Best Crypto Wallets 2025: Secure & Reliable Options for Every User

Secure Your Digital Assets: Expert Insights on Selecting the Best Crypto Wallet for Every User in 2025

- What Makes a Crypto Wallet Secure in 2025?

- 1. Non-Custodial Control (You Hold Your Keys)

- 2. Multi-Layer Security Protection

- 3. Multi-Chain and DApp Compatibility

- 4. Recovery and Backup Systems

- 5. Open-Source Code and Audits

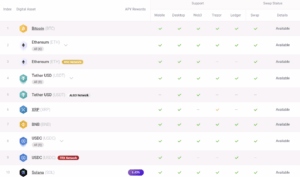

- Top 5 Crypto Wallets of 2025 — Comparison Table

- 2. Best Crypto Wallets to Use in 2025 (Beginner-Friendly & Secure Options)

- Hardware Wallets (Maximum Security for Long-Term Storage)

- Key Advantages

- Limitations

- Top Hardware Wallets for 2025

- Non-Custodial Software Wallets (Best for Control + Convenience)

- Key Advantages

- Limitations

- Top Non-Custodial Wallets for 2025

- Custodial Exchange Wallets (Beginner-Friendly, Not Fully Secure)

- Key Advantages

- Limitations

- Top Custodial Wallet Options

- Comparison Table — Best Crypto Wallets in 2025

- How to Choose the Right Wallet as a Beginner (2025)

- 🔹 When a Hardware Wallet Makes Sense

- 🔹 When a Non-Custodial Software Wallet Is the Better Fit

- 🔹 When a Custodial Exchange Wallet Is Acceptable

- Choosing the Best Crypto Wallets in 2025 (Detailed Reviews + Comparisons)

- 1. Ledger Nano X — Best Hardware Wallet for Long-Term Security

- Why Ledger Nano X Still Leads in 2025

- Key Features

- Pros

- Cons

- Best For

- 2. Trezor Model T — Best for Open-Source Security & Transparency

- Why Trezor Matters in 2025

- Key Features

- Pros

- Cons

- 3. MetaMask — Best Hot Wallet for Ethereum, DeFi, and Web3

- Why MetaMask Dominates Web3 in 2025

- Key Features

- Pros

- Cons

- 4. Coinbase Wallet — Best Beginner-Friendly Non-Custodial Wallet

- Why Coinbase Wallet Is Ideal for New Users

- Key Features

- Pros

- Cons

- 5. Trust Wallet — Best Mobile Wallet for Multi-Chain Support

- Why Trust Wallet Excels

- Key Features

- Pros

- Cons

- 6. Phantom Wallet — Best for Solana Ecosystem

- Why Phantom Continues to Grow in 2025

- Key Features

- Pros

- Cons

- 7. Exodus Wallet — Best for Beautiful UI & Multi-Chain Beginners

- Why Exodus Is Popular Among New Users

- Key Features

- Pros

- Cons

- 8. BitBox02 — Best Minimalist Hardware Wallet

- Why BitBox02 Has a Loyal User Base

- Key Features

- Pros

- Cons

- Comparison Table — Best Crypto Wallets in 2025

- How to Match a Wallet to Your Investing Style

- If you’re a beginner → Coinbase Wallet or Exodus

- If you’re investing long-term → Ledger or Trezor

- If you’re using DeFi → MetaMask or Rabby

- If you’re in the Solana ecosystem → Phantom

- If you manage everything on mobile → Trust Wallet

- If you want transparency → Trezor or BitBox02

- Which Wallet NOT to Choose? (Common Beginner Mistakes)

- Conclusion: Choosing the Right Crypto Wallet in 2025

- ⚠️ Disclaimer

- ⚠️ No Investment Advice

Cryptocurrency adoption continues to grow in 2025, and choosing the right crypto wallet has become essential for both beginners and advanced users. Wallets now offer stronger security standards, biometric protection, improved backup systems, and seamless integration with decentralized applications. However, not every wallet fits every user. The right choice depends on your security needs, your experience level, and the type of assets you hold.

“Strong wallet security is the first step toward responsible crypto ownership. A secure wallet does not guarantee profits, but it protects users from avoidable risks.”

