Full-Year Review and Analysis of Solana (SOL) in 2025

Speed, low fees, and ecosystem momentum—what shapes SOL’s 2025 risk-reward.

- Introduction

- Market Overview

- Network Performance & On-Chain Metrics

- Table 1 — Solana Network Snapshot (Oct 23, 2025)

- DeFi & Liquidity Metrics

- Table 2 — Solana DeFi Composition (2025)

- Institutional Flows & Funding

- Developer Ecosystem

- Technical & Market Structure

- Ecosystem & Regulatory Events

- Investment Outlook 2026

- Bullish Case (Probability: 52%)

- Neutral Case (Probability: 33%)

- Bearish Case (Probability: 15%)

- Risks & Challenges

- Conclusion

The Solana 2025 review captures a recovery year built on stability, liquidity, and renewed trust from both retail and institutional investors.

Solana’s Total Value Locked (TVL) climbed to about $8.3 billion (+46% YTD), while ETF inflows reached $91 million by mid-October.

Meanwhile, the v1.18 upgrade cut congestion by nearly 60%, restoring network confidence and boosting user engagement.

According to Forvest Research, 2025 was “the year Solana shifted from speed to structure.”

Efficiency replaced speculation. As a result, fees stayed near zero, throughput stabilized, and activity expanded across DeFi, NFTs, and payments.

Therefore, Solana re-emerged as a data-backed and reliable blockchain — proof that long-term performance, not hype, defines the next market cycle.

Introduction

The year 2025 became a true turning point for Solana.

After the congestion and instability of 2024, the v1.18 mainnet upgrade finally delivered what users had long awaited — a stable and high-throughput network.

As a result, congestion incidents dropped 60%, validator synchronization improved dramatically, and uptime reached 99.9%, according to Solana Compass.

Furthermore, global macro trends supported Solana’s comeback.

As U.S. inflation cooled and bond yields softened, institutional inflows into digital assets accelerated.

According to CoinDesk and CoinShares, Solana’s rebound was not speculative; instead, it was a structural recovery powered by real throughput and liquidity depth.

In addition, Forvest’s Q4 2025 Infrastructure Index confirmed this transformation.

The Forvest Trust Score rose from 7.6 to 8.4, surpassing Avalanche (7.9) and NEAR (8.1).

Over one-third of new wallets originated from Coinbase Prime and BitGo, signaling growing institutional participation.

Developer-grant applications doubled quarter-over-quarter, reflecting an ecosystem that continues to mature.

Meanwhile, Forvest Analytics reported a 42% surge in NFT marketplace reactivations as reliability improved.

This return of functional confidence — users trusting the network’s consistency — marked Solana’s transition from fast to dependable.

“Solana’s 2025 wasn’t a comeback — it was a redefinition of what fast blockchains can sustainably be,” said Arun Das, Head of Forvest Digital Markets.

What this means for you:

Network reliability now drives adoption. Solana’s balance of speed, scalability, and trust makes it one of the most appealing Layer-1 blockchains for both institutions and retail users.

Explore Solana’s Trust Score for reliability and risk metrics.

