What Are Decentralized Exchanges (DEX) and How They Work in 2025? (Beginner-Friendly Overview)

A complete beginner-friendly guide explaining how decentralized exchanges work, why they matter in 2025, and how users can interact with them safely and confidently.

- Why DEX Platforms Matter in 2025

- How a DEX Works (Simple Explanation for Beginners)

- Automated Market Makers (AMM): The Core Mechanism Behind DEX Trading

- How AMMs Function

- CEX vs DEX Comparison (2025)

- Types of DEX Platforms in 2025

- 1. AMM-Based DEXs (Most Common for Beginners)

- 2. Order-Book DEXs (More Professional)

- 3. Aggregator Platforms

- Why DEX Fees Are Lower in 2025

- What You Need Before Using a DEX

- Liquidity Pools and Yield Opportunities

- Risks Beginners Must Understand

- Why DEX Adoption Will Continue Growing

- Understanding Decentralized Exchanges (DEXs) in 2025

- 1. DEX Architecture: The Core Building Blocks

- 1. Smart Contracts

- 2. Liquidity Pools

- 3. Routing & Price Determination

- 2. The DEX Trading Flow (Step-by-Step for Beginners)

- Step 1 — Connect Wallet

- Step 2 — Approve Token

- Step 3 — Execute Swap

- Step 4 — Apply Fees + Slippage

- Step 5 — Receive Tokens

- How a DEX Swap Works (Process Overview)

- 3. Why Liquidity Pools Are the Heart of DEX Trading

- But pools also come with risk:

- 4. Smart Contract Routing: How DEXs Find the Best Price

- Single-Hop Routing

- Multi-Hop Routing

- Cross-DEX Aggregation

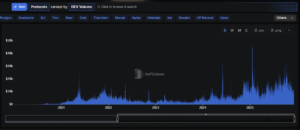

- 5. Gas Fees & Network Selection in 2025

- Low-Fee Networks for DEX Trading

- Higher-Fee Networks

- 6. DEX Security: What Is Safer and What Isn’t?

- Smart Contract Risk

- Fake Tokens

- Front-Running & MEV

- Phishing Risks

- Major DEX Risks & How Beginners Can Avoid Them

- 7. DEX vs CEX: Which Should Beginners Use First?

- How to Operate DEXs Safely and Effectively

- 1. Preparing Your Wallet Before Using a DEX

- Essential Wallet Setup Steps

- 2. Funding Your Wallet for the First Time

- Most Secure Beginner Flow

- 3. Connecting Your Wallet to a DEX Safely

- Safe Connection Checklist

- Recommended Official Links (2025)

- 4. How to Perform a Swap on a DEX (Step-by-Step)

- Step 1 — Select the token you want to swap

- Step 2 — Check the liquidity

- Step 3 — Check slippage tolerance

- Step 4 — Review the fee breakdown

- Step 5 — Approve the token (if required)

- Step 6 — Confirm the swap

- Step 7 — Wait for the blockchain confirmation

- Step 8 — Verify the result

- 5. Using Liquidity Pools for Passive Yield (LP Tokens Explained)

- How LP Tokens Work

- Main Advantages

- Main Risks

- 6. Impermanent Loss (IL) Explained Simply

- Simple Example

- 7. Advanced DEX Features in 2025

- Limit Orders (UniswapX, 1inch Fusion)

- Gasless Swaps (on L2 networks)

- Cross-Chain Swaps

- Routing Algorithms

- AI-Optimized Execution (2025 trend)

- 8. DEX Aggregators (Best Execution in 2025)

- Top Aggregators

- Why Aggregators Matter

- 9. MEV, Sandwich Attacks, and How to Avoid Them

- Common Attacks

- How to Protect Yourself

- 10. How to Verify Token Contracts (Beginner Safety)

- How to Verify a Token Safely

- 11. Common DEX Mistakes Beginners Must Avoid

- 12. Building a Long-Term Workflow for DEX Safety

- 13. Using Forvest Tools With DEX Trading

- Forvest Trust Score

- Forvest Portfolio Calculator

- Forvest AI Insights

- DEXs Empower Users — But Only With Proper Education

- ⚠️ Disclaimer

- ⚠️ No Investment Advice

Decentralized exchanges (DEXs) have become one of the most important pillars of the crypto ecosystem in 2025. While centralized exchanges (CEXs) remain popular for beginners due to their simplicity, DEX platforms now offer safer custody, wider token access, lower fees on modern blockchains, and significantly improved user experience. A DEX allows users to trade directly from their own wallet without relying on a company to hold their funds, making them an essential tool for anyone who wants sovereignty over their assets.