👉If you want to understand how wallets actually fit into a long-term investing plan, start with our How to Invest in Cryptocurrency: Step-by-Step Beginner’s Guide — it walks you through exchanges, portfolio structure, and risk basics before you pick your first wallet.

What Makes a Crypto Wallet Secure in 2025?

In 2025, crypto wallets are evaluated by a combination of technical and usability standards. Security is no longer just about private keys — it involves backup systems, protection against phishing, hardware isolation, multi-chain compatibility, and verification layers that prevent unauthorized access.

The strongest wallets in 2025 share these characteristics:

1. Non-Custodial Control (You Hold Your Keys)

Wallets where users control their private keys remain the most secure option for long-term storage. These wallets eliminate counterparty risk and ensure full asset ownership.

2. Multi-Layer Security Protection

Modern wallets include:

-

Biometric authentication

-

Multi-signature support

-

Hardware-level encryption

-

Encrypted cloud backups

-

Anti-phishing protection

-

Transaction simulation (to prevent malicious smart contracts)

Technical standards for modern wallet security are documented in the cybersecurity guidelines provided by NIST (National Institute of Standards and Technology).

3. Multi-Chain and DApp Compatibility

With growing activity on Ethereum, Solana, Bitcoin L2s, and new chains, multi-chain support is now essential. The best wallets integrate seamlessly with DEX platforms, NFT marketplaces, and DeFi protocols.

4. Recovery and Backup Systems

Instead of a simple 12–24 word phrase, new wallets offer:

-

Social recovery

-

Multi-device backup

-

Shamir Secret Sharing

-

Secure encrypted cloud backup

These features reduce the risk of lost access.

5. Open-Source Code and Audits

Transparent, publicly-audited code is a major trust factor. Wallets that undergo regular audits and publish security reports offer stronger long-term reliability.

👉Before you decide which coins to hold in your wallet, you can run them through the Forvest Trust Score Analysis to see a data-driven review of risk, fundamentals, and sentiment in one place.

Top 5 Crypto Wallets of 2025 — Comparison Table

| Wallet | Best For | Security Level | Supported Chains | Key Features |

|---|---|---|---|---|

| Ledger Nano X (Hardware) | Long-term storage | ⭐⭐⭐⭐⭐ | BTC, ETH, SOL, 100+ | Hardware isolation, Bluetooth, audited firmware |

| Trezor Model T (Hardware) | Maximum transparency | ⭐⭐⭐⭐⭐ | BTC, ETH, LTC | Open-source, Shamir backup, touchscreen |

| MetaMask (Software) | Ethereum & L2 users | ⭐⭐⭐⭐ | ETH, Arbitrum, Optimism, Base | DApp browser, swaps, staking |

| Phantom (Software) | Solana ecosystem | ⭐⭐⭐⭐ | SOL, ETH, Polygon | NFTs support, biometric login, multi-chain |

| Trust Wallet (Software) | Multi-chain mobile users | ⭐⭐⭐⭐ | 100+ chains | DEX support, staking, simple UI |

2. Best Crypto Wallets to Use in 2025 (Beginner-Friendly & Secure Options)

Choosing the right crypto wallet is one of the most important steps for anyone entering the digital asset market. In 2025, wallet technology has matured, security standards have improved, and users now have access to multiple wallet types—each suited for a different level of experience and risk profile.

Wallets can generally be grouped into three categories:

hardware wallets, non-custodial software wallets, and custodial exchange wallets.

Understanding how each one works helps beginners protect their assets while keeping the user experience simple and manageable.

“A good wallet should balance security, usability, and control — your needs determine the right choice, not hype.”

Hardware Wallets (Maximum Security for Long-Term Storage)

Hardware wallets are physical devices that store private keys offline, away from online threats. They are ideal for users who plan to hold crypto long-term or want institutional-grade protection for larger balances.

👉Even if you store your crypto in a secure hardware wallet, you still need a simple way to track performance over time. The easiest way to do that is with the Forvest Portfolio Calculator, which shows your real P/L, allocations, and long-term trends in a clean, beginner-friendly dashboard.

