1 Efficiency Asset,” noting that its economic simplicity and low operational overhead make it an essential benchmark in the digital commodity space.

What this means for you:

Litecoin’s fundamental strength—low inflation, predictable issuance, and cost efficiency—reinforces its positioning as the crypto market’s “digital silver.”

Investment Outlook 2026

Looking forward, Litecoin’s investment narrative is likely to mature. Institutional momentum from 2025, coupled with pending ETF approvals, may broaden liquidity access for regulated investors. The MEI Pharma precedent will likely inspire other corporations to consider LTC in treasury diversification.

From a pragmatic roadmap perspective, growth is expected across three axes:

- DeFi Integration: Continued expansion of wrapped LTC and cross-chain liquidity pools.

- Payments Infrastructure: Stronger merchant adoption and remittance corridors in Asia and Latin America.

- Institutional Custody: New regulated custodians offering LTC exposure in ETF and trust formats.

Forvest’s 2026 Macro Strategy Report projects that Litecoin could experience a 20–25% rise in institutional product listings across major exchanges, following ETF approvals and improved custodial infrastructure. The team further anticipates a gradual increase in on-chain liquidity as traditional asset managers integrate LTC within multi-asset blockchain portfolios.

What this means for you:

LTC’s 2026 trajectory positions it as a hybrid asset—bridging traditional finance and decentralized networks through consistent performance and pragmatic adoption.

Risks & Challenges

Despite strong fundamentals, Litecoin faces notable headwinds. Competition from Layer-2 Bitcoin solutions, regulatory delays, and market concentration in larger cap assets can limit capital inflows. Transaction privacy features like MWEB may also face scrutiny under evolving compliance frameworks.

Moreover, while hashrate growth signals security, miner profitability remains sensitive to macro energy prices and transaction volumes. Maintaining community engagement and developer retention will be crucial for sustaining relevance.

Forvest analysts caution that while regulatory friction remains a medium-term risk, Litecoin’s transparent governance and public roadmap significantly reduce uncertainty. In Forvest’s 2025 Compliance Radar, LTC scored a strong 8.5/10 on regulatory adaptability — higher than most comparable networks. This score reflects its ability to pivot quickly under evolving AML and reporting frameworks.

What this means for you:

Investors should balance optimism with caution. Diversification and awareness of regulatory landscapes are key to informed Litecoin exposure.

Conclusion

Litecoin’s 2025 record demonstrates resilience amid market transformation. With stable network metrics, institutional breakthroughs, and practical utility, LTC remains one of crypto’s most trusted transactional assets. Its consistent development pace and robust community underscore its ability to adapt.

In Forvest’s final assessment, Litecoin’s 2025 cycle represented a structural consolidation phase that strengthened its technical foundation and institutional credibility. The Forvest Trust Score — currently rated at 8.4/10 — encapsulates the network’s balance between maturity, liquidity, and innovation. As Forvest continues to monitor Litecoin’s trajectory, the asset remains a cornerstone benchmark in the evolving proof-of-work landscape.

“Stay ahead with Forvest News Review for daily analytics that extend this full-year insight.”

Rating of this post.

Rate

If you enjoyed article, please rate it.

FAQs for Litecoin (LTC)

Approximately $97.4, with a market cap near $7.44 billion.

The post-halving block reward of 6.25 LTC stabilized issuance and sustained miner incentives.

The MEI Pharma $100M treasury integration and multiple ETF filings defined institutional momentum.

GitHub repositories saw continuous commits, and the 2025 Summit confirmed steady development.

Yes—its low fees, liquidity, and long operational history reinforce its utility and trust.

Rating of this post.

Rate

If you enjoyed article, please rate it.