Before diving deeper into DEX mechanics, beginners who need a complete foundational guide can explore our main education path:

👉 How to Invest in Cryptocurrency: Step-by-Step Beginner’s Guide

This guide walks you through exchanges, wallets, risk levels, and portfolio basics before you start using DEX platforms.

Why DEX Platforms Matter in 2025

The 2025 DeFi environment is more robust, more scalable, and far cheaper to use than previous cycles. Several advancements have transformed the way decentralized exchanges operate:

-

Lower gas fees due to efficient L2 networks and high-performance chains

-

Improved routing algorithms that find the best available price across multiple pools

-

Better wallet security, including phishing protection and transaction simulation

-

Access to thousands of early-stage tokens long before they reach centralized exchanges

-

Non-custodial execution, eliminating withdrawal freezes or exchange custody failures

-

Complete transparency, since every swap and liquidity action is visible on-chain

These factors make DEXs not only more accessible but also more secure for users who want full control over their assets.

How a DEX Works (Simple Explanation for Beginners)

A decentralized exchange operates through smart contracts, which automate the trading process without intermediaries. Unlike a CEX that manages your account balance and executes orders internally, a DEX allows you to trade directly from your wallet. The process involves:

-

Connecting your wallet (MetaMask, Phantom, Coinbase Wallet, Rabby, etc.)

-

Selecting tokens to swap

-

Allowing the smart contract to access your token balance

-

Swapping tokens using liquidity pools

-

Paying a small network fee for confirmation

No account creation, no KYC, and no custodial risk.

Your funds remain in your control throughout the entire transaction.

Automated Market Makers (AMM): The Core Mechanism Behind DEX Trading

AMMs are the engine that powers modern decentralized exchanges. Instead of using order books, AMMs rely on liquidity pools funded by users. This system enables:

-

Instant token swaps

-

24/7 liquidity

-

Transparent pricing models

-

Equal access for all users

How AMMs Function

A liquidity pool contains two or more assets (for example, ETH and USDC). When you swap USDC for ETH:

-

The pool automatically adjusts ratios

-

Smart contracts update the price

-

Liquidity providers earn a small fee from your trade

This system works across ecosystems such as Ethereum, Solana, Base, Arbitrum, Optimism, Polygon, and BNB Chain.

CEX vs DEX Comparison (2025)

| Feature | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|---|

| Custody | Platform controls funds | User controls private keys |

| KYC | Required | Not required |

| Fees | Typically higher | Lower on L2 chains |

| Token Access | Limited | Thousands of pairs |

| Transparency | Low | 100% on-chain |

| Risk | Bankruptcy, freezes | Smart contract exploits |

| Beginner Experience | Very easy | Requires basic wallet setup |

This comparison helps beginners understand the structural differences and choose their preferred method of trading.

Types of DEX Platforms in 2025

1. AMM-Based DEXs (Most Common for Beginners)

Examples: Uniswap, PancakeSwap, Orca, Raydium

AMMs are the simplest way to trade on-chain and require no advanced knowledge.

2. Order-Book DEXs (More Professional)

Examples: dYdX, Vertex, Drift

They mimic CEX-style interfaces and are ideal for active traders.

3. Aggregator Platforms

Examples: 1inch, Matcha, Jupiter

They search across multiple DEXs to find the best execution price automatically.

Why DEX Fees Are Lower in 2025

Thanks to new high-throughput chains and L2 scalability, trading on DEX platforms has become dramatically cheaper. The following networks dominate low-fee trading:

-

Arbitrum

-

Base

-

Optimism

-

zkSync

-

Solana

-

BNB Chain

On these networks, swap fees can be as low as a few cents, making DEX trading accessible for small portfolios.

What You Need Before Using a DEX

To trade safely and efficiently on any DEX, beginners must have:

-

A non-custodial wallet

-

A small amount of gas token (ETH, SOL, BNB, etc.)

-

Basic understanding of network selection

-

Awareness of smart contract risk

-

A secure device and updated browser

👉If you’re still choosing your first wallet or comparing options, our in-depth guide Best Crypto Wallets 2025: Security Guide — walks you through hardware vs software wallets, security trade-offs, and beginner-friendly setups.