Key Advantages

-

Private keys remain fully offline

-

Resistant to hacking, malware, and phishing

-

Ideal for cold storage and long-term strategies

-

Backup and recovery systems are simple and reliable

Limitations

-

Cost more than software wallets

-

Less convenient for daily transactions

-

Requires physical device access to sign transactions

Top Hardware Wallets for 2025

Ledger Nano X

A widely trusted device with Bluetooth support. Strong ecosystem, simple interface, and audited firmware.

Trezor Model T

Open-source security architecture with touchscreen interface and strong recovery features.

Keystone Pro

QR-based signing for added protection, air-gapped architecture, and strong anti-tamper hardware.

Non-Custodial Software Wallets (Best for Control + Convenience)

These wallets allow users to control their private keys without needing a physical device. They are easy to use, often free, and suitable for daily use or beginner portfolios.

Key Advantages

-

Full control of private keys

-

Easy setup, mobile-friendly

-

Great for DeFi, NFTs, and token transfers

-

No hardware purchase required

Limitations

-

Still vulnerable to phishing & malware

-

Requires secure device habits

-

Beginners must manage their own recovery phrase

Top Non-Custodial Wallets for 2025

MetaMask

The gateway to Ethereum and most EVM-compatible blockchains. Excellent for DeFi and Web3 interaction.

Phantom Wallet

One of the top non-custodial wallets for Solana users. Fast, modern UI, multi-chain expansion underway.

Rabbi Wallet

A growing alternative with clean UX, browser extension support, and multi-network functionality.

Exodus Wallet

Visually appealing, simple for beginners, supports large multi-asset portfolios.

Custodial Exchange Wallets (Beginner-Friendly, Not Fully Secure)

Custodial wallets store user funds on an exchange. They offer simplicity and easy access to buying/selling — but users do not control their private keys.

Key Advantages

-

Fast account creation

-

Integrated with trading and staking tools

-

Easy recovery options

-

No need to manage private keys

Limitations

-

“Not your keys, not your crypto”

-

Risk of exchange freezes or outages

-

Not suitable for long-term storage

Top Custodial Wallet Options

Coinbase

Highly regulated and beginner-friendly with top-tier security controls.

Binance Wallet

Supports thousands of assets with low transfer fees and strong infrastructure.

Kraken Wallet

Well known for security audits and transparent operational standards.

Comparison Table — Best Crypto Wallets in 2025

| Wallet Type | Best For | Security Level | Ease of Use | Control of Keys | Notable Strength |

|---|---|---|---|---|---|

| Ledger Nano X (Hardware) | Long-term storage | Very High | Medium | Full | Offline, tamper-resistant security |

| Trezor Model T (Hardware) | Security-focused users | Very High | Medium | Full | Open-source protection |

| MetaMask (Software) | DeFi & Web3 users | Medium | High | Full | Browser + mobile support |

| Phantom (Software) | Solana users | Medium | Very High | Full | Clean UI, fast transactions |

| Exodus (Software) | Beginners | Medium | Very High | Full | Multi-asset & simple UX |

| Coinbase Wallet (Custodial) | Beginners on CEX | Medium | Very High | None | Regulated & secure infrastructure |

| Kraken Wallet (Custodial) | Security-focused CEX users | Medium–High | High | None | Transparent, audited ecosystem |

How to Choose the Right Wallet as a Beginner (2025)

Choosing a wallet as a beginner depends on three factors:

how frequently you transact, how much you invest, and how comfortable you are managing your own security.

Different wallet types offer different levels of protection and convenience, so beginners benefit from matching the wallet to their usage style.

🔹 When a Hardware Wallet Makes Sense

A hardware wallet is suitable if:

-

you plan to hold your assets for long periods

-

long-term protection is your priority

-

your portfolio may grow over time

-

you prefer offline, tamper-resistant security

Hardware wallets reduce exposure to online threats and are commonly used once beginners develop larger or multi-year portfolios.

🔹 When a Non-Custodial Software Wallet Is the Better Fit

Choose a non-custodial software wallet if:

-

you want both control and day-to-day convenience

-

you interact with DeFi protocols, swaps, or NFTs

-

you prefer a free, mobile-friendly setup

-

you want to manage your own private keys

These wallets provide strong flexibility but require safe handling of recovery phrases and device security.

