How to Avoid Falling for Fake Trust Scores in Crypto: Protect Your Investments

- Key Takeaways:

- What Are Crypto Trust Scores?

- Common Types of Fake Trust Scores

- Bogus rating websites

- Purchased or fake reviews

- Imposter trust seals

- Influencer-boosted rankings

- Red Flags: How to Spot Fake Trust Scores

- Guaranteed returns or “100% safe” claims

- Upfront payments or pressure

- Flood of generic reviews

- No clear methodology

- Conflicting signals

- Reliable Tools and Methods to Verify Trust Scores

- Best Practices to Evaluate Trustworthiness in Crypto

- Diversify Holdings

- Conduct Due Diligence (DYOR)

- Review Audit Reports

- Stay Educated

- Real-life Examples of Fake Trust Score Scams

- Conclusion

Cryptocurrency scams are rampant – Americans lost an estimated $9.3 billion in crypto fraud in 2024. Scammers have grown more sophisticated, using tools like fake trust scores to make bogus coins or exchanges look legitimate. Understanding how crypto trust scores work is essential before relying on them to judge exchanges or tokens.

Fake trust scores are misleading credibility ratings pushed by scammers. To avoid them:

1.Cross-check exchange liquidity and trust metrics on reputable data aggregators such as CoinGecko and CoinMarketCap.

2. Watch for obvious red flags (guarantees, payment demands, fake reviews).

3. Always verify with independent research and trusted tools.

By following these steps, you’ll protect your crypto portfolio from phony ratings and scams.

Key Takeaways:

Fake trust scores are manipulated ratings used to mislead investors.

Always verify trust metrics on trusted platforms and cross-check with multiple signals.

Look out for red flags: guaranteed returns or requests for payment (scammers demand crypto in advance), and suspiciously unanimous reviews.

Use reliable tools like Forvest’s Fortuna Trust Score Analysis to get AI-driven trust ratings.

Continue due diligence: diversify your investments, read audits and project docs, and stay informed via credible news and community feedback.

Source: CoinGecko – Binance Exchange Profile

What Are Crypto Trust Scores?

Crypto trust scores are reputation ratings meant to reflect how safe or trustworthy a crypto platform, exchange, or token is. They combine data points like trading volume, liquidity, security features, and team quality into a single score. For example, CoinGecko’s Trust Score (1–10 scale) ranks exchanges by their market liquidity, API coverage, cybersecurity and more. CoinMarketCap similarly ranks exchanges using web traffic and volume. Emerging AI-driven tools (like Forvest’s Trust Score Analysis) aggregate on-chain metrics, market stats, and fundamentals to compute an “investment trust score” for each asset.

Common Types of Fake Trust Scores

Scammers use many tricks to fabricate trust indicators. Some common fake “trust scores” include:

Bogus rating websites

Unregulated sites may claim to score crypto projects but use arbitrary or outdated data. (Example: unknown services with names like “SafeCryptoCheck”.) These sites often lack transparency and can easily mark any project as “safe.”

Purchased or fake reviews

Some platforms show inflated star ratings (e.g. on Trustpilot or Google) by using networks of fake accounts or paid reviewers. If a crypto platform’s review page is flooded with generic 5-star reviews, that’s a classic sign of manipulation.

Imposter trust seals

Fraudulent projects might slap on graphics like “Certified Crypto Safe” or “Approved by CryptoGuard” with no verifiable source. These trust badges look official but are self-generated.

Influencer-boosted rankings

Promoters sometimes highlight made-up “honors” or rankings for coins. For instance, an influencer might falsely claim a token is “#1 trusted” on social media. Investors should verify such claims through proper channels.

No matter the form, any trust score that sounds too easy or too good should be taken with skepticism. Real trust scores reference real data; fake ones do not.

Red Flags: How to Spot Fake Trust Scores

Spotting a fake trust score often comes down to recognizing common warning signs:

Guaranteed returns or “100% safe” claims

Scammers love to promise you will make money or be fully protected. The FTC warns, “Only scammers will guarantee profits or big returns”. A trust score that implies zero risk is almost certainly fabricated.

Upfront payments or pressure

Legitimate ratings don’t require you to pay anything to see them or to improve them. If a site asks for a fee to “verify” your trust rating or remove a negative label (as happened with some scam-alert services), consider it a scam.

Flood of generic reviews

Be wary if you see dozens of one-liner testimonials praising a project. Unusually uniform 5-star reviews, copied text, or a recent review spike often mean the trust metric was gamed.

Source: General crypto scam education and investor protection guidelines

No clear methodology

Real trust scores explain what they measure. If a rating just shows a number without explaining which factors (security, liquidity, audits, etc.) were considered, it’s likely bogus.

Conflicting signals

If a high trust score clashes with other information – for example, news of hacks, unresolved withdrawals, or community warnings – dig deeper before trusting the score.

In short: too good to be true? It probably is. Any rating with red flags like those above should be treated as untrustworthy. Use common sense and don’t let a shiny score lull you into a trap.

