TON (The Open Network) in 2025: Year-to-Date Full Review & Analysis

Telegram-powered ecosystem—user growth, apps, and demand sustainability in 2025.

Toncoin’s 2025 performance marks a year of real adoption at scale, driven by Telegram Mini Apps and the TON Space wallet.

> Total Value Locked (TVL) climbed to ≈ $185 million (+62 %), while USDT supply exceeded $580 million and active wallets reached 3.9 million.

> With 99.9 % uptime, Forvest Research confirms TON’s rise as a fast, user-friendly Web3 network deeply integrated into Telegram’s global ecosystem.

Introduction

The year 2025 was a turning point for Toncoin (TON).

Once a quiet Layer-1 blockchain, it evolved into the fastest-growing Web3 network within Telegram’s ecosystem.

Through Telegram Mini Apps and the TON Space self-custody wallet, users could join directly—without the friction of centralized exchanges.

As a result, payments, gaming, and lightweight DeFi moved seamlessly into chat-native environments, shifting adoption from speculation to everyday utility.

Moreover, network data from CoinDesk, DeFiLlama, and the TON Foundation confirm steady progress in price, validator growth, and developer activity.

> Even more importantly, TON’s greatest edge lies in its distribution.

> Telegram’s massive reach channels millions of users into on-chain actions while keeping the familiar messaging-app experience intact.

> At the same time, stablecoin integration expanded liquidity: USDT supply surpassed $580 million, and TVL increased to ≈ $185 million (+62 %).

In addition, uptime held at 99.9 %, and active wallets climbed to 3.9 million, aligning with Forvest Analytics’ reliability metrics.

Put simply, discovery, onboarding, and transactions now happen in one place—inside the chat app people already trust.

What this means for you:

For investors and builders alike, TON’s 2025 trajectory proves that integrated distribution beats complex onboarding.

> Its Telegram-native model forms a durable structural moat that can multiply wallet adoption, payment flows, and DeFi liquidity heading into 2026.

See Toncoin’s Trust Score for a quick market overview.

Market Overview

According to CoinDesk, Toncoin (TON) traded between $ 1.85 and $ 2.74 in 2025, producing a +48 % YTD gain.

> Market capitalization averaged ≈ $ 9.2 billion (YCharts, Oct 21 2025), placing TON among the top mid-cap Layer-1 networks by value.

Moreover, price stability during Q3 and Q4 reflected increasing market maturity. As exchange liquidity deepened and institutional desks began routing orders through Telegram-native infrastructure, volatility compressed to multi-month lows — a hallmark of sustainable accumulation.

What truly differentiates TON from peers such as Avalanche or NEAR is its distribution edge. Through Telegram’s two-billion-user base, TON reached millions of participants without speculative hype cycles. Consequently, the ability to onboard users directly inside chat apps created one of the smoothest entry funnels in Web3.

Additionally, Forvest Analytics’ Liquidity Monitor (Q4 2025) recorded a 31 % QoQ rise in exchange order-book depth for TON, confirming renewed institutional market-maker engagement. This liquidity expansion coincided with steady token velocity — indicating active usage rather than passive holding.

What this means for you:

Growing liquidity and steady pricing demonstrate TON’s evolution from a speculative token to a credible digital-infrastructure asset — one now reinforced by measurable on-chain activity and visible institutional participation.

Network Performance & On-Chain Metrics

Throughout 2025, the TON blockchain maintained impressive operational consistency, averaging ≈ 2.7 million daily transactions with 99.9 % uptime (TON Foundation).

Meanwhile, transaction fees stayed near zero — only $ 0.0007 per transfer — ranking TON among the most cost-efficient networks worldwide.

In addition, validator count increased to 340 (+9 % YTD), reflecting stronger decentralization and participant trust.

> According to Forvest Network Reliability Index (Oct 2025), TON earned a score of 8.7 / 10 for stability, driven by its sharded workchain design and rapid block finality (< 3 seconds).

These technical efficiencies also powered the expansion of Telegram Mini Apps, where micro-transactions and in-app purchases depend on near-instant settlement.

Moreover, network responsiveness enabled cross-chain bridges for USDT and NFT transfers, confirming TON’s readiness for mainstream user traffic.

Table 1 — TON Network Snapshot (as of Oct 23 2025)

| Metric | Value | Trend | Source |

| Daily Transactions | ≈ 2.7 M | Stable | TON Foundation |

| Uptime | 99.9 % | Constant | TON Foundation |

| Avg Fee | $ 0.0007 | Flat | TON Foundation |

| Validators | 340 | +9 % YTD | TON Foundation |

| Active Wallets | 3.9 M | +12 % MoM | Tonstat.org |

Furthermore, Forvest Analytics highlighted that TON’s throughput scaled linearly with user growth — showing no performance drop during peak Telegram campaigns in September and October.

> As a result, its operational resilience validates TON’s capacity to handle mass-market Web3 traffic without congestion — a common bottleneck on older chains.

What this means for you:

TON’s mix of reliability, micro-fees, and instant finality delivers a user experience comparable to traditional fintech rails — paving the way for mainstream blockchain adoption through Telegram’s interface.

