NEAR Protocol Analysis: Performance, Risk Metrics & Trust Score

NEAR USDT

Cryptocurrency

NEAR Protocol Risk & Performance Analysis: Trust Score Insights

Imagine investing in NEAR Protocol in 2025 — a blockchain built for usability and speed. Will its developer-first design and sharding technology drive long-term returns, or does it risk being overshadowed by bigger ecosystems?

What is NEAR Protocol (NEAR)?

NEAR Protocol is a Layer-1 blockchain designed for scalability, developer accessibility, and user-friendly applications. At its core, NEAR utilizes Nightshade sharding architecture, which splits network load across multiple parallel shards for simultaneous transaction processing. This innovative approach allows NEAR to process over 100,000 transactions per second with near-instant finality of 1-2 seconds.

The protocol operates on a Proof-of-Stake (PoS) consensus mechanism and focuses heavily on developer-friendly tools, including support for popular programming languages like Rust and AssemblyScript. In 2023, NEAR introduced the Blockchain Operating System (BOS), creating an industry-first common layer for browsing and discovering Web3 experiences compatible with any blockchain. BOS enables developers to create composable frontends that are permanently stored on-chain, enhancing security and eliminating single points of failure.

NEAR's hybrid approach balances decentralization with simplicity, positioning it as a direct competitor to Ethereum, Solana, and Avalanche. The network is carbon-neutral, certified by South Pole, making it attractive to ESG-focused investors.

Why NEAR Protocol is a Good Investment (2025)

