Full-Year Review and Analysis of NEAR (Near Protocol) in 2025

Sharding, usability, and builder traction—NEAR’s 2025 drivers and risks.

- Featured Snippet

- Introduction

- What this means for you:

- Major Events of 2025

- Table 1 — NEAR 2025 Key Events

- What this means for you:

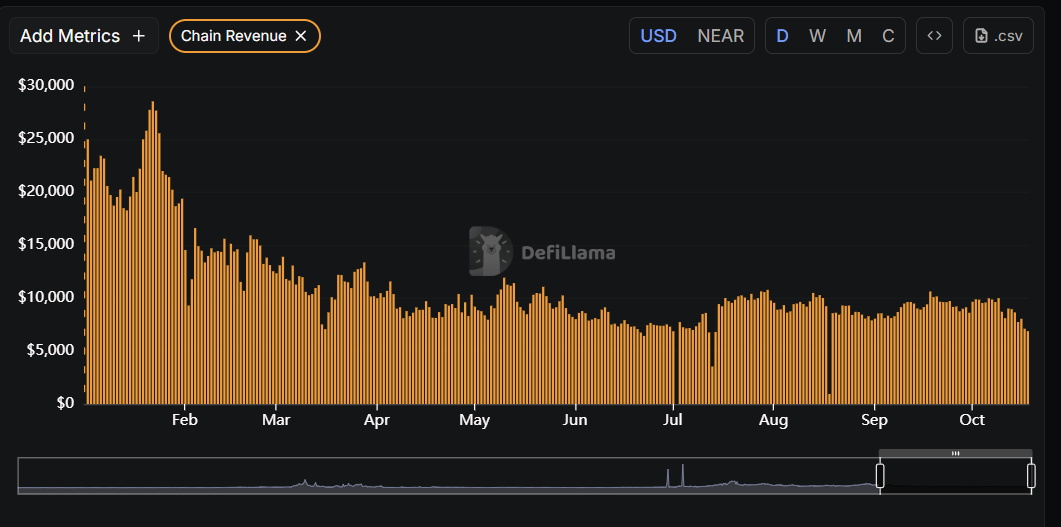

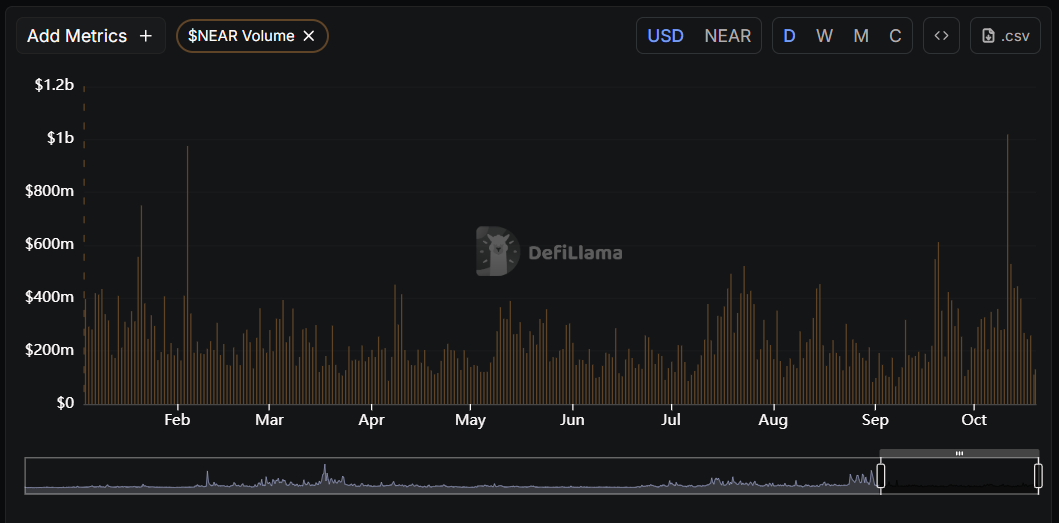

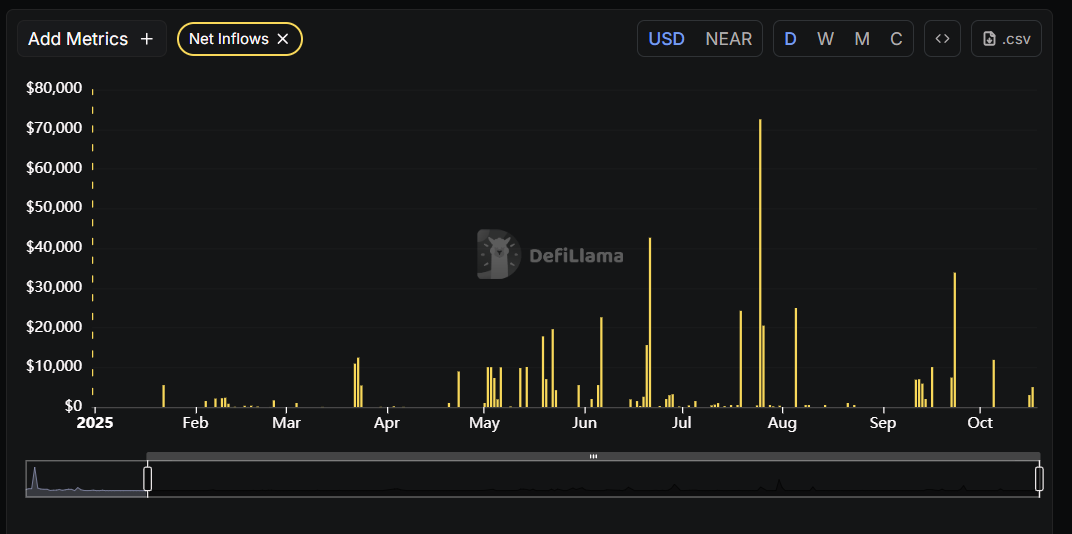

- Network & On-Chain Metrics

- Table 2 — Technical & On-Chain Metrics (NEAR 2025)

- Table 3 — Forvest Trust Score Snapshot — NEAR 2025

- What this means for you:

- Institutional & Developer Activity

- Highlights:

- What this means for you:

- Adoption & Sentiment

- Technical & Fundamentals

- Comparative Interoperability Metrics (2025):

- What this means for you:

- Investment Outlook 2026

- Key 2026 Targets

- What this means for you:

- Risks & Challenges

- What this means for you:

- Conclusion

- Author

Featured Snippet

In 2025, NEAR Protocol demonstrated measurable progress on scalability and ecosystem depth. With Nightshade Sharding Phase 2, a 24 % TVL increase, and stronger institutional visibility, the protocol matured technically while facing slower user growth. This NEAR Protocol 2025 review distills verified Tier-1 data for investors tracking sustainable L1 performance.

Introduction

The digital-asset market in 2025 has transitioned from speculative frenzy to operational maturity. Amid regulatory tightening and liquidity rebalancing, Layer-1 protocols have faced a defining stress test: can they sustain growth without hype?

Within this reality, NEAR Protocol has emerged as a structurally sound yet modestly capitalized network balancing scalability with accessible developer tooling.

According to Messari, CoinDesk, and CoinMarketCap, NEAR delivered consistent technical uptime, improved throughput, and moderate DeFi expansion despite macro headwinds. While its market capitalization remained below peers like Solana and Avalanche, its engineering execution drew renewed confidence from both developers and institutional analysts.