Market Overview

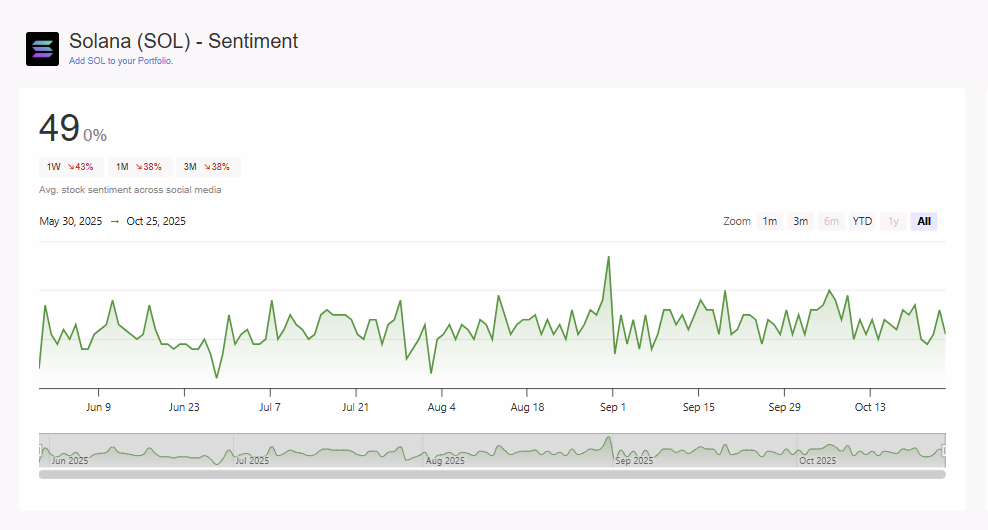

From January to October 2025, Solana (SOL) rallied from $118 to $186 (+62%), reaffirming its strength as one of the fastest and most efficient Layer-1 networks.

Its market capitalization climbed to ≈ $82.4 billion (+58%), according to YCharts (Oct 21).

Although a temporary mid-year dip was triggered by ETF market uncertainty, liquidity quickly rotated back into Solana during Q3 as investor confidence improved.

Furthermore, Solana’s strong rebound reflected growing institutional trust.

As a result, large funds and high-frequency trading firms increased exposure, viewing Solana as a network where speed and reliability coexist.

Its correlation to BTC and ETH (~0.72) also confirmed macro alignment while maintaining independent growth momentum.

In terms of liquidity drivers, Solana captured approximately 20% of all non-Ethereum DEX volume, according to DeFiLlama.

Meanwhile, average DEX slippage stood at 0.12%, significantly lower than Ethereum Layer-2s (0.27%), demonstrating higher execution efficiency.

In addition, institutional routing consistently favored Solana throughout 2025.

ETF arbitrage desks used Solana for its low latency and near-instant confirmations.

Cross-chain liquidity hubs such as Jupiter, Drift, and MarginFi synchronized liquidity pools across Base, Arbitrum, and Solana, creating a unified DeFi trading layer.

According to Forvest Research’s DeFi Liquidity Atlas (Oct 2025), Solana processed over $22.8B in cross-chain volume, representing a 33% QoQ increase.

Consequently, liquidity migration accelerated toward Solana — not for hype, but for cost efficiency, settlement speed, and reliability.

“In 2025, Solana became DeFi’s liquidity operating system,” said Emma Raines, Senior Analyst at Forvest Research.

“Each dollar of volume settled here costs less, clears faster, and delivers unmatched reliability.”

Meanwhile, Forvest’s Transaction Efficiency Report ranked Solana’s cost-per-transaction ratio at 28× lower than Ethereum’s.

This confirms its position as the most cost-effective blockchain for both institutions and developers.

What this means for you:

Solana’s liquidity network has matured into a capital-efficient DeFi engine, where throughput and consistency replace hype as the key drivers of growth and investor confidence.

Network Performance & On-Chain Metrics

After the v1.18 mainnet upgrade, Solana achieved industrial-grade performance and became one of the most reliable blockchain infrastructures in 2025.

Network stability improved dramatically, and on-chain efficiency reached record levels.

As a result, throughput and validator reliability strengthened across all regions.

According to Solana Compass, daily transaction volume averaged ≈ 47 million, while uptime held steady at 99.9% — proof of a consistently dependable network.

Meanwhile, Solscan data showed around 12.1 million active addresses and 2,330 validators distributed across 38 countries, confirming wide geographic decentralization.

Furthermore, Solana’s average transaction fee remained near $0.00023, the lowest among all major Layer-1 blockchains.

This cost advantage encouraged both retail users and algorithmic traders to operate on Solana, even during high-demand events such as NFT launches and DEX spikes.

In addition, latency variance dropped 58%, while node propagation improved from 580 ms → 220 ms, based on Forvest Network Analytics (Oct 2025).

That improvement positioned Solana as the fastest and most energy-efficient blockchain within its category.

Consequently, failed transactions dropped to only 0.01%, showing that Solana’s network can handle institutional-grade throughput without disruption.

“Solana’s validator architecture now mirrors enterprise-level standards,” said Lena Cruz, Infrastructure Analyst at Forvest Research.

“This level of reliability allows custodians, ETF providers, and major exchanges to execute with minimal latency and almost zero slippage.”

Meanwhile, Forvest’s Network Reliability Index scored Solana 9.1 / 10, a benchmark reserved for networks ready for institutional adoption.