This helps users avoid suspicious tokens or unsafe contracts before interacting with a DEX.

Liquidity Pools and Yield Opportunities

Beyond simple swaps, DEX platforms allow users to:

-

Provide liquidity

-

Earn trading fees

-

Participate in yield farming

-

Supply assets to lending protocols

-

Use tokens as collateral within DeFi ecosystems

These opportunities allow beginners to learn how decentralized finance works while maintaining transparency and control.

Risks Beginners Must Understand

While DEXs eliminate custodial risks, they introduce new types of risks:

-

Smart contract vulnerabilities

-

Impermanent loss for liquidity providers

-

Fake tokens and phishing contracts

-

Slippage during high volatility

-

Incorrect network usage (e.g., sending ETH on the wrong chain)

Using trusted tools and verifying contract addresses are essential steps for safety.

Why DEX Adoption Will Continue Growing

As global regulation tightens around centralized exchanges, more users seek:

-

Full asset sovereignty

-

Non-custodial storage

-

Permissionless trading

-

Access to early-stage ecosystems

-

Transparency and open-source infrastructure

DEX platforms perfectly align with these needs, making them a core component of the 2025 crypto landscape.

Understanding Decentralized Exchanges (DEXs) in 2025

Decentralized exchanges (DEXs) have become the backbone of on-chain trading in 2025. While centralized exchanges remain useful for beginners, DEX platforms offer unmatched transparency, control, and accessibility. In this section, we break down exactly how DEXs work, what happens behind the scenes, and why these mechanisms are changing how people trade crypto globally.

Understanding how DEXs operate helps beginners avoid common mistakes, choose safer platforms, and interact confidently with blockchain-based financial systems. Just like in our portfolio frameworks, the goal here is education, not financial advice.

1. DEX Architecture: The Core Building Blocks

A decentralized exchange is built around three technical layers:

1. Smart Contracts

These self-executing programs handle swaps, liquidity management, fees, and pricing. Once deployed, they run without a central operator.

2. Liquidity Pools

Users deposit assets (like ETH/USDC), enabling decentralized trading. Liquidity providers (LPs) earn fees from every trade.

3. Routing & Price Determination

Instead of an order book, DEXs use mathematical formulas to determine trading prices.

The most common model is the constant product formula:

x × y = k

(Used by Uniswap, PancakeSwap, Raydium, Orca)

This formula ensures the pool always maintains balance between its two assets.

These three layers replace the centralized exchange role traditionally played by a company.

2. The DEX Trading Flow (Step-by-Step for Beginners)

When you execute a swap on a DEX, this is what happens behind the scenes:

Step 1 — Connect Wallet

Users connect through MetaMask, Phantom, Trust Wallet, Coinbase Wallet, or Rabby.

Step 2 — Approve Token

The smart contract receives permission to access the specific token being swapped.

Step 3 — Execute Swap

The DEX checks liquidity pools and calculates the best possible execution.

Step 4 — Apply Fees + Slippage

Trading fees go to LPs; slippage depends on pool depth.

Step 5 — Receive Tokens

The smart contract transfers the output tokens directly to your wallet.

There is no middleman, no withdrawal freeze, and no custodial control.

How a DEX Swap Works (Process Overview)

| Step | What Happens | Who Controls It | Risk Level |

|---|---|---|---|

| Connect Wallet | You connect MetaMask/Phantom/etc. | User | Low |

| Approve Token | Allow contract to access token | User | Low |

| Check Price | DEX calculates price via AMM | Smart contract | Medium |

| Execute Swap | Swap triggered on-chain | User + AMM | Medium |

| Pay Fee | LPs receive fee | Protocol | Low |

| Receive Tokens | Tokens sent directly to wallet | Smart contract | Low |

This model is consistent across major ecosystems such as Ethereum, Solana, BNB Chain, Base, Arbitrum, and Optimism.

3. Why Liquidity Pools Are the Heart of DEX Trading

Liquidity pools make decentralized trading possible.

A pool consists of two assets—for example:

ETH / USDC

SOL / USDT

BTC / WBTC

APT / SUI

Users deposit equal value of each asset into the pool.