🔹 When a Custodial Exchange Wallet Is Acceptable

A custodial wallet can be appropriate if:

-

you are just beginning and want a simple interface

-

you prefer having customer support available

-

you are not ready to manage private keys yet

-

ease of deposits and withdrawals matters most

Custodial wallets reduce responsibility but also reduce control, which is why many users eventually transition to non-custodial or hardware wallets as their portfolios grow.

Public financial references, including the Investopedia crypto wallet overview, outline standard wallet categories and common security considerations in a neutral, descriptive format.

Choosing the Best Crypto Wallets in 2025 (Detailed Reviews + Comparisons)

Now that you understand the fundamentals of crypto wallets and the criteria for choosing one, it’s time to look at the best crypto wallets to use in 2025. The reviews below evaluate each wallet from a beginner’s point of view while also considering deeper technical features like key management, recovery systems, staking support, and compatibility with DeFi applications.

Each wallet is analyzed through five lenses:

-

Security Model (custodial / non-custodial, hardware isolation)

-

Ease of Use (beginner-friendly UI, onboarding steps)

-

Supported Assets (BTC, ETH, L2s, Solana, stablecoins, multi-chain support)

-

Staking & Yield Features

-

Best Use Case (beginners, long-term holders, DeFi users)

Let’s dive into the top wallets shaping the 2025 ecosystem.

1. Ledger Nano X — Best Hardware Wallet for Long-Term Security

Why Ledger Nano X Still Leads in 2025

Ledger remains one of the most trusted names in cold storage. The Nano X provides secure offline key storage, Bluetooth connectivity, and support for thousands of coins. It’s ideal for long-term investors who prioritize protection against hacks, exchange failures, and phishing attempts.

Key Features

-

Fully offline private key storage

-

Ledger Live app for portfolio tracking

-

Supports 5,500+ cryptocurrencies

-

Bluetooth connectivity for mobile use

-

Passphrase support for advanced users

Pros

-

Industry-leading security

-

Compatible with DeFi via Ledger Connect

-

Easy for beginners after initial setup

Cons

-

Requires purchasing the device

-

Some features require third-party integrations

Best For

Long-term holders, large portfolios, security-focused users.

2. Trezor Model T — Best for Open-Source Security & Transparency

Why Trezor Matters in 2025

Trezor’s complete open-source architecture makes it a favorite among advanced users who value transparency. Its touchscreen interface simplifies signing transactions and interacting with dApps safely.

Key Features

-

100% open-source firmware

-

Built-in password manager

-

Native Bitcoin-only mode

-

Touchscreen signing

-

Direct integration with multiple wallets (Exodus, MetaMask, Electrum)

Pros

-

Fully auditable open-source code

-

Excellent for multi-chain portfolios

-

Simple recovery process

Cons

-

Slightly bulkier than Ledger

-

No mobile app equivalent to Ledger Live

Best For Users prioritizing transparency, developers, Bitcoin-focused investors.

3. MetaMask — Best Hot Wallet for Ethereum, DeFi, and Web3

Why MetaMask Dominates Web3 in 2025

MetaMask continues to be the gateway to decentralized apps across Ethereum and Layer-2 networks. Whether you’re exploring DeFi, minting NFTs, or connecting to Web3 social platforms, MetaMask remains the most widely supported wallet in the ecosystem.

Key Features

-

Direct access to Ethereum, Arbitrum, Base, Optimism, Polygon

-

Browser extension + mobile app

-

Supports hardware wallets

-

Custom networks (zkSync, Linea, Scroll)

-

Built-in swaps and bridging

Pros

-

Easy onboarding for beginners

-

Essential for interacting with DeFi

-

Strong community and documentation

Cons

-

Hot wallets are less secure than hardware wallets

-

Requires careful avoidance of phishing sites

Best For DeFi users, NFT collectors, Web3 explorers, L2 enthusiasts.

4. Coinbase Wallet — Best Beginner-Friendly Non-Custodial Wallet

Why Coinbase Wallet Is Ideal for New Users

Unlike Coinbase Exchange (custodial), Coinbase Wallet gives users full control over private keys while keeping the interface extremely simple. Multi-chain support and strong educational resources make it one of the best onboarding wallets for new investors.