Scalability & Performance Excellence

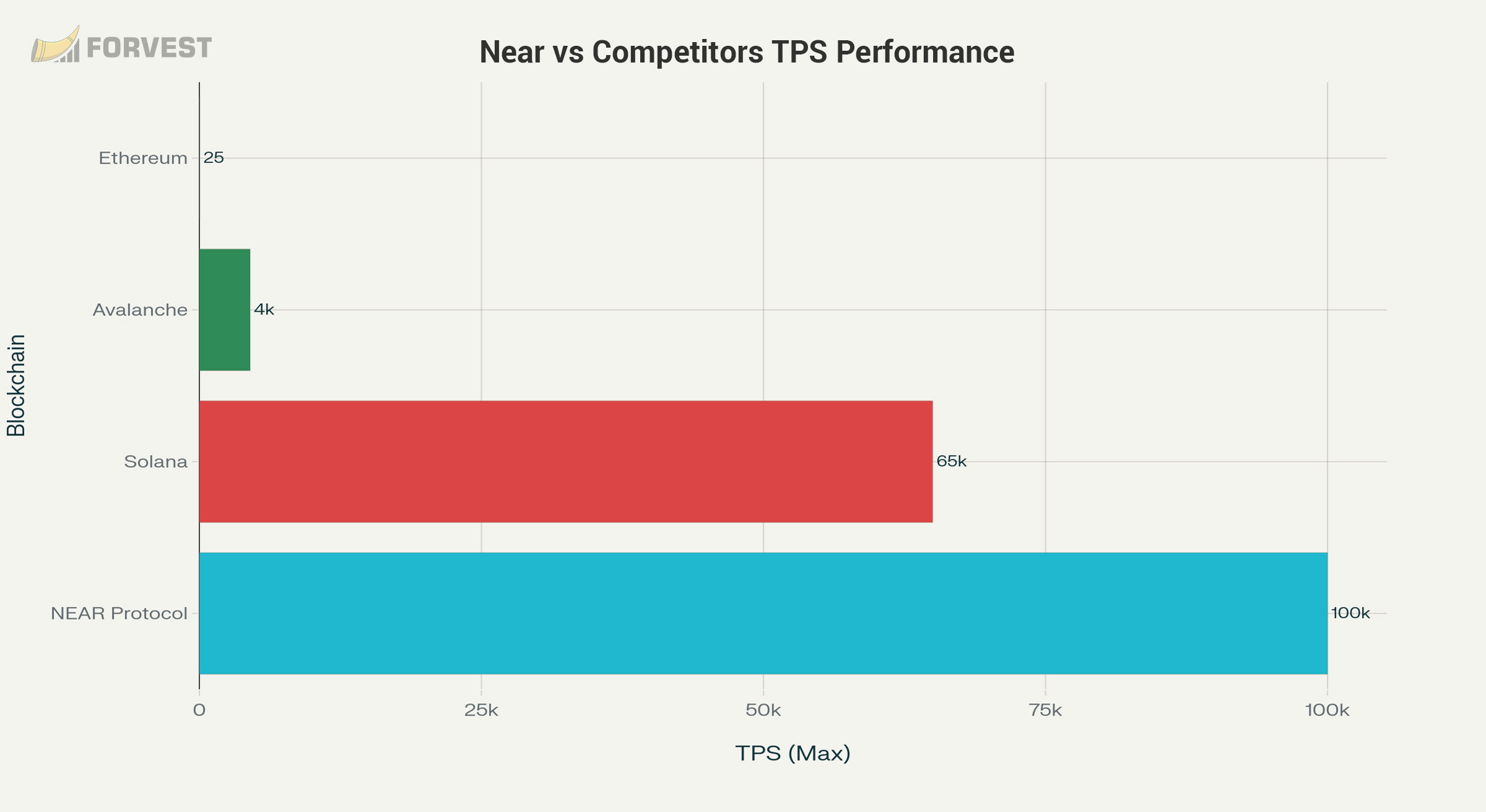

NEAR's Nightshade 2.0 upgrade represents a fundamental breakthrough in blockchain scalability. The system processes transactions with 600ms block times and 1.2 seconds finality, enabling 63.73 TPS in practice with theoretical capacity exceeding 100,000 TPS. Unlike traditional sharding approaches that split blockchains into multiple states, NEAR maintains a single sharded entity with synchronized state mechanisms.

Dynamic resharding allows NEAR to automatically adjust the number of shards based on network demand. Currently running 6 active shards with plans to expand to 8 shards in Q1 2025, this architecture provides potentially infinite scalability.

Exceptional User Growth

NEAR has achieved remarkable user adoption, reaching 46-51 million monthly active users by 2025, making it the second-largest Layer-1 blockchain after Solana. Daily transaction volume exceeds 8 million, representing a doubling from early 2024. The protocol hosts four of the top Web3 applications by monthly active users, including KAIKAI (31.7 million users) and Here Wallet (4.2 million users).

Competitive Transaction Economics

With transaction fees ranging from $0.001 to $0.003, NEAR offers cost-effectiveness that rivals Solana while maintaining superior decentralization. This pricing structure, combined with fast finality, makes NEAR particularly attractive for high-frequency applications like DeFi, gaming, and micropayments.

Cross-Chain Innovation Leadership

NEAR's Chain Signatures technology, launched in 2024, enables NEAR accounts to authorize transactions on external blockchains through multi-party computation. This innovation eliminates traditional bridging complexities while maintaining asset security on native chains. Partnerships with EigenLayer for additional security and integrations across major chains including Ethereum, Bitcoin, and Solana demonstrate NEAR's commitment to interoperability.