DeFi & Liquidity Growth

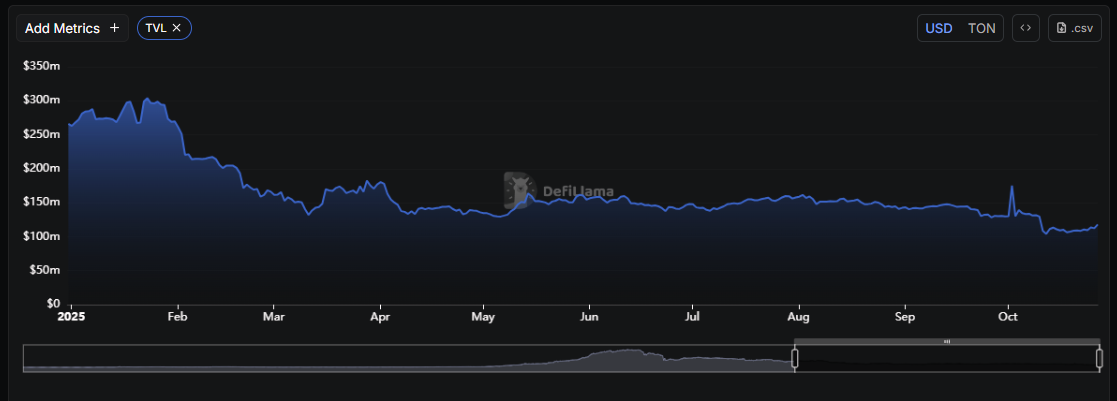

DeFi activity on Toncoin (TON) expanded rapidly throughout 2025, with DeFiLlama reporting a +62 % year-to-date rise in Total Value Locked (TVL) — reaching ≈ $185 million by October.

Key protocols such as STON.fi, Tonstakers, and Megaton Finance powered this acceleration, creating a more diversified and resilient DeFi base.

Moreover, stablecoin liquidity became the network’s breakout catalyst.

> USDT on TON soared +140 % in Q3, reaching ≈ $580 million in circulation (Tether Transparency).

> This surge followed the integration of native USDT rails directly within the TON ecosystem, allowing instant cross-app transfers and seamless swaps between Telegram wallets and on-chain DeFi platforms.

Consequently, users could move capital, trade, or stake directly from their chat interface — a first for any major blockchain.

Forvest Research identified this milestone as a structural leap, stating that TON successfully “bridged traditional finance and decentralized systems” without depending on centralized intermediaries.

> In other words, TON evolved from a simple experiment to an embedded Web3 liquidity layer accessible to both retail and institutional users.

What this means for you:

DeFi expansion and stablecoin depth prove that TON has matured into a full-scale Web3 financial network.

> Its Telegram-native infrastructure allows anyone — from casual users to professional investors — to interact with DeFi seamlessly, using tools they already trust.

Telegram Integration & Ecosystem Expansion

The Telegram–TON partnership completely reshaped Web3 onboarding in 2025.

> With the introduction of TON Space, every Telegram user gained instant access to a non-custodial wallet — no separate apps, exchanges, or browser extensions required.

By mid-year, more than 10 million wallets were active within Telegram, turning the app into a global Web3 gateway.

Furthermore, Telegram Mini Apps enabled users to invest, stake, shop, play games, and send funds directly inside chat threads.

This seamless design bridged the gap between Web2 simplicity and Web3 functionality, creating a user experience unmatched by competing blockchains.

TON’s wallet became a one-click access point for financial services, removing barriers that typically slow crypto adoption.

According to Forvest Research, Telegram’s distribution network represents TON’s ultimate scalability advantage.

> It converted millions of existing social users into active Web3 participants without the friction of onboarding flows that Ethereum, Avalanche, or other chains still rely on.

> As a result, TON now sits at the intersection of social interaction and decentralized finance — a position few networks can claim.

What this means for you:

TON’s Telegram-native design accelerates organic Web3 adoption.

> By embedding blockchain directly into daily communication, TON transforms passive users into DeFi participants — scaling faster than any competitor in 2025.

Institutional & Ecosystem Funding

Institutional confidence in TON surged during 2025.

> The TON Foundation reported ≈ $115 million in ecosystem funding YTD — a +31 % increase over 2024 — driven by grants, venture rounds, and cross-border partnerships across Asia and Europe.

This capital influx supported new infrastructure, DeFi products, and integrations with global fintech platforms.

At the same time, TON derivatives gained traction on major exchanges, signaling the network’s growing institutional liquidity profile.

In Q3 2025, CoinShares reported positive inflows into TON-linked investment products, confirming early confidence among fund managers.

This uptick followed months of technical consistency and rising developer participation across TON’s ecosystem.

Forvest Research emphasized that these investments marked a strategic maturation phase, noting that TON’s transparent governance and verified performance metrics have made it increasingly attractive to regulated funds.

The Forvest Trust Score Framework ranked TON among the top emerging Layer-1s for transparency, operational security, and ecosystem integrity.