Key Features

-

Non-custodial

-

Supports Ethereum, L2s, Solana, and EVM chains

-

Easy bridging and token swaps

-

Backed by a major regulated company

-

One-tap dApp browser for mobile

Pros

-

Very user-friendly

-

Multi-chain coverage

-

Safety alerts on risky tokens or contracts

Cons

-

Not open-source

-

Limited advanced settings compared to MetaMask

Best For Beginners learning self-custody, multi-chain users, simple DeFi tasks.

5. Trust Wallet — Best Mobile Wallet for Multi-Chain Support

Why Trust Wallet Excels

Trust Wallet supports more than 9 million tokens across nearly every major blockchain. Its mobile-only design makes it a great choice for users who manage everything from their phone.

Key Features

-

Supports 70+ blockchains

-

Browser for dApps

-

Staking for 10+ assets

-

Native support for NFTs

-

Simple recovery phrase setup

Pros

-

Extremely wide asset support

-

Great for mobile-first users

-

Supports most DeFi ecosystems

Cons

-

Not ideal for large holdings

-

Requires caution when using dApps

Best For Everyday users, mobile-first DeFi activity, multi-chain portfolios.

6. Phantom Wallet — Best for Solana Ecosystem

Why Phantom Continues to Grow in 2025

Phantom is the dominant wallet for Solana. Its speed, clean interface, and easy staking make it perfect for users interacting with Solana NFTs, DePIN apps, or high-speed trading environments.

Key Features

-

Solana-native design

-

Instant staking

-

NFT viewer

-

Browser & mobile

-

Supports Solana + Ethereum + Polygon (2025)

Pros

-

Fastest UX in any wallet

-

Extremely smooth NFT management

-

Built-in DEX swaps

Cons

-

Limited to SOL + EVM chains

-

Not ideal for Bitcoin users

Best For Solana traders, NFT collectors, consumer apps on SOL.

7. Exodus Wallet — Best for Beautiful UI & Multi-Chain Beginners

Why Exodus Is Popular Among New Users

Exodus is one of the most visually polished crypto wallets. Its simple interface, multi-chain support, and hardware integration make it a strong choice for beginners who want beauty + functionality.

Key Features

-

Desktop + mobile

-

Supports 350+ assets

-

Built-in portfolio tracker

-

Integrated with Trezor

-

Staking available for several coins

Pros

-

Easiest UI for absolute beginners

-

No account needed

-

Smooth hardware wallet pairing

Cons

-

Closed-source

-

Limited advanced DeFi features

Best For New users who want a simple, elegant wallet experience.

8. BitBox02 — Best Minimalist Hardware Wallet

Why BitBox02 Has a Loyal User Base

BitBox02 appeals to users who want a minimal setup experience without sacrificing security. Its touch and tap gestures make transaction signing intuitive.

Key Features

-

MicroSD backup

-

Minimalist design

-

Open-source firmware

-

Supports Bitcoin-only or multi-edition models

Pros

-

Highly secure

-

Easy physical backups

-

Great for Bitcoin maxis

Cons

-

Fewer supported assets than Ledger/Trezor

Best For Security-focused users wanting a simple hardware wallet.

Comparison Table — Best Crypto Wallets in 2025

| Wallet | Type | Best For | Security Level | Supported Ecosystems | Difficulty |

|---|---|---|---|---|---|

| Ledger Nano X | Hardware | Long-term holding | Very High | Multi-chain | Medium |

| Trezor Model T | Hardware | Transparency & open-source | Very High | Multi-chain | Medium |

| MetaMask | Hot wallet | DeFi & Web3 | Medium | ETH, L2s | Easy |

| Coinbase Wallet | Hot wallet | Beginners & multi-chain | Medium | ETH, L2s, SOL | Very Easy |

| Trust Wallet | Hot wallet | Mobile-first users | Medium | 70+ chains | Easy |

| Phantom | Hot wallet | Solana ecosystem | Medium | SOL + EVM | Very Easy |

| Exodus | Desktop/Mobile | Beginners | Medium | 300+ assets | Very Easy |

| BitBox02 | Hardware | Minimalist security | Very High | BTC or multi-edition | Medium |

How to Match a Wallet to Your Investing Style

Instead of choosing a wallet randomly, align it with your goal:

If you’re a beginner → Coinbase Wallet or Exodus

Simple setup, intuitive layout, strong safety features.

If you’re investing long-term → Ledger or Trezor

Best protection against hacks and exchange failures.

