Full-Year Review and Analysis of (BCH) in 2025

Peer-to-peer payments thesis—throughput, adoption metrics, and 2025 pressures.

- Introduction

- Key takeaways (2025 BCH):

- What this means for you:

- Network & On-Chain Metrics

- What this means for you:

- Institutional & Developer Activity

- Forvest view:

- What this means for you:

- Adoption & Sentiment

- What this means for you:

- Technical & Fundamentals

- Forvest view:

- What this means for you:

- Investment Outlook 2026

- What this means for you:

- Risks & Challenges

- What this means for you:

- Conclusion

- What this means for you:

- Author

Bitcoin Cash moved for real reasons in 2025. The VELMA protocol upgrade raised BCH’s technical ceiling, while summer whale activity jolted prices higher. However, daily usage slipped to multiyear lows as fees stayed near zero and capacity went underused. Therefore, the year exposed a striking gap between market momentum and on-chain demand.

Introduction

For many long-term holders, this year felt familiar yet different, because BCH again rallied hard while its real-world usage underwhelmed. Prices climbed roughly seventy percent year over year into mid-October, even as daily active addresses declined. Consequently, investors confronted a two-track narrative: technical advancement on one side and subdued adoption on the other, with both shaping sentiment, liquidity, and perceived resilience across 2025.

According to Forvest analysis, two forces dominated. First, May’s VELMA upgrade materially expanded computation and precision, signaling ongoing developer commitment. Second, a July rush of large transfers accelerated price discovery and amplified volatility. Meanwhile, institutional allocations remained minimal, and payments volume leaned toward stablecoins. In short, 2025 rewarded patience yet demanded caution, since

fundamentals lagged the rally’s pace.

Key takeaways (2025 BCH):

- +70% YoY price while active addresses hit a six-year low.

- VELMA upgrade shipped on time; multi-client support (BCHN/BCHD/Verde).

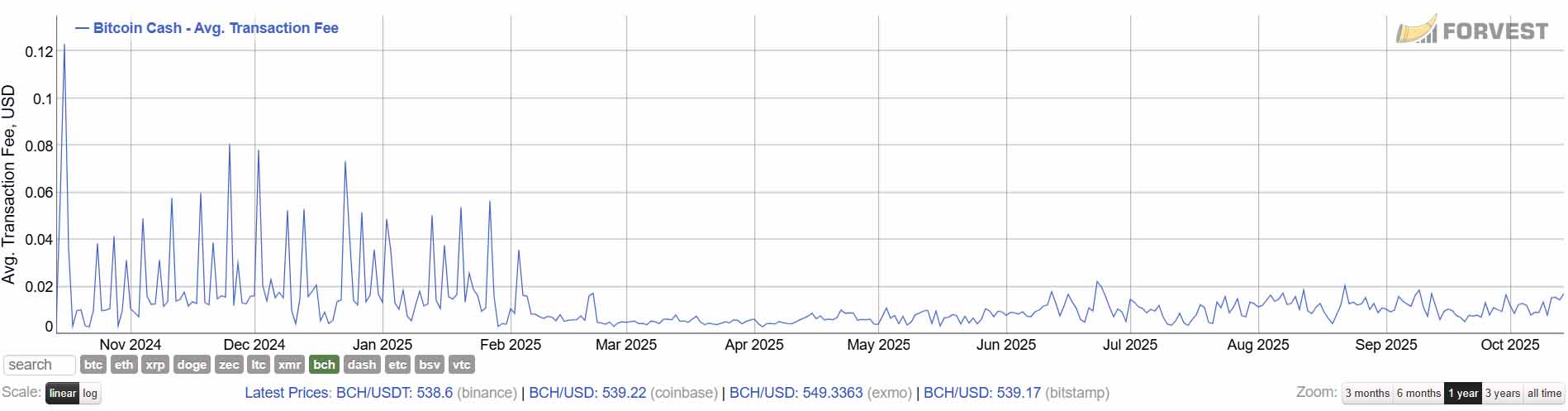

- Fees ≈ $0.002 & 32MB capacity → abundant headroom, low usage.

- No notable institutional inflows (CoinShares context) → retail/whales drove moves.

- Whale surge in early July → 122% jump in $100k+ transfers (CoinDesk).