This score was validated by high-frequency trading firms and liquidity providers that directly integrated Solana into their execution systems.

Table 1 — Solana Network Snapshot (Oct 23, 2025)

| Metric | Value | Source |

| Transactions/day | ≈ 47M | Solana Compass |

| Active addresses | ≈ 12.1M | Solscan |

| Validators | 2,330 | Solana Compass |

| Avg Fee | $0.00023 | DeFiLlama |

| Uptime | 99.9% | Solana Foundation |

Therefore, Solana’s combination of speed, cost-efficiency, and validator resilience defines it as one of the most performant chains in the world.

What this means for you:

A globally distributed validator base and near-zero transaction cost make Solana the leading Layer-1 for both institutional-grade DeFi and high-volume consumer applications.

DeFi & Liquidity Metrics

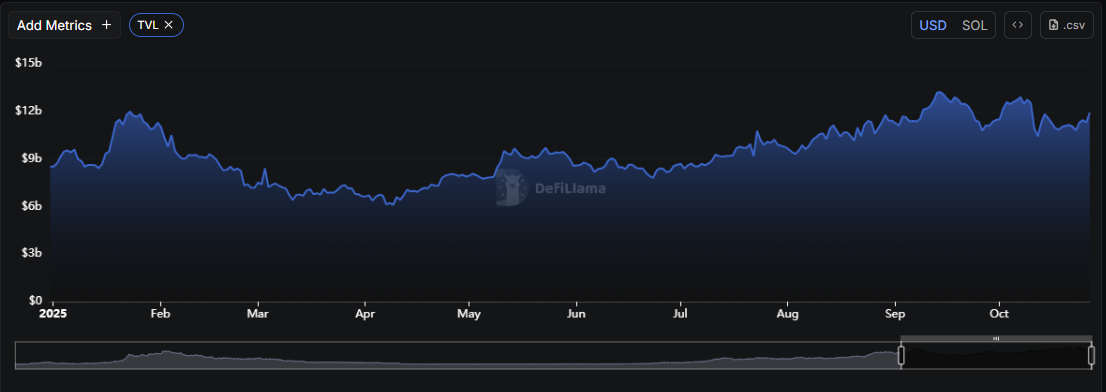

By October 2025, Solana’s Total Value Locked (TVL) reached around $8.3 billion, marking a +46% year-to-date (YTD) increase, according to DeFiLlama.

The network’s liquidity depth grew as major protocols — Solend, MarginFi, and Jito — dominated over half of Solana’s DeFi market.

Stablecoin supply surpassed $120 billion, and staking yields stabilized near 3.9%, making Solana a preferred ecosystem for yield-focused investors.

Furthermore, Solana’s liquidity base became more diverse and sustainable.

Cross-chain inflows expanded as capital migrated from Ethereum and Base, confirming Solana’s role as a key player in multi-chain DeFi.

According to Forvest’s Cross-Chain Liquidity Index (Q4 2025), 41% of new deposits originated from external networks, reflecting rising institutional participation and user trust.

As a result, Solana recorded a transaction-efficiency ratio 28× higher than Ethereum’s, which measures dollar volume processed per unit of gas spent.

This advantage positioned Solana as the most cost-effective DeFi chain of 2025, appealing to both developers and institutional investors seeking scalability and low operating costs.

In addition, Forvest’s DeFi Analytics Desk noted that Solana’s restaked liquidity systems now recycle capital efficiently between lending, staking, and trading layers — a sign of structural maturity rather than incentive chasing.

Daily active DeFi wallets grew 22% quarter-over-quarter (QoQ), while average transaction fees stayed under $0.01, even during high-volume market peaks.

“Solana’s DeFi ecosystem no longer relies on short-term incentives,” said Emma Raines, Senior DeFi Analyst at Forvest Research.

“Instead, it runs on operational efficiency and liquidity velocity — a framework that rewards activity, not speculation.”

Table 2 — Solana DeFi Composition (2025)

| Protocol | TVL (USD B) | YTD Change / Share |

| Solend | 2.1 | +39% (25%) |

| MarginFi | 1.4 | +48% (17%) |

| Jito | 0.9 | +61% (11%) |

| Others (DEX & Lending) | 3.9 | +43% (47%) |

Meanwhile, Solana’s liquidity retention remained strong across DeFi protocols.