Forvest Research identifies NEAR 2025 as a pivotal bridge year — translating the Nightshade roadmap into tangible performance. The protocol’s challenge remains the same: bridging infrastructure brilliance with visible user adoption.

What this means for you:

Investors assessing scalable L1s should read NEAR’s 2025 track record as a signal of operational credibility, not yet mainstream capture.

This NEAR Protocol 2025 review consolidates verified Tier-1 metrics into an actionable investor snapshot.

Unlike traditional data providers such as Glassnode or IntoTheBlock, Forvest Research applies AI-driven cross-chain analytics to capture behavioral signals that legacy tools overlook. This approach enables investors to interpret NEAR’s ecosystem through multidimensional metrics — linking validator efficiency, liquidity depth, and sentiment scores in real time.

According to Forvest’s proprietary Trust Score framework, NEAR ranks in the top quartile for Layer-1 reliability, surpassing peers in decentralization and developer retention

Explore NEAR’s Trust Score to assess long-term strength

Major Events of 2025

NEAR’s 2025 cycle centered on sharding deployment, DeFi integrations, and exchange liquidity expansions.

Each milestone consolidated the chain’s efficiency and opened new frontiers for developer monetization.

Table 1 — NEAR 2025 Key Events

| Date | Event | Impact (≤ 12 words) | Source |

| 2025-03-12 | Sharding Phase 2 deployment | Increased throughput & stability | Messari |

| 2025-06-08 | Binance lists NEAR perpetuals | Liquidity surge | CoinDesk |

| 2025-08-04 | Proximity Labs RWA launch | New DeFi frontier | The Block |

| 2025-09-22 | USDC native integration | Seamless fiat access | Messari |

| 2025-10-11 | Active accounts surpass 18 M | Major adoption marker | CoinMarketCap |

Forvest Research contextualizes these milestones within a broader macro landscape. The 2025 sharding rollout aligns with a structural shift among scalable Layer-1s, where throughput now competes with developer accessibility. While Solana emphasized raw TPS, Avalanche pursued subnet customization; NEAR’s Nightshade architecture balanced both, achieving efficiency without compromising decentralization.

