Crypto Portfolio Backtesting — The Complete Guide

A practical, risk-aware framework to test crypto investment strategies across market regimes.

- TL;DR (Key Takeaways)

- What Is Investment Backtesting?

- Why It Matters for Long-Term Crypto Portfolios

- Data, Costs & Market Regimes

- A) Data Quality

- B) Costs & Liquidity

- C) Market Regimes

- Core Workflow: Step-by-Step

- Step1 — Objective & Hypothesis

- Step2 — Portfolio Rules

- Step3 — Data & Frictions

- Step4 — Simulation

- Step5 — Evaluation

- Step6 — Iterate Carefully

- Metrics That Matter (Investor Edition)

- Optimization vs Overfitting (How to Avoid It)

- Walk-Forward & Forward Testing (Turning Theory Into Durability)

- A) Walk-Forward Testing (Rolling Validation)

- B) Forward Testing (Paper / Live-Small)

- A Practical Example: Comparing Two Portfolio Models

- Model A — Equal-Weight + Simple Regime Filter

- Model B — 12-Month Momentum Tilt

- Evaluation Snapshot (Illustrative)

- Walk-Forward Glimpse

- Common Pitfalls (and Quick Fixes)

- Tools & Setups for Investors (Practical, Not Dogmatic)

- From Backtesting to Action (Turning Tests Into Decisions)

- Closing Note

- Related Forvest Tools in Our AI Assistant, Fortuna

Investment backtesting simulates a portfolio’s rules on historical crypto data to measure growth, drawdowns, and risk-adjusted quality across bull, bear, and sideways markets. The goal isn’t perfect timing; it’s building a repeatable, robust process investors can tolerate—and validate later with walk-forward and forward tests.

TL;DR (Key Takeaways)

-

Investor backtesting ≠ trader backtesting: focus on portfolios, regimes, and risk-adjusted results.

-

Core metrics: CAGR, Max Drawdown, Sharpe/Calmar, consistency across sub-periods.

-

Data quality, fees/slippage, liquidity affect reality more than models.

-

Use simple, explainable rules; avoid overfitting with train/test splits and robustness checks.

-

After testing, align with the current regime and monitor thresholds before real allocation.

What Is Investment Backtesting?

Investment backtesting is a disciplined simulation: you define portfolio rules, apply them to historical data, and observe how the strategy would have behaved over time. The emphasis is on repeatability and tolerability, not intraday precision.

How it differs from trader backtesting

-

Unit of analysis: portfolio allocation policies (e.g., BTC/ETH/SOL + stables), not rapid entry/exit signals.

-

Time horizon: weeks–months and multi-year cycles, not minute bars.

-

Success: stable, risk-adjusted outcomes vs. peak raw returns.

-

Cadence: scheduled or regime-based rebalancing, not constant micro-timing.

Bottom line: you’re testing whether a clear, simple policy behaves well enough across bull, bear, and sideways phases to be investable.

Why It Matters for Long-Term Crypto Portfolios

Crypto’s volatility punishes impulsive decisions. Backtesting helps investors:

-

Replace emotion with pre-committed rules (allocation, rebalancing, de-risking triggers).

-

Quantify downside: measure Max Drawdown, worst month/year, time under water.

-

Build regime awareness: see where a policy shines and where it struggles.

-

Create repeatability: a process you can defend and follow during stress.

The payoff is not just higher CAGR; it’s more livable performance—returns you can actually stick with.

Data, Costs & Market Regimes

Great math can’t rescue bad assumptions. Three levers decide realism:

A) Data Quality

-

Use credible sources; clean anomalies (re-denominations, delistings, stale ticks).

-

Ensure coverage across regimes (ideally 3–5 years).

-

Handle survivorship bias: include assets as they truly existed.

B) Costs & Liquidity

-

Model fees, slippage, spreads; stress-test with conservative values.

-

Rebalancing frequency multiplies costs—make it explicit.

-

Enforce liquidity filters (volume, market-cap) to avoid unrealistic fills.

C) Market Regimes

-

Label periods: bull / bear / range.

-

Examine regime sensitivity: if results hinge on one phase, risk is higher.

-

Prefer acceptable behavior across phases, even if it’s not “best” in any single one.

If fees/slippage/liquidity are ignored, you’re grading fantasy, not strategy.

Core Workflow: Step-by-Step

Step1 — Objective & Hypothesis

-

Define what matters: stability, capped drawdowns, lower variance, or growth with constraints.

-

Example hypothesis: “A simple regime filter (risk-off to stables in deep downtrends) reduces Max DD while preserving most CAGR.”

Step2 — Portfolio Rules

-

Universe: which assets (BTC, ETH, SOL, stables…).

-

Allocation: equal weight, risk-based, momentum tilt, caps/floors per asset.

-

Signals: regime filters (trend, breadth, volatility), or valuation bands.

-

Rebalancing: monthly/quarterly or conditional (only when triggers fire).

Step3 — Data & Frictions

-

Timeframe: daily/weekly bars suit investors.

-

Costs: fees + slippage; test sensitivity to higher frictions.

-

Liquidity: enforce minimum thresholds; exclude thin assets.

Step4 — Simulation

-

Split in-sample (design) vs. out-of-sample (validation).

-

Apply rules mechanically; avoid hindsight edits.