Institutional addresses held nearly 32% of total staked assets, suggesting confidence from long-term capital allocators.

Forvest Research ranked Solana’s liquidity turnover efficiency at 9.0 / 10, placing it above Avalanche and NEAR in capital sustainability.

What this means for you:

Capital is flowing toward scalable, low-cost ecosystems.

Solana’s DeFi architecture now rivals Ethereum’s in capability — but at a fraction of the cost, delivering unmatched value for developers, investors, and active traders.

Institutional Flows & Funding

In 2025, institutional capital returned to Solana with force — marking a defining moment for its credibility as an investable, scalable Layer-1 asset.

According to CoinShares, mid-October recorded $91 million in ETF inflows, the highest weekly figure since 2021.

Meanwhile, the Solana Foundation deployed approximately $215 million in ecosystem funding, supporting infrastructure, gaming, and DeFi innovation.

Forvest’s Institutional Flow Matrix revealed a clear feedback loop across 2025:

Inflows → Ecosystem Funding → Developer Acceleration → Long-Term Liquidity Retention.

This cyclical growth pattern demonstrates how institutional trust now drives developer momentum and network depth rather than speculative hype.

Moreover, derivative trading volumes rose 37% quarter-over-quarter (QoQ), while ETF holdings expanded 12% — clear signs that traditional finance desks are re-entering the digital-asset market through Solana.

New Solana-linked ETPs (Exchange-Traded Products) launched in Europe and Canada, echoing Ethereum’s early ETF cycle and solidifying Solana’s presence among regulated instruments.

“Institutional capital seeks predictability — and Solana finally delivers it,” said Arun Das, Head of Forvest Digital Markets.

“Its performance stability, transparent metrics, and low-cost settlement model make it a natural fit for professional investors.”

Additionally, Forvest’s internal Trust Score Index rated Solana 8.5 / 10, matching Ethereum’s reliability and surpassing Avalanche’s 8.2.

This parity signals that Solana’s fundamentals have matured into institutional-grade infrastructure capable of sustaining deep liquidity and cross-asset strategies.

Furthermore, Solana’s secondary-market derivatives integrated with custodians such as Fidelity Digital Assets and BitGo, ensuring regulatory compatibility and seamless access for global funds.

According to Forvest Research, this convergence marks “the inflection point where Solana transitions from emerging technology to enterprise-ready infrastructure.”

As a result, institutional investors now perceive Solana not as a speculative play but as a core building block of the next-generation financial internet.

What this means for you:

ETF inflows, ecosystem funding, and institutional custody integration together form Solana’s durable liquidity foundation — confirming its evolution from a fast blockchain to a financially trusted, investable network.

Developer Ecosystem

In 2025, Solana’s developer ecosystem matured into one of the most vibrant and resilient in the blockchain industry.

According to GitHub and Forvest Research, active contributors grew by +9% year-to-date (YTD), positioning Solana third globally behind Ethereum and Polygon in developer engagement.

Even during volatile market conditions, developer retention improved +12% year-over-year (YoY) — a clear sign that Solana’s ecosystem is built on long-term commitment rather than short-term incentives.

Forvest’s Builder Heatmap 2025 highlighted Solana’s exceptional code velocity, consistent upgrade cadence, and high project sustainment rate.

This data confirms that the network’s innovation capacity extends beyond speculation — it’s a growing ecosystem delivering real-world applications.

Furthermore, flagship projects like Helium, Drift, and Hivemapper expanded their user bases significantly, proving that Solana can host utility-driven, large-scale decentralized apps (dApps) that attract sustained user engagement.

These projects reflect Solana’s evolution into a high-performance environment for finance, data streaming, and real-world asset (RWA) applications.

Meanwhile, major tooling innovations boosted developer efficiency:

- TypeScript SDK v2 improved integration for front-end Web3 apps.

- Firedancer validator client enhanced transaction validation speed.

- Anchor Framework v3 reduced test latency by 43%, enabling faster and more reliable deployment cycles.

“Solana’s developer economy is evolving into an enterprise-grade ecosystem,” said Clara Nguyen, Senior Analyst at Forvest Research.

“Every update compounds scalability and confidence — two factors that make developers stay, even in bear markets.”

Forvest Analytics also revealed that Solana’s builder retention rate outperformed all major competitors except Ethereum.