Strong Staking Economics

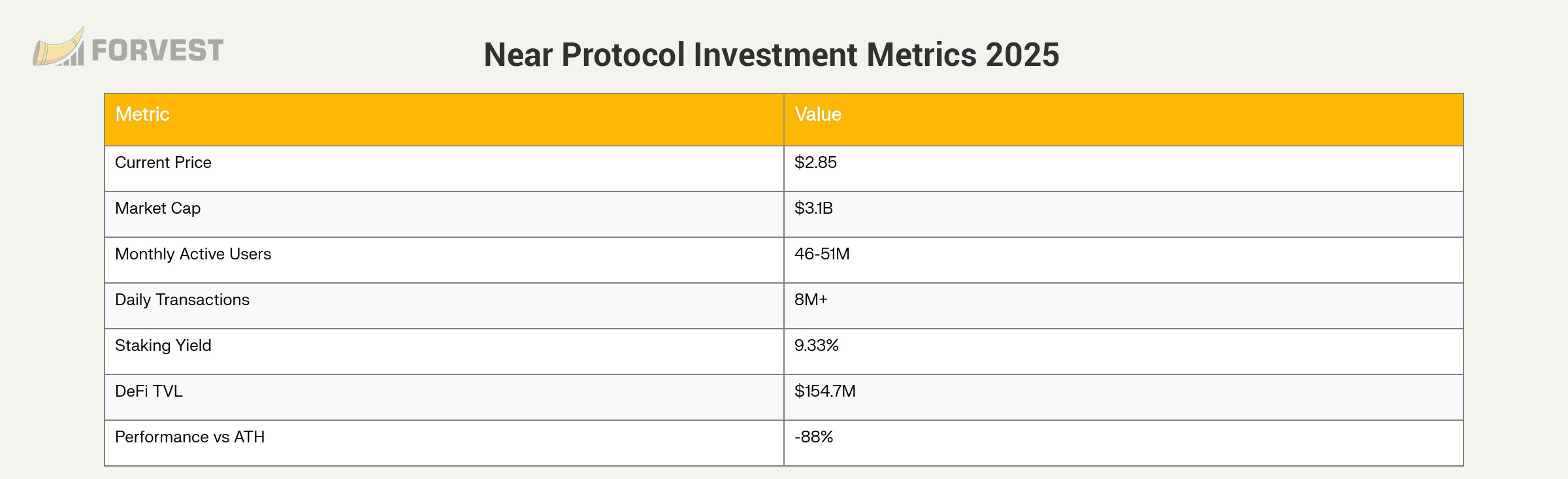

NEAR offers competitive 9.33% staking yields with 46.25% of the token supply actively staked. The protocol's inflation reduction proposal aims to optimize tokenomics while maintaining attractive rewards for validators and delegators. Additional "boosted" rewards programs can increase yields by up to 50% for limited periods.

💡 Read: Full-Year Review and Analysis of NEAR Protocol (NEAR) in 2025

Why NEAR Protocol Might Not Be a Good Investment (2025)

Intense Market Competition

NEAR faces formidable competition from established players and emerging alternatives. Ethereum's Layer-2 solutions like Arbitrum and Optimism offer similar scalability benefits while leveraging Ethereum's massive ecosystem and liquidity. Solana maintains technical advantages with 65,000 TPS and $0.0001 transaction fees, plus a $110 billion market cap compared to NEAR's $3.1 billion.

The blockchain space experiences rapid innovation cycles, and newer platforms may surpass NEAR's technical capabilities. Competition from Layer-2 solutions and other high-performance Layer-1s creates significant market share pressure.

Limited Ecosystem Development

Despite technical prowess, NEAR's DeFi ecosystem remains relatively small with only $154.7 million in Total Value Locked (TVL) compared to Ethereum's hundreds of billions. This limits composability opportunities and reduces network effects that drive adoption. The protocol's DeFi growth, while positive at 7.63% quarter-over-quarter, still lags behind major competitors.

NEAR's NFT and gaming ecosystems, while growing, haven't achieved the scale of Ethereum or Solana platforms. Limited brand recognition outside developer circles may hinder mainstream adoption.

Market Performance Concerns

NEAR has experienced significant price volatility, declining 88% from its $20.42 all-time high in January 2022. In 2025, NEAR was among the worst-performing altcoins, with analysts noting structural challenges in achieving explosive growth due to market maturity. The token's large market cap may limit potential for dramatic price appreciation compared to smaller-cap alternatives.

Technical Complexity Risks

Sharding implementation introduces complexity that could create unforeseen vulnerabilities. The protocol's multi-shard architecture requires sophisticated coordination mechanisms, and any technical failures could impact network stability. Additionally, the transition to new features like Chain Signatures and BOS involves execution risks that could affect investor confidence.

NEAR's Invest Score & Market Performance

NEAR demonstrates strong fundamentals across multiple metrics that contribute to investment confidence. The protocol maintains robust decentralization with hundreds of validators securing the network and 46.25% of tokens staked. Technical innovation through Nightshade sharding and Chain Signatures positions NEAR at the forefront of blockchain development.

User engagement metrics are particularly compelling. With 46 million monthly active users and 8+ million daily transactions, NEAR exhibits real-world utility that transcends speculative trading. The protocol's $700 million stablecoin inflows in 2024 (a 20x year-over-year increase) and DeFi TVL growth from $88 million to $430 million demonstrate expanding ecosystem value.

Market positioning shows NEAR ranked as the 33rd largest cryptocurrency by market cap, with strong institutional interest evidenced by Goldman Sachs, a16z, and Bitwise investment products. The launch of the Bitwise NEAR Staking ETP on Deutsche Börse Xetra provides institutional-grade exposure for European investors.

However, performance metrics reveal challenges. NEAR's price has declined significantly from its peak, with some periods showing substantial volatility. The protocol faces the challenge of converting technical excellence and user growth into sustained price appreciation.

Investment Risks for NEAR in 2025

Competition Risk

NEAR operates in an increasingly crowded Layer-1 space where technological advantages may be temporary. Ethereum's Layer-2 scaling solutions are rapidly improving, potentially reducing demand for alternative Layer-1 platforms. Solana's established market position and superior transaction throughput create ongoing competitive pressure.