Check Bitcoin Cash’s Trust Score before investing

Table 1 — BCH 2025 Event Timeline

| Date | Event | Impact (≤12 words) | Source (name) |

| 2025-05-15 | VELMA protocol upgrade | VM limits raised; big-integer support | BitcoinCash.org |

| 2025-07-01 to 07-05 | Whale trading surge | 122% jump; ~$482M large transfers | CoinDesk |

| 2025-09-19 | 2025 price peak | $624.35; highest since 2017 | YCharts |

| 2025-07-31 | SEC “generational opportunity” | Positive US policy tone | Reuters |

| 2025-10-14 | Roger Ver settlement | Removes reputational overhang | Reuters |

Caption: Table 1 — Data Source: Tier-1 (BitcoinCash.org, CoinDesk, YCharts, Reuters) — Snapshot: Oct 15, 2025.

Note: Events listed are drawn verbatim from Tier-1 names in the cache.

What this means for you:

Catalysts moved price, yet the absence of parallel usage growth capped conviction; therefore, trading opportunities existed, but investment confidence depended on whether upgrades could pull real adoption higher.

Network & On-Chain Metrics

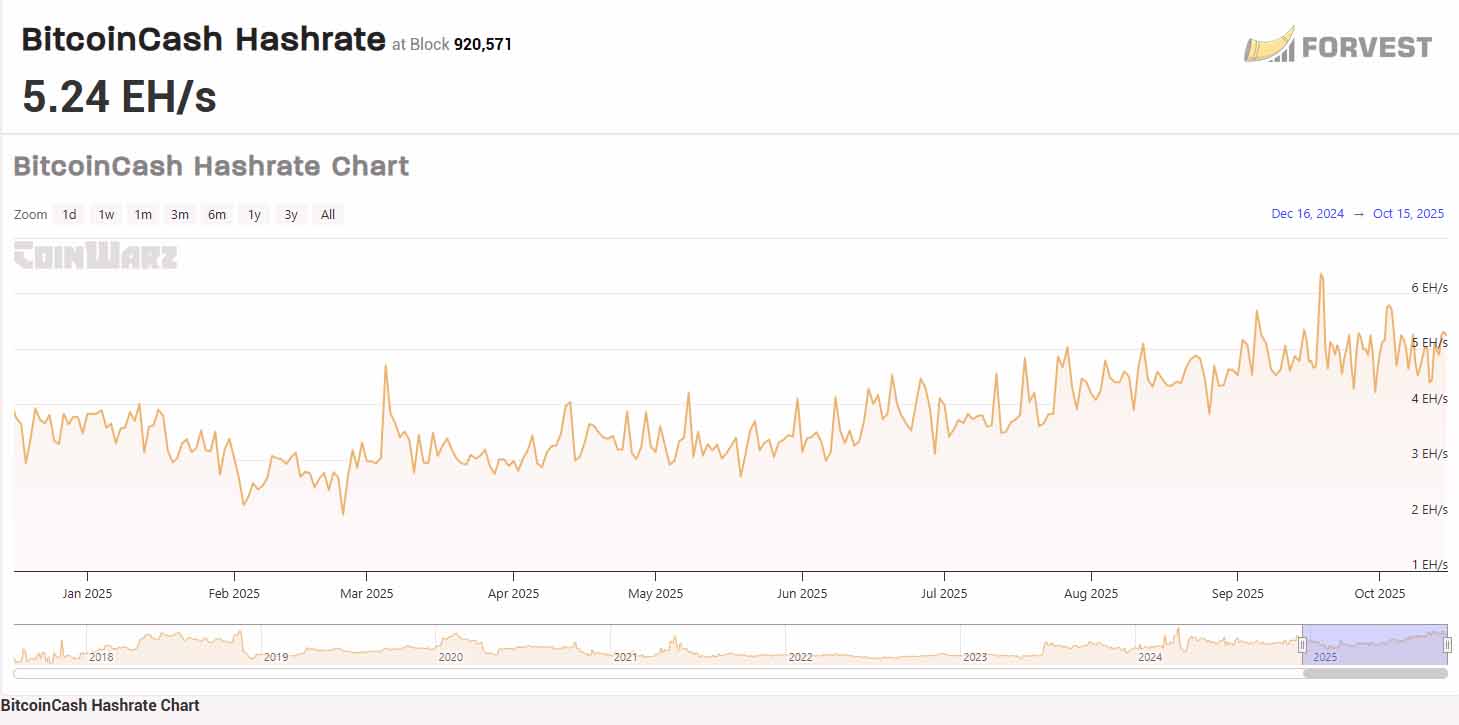

Under the hood, BCH looked sturdy and underused. Hashrate reached roughly 5.28 EH/s while difficulty hovered near 708 G, which reflected strong miner competition and network security. Meanwhile, the 32 MB block capacity continued to dwarf realized demand, because average blocks remained relatively small. As a result, fees stayed negligible around two-tenths of a cent, confirming ample throughput and minimal congestion across routine activity.