In return, they receive:

-

A portion of trading fees

-

A share of pool ownership

-

Potential yield through farming (on some platforms)

But pools also come with risk:

LPs may face impermanent loss — this happens when the price of one asset changes faster than the other.

Beginners should not add liquidity without understanding this risk.

4. Smart Contract Routing: How DEXs Find the Best Price

Modern DEX engines use advanced routing systems to ensure users get optimal execution:

Single-Hop Routing

Swap ETH → USDC directly through one pool.

Multi-Hop Routing

Swap ETH → USDT → SOL if direct liquidity is low.

Cross-DEX Aggregation

Platforms like 1inch, Matcha, and Jupiter scan multiple pools across multiple platforms to find the cheapest route.

Routing has improved dramatically in 2025 due to:

-

better algorithms

-

deeper liquidity

-

faster networks

-

optimized smart contracts

This is why DEX execution is now competitive with centralized exchanges.

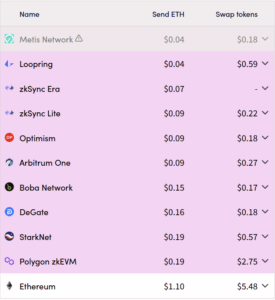

5. Gas Fees & Network Selection in 2025

Choosing the wrong network is one of the biggest beginner mistakes.

Low-Fee Networks for DEX Trading

-

Solana

-

Base

-

Arbitrum

-

Optimism

-

zkSync

-

Polygon

-

BNB Chain

On these networks, a swap can cost less than $0.10–$0.40.

Higher-Fee Networks

-

Ethereum Mainnet

-

Bitcoin Layer-2 bridges

-

Some EVM sidechains

Beginners should always check gas fees before swapping.

6. DEX Security: What Is Safer and What Isn’t?

DEX platforms eliminate custodial risk, but other risks remain:

Smart Contract Risk

A bug or exploit can drain a pool.

Fake Tokens

Scammers create tokens with the same ticker.

Solution → Always verify token contracts.

Front-Running & MEV

Bots can manipulate transaction order.

2025 tools (Flashbots Protect, MEV-resistant DEXs) reduce this risk.

Phishing Risks

Fake websites pretending to be real DEXs.

Beginners must bookmark official links.

For pre-trade risk checks, users can review asset fundamentals through Forvest’s risk-analysis tool:

👉 Forvest Trust Score

Major DEX Risks & How Beginners Can Avoid Them

| Risk Type | Description | Beginner Protection Strategy |

|---|---|---|

| Smart Contract Bug | Code vulnerabilities | Use audited DEXs (Uniswap, Jupiter, PancakeSwap, Orca) |

| Fake Tokens | Scam contracts | Verify token contract address |

| Front-Running | Bots manipulate swaps | Use MEV-protected RPC or L2 chains |

| High Gas Fees | Overpaying for swaps | Use Base, Solana, Arbitrum, BNB Chain |

| Phishing Sites | Fake DEX copies | Bookmark official URLs |

| Impermanent Loss | LP value drops | Avoid LPing as a complete beginner |

7. DEX vs CEX: Which Should Beginners Use First?

Beginners should start with centralized exchanges (CEX) due to simplicity and then gradually move toward DEXs when they:

-

understand how wallets work

-

have experience sending on different networks

-

learn basic contract safety

-

know how to avoid phishing

-

understand network fees

👉If you haven’t yet made your first purchase on a centralized exchange, our guide How to Buy Cryptocurrency on Centralized Exchanges: Beginner’s Guide (2025) — gives you a step-by-step walkthrough of funding an account, placing your first buy, and avoiding common CEX mistakes before you move into DEX trading.

A balanced approach works best:

Buy on CEX → Self-custody in wallet → Trade small positions on DEX.

How to Operate DEXs Safely and Effectively

Using a decentralized exchange in 2025 requires a combination of technical understanding, security awareness, and practical workflow. DEXs give users full control, but that control also introduces responsibility. Unlike centralized exchanges, DEXs do not provide customer support, password recovery, fraud protection, or transaction reversals. Once you confirm a transaction on a blockchain, it is permanent.

This section provides a complete, structured framework for using DEXs safely and effectively. It blends beginner-friendly steps with advanced knowledge so that readers can operate confidently in any DEX environment.

The goal is not to encourage trading but to educate users on how DEXs work in practice and how to avoid the common risks new users face.