If you’re using DeFi → MetaMask or Rabby

Essential for Ethereum and Layer-2 activity.

If you’re in the Solana ecosystem → Phantom

Fastest and most optimized Solana wallet.

If you manage everything on mobile → Trust Wallet

Huge ecosystem + simple staking.

If you want transparency → Trezor or BitBox02

Open-source and highly auditable.

👉Once you choose your wallet, you can connect your holdings to the

Forvest Portfolio Calculator to see whether your allocation and risk levels match your long-term strategy.

Which Wallet NOT to Choose? (Common Beginner Mistakes)

Avoid wallets that:

-

Do not give you a recovery phrase (custodial only)

-

Are clones or fake extensions

-

Offer unrealistic interest rates

-

Require installing unknown software

-

Push high-risk “airdrops” or random tokens

If your wallet does not give you full control of your private keys:

“Not your keys, not your crypto.”

Conclusion: Choosing the Right Crypto Wallet in 2025

The crypto wallet ecosystem has evolved significantly by 2025. Investors now have access to secure hardware devices, intuitive mobile apps, and advanced Web3 wallets designed for DeFi and multi-chain activity. The right wallet depends on your goals:

-

Long-term holders benefit from hardware wallets like Ledger and Trezor.

-

Beginners find the most comfort in simple interfaces such as Coinbase Wallet or Exodus.

-

Solana and high-speed app users generally prefer Phantom.

-

DeFi participants rely heavily on MetaMask or similar wallets with strong dApp integrations.

No single wallet is perfect for every user. What matters most is understanding your personal risk level, how much control you want over your assets, and whether you require features like staking, NFTs, or multi-chain access.

If you’re uncertain where to begin, start with a beginner-friendly non-custodial wallet, then upgrade to a hardware device when your portfolio grows. And as your activity expands across networks, consider using multiple wallets — each optimized for a different purpose.

The cryptocurrency landscape rewards careful preparation, strong security habits, and continuous learning. With the right wallet setup, you can manage your digital assets safely and confidently in 2025 and beyond.

👉With the right wallet setup, you can manage your digital assets safely and confidently in 2025 and beyond. Once your wallet is in place, the next logical step is to structure a simple beginner-friendly portfolio that fits your risk profile and time horizon — for example, using a layered approach like the one we explain in our beginner crypto portfolio framework for 2025.

⚠️ Disclaimer

This article is provided solely for educational and informational purposes.

It does not contain legal, tax, financial, or trading advice, and should not be interpreted as a recommendation to buy, sell, or hold any cryptocurrency or financial product. Digital asset markets are volatile, and you may lose all or part of your capital.

Readers should evaluate their personal financial circumstances independently and, if needed, consult qualified professionals who can provide advice tailored to their situation.

👉Publicly available materials from global regulatory bodies—such as consumer protection notices and educational guidance issued by organizations like the U.S. Federal Trade Commission—offer general information on recognizing crypto-related risks and common online fraud patterns. These resources are informational in nature and do not constitute endorsements.

⚠️ No Investment Advice

Nothing in this guide should be interpreted as an endorsement, investment recommendation, or suggestion to buy, sell, or hold any cryptocurrency or financial product.

All examples and wallet options discussed here are illustrative only and may not be suitable for your personal needs or risk tolerance.

You are solely responsible for your financial decisions.

Rating of this post

Rate

If you enjoyed this article, please rate it.

FAQs for crypto wallet best

The best crypto wallets in 2025 include Ledger Nano X and Trezor Model T for hardware security, plus MetaMask, Coinbase Wallet, Phantom, and Trust Wallet for software use.

Hardware wallets like Ledger Nano X and Trezor Model T are considered the safest choices because they store private keys offline and reduce exposure to online threats.

Beginner-friendly wallets include Coinbase Wallet and Exodus. They offer simple interfaces, strong security alerts, and easy multi-chain access.

Yes. Multi-chain wallets such as Trust Wallet, MetaMask (with custom networks), and Phantom (2025 version) allow users to manage multiple blockchains in one place.

Not necessarily. For small portfolios, secure non-custodial wallets are often enough. Hardware wallets become more useful when your holdings increase over time.

Rating of this post

Rate

If you enjoyed this article, please rate it.