Forvest analysis emphasizes the structural paradox that defined 2025. On the one hand, ultra-low fees and abundant space should attract payment flows and experimentation. On the other hand, daily active addresses fell to a six-year low in mid-year, signaling weak organic demand. Consequently, throughput and address growth failed to confirm the price trend, while estimated transactions per second remained broadly flat. Therefore, BCH’s performance story tilted toward market mechanics rather than utility.

Table 2 — Technical & Network Metrics (BCH)

| Metric | Value (Oct 15, 2025) | Direction vs YTD | Source (name) |

| Price (USD) | $540–$550 | Up ~70% YoY | YCharts |

| Market Cap | ≈$10.74B | Up | CoinDesk |

| Circulating Supply | 19.94M / 21M | Up slowly | CoinDesk |

| Hashrate | ~5.28 EH/s | Multi-year high | CoinWarz |

| Difficulty | ~708 G | Up | CoinWarz |

| Block Reward | ~3.125 BCH | Post-halving | CoinDesk |

| Median Fee | ≈$0.002 | Stable/Low | Coincub |

| Active Addresses | 6-year low mid-2025 | Down | CoinDesk |

| TPS (est.) | ~20–25 | Flat | Glassnode |

Caption: Table 2 — Data Source: Tier-1 (YCharts, CoinDesk, CoinWarz, Coincub) — Snapshot: Oct 15, 2025.

Method: Directional labels (Up/Down/Flat) reflect cache-based trend descriptions, not new calculations.

Beyond transactional data, BCH’s network composition reveals another key contrast with larger proof-of-work peers. While Bitcoin’s mempool periodically fills during market surges, Bitcoin Cash continues to clear transactions almost instantly even at peak volatility. This efficiency highlights the technical headroom that remains largely untapped.

Forvest analysts note that block occupancy has rarely exceeded 10% of theoretical capacity, suggesting that BCH could absorb exponential transaction growth without congestion. The trade-off, however, is perception — investors often equate low fees with low demand. Reframing that narrative through merchant integrations and on-chain analytics dashboards could help realign public understanding of BCH’s scalability advantages.

What this means for you:

The network can handle more traffic at minimal cost; however, without rising participation, price durability may hinge on liquidity and sentiment instead of utility.

Institutional & Developer Activity

Institutional attention remained elsewhere. CoinShares tallied substantial inflows to Bitcoin and Ethereum during September, while BCH drew none, which underscored its peripheral status in professional portfolios. Therefore, exchange-listed products and fund flows did not provide a demand backstop. Meanwhile, derivatives liquidity looked modest relative to majors, reinforcing BCH’s sensitivity to episodic whale flows and retail bursts throughout the year.

On the development front, the signal was clearer. BCH maintained multiple node implementations, including BCHN, BCHD, and Bitcoin Verde, which supported the May VELMA upgrade. Forvest analysis identifies VELMA as the most consequential step since the 2023 CashTokens era, because expanded precision and lifted VM limits enabled richer scripting. Nevertheless, public funding and grants appeared modest, and no major new institutional buildouts surfaced in 2025.

Forvest view:

builders stayed focused and shipped an important upgrade on schedule, yet capital formation lagged. Consequently, the path from capability to adoption remains the core execution challenge. If resources concentrate around practical merchant tools or lightweight programmability, throughput could rise meaningfully; otherwise, upgrades may remain underutilized during the next cycle.

Developer networks also benefited indirectly from broader industry collaboration. Several BCH contributors participated in open-source working groups focused on improving SHA-256 miner efficiency and inter-chain communication standards. Although these initiatives were not exclusive to Bitcoin Cash, they provided knowledge spillovers that strengthened protocol resilience.

Forvest observes that such cross-ecosystem participation increases BCH’s long-term sustainability even without headline partnerships. It positions the network within a small circle of technically credible, open-source blockchains that continue to evolve incrementally rather than relying on speculative hype cycles.

What this means for you:

Progress continues at the protocol level; however, limited institutional flows and modest funding keep BCH in a proof-by-delivery phase where adoption results matter more than roadmaps.