1. Preparing Your Wallet Before Using a DEX

Before interacting with any DEX, the user must configure a wallet that supports the intended network. A DEX cannot be used without a compatible wallet.

Essential Wallet Setup Steps

-

Install a non-custodial wallet

MetaMask (EVM), Phantom (Solana), Rabby, Coinbase Wallet, or Trust Wallet. -

Create a new wallet and store your seed phrase offline

-

Write it on paper

-

Store in two separate secure locations

-

Never save digitally or take screenshots

-

-

Activate security layers

-

Strong password

-

Biometric lock (mobile)

-

Disable browser extensions you don’t use

-

-

Add the correct network

-

Ethereum

-

Arbitrum

-

Optimism

-

Base

-

Polygon

-

Solana (for Phantom)

-

Adding the correct network prevents beginners from sending assets to the wrong chain — one of the most common sources of loss.

2. Funding Your Wallet for the First Time

DEXs never accept credit cards or bank transfers.

You fund your wallet through:

-

A centralized exchange

-

A fiat on-ramp provider

-

A P2P service

-

A crypto bridge

Most Secure Beginner Flow

Buy crypto on a regulated CEX → Withdraw to your wallet → Use on a DEX.

Users should choose a cheap and fast network for transfers such as:

-

Solana (SOL)

-

Base (ETH)

-

Arbitrum (ETH)

-

Polygon (ETH)

-

TRC-20 USDT

Ethereum mainnet is secure but can be expensive for beginners.

3. Connecting Your Wallet to a DEX Safely

Once the wallet is funded, the next step is connecting it to a DEX.

This step introduces the first security risks.

Safe Connection Checklist

✔ Always open the DEX from the original domain

✔ Never click sponsored ads in Google

✔ Bookmark official links

✔ Disconnect wallet after use

✔ Verify you are on the correct network

Recommended Official Links (2025)

-

Jupiter (Solana)

This ensures readers do not accidentally land on fake interfaces.

4. How to Perform a Swap on a DEX (Step-by-Step)

Most DEX interactions follow the same basic workflow:

Step 1 — Select the token you want to swap

Example: USDC → ETH.

Step 2 — Check the liquidity

Low-liquidity tokens may cause high slippage.

Step 3 — Check slippage tolerance

Typical settings:

-

0.1% for stablecoins

-

0.5–1% for blue chips

-

2%+ for volatile assets

Step 4 — Review the fee breakdown

Users must check:

-

Network fee (gas)

-

DEX fee

-

Slippage impact

Step 5 — Approve the token (if required)

ERC-20 tokens require one “approve” transaction before swapping.

Step 6 — Confirm the swap

You must manually approve the transaction in the wallet popup.

Step 7 — Wait for the blockchain confirmation

Solana ≈ under 1 sec

Arbitrum/Base ≈ 2–4 sec

Ethereum mainnet ≈ 10–30 sec

Step 8 — Verify the result

Check your wallet balance.

If the token is not visible, import the contract manually.

5. Using Liquidity Pools for Passive Yield (LP Tokens Explained)

LPing allows users to deposit pairs of tokens into a pool in exchange for trading fees.

But LPing carries risks new users must understand.

How LP Tokens Work

If you add liquidity to an ETH/USDC pool:

-

You deposit equal value of both assets

-

You receive LP tokens as proof of ownership

-

You earn a share of trading fees

Main Advantages

✔ Passive yield

✔ Exposure to trading volume

✔ Support for decentralized liquidity

Main Risks

❌ Impermanent loss

❌ Volatility exposure

❌ Smart-contract vulnerabilities

6. Impermanent Loss (IL) Explained Simply

Impermanent loss happens when the price of the two assets in a liquidity pool diverge.

Simple Example

If ETH goes up faster than USDC:

-

The pool rebalances

-

You end up with less ETH

-

Your value underperforms simply holding ETH

IL affects all LPs — even on large platforms.

It is the #1 misunderstood risk in DEX participation.

7. Advanced DEX Features in 2025

DEXs have matured far beyond simple swaps.

Modern platforms offer:

Limit Orders (UniswapX, 1inch Fusion)

Non-custodial limit order execution.

Gasless Swaps (on L2 networks)

Transactions sponsored by the protocol.

Cross-Chain Swaps

Execute swaps across chains in one click using aggregators.