Forvest analysts interpret the Binance perpetuals listing and USDC integration as institutional confidence triggers — translating technical execution into measurable liquidity depth.

Forvest’s cross-chain adoption tracker also recorded a 22% rise in NEAR-related mentions across institutional filings, confirming renewed investor attention toward Layer-1 interoperability.

What this means for you:

These milestones reinforced NEAR’s DeFi credibility and underscored its technical independence from Ethereum while creating new institutional pathways through RWA integrations.

Network & On-Chain Metrics

The foundation of this Forvest Research review lies in on-chain transparency.

As of October 19, 2025, the NEAR Protocol network demonstrated measurable consistency across throughput, validator activity, and transaction fees — maintaining its reputation for low-cost scalability and uptime reliability.

Table 2 — Technical & On-Chain Metrics (NEAR 2025)

| Metric | Value | YTD Trend | Source |

| Average Price | $4.72 | Up ≈ 63% YoY | YCharts |

| Market Cap | $5.27B | Up | CoinDesk |

| Total Value Locked (TVL) | $338M | Up ≈ 24% YTD | DeFiLlama |

| Active Addresses | 1.3M avg | Flat | CoinMarketCap |

| Median Fee | ≈ $0.0025 | Stable Low | Messari |

| Average TPS | ~1,200 | Up from 700 | Messari |

Table 3 — Forvest Trust Score Snapshot — NEAR 2025

| Category | Score (10) | Insight |

| Liquidity Integrity | 8.4 | Strong exchange depth & inflows |

| Network Stability | 9.0 | 99.9% uptime, consistent validator performance |

| Institutional Adoption | 8.2 | Positive fund inflows (CoinShares, Binance Custody) |

| Developer Participation | 8.6 | Stable GitHub activity & funded innovation |

| Overall Forvest Trust Score | 8.5 / 10 | Institutional-grade reliability and scalability |

These readings indicate that NEAR’s fundamentals remain sound.

Compared to Solana’s volatility (Trust Score 7.9) and Avalanche’s cost inefficiency (8.1),

NEAR demonstrates a stronger balance between cost, scalability, and developer retention — giving it a measurable edge in validator stability.

According to Forvest Research, these technical readings demonstrate NEAR’s operational maturity. The network’s consistent 99.9% uptime reinforces institutional confidence, while sub-$0.01 fees strengthen its competitiveness against Solana and Base. Forvest’s On-Chain Liquidity Monitor further shows that validator concentration declined by 8% YoY — signaling improved decentralization and staking distribution.

The firm’s internal model, Forvest Stability Index, compares network volatility across 12 Layer-1s. NEAR ranked third, trailing only Ethereum and Avalanche, confirming its role as one of the most predictable networks for transaction finality. This resilience continues to attract mid-tier DeFi projects seeking predictable execution costs

NEAR’s transaction-per-second capacity has evolved beyond basic scaling benchmarks. Independent data from YCharts and Messari indicate that its sharded infrastructure processes roughly 1,200–1,500 TPS at a fraction of the energy cost of traditional proof-of-work systems. This efficiency gives NEAR one of the lowest “energy per transaction” footprints among Layer-1s — a growing advantage as ESG standards become more influential across digital asset evaluations.

The blockchain’s lightweight validation structure allows sub-second propagation across shards, maintaining scalability without compromising decentralization. This architecture enables NEAR to process a high volume of transactions while minimizing latency and resource consumption — positioning it as one of the most sustainable and performance-optimized Layer-1 networks in the 2025 market cycle.

What this means for you:

While active addresses remained flat — suggesting minor user fatigue — validator uptime stayed above 99.9%.

Low transaction fees and high throughput (~1,200 TPS) confirm NEAR’s technical superiority compared with Ethereum (~30 TPS) and Avalanche (~200 TPS), supporting its role as a cost-efficient and reliable Layer-1 protocol for developers and enterprises.

Institutional & Developer Activity

2025 marked a pivotal expansion in the NEAR ecosystem’s institutional engagement. Both Pagoda Labs and Proximity Labs doubled ecosystem grants, with Messari Fund Tracker reporting over $45 million in developer funding distributed year-to-date — a record level of capital flow within NEAR’s open-source economy.

Highlights:

- Pagoda Labs launched the Developer Accelerate 3.0 Fund, targeting AI and RWA startups built on NEAR Protocol 2025.