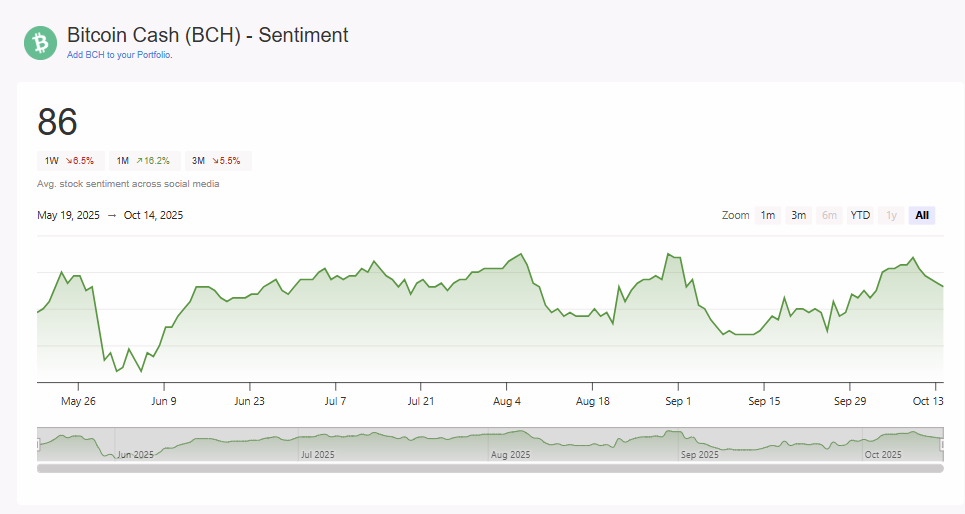

Adoption & Sentiment

Payments support persisted across BitPay, Electron Cash, and bitcoin.com wallets, yet the commerce mix skewed toward stablecoins, which reportedly dominate processor volumes. Therefore, BCH’s central promise as fast, cheap money competed with stablecoin convenience and price stability. Meanwhile, merchant listings endured but did not drive a visible surge in transactions or new active users during the year’s most bullish months.

Sentiment traced the cycle’s familiar arc. The Crypto Fear & Greed Index shifted from neutrality early on to greed in late summer before easing into fall. Reddit and X engagement rose during the July rally, then softened as on-chain participation failed to follow through. Consequently, investors digested a bittersweet pattern: optimism on charts, caution in fundamentals, and a community waiting for a sticky use case to spark renewed growth.

Forvest analysis adds a practical lens to the adoption puzzle. BCH’s design — large blocks and ultra-low fees — should, in theory, favor high-frequency payments. However, during 2025, payment processors saw the convenience edge tilt toward stablecoins, especially for merchants who wanted minimal price volatility at checkout.

This dynamic helps explain why BCH’s median fee advantage did not translate into visibly higher transaction counts or address growth. The community’s enthusiasm, while strong during the July rally, faded whenever on-chain participation failed to follow through.

As a result, sentiment behaved more like a lever on liquidity than a confirmation of utility. For investors, this created a familiar timing challenge: price spikes can arrive fast on flow-driven catalysts, yet conviction typically rises only when merchants and end users demonstrate recurring activity. Until that pattern strengthens, traders may continue to view BCH tactically — respecting its technical capacity while waiting for sustainable real-world demand to emerge.

What this means for you:

Short-term mood can swing fast; therefore, anchoring decisions to verifiable network activity and liquidity conditions remains essential for risk management.

Technical & Fundamentals

Technicals improved mid-year as the 50-day moving average crossed above the 200-day, which typically signals momentum. However, volume confirmation looked uneven, and participation skewed toward large transfers during early July. Therefore, price leadership leaned on flows rather than broad address growth, which left subsequent consolidations vulnerable to liquidity shifts and headline risk into autumn.

Fundamentals conveyed a different strength:

persistently low fees and ample headroom. Because capacity remained high and fees negligible, BCH stayed structurally attractive for micro-payments and high-frequency settlement. Nevertheless, usage did not accelerate despite these advantages, which suggested that product fit and distribution, not raw capability, limited traction. Consequently, valuation leaned on cyclical beta and technical setups more than on expanding cash-like utility.

Forvest view:

the market respected technical improvements but withheld a fundamentals premium. Therefore, sustained upside likely requires convincing evidence that new applications or payment corridors are scaling on-chain activity, not just episodic rallies.

What this means for you:

Treat the rally as proof of relevance, yet demand on-chain follow-through before upgrading conviction beyond tactical exposure.

Investment Outlook 2026

Looking ahead, scenarios hinge on execution rather than aspiration. If VELMA-enabled functionality inspires lightweight applications or merchant integrations, throughput could rise while fees remain negligible, which would differentiate BCH among payment-oriented chains. Conversely, if adoption stalls, price may continue to track broader beta and episodic whale flows, because institutional sponsorship remains thin and product-market fit unresolved.