The emergence of new blockchain architectures and consensus mechanisms could make NEAR's current advantages obsolete. Platforms like Sui, Aptos, and others are targeting similar use cases with potentially superior technical specifications.

Market Risk Exposure

As a high-beta altcoin, NEAR experiences amplified volatility relative to broader crypto markets. Macroeconomic uncertainty, regulatory changes, or general risk-off sentiment could disproportionately impact NEAR's price. The protocol's correlation with overall crypto market movements limits its effectiveness as a portfolio diversifier.

Institutional adoption, while growing, remains limited compared to Bitcoin and Ethereum. Reduced institutional interest could limit capital inflows and price support during market downturns.

Adoption Risk Factors

NEAR's success depends on developer adoption and ecosystem growth. Despite technical advantages, converting developer interest into significant protocol usage requires time and sustained effort. Competition for developer mindshare is intense, with established platforms offering superior tooling, documentation, and community support.

User experience improvements, while notable, may not be sufficient to drive mainstream adoption. The protocol needs compelling consumer applications that leverage its technical capabilities to justify investment thesis.

Governance and Decentralization Risk

As NEAR's ecosystem grows, governance decisions become increasingly critical for protocol development. Centralized decision-making or community disagreements could impact network upgrades and strategic direction. The transition to community-driven governance through the NEAR Digital Collective (NDC) introduces execution risks.

Validator distribution and staking concentration could affect network security and decentralization over time. While current metrics appear healthy, maintaining decentralization as the network scales presents ongoing challenges.

Case Study: The Blockchain Operating System (BOS) Launch Impact

NEAR's introduction of the Blockchain Operating System in March 2023 exemplifies the protocol's innovation-driven approach to ecosystem growth. BOS created an entirely new category by establishing a unified layer for Web3 experiences compatible with any blockchain.

Technical Innovation: BOS enables developers to create composable frontends with code permanently stored on-chain. This approach eliminates single points of failure that plague traditional Web3 applications, as demonstrated by the Curve exploit where attackers compromised centralized frontends.

Developer Adoption: The BOS framework provided plug-and-play components for DeFi applications, games, DAOs, and wallets, significantly reducing development time. Templates and simplified deployment processes attracted developers from other ecosystems.

Ecosystem Impact: BOS facilitated the creation of cross-chain applications without traditional bridging requirements. This capability enhanced NEAR's value proposition as infrastructure for multi-chain Web3 experiences rather than a single-chain solution.

Market Response: The BOS launch contributed to NEAR's ecosystem expansion and user growth, though immediate price impact was limited due to broader market conditions. Long-term benefits include positioning NEAR as essential infrastructure for Web3 frontend development.

Conclusion: Is NEAR Protocol (NEAR) a Good Investment for You?

NEAR Protocol presents a compelling long-term investment opportunity for investors seeking exposure to next-generation blockchain infrastructure. The protocol's technical excellence through Nightshade sharding, innovative Chain Signatures technology, and developer-friendly BOS framework create a strong foundation for sustained growth.

Strengths supporting investment thesis include exceptional scalability (100,000+ TPS potential), competitive economics ($0.001-$0.003 transaction fees), and remarkable user adoption (46+ million monthly active users). NEAR's carbon-neutral operations and ESG compliance attract institutional capital, while 9.33% staking yields provide attractive risk-adjusted returns.

However, investment risks are significant. Intense competition from Ethereum Layer-2s and Solana, limited DeFi ecosystem development, and -88% decline from all-time highs demonstrate the challenges facing NEAR. The protocol's success depends on converting technical advantages into meaningful ecosystem growth and sustained price appreciation.

NEAR fits investors with longer investment horizons who appreciate technical innovation and are comfortable with moderate-to-high risk exposure. The protocol's focus on usability, developer experience, and cross-chain interoperability positions it well for the multi-chain future of blockchain technology.

For portfolio allocation, NEAR represents a growth-oriented position rather than a defensive holding. Investors should consider NEAR alongside other Layer-1 tokens as part of a diversified cryptocurrency portfolio, recognizing both its potential for significant returns and the inherent volatility of emerging blockchain platforms.

NEAR Protocol Historical Performance: Quarterly, Monthly & Weekly Returns

This analysis section presents historical returns for different time intervals including quarterly, monthly, and weekly periods. The performance bar chart and returns heatmap help users visually compare price changes and identify trend patterns across varying time frames. The maximum drawdown chart provides insight into asset risk by illustrating the largest observed decline. All figures are provided for educational analysis and should not be interpreted as investment advice.