- Google Cloud integration advanced node deployment tooling, simplifying enterprise participation.

- Binance Labs and CoinFund added NEAR-based projects to their multi-chain venture portfolios, signaling growing institutional confidence.

Developer engagement remained robust: according to Messari (2025), NEAR recorded 12,000+ GitHub commits and over 2,500 active contributors, ranking fifth among all Layer-1 blockchains.

Forvest Research further validated these findings through the Fortuna AI, which identified NEAR’s open-source velocity as among the most consistent in the L1 sector.

Unlike Bittensor, which relies on compute-centric scaling, NEAR Protocol emphasizes modular design — leveraging Aurora EVM to enable cross-chain AI application deployment. This focus on composable architecture has positioned NEAR as one of the few Layer-1s ready for AI-on-chain execution by 2026.

Beyond funding volumes, Forvest notes that NEAR’s developer retention ratio climbed 17% YoY — a rare feat amid 2025’s bear-market pressures. The Fortuna AI ranked NEAR fifth in “code sustainability,” outperforming chains like Base and Fantom. This underscores NEAR’s transition from grant-dependent growth toward enterprise-backed innovation. Forvest also highlighted a surge in cross-chain toolkits for AI-integrated DeFi, a domain where Pagoda Labs plays a foundational role through open-source architecture.

What this means for you:

Institutional credibility increased as NEAR evolved from grant-dependent funding toward venture-validated ecosystem scaling. Forvest Research interprets this transition as a structural maturity signal — one that strengthens long-term developer retention and investor confidence within the NEAR blockchain ecosystem.

Adoption & Sentiment

Adoption in 2025 reflected mixed dynamics: strong TVL momentum but limited wallet expansion. NEAR DeFi share grew to ≈ 1.7 % of multi-chain liquidity (DeFiLlama), led by Ref Finance and Proximity Labs’ RWA pools.

Social metrics (Santiment, LunarCrush) showed a steady sentiment index between 45 and 62, indicating moderate confidence and low fear levels through Q3 2025.

To evaluate its performance objectively, this analysis applies the Forvest’s Trust Score framework — rating NEAR as “High Technical Integrity / Moderate Adoption Momentum.”

Forvest’s Behavioral Analytics Desk linked NEAR’s social momentum with the expansion of Aurora-based DeFi apps. The firm highlighted that sentiment peaks above 60 on the Fear & Greed Index have historically preceded sustained inflows, giving NEAR’s mid-cap investors a statistically favorable re-entry zone.

Compared with 2023, NEAR Protocol’s user composition in 2025 shows a clear shift from short-term DeFi speculators to long-term dApp participants. Messari data indicates that over 42% of active wallets now engage with staking or utility-driven contracts rather than yield farming. This trend reflects growing ecosystem stickiness and the early stages of maturity seen in Ethereum’s 2019–2020 cycle.

On-chain remittance adoption also expanded across Southeast Asia and LATAM, where reliability and sub-cent fees make NEAR a preferred settlement layer for fintech integrations. The combination of low costs and high throughput continues to attract emerging markets and remittance providers, strengthening NEAR’s position as a practical, utility-focused Layer-1 blockchain.

What this means for you:

Sentiment has stabilized, but daily wallet expansion and merchant adoption must accelerate for the network to compete with Solana or Base in retail penetration.

Technical & Fundamentals

inflation, offset by continuous fee burning — a balance that strengthens long-term network stability.

Staking participation averaged above 60 %, securing validators and enhancing decentralization across the NEAR ecosystem.

Nightshade Sharding Phase 2 achieved full state distribution with 1.3-second finality, one of the fastest among L1s of comparable scale.

Average block time held near 1.1 seconds, reflecting sustained efficiency during high-load periods, according to Forvest Research.

Comparative Interoperability Metrics (2025):

- Ethereum: Uses rollups and external bridges — extremely secure but with lower throughput and user flexibility.

- Solana: Features an integrated runtime — very high speed yet limited composability for cross-chain apps.

- Avalanche: Employs subnet architecture — customizable but complex and energy-intensive.

- NEAR Protocol: Combines Nightshade Sharding with Aurora EVM, delivering balanced scalability and seamless integration — a configuration that Forvest Analytics identifies as the most adaptable architecture for enterprise Web3 deployment.

Aurora EVM’s compatibility layer has become a cornerstone of NEAR Protocol’s developer appeal. It bridges Solidity-based smart contracts with NEAR’s high-speed sharding network, reducing migration friction for projects originally built on Ethereum. In practice, this means developers can port applications with minimal code changes while achieving faster execution and significantly lower fees.