Reliable Tools and Methods to Verify Trust Scores

Don’t rely on a single trust number – use solid research tools to verify it. Check reputable data platforms first: CoinGecko and CoinMarketCap publish trust metrics for exchanges (CoinGecko’s 1–10 scale, CMC’s exchange trust score). Look up the project’s fundamentals on sites like CryptoCompare or DeFiLlama. Inspect official disclosures: verify if exchanges publish proof-of-reserves or if tokens have third-party audit reports. Use on-chain explorers (like Etherscan) to see transaction patterns or large transfers that might not fit a high-trust narrative.

Another great approach is cross-referencing social and community feedback. Search crypto forums or Twitter for user experiences – often legitimate concerns surface there before anywhere else.

For a more automated layer of verification, some investors also use AI-driven trust analysis tools that aggregate on-chain data, market statistics, and fundamental signals to assess relative risk. Platforms such as Forvest provide trust score analyses that can help flag assets or exchanges requiring closer scrutiny. These tools are best used as a secondary reference, not a substitute for independent research or due diligence.

Source: Binance

Best Practices to Evaluate Trustworthiness in Crypto

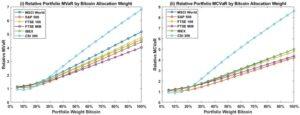

As a retail investor, I’ve learned the hard way that no metric replaces your own judgment. It’s wise to diversify and verify everything. A balanced crypto portfolio (illustrated above) might spread funds across several large-cap coins, mid-cap projects, and maybe one or two speculative bets, rather than putting all eggs in one basket. This way, if one asset has a misleadingly high trust score and then tanks, your entire portfolio isn’t wiped out.

Always do your own research (DYOR). Check the team’s credentials (LinkedIn, past projects), read the whitepaper, and understand the tokenomics. For instance, we advise investors to “investigate the team, read the whitepaper, understand the tokenomics” as part of your vetting process. If a project lacks a verifiable team or has unrealistic promises, even a strong-looking trust score shouldn’t convince you otherwise.

Set personal rules too: maybe you decide to only keep funds on exchanges with trust scores above a certain threshold, or always withdraw profits from any new coin within 48 hours. Using portfolio trackers that alert you to sudden trust-score drops can also be smart. Remember, tools like trust scores are helpers, not decision-makers.

Diversify Holdings

Don’t concentrate on one coin or exchange. Spread risk across different asset types and venues.

Conduct Due Diligence (DYOR)

Always verify any claim yourself. (Advisors stress “conduct your own research” before investing.)

Source: Academic portfolio risk analysis (Bitcoin allocation studies)

Review Audit Reports

Make sure platforms have third-party audits or proof-of-reserves. Lack of audits is a red flag.

Stay Educated

Follow crypto news and security alerts. If a platform’s score suddenly drops (or should drop due to an incident), respond by securing your funds.

By combining trust scores with these best practices, you create a safety net. In my experience, a well-diversified, thoroughly researched strategy beats chasing a “100% safe” badge every time.

Real-life Examples of Fake Trust Score Scams

Seeing is believing – real cases underscore why skepticism is healthy. In one reported scam, several fraudulent crypto sites (all part of the “Dex Network” scheme) were rated green by a popular online checker. ScamAdviser gave one scam site a 91/100 trust score, stating it “might be safe”, even though each site was actually a phishing operation. The moderator noted: “Please note that I have positively identified each of these websites as fraudulent… The advice given by ScamAdviser is both wrong and misleading.” This shows how a “high” trust rating can be completely fake.

Another cautionary tale involves Binance’s Trustpilot reviews. In 2020, Binance’s page became riddled with fake 5-star reviews and bots, so much so that Trustpilot disabled the rating system for Binance entirely. Even such a major exchange fell victim to review manipulation.

These examples highlight that no one is immune – scammers will inflate any metric to trick you. The takeaway: always question the trust signals. A high score on its own is no substitute for solid evidence.

Conclusion

Fake trust scores in crypto are a pervasive scam tactic, but you can outsmart them with vigilance. Always verify any rating using multiple sources, watch for red flags, and keep educating yourself. If something feels off, take the time to dig deeper before investing.

Staying skeptical, informed, and disciplined is one of the most effective ways to protect your crypto portfolio from misleading trust signals.

Rating of this post.

Rate

If you enjoyed this article, please rate it.

FAQs for Protect Your Investments

A fake trust score is a fraudulent rating created by scammers to make a crypto project or exchange appear safe. It typically comes from an unverified or malicious source and lacks real supporting data. Always treat any unexpected high trust rating with suspicion, and verify through established platforms.

Cross-check any rating with reputable sources (CoinGecko, CoinMarketCap) and use multiple indicators. Check the project’s official communications, audit records, and community discussions. Tools like Forvest’s Trust Score Analysis can help spot inconsistencies. If something feels off (e.g. too-good-to-be-true promises), do extra homework or steer clear.

Not necessarily. Trust scores from reputable aggregators can be helpful initial filters, but different platforms use different criteria. One source might focus on liquidity, another on user reviews. They should be one part of a broader research process. If scores conflict or don’t make sense given what you know about a coin, investigate further.

Yes. Trust scores reflect data at a given time. A previously safe platform can get hacked or a coin can crash, and any trust rating might lag behind. Always use current information: re-check trust scores and news especially after major events.

Don’t trust it. Instead, rely on your due diligence. Report the scam if possible, and focus on securing your investments. Use reliable metrics and community signals when evaluating projects

Rating of this post.

Rate

If you enjoyed this article, please rate it.