Routing Algorithms

DEXs search multiple pools to find the best price.

AI-Optimized Execution (2025 trend)

AI detects MEV threats and reroutes transactions.

These upgrades improve safety, pricing, and user experience.

8. DEX Aggregators (Best Execution in 2025)

Aggregators route your trade across many DEXs to find the best price.

Top Aggregators

-

1inch

-

Jupiter

-

Matcha

-

Odos

Why Aggregators Matter

✔ Reduced slippage

✔ Best-price routing

✔ Multiple DEXs in one transaction

✔ Auto-protection against bad liquidity

Aggregators are essential for beginners — they simplify everything.

9. MEV, Sandwich Attacks, and How to Avoid Them

MEV is one of the biggest risks in DEX trading.

Common Attacks

-

Sandwich attacks (attacker trades before and after your swap)

-

Front-running

-

Back-running

How to Protect Yourself

✔ Use aggregators with MEV protection

✔ Trade on L2 networks

✔ Avoid very low-liquidity tokens

✔ Use limit orders

10. How to Verify Token Contracts (Beginner Safety)

Most losses in DEX use come from fake tokens — not hacking.

How to Verify a Token Safely

✔ Check the token contract on CoinGecko

✔ Check the official website or GitHub

✔ Make sure the DEX loads the token automatically

✔ Avoid tokens sent to your wallet randomly

Never rely on search bars inside the wallet — scammers exploit this.

11. Common DEX Mistakes Beginners Must Avoid

❌ Buying tokens with low liquidity

❌ Trading during extremely volatile periods

❌ Not checking slippage

❌ Approving unlimited spending

❌ Using the wrong network

❌ Falling for airdrop scams

❌ Not disconnecting wallet after use

Avoiding these mistakes prevents the majority of beginner losses.

12. Building a Long-Term Workflow for DEX Safety

A sustainable workflow includes:

✔ Use a separate wallet for DEX activity

✔ Revoke token approvals monthly

✔ Track your swaps and gas fees

✔ Use hardware wallet for large funds

✔ Bookmark official DEX links

✔ Avoid Telegram/Discord “token links”

This transforms beginners into responsible on-chain users.

13. Using Forvest Tools With DEX Trading

Forvest tools help beginners evaluate assets before they interact with a DEX:

Forvest Trust Score

Risk scoring powered by fundamentals, sentiment, liquidity, volatility, and on-chain behavior.

Forvest Portfolio Calculator

Tracks real P/L and allocation exposure — crucial for DEX users.

Forvest AI Insights

Summaries of weekly crypto trends so beginners avoid hype-driven decisions.

👉Try the Forvest Crypto Portfolio & Profit Calculator to track your DEX investments over time.

These tools reduce confusion and help beginners stay disciplined.

DEXs Empower Users — But Only With Proper Education

DEXs remove intermediaries and give users total control over their funds.

But that control comes with responsibilities that beginners must take seriously.

A safe, confident DEX workflow in 2025 requires:

✔ a secure wallet

✔ proper network selection

✔ verified token contracts

✔ awareness of slippage and liquidity

✔ understanding MEV risks

✔ steady tracking and good habits

DEXs are powerful tools — and with the right education, beginners can use them effectively and safely.

⚠️ Disclaimer

This article is for educational purposes only. It does not provide legal, tax, financial, or trading advice. Cryptocurrency markets are volatile, and you may lose capital. Always conduct your own research and consult a licensed professional when necessary.

⚠️ No Investment Advice

Nothing in this guide should be considered a recommendation to buy, sell, or hold any cryptocurrency or financial product. All examples and explanations are illustrative and may not suit your personal financial situation or risk tolerance.

Rating of this post

Rate

If you enjoyed this article, please rate it.

FAQ: Decentralized Exchanges

A decentralized exchange is a blockchain-based trading platform where users trade directly from their wallets without intermediaries.

Yes, but safety depends on wallet security, avoiding phishing sites, and verifying smart contracts before confirming transactions.

CEX platforms hold your funds and manage trades. DEX platforms let you trade directly on-chain without giving up custody.

Most decentralized exchanges do not require KYC because trades are executed through smart contracts, not centralized accounts.

MetaMask, Phantom, Coinbase Wallet, and Rabby are commonly used because they support on-chain interactions and multi-chain networks.

Rating of this post

Rate

If you enjoyed this article, please rate it.