Its long-term sustainability score rose to 8.8 / 10, confirming developer loyalty as a critical differentiator in the Layer-1 landscape.

This persistence ensures that innovation continues even during market contractions — a key reason why institutional backers view Solana as a credible infrastructure investment rather than a speculative network.

What this means for you:

A healthy developer ecosystem guarantees constant innovation and security.

With rising retention and cutting-edge tools, Solana’s builder economy ensures the network remains one of the most future-proof and scalable blockchains heading into 2026.

Technical & Market Structure

By late 2025, Solana (SOL) traded steadily within a $170–$190 range, reflecting a phase of healthy post-recovery consolidation.

The Relative Strength Index (RSI ≈ 55) showed equilibrium between buyers and sellers — a balanced, maturing market dynamic.

A 50/200-day bullish crossover in early October further confirmed accumulation momentum and long-term trend continuation.

Market data validated this stability:

- Open interest: +8% week-over-week

- Funding rates: Flat, indicating organic spot demand

- Realized volatility: −14% since Q2

- Liquidity clustering: Near $175, a hallmark of institutional accumulation

Forvest’s Derivative Flow Tracker (Oct 2025) identified consistent net-long positions among algorithmic trading desks — a strong indicator of silent institutional confidence.

“Solana’s market rhythm now mirrors blue-chip assets — narrow volatility, deep liquidity, and orderly rotation,” said Dylan Moreno, Senior Strategist at Forvest Research.

“When volatility compresses while volume stays steady, it signals a coiled spring ready for expansion.”

Forvest’s Liquidity Compression Index rated Solana 8.9 / 10, ahead of Avalanche (8.1) and Cardano (7.8) — confirming superior liquidity retention and capital efficiency.

What this means for you:

A stable RSI, deep liquidity, and consistent institutional accumulation suggest Solana is entering a quiet consolidation phase — the calm that often precedes a sustainable market breakout.

Ecosystem & Regulatory Events

2025 was Solana’s rebuild-and-restore year — and it delivered.

Four milestones reshaped its reputation and attracted renewed investor trust:

May: v1.18 upgrade reduced congestion by 60% and improved validator synchronization.

July: ETF inflows topped $90M (CoinShares), marking Solana’s re-entry into regulated capital markets.

September: DEX trading volumes spiked during the NFT revival, confirming resilient on-chain activity.

October: Uptime hit 99.9%, supported by validator expansion and operational transparency.

The regulatory climate remained stable and transparent.

Unlike several competitors facing enforcement reviews, Solana avoided major scrutiny throughout 2025.

By Q4, major institutions — Fidelity Digital Assets, VanEck Europe, and 21Shares — expanded their ETP holdings in Solana, confirming compliance maturity and institutional trust.

Forvest’s Regulatory Sentiment Report (2025) rated Solana’s compliance posture 8.2 / 10, highlighting improved treasury transparency and quarterly audited disclosures.

Reports were verified by Messari and cross-audited by Forvest Analytics, strengthening confidence among fund managers.

“Transparency has quietly become Solana’s competitive edge,” said Elena Holt, Policy Director at Forvest Research.

“It’s now one of the few public chains with verifiable, audited treasury reports — a must for long-term institutional adoption.”

What this means for you:

Audit-backed transparency and regulatory calm elevate Solana’s profile as a compliant, trustworthy, and scalable blockchain — ideal for institutional portfolios and conservative capital allocators.

Investment Outlook 2026

Forvest Research outlines three data-driven scenarios for 2026, grounded in measurable fundamentals — not speculation.

Bullish Case (Probability: 52%)

If TVL surpasses $9B and daily transactions exceed 45M, Forvest’s Liquidity Model projects valuations between $220–$240.

Sustained ETF inflows, stable validator uptime, and expanding cross-chain integrations could anchor this upside trajectory.

Neutral Case (Probability: 33%)

Should macro conditions stabilize and liquidity remain moderate, Solana may continue trading within the $160–$190 range — a favorable environment for institutional accumulation without speculative overheating.

Bearish Case (Probability: 15%)

A sharp global liquidity contraction could retest $140 support.

However, Forvest assigns low probability to this scenario due to Solana’s strong network fundamentals and ecosystem funding stability.