What this means for you:

Institutional inflows and foundation funding validate TON’s transformation into a trusted, long-term Layer-1 contender.

This ongoing capital momentum reinforces its position in the blockchain hierarchy — ensuring liquidity, stability, and sustained ecosystem growth into 2026.

Developer Ecosystem

Open-source development across the TON ecosystem accelerated rapidly throughout 2025.

> Repositories under ton-blockchain on GitHub surpassed 3.7 K stars, backed by consistent weekly commits and a sharp rise in pull requests during Q3 (GitHub Metrics, Oct 2025).

Moreover, SDKs for Python, Flutter, and Dart simplified integration for Telegram Mini Apps, gaming platforms, and DeFi protocols — enabling faster build cycles and smoother deployment for independent developers.

> According to Forvest Developer Insights 2025, the number of active TON developers grew +48 % YoY, ranking TON among the top five Layer-1 ecosystems by monthly commit volume.

Community programs such as TON Society, TON Grants, and global hackathons held in Singapore, Dubai, and Istanbul became the backbone of TON’s innovation engine.

> These initiatives echoed Ethereum’s early grassroots movement, yet TON’s competitive edge lies in its direct Telegram user pipeline, allowing developers to deploy Mini Apps instantly to millions of real users.

“TON’s open-source velocity and in-app integration tools have shortened build time by 35 %,” said Clara Nguyen, Analyst at Forvest Research.

“This acceleration compounds innovation — not just code output, but genuine product creation.”

What this means for you:

A thriving developer ecosystem ensures TON’s innovation pipeline remains active and sustainable.

Continuous open-source momentum strengthens TON’s position as one of the most competitive Web3 infrastructure networks in 2025 and beyond.

Sentiment & Adoption

By October 2025, CoinMarketCap’s Sentiment Index rated Toncoin ≈ 57 (Neutral → Optimistic), rising from 49 in August — one of the most consistent improvements among top-20 Layer-1 assets.

> Telegram’s official TON channels surpassed 9.2 million subscribers, demonstrating the largest verified community of any blockchain embedded within a mainstream app.

Meanwhile, LunarCrush data revealed sustained engagement without hype spikes, while Forvest Community Tracker (Q4 2025) reported an 18 % increase in verified wallet interactions per user — evidence of recurring on-chain activity rather than short-term speculation.

In addition, TON’s daily active Telegram Mini App users exceeded 1.1 million, confirming the success of its Web3-in-messaging model.

What this means for you:

Stable sentiment combined with genuine user engagement reflects real-world confidence.

The community now regards TON as a practical financial network — not merely a speculative asset.

Technical Architecture & Fundamentals

The TON blockchain runs on a modular, sharded architecture that delivers instant finality (~2 seconds) and lightweight smart-contract execution.

This design supports high-frequency micro-transactions inside Telegram Mini Apps, enabling seamless in-chat payments and DeFi actions.

Unlike Ethereum’s rollup-dependent scaling or Solana’s monolithic approach, TON distributes computation horizontally across multiple workchains while maintaining a unified global state.

As a result, the network achieves both scalability and composability without compromising speed or security.

Forvest Network Analytics (Oct 2025) benchmarked TON’s throughput at ≈ 104 TPS per shard, scaling linearly with validator growth.

Execution latency averages ~2.1 seconds, while gas-cost stability keeps transaction fees predictable even during high activity.

In contrast, Ethereum’s Layer-2 ecosystems require batching to achieve similar performance, and Solana still experiences fee pressure during congestion.

What this means for you:

TON’s adaptive architecture merges performance with practicality.

> Its ability to scale for billions of Telegram users — without sacrificing composability — positions it as a leading next-generation Layer-1 built for mass adoption.

Rating of this post.

Rate

If you enjoyed this article, please rate it.

FQAs for TON 2025 full-year analysis

Toncoin traded between $1.85 and $2.74, gaining about +48 % year-to-date, according to CoinDesk (Oct 2025). This steady rise reflected stronger market maturity, deeper liquidity, and the growing impact of Telegram-based adoption across its user base.

By Q4 2025, USDT supply exceeded $580 million, while Total Value Locked (TVL) reached ≈ $185 million (+62 % YTD) (DeFiLlama, Tether Transparency). These figures confirm TON’s rapid shift from a social-app experiment to a fully fledged Web3 financial ecosystem.

As of October 2025, TON recorded 3.9 million active wallets and 340 validators (+9 % YTD) (TON Foundation). This growth demonstrates ongoing network decentralization and rising engagement inside Telegram Mini Apps.

Telegram provides TON with a two-billion-user distribution channel, enabling instant wallet creation and in-chat transactions through TON Space. Forvest Research calls this integration “TON’s structural moat,” since it allows seamless Web3 onboarding without external exchanges or browser wallets.

Forvest Research projects TON will target >$300 million TVL, >$1 billion USDT, and 20 million Telegram wallets by 2026. Key challenges include expanding validator diversity and deepening DeFi liquidity to sustain long-term scalability and regulatory compliance.

Rating of this post.

Rate

If you enjoyed this article, please rate it.