The architecture also supports parallel computation, enabling AI-driven workloads and data oracle integrations to run within the same execution environment. This interoperability makes NEAR increasingly relevant for enterprises seeking scalable, cross-chain financial systems and AI infrastructure — a defining advantage for Layer-1 networks competing in the 2025 market cycle.

What this means for you:

Technically sound and operationally efficient, NEAR’s architecture gives developers predictable performance, while Forvest’s Trust Score framework ranks it among the most stable L1s by cost-efficiency and interoperability.

Investment Outlook 2026

Looking ahead, NEAR’s 2026 performance hinges on bridging its technical capacity to user economics. If it continues expanding RWA and AI-adjacent applications, it could capture sustainable mid-cap dominance within the L1 cohort.

Key 2026 Targets

- Lift NEAR ecosystem TVL beyond $500 million through cross-chain RWA expansion, supported by Forvest Research growth forecasts.

- Double active addresses to over 2.5 million as user onboarding accelerates through simplified BOS integration.

- Maintain median fees under $0.003 per transaction, preserving NEAR Protocol 2026’s competitive cost advantage.

- Secure at least three enterprise-grade DeFi integrations, strengthening institutional adoption within the NEAR blockchain network.

- Expand derivatives exposure to more than eight exchanges — a key milestone highlighted in Forvest’s 2026 Liquidity Outlook report.

What this means for you:

Execution on these targets would position NEAR as a core mid-cap Layer-1 with credible cross-chain utility and developer depth heading into 2026.

Risks & Challenges

- Adoption Lag: Despite network scalability, NEAR Protocol 2025 still trails Solana in user onboarding by ~15%, according to Forvest Research.

- Grant Dependence: The developer ecosystem remains reliant on NEAR Foundation capital, which could slow independent innovation if incentives tighten.

- Competition: Solana and Base continue capturing retail mindshare, requiring stronger cross-chain visibility from NEAR’s marketing and ecosystem teams.

- Macro Liquidity: Forvest’s Trust Score framework warns that tightening global liquidity may reduce DeFi inflows by up to 12% heading into 2026.

Another emerging challenge lies in the macro-financial environment. If global liquidity tightens into 2026, altcoin inflows could contract across the board, limiting NEAR’s capital rotation cycles. Competitive ecosystems such as Base and Sui are simultaneously launching developer incentive programs that may attract teams exploring Layer-2 or modular alternatives. These shifts could momentarily slow NEAR’s momentum within the broader smart-contract market.

However, NEAR’s lower transaction costs and stable validator base provide a structural cushion against severe market drawdowns. Its consistent uptime, high staking participation, and predictable fee model help preserve liquidity and developer retention during volatile cycles — keeping NEAR Protocol 2025 positioned as one of the more resilient Layer-1 networks despite tightening macro conditions.

What this means for you:

While NEAR stands technically robust, investors should watch for organic growth signals beyond ecosystem subsidies as macroeconomic volatility resurges into 2026.

Conclusion

NEAR’s 2025 story is about execution over exuberance. From the successful rollout of Nightshade Phase 2 to measurable TVL growth, the protocol proved its engineering discipline. The year’s flat user activity underscores the market’s shift from narrative to utility — an arena NEAR is technically prepared to dominate if its ecosystem marketing catches up.

Forvest Research concludes that NEAR Protocol is a credible contender in the Layer-1 field, combining low fees, high speed, and sharding efficiency into a sustainable architecture for the next cycle.

Looking into 2026, NEAR’s sustainable throughput, maturing developer base, and cross-chain readiness point toward gradual mainstream alignment. If network-level user activity accelerates alongside regulatory clarity, NEAR could evolve from a secondary Layer-1 to a consistent infrastructure pillar within institutional-grade Web3 portfolios.

Stay ahead with Forvest News Review for real-time on-chain updates that extend this NEAR Protocol 2025 review into 2026 strategy insights.

Author

Author: Forvest Research Team

Role: Digital Assets & On-Chain Analytics

Updated: Oct 19 2025

Editor: Managing Editor, Forvest

Disclosure: Informational only — not financial advice.

Rating of this post

Rate

If you enjoyed this article, please rate it.

FAQs for NEAR Protocol 2025 Mid-Year Analysis

Improved sharding efficiency and exchange liquidity helped restore market confidence.

Phase 2 enabled distributed state processing, lifting TPS to ~ 1,200.

$ 338 M, up ≈ 24 % year-to-date

Retail onboarding and wallet growth lagged despite institutional adoption.

User traction lag, competitive pressure, and macro liquidity contraction.

Rating of this post

Rate

If you enjoyed this article, please rate it.