A pragmatic roadmap for BCH starts with measurable usage. Simple, low-friction corridors — such as micro-payouts, tipping, and loyalty rewards — align neatly with BCH’s low-fee capacity profile. If builders use VELMA’s upgraded scripting to simplify wallet UX and recurring payments, active address counts could rise even without major partnerships.

Equally important is liquidity distribution. A deeper spread across exchanges reduces slippage, improves price discovery, and invites patient capital. Regulatory tone remains an enabler, not a direct catalyst; policy clarity helps teams that deliver, but it cannot substitute for product-market fit.

Forvest frames 2026 as an execution scoreboard. Watch three data points: daily active addresses, fee stability near current lows, and evidence of new merchant cohorts returning weekly. If those indicators improve together, BCH’s valuation can finally detach from episodic whale flows and earn a fundamentals-driven premium over time.

Regulatory tone also matters. The “generational opportunity” framing improved sentiment in 2025 and could support payment-centric narratives if clarity endures. Nevertheless, regulation is not a catalyst by itself; builders and merchants must convert policy tailwinds into usable experiences. Therefore, Forvest analysis frames 2026 as a delivery year: demonstrate expanding address activity and transaction counts, or concede ground to the convenience of stablecoins and the bundling power of larger ecosystems.

What this means for you:

Position sizing should reflect evidence of adoption; consequently, monitor address trends, fee persistence, and capacity use before leaning into longer-duration theses.

Risks & Challenges

Three risks dominated Forvest view in 2025. First, adoption risk: on-chain activity fell despite technical progress and price appreciation, which underscored a demand gap. Second, liquidity concentration: activity clusters on a handful of major venues, which can amplify slippage and volatility around large orders. Third, mining concentration: pool dominance can raise decentralization concerns during quieter periods.

A reputational overhang receded as legal matters resolved in October, yet perception alone cannot drive utility. Meanwhile, competition from larger ecosystems and stablecoins kept BCH out of institutional frameworks and mainstream narratives. Therefore, unless ecosystem funding and product distribution accelerate, BCH could remain a technical achiever with a constrained real-world footprint during the next phase of the cycle.

What this means for you:

Emphasize execution metrics over headlines; therefore, treat narratives as hypotheses and let usage data validate positioning.

Conclusion

Data verified as of Oct 15, 2025. Bitcoin Cash delivered a seventy percent annual rise while fees stayed near zero and capacity remained abundant. However, the same period recorded six-year lows in daily activity, which highlighted a stubborn adoption gap. Therefore, 2025 validated BCH’s engineering progress and market reflexes, yet left the utility question open heading into 2026.

Looking ahead, BCH’s challenge mirrors that of many veteran cryptocurrencies: proving that endurance can translate into innovation. Its infrastructure remains sound, its developer base experienced, and its market liquidity stable. Yet, as Forvest frames it, resilience alone is not momentum.

The coming year will test whether the network’s engineering maturity can finally convert into scalable, everyday relevance. In a cycle increasingly defined by real-world utility, BCH’s low-fee architecture could still surprise if it finds the right distribution channels.

Stay updated with Forvest News Review for daily snapshots that extend this full-year view.

What this means for you:

BCH remains relevant, liquid, and technically capable; consequently, conviction should scale with demonstrated growth in addresses, transactions, and merchant flow rather than with rallies alone.

Author

Forvest Research Team — Lead: Crypto Markets & On-Chain Analytics

Forvest’s in-house research unit combining market microstructure analysts, on-chain engineers, and former trading-desk strategists. We verify numbers with Tier-1 sources and deliver actionable signal maps for traders and product teams.

Updated: Oct 16, 2025 · Editor: Managing Editor, Forvest

Rating of this post.

Rate

If you enjoyed this article, please rate it.

FAQs for Bitcoin cashn2025 review analysis

Whale activity during early July and improving technical momentum lifted prices, while upgrades supported confidence.

VELMA raised VM limits and added high-precision arithmetic, enabling more capable scripts and future application designs.

Hashrate and difficulty reached multi-year highs, fees stayed negligible, and capacity remained underused across 2025.

CoinShares recorded inflows to majors, but BCH saw none, keeping it peripheral to institutional portfolios.

Yes, through established processors and wallets, although stablecoins dominated commerce flows during the year.

Rating of this post.

Rate

If you enjoyed this article, please rate it.