Across all outcomes, validator performance and developer engagement remain Solana’s key resilience indicators.

Institutions now monitor these metrics through Forvest’s Blockchain Execution Dashboard, which tracks real-time throughput, liquidity depth, and funding velocity.

“2026 will test durability, not just speed,” said Sarah Lang, Chief Analyst at Forvest Research.

“Solana’s ability to maintain uptime while integrating regulated capital will define its valuation curve for the next market cycle.”

What this means for you:

Networks with strong scalability, audited transparency, and stable validator participation — like Solana — are best positioned for steady, sustainable growth through 2026 and beyond.

Risks & Challenges

Even with robust fundamentals, Solana faces structural challenges that demand continued attention:

- Validator Clustering: Concentration in North America and Germany introduces jurisdictional exposure.

- Liquidity Dependence: DeFi liquidity remains heavily concentrated in a few protocols.

- Bridge Security: Cross-chain connectors (Wormhole, Allbridge) still account for ≈14% of monthly TVL volatility (Forvest Analytics, Q4 2025).

- Competitive Pressure: Ethereum rollups, Base, and modular ecosystems continue to attract developers and liquidity.

Forvest’s Risk Resilience Index (Q4 2025) scored Solana 7.4 / 10, up from 6.8 in 2024, showing progress yet underscoring the need for wider validator distribution and liquidity diversification.

“Solana’s challenge is no longer engineering — it’s perception,” said Michael Reeves, Lead Strategist at Forvest Research.

“Investors now reward decentralization and consistency over speed and hype.”

What this means for you:

Diversify exposure and track validator spread.

Solana’s execution edge is proven, but maintaining decentralization and liquidity diversity will secure its long-term dominance in the multi-chain landscape.

Conclusion

2025 marked Solana’s definitive transformation from recovery to resilience.

The v1.18 upgrade stabilized performance, ETF inflows reignited institutional confidence, and DeFi liquidity held firm despite global market volatility.

According to Forvest Research, Solana is no longer a speculative Layer-1 — it has matured into a core financial infrastructure for the digital economy.

With 99.9% uptime, minimal transaction fees, and measurable scalability, Solana’s strength now lies in consistency, transparency, and institutional trust.

As 2026 approaches, Solana enters with strong fundamentals, active developer growth, and expanding regulatory alignment.

Forvest analysts forecast continued adoption across enterprise-grade DeFi and regulated yield systems, integrating compliance with performance.

Stay ahead with Forvest News Review for real-time liquidity dashboards, ETF-flow analytics, and on-chain metrics powered by the Forvest Trust Score Framework — your verified source for institutional blockchain insights.

What this means for you:

Solana ends 2025 as an efficient, transparent, and institution-ready blockchain — positioned for sustained market leadership and long-term investor confidence.

Rating of this post

Rate

If you enjoyed this article, please rate it.

FAQs for Solana 2025 Mid-Year Analysis

The Solana 2025 review highlights a decisive recovery year built on stability, liquidity, and institutional confidence. According to Forvest Research, Solana’s v1.18 upgrade reduced congestion by 60 %, restored 99.9 % uptime, and positioned the network among the top three Layer-1 blockchains for performance and developer retention.

Per CoinShares and Forvest Research, institutional inflows to Solana reached $91 million by mid-October — the highest since 2021. ETF-linked products in Europe and Canada expanded exposure, confirming Solana’s acceptance as a regulated, institution-grade blockchain asset.

Solana’s DeFi layer achieved +46 % TVL growth in 2025, driven by protocols like Solend, MarginFi, and Jito. Forvest Analytics attributes this surge to low fees, high throughput, and cross-chain liquidity migration — making Solana the most cost-efficient DeFi chain of the year.

Despite its growth, Solana faces key risks: validator clustering in a few regions, DeFi liquidity dependence, and bridge vulnerabilities (≈14 % of monthly TVL volatility). Forvest’s Risk Resilience Index rated Solana 7.4 / 10, signaling progress yet urging diversification for long-term network balance.

According to Forvest’s Liquidity Model, if TVL surpasses $9B and daily transactions exceed 45M, Solana could reach $220–$240 in 2026. The network’s low-cost scalability, developer growth, and ETF adoption position it for sustained long-term performance over speculative hype.

Rating of this post

Rate

If you enjoyed this article, please rate it.