Step5 — Evaluation

-

Track CAGR, Max DD, Sharpe/Calmar, worst year/month, time under water.

-

Check stability by sub-period (per-year stats).

-

Inspect the equity curve: is the path livable?

Step6 — Iterate Carefully

-

Change one thing at a time; seek robustness improvements, not record highs.

-

Prepare for walk-forward validation (Part 2).

Metrics That Matter (Investor Edition)

| Metric | What it tells you | Investor use |

|---|---|---|

| CAGR | Compound annual growth | Long-run compounding strength |

| Max Drawdown | Deepest peak-to-trough loss | Pain ceiling; capital at risk |

| Sharpe | Return per unit of volatility | Quality/consistency of outcomes |

| Calmar | CAGR / Max DD | Growth per unit of worst pain |

| Ulcer Index | Depth & duration of drawdowns | Psychological stress over time |

| Hit Rate & Avg Win/Loss | Distribution profile | Are results steady or concentrated? |

Interpretation tips

-

In crypto, Max DD can dominate behavior; investors abandon unlivable paths.

-

Sharpe/Calmar compare strategies with similar CAGR but different risk quality.

-

Per-year stability matters; a “one-year wonder” often signals regime dependency.

-

Time under water tests discipline more than a brief deep dip.

Optimization vs Overfitting (How to Avoid It)

Overfitting means the strategy memorized the past. Your edge should survive small changes and new data.

Common overfitting tells

-

Fragile, micro-tuned parameters (EMA 47 works, EMA 48 fails).

-

Too many knobs (8–10 parameters) with accidental interactions.

-

Single-regime success; poor elsewhere.

-

Performance collapses when realistic costs are applied.

Defenses that work

-

Train/Test split with a clean validation window.

-

Walk-forward re-estimation in rolling windows (covered in Part 2).

-

Robustness checks: parameter sweeps, Monte Carlo/bootstrapping, cost sensitivity.

-

Prefer fewer, explainable rules with economic intuition.

If a tiny parameter nudge breaks results, there’s no edge—just curve-fit.

Walk-Forward & Forward Testing (Turning Theory Into Durability)

Backtests can look brilliant—until they face new, unseen data. That’s why investors rely on two validators:

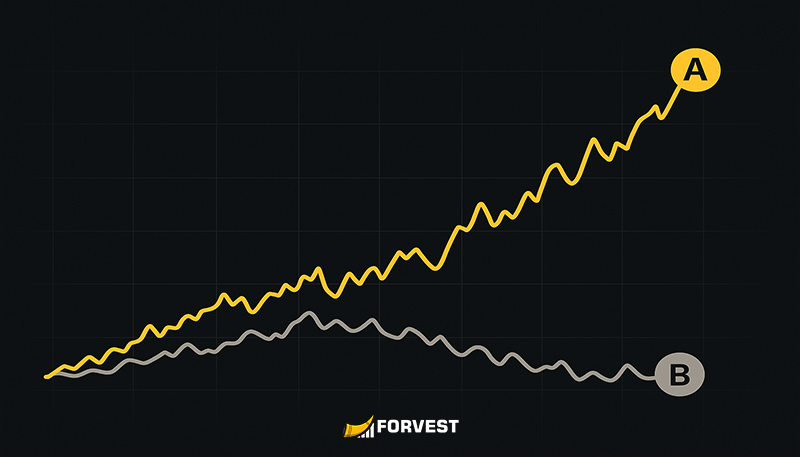

A) Walk-Forward Testing (Rolling Validation)

Divide history into sequential windows (e.g., 12–18 months). In each window:

-

Estimate parameters modestly on the first sub-window.

-

Test those parameters on the next sub-window.

-

Roll the window forward and chain results.

This produces a stitched equity curve across changing conditions, revealing whether the strategy adapts to regime shifts or only thrives in one phase.

Execution principles

-

Don’t make windows too short (noise) or too long (overfit to an era).

-

Keep parameter ranges simple and bounded—you’re targeting robustness, not backtest records.

-

Evaluate the full panel: CAGR, Max Drawdown, Sharpe/Calmar, per-window consistency, and time under water.

Learn the practical differences in our guide to backtesting vs forward testing

B) Forward Testing (Paper / Live-Small)

After walk-forward, deploy the strategy on fresh data—either paper trading or with small capital. Validate the practical frictions you modeled: rebalancing cadence, execution delay, spreads at the time you actually trade, and unplanned market events.

Purpose: before meaningful allocation, confirm that your process behaves in the current regime and under real execution constraints.

A Practical Example: Comparing Two Portfolio Models

Numbers below are illustrative—designed to show how to evaluate, not to prescribe a specific system.

Shared assumptions

-

Universe: BTC, ETH, SOL (+ stables in risk-off)

-

Period: 5 years

-

Timeframe: weekly

-

Costs: 0.10% fee per trade; 0.05% slippage

-

Rebalancing: monthly, unless a conditional rule triggers

Model A — Equal-Weight + Simple Regime Filter

-

Equal weight across BTC/ETH/SOL.

-

If a regime indicator (e.g., broad trend deterioration) flags deep risk-off, shift up to 30% into stables.

-

Cap any single asset at 45% to prevent single-asset dominance.

Model B — 12-Month Momentum Tilt

-

Weights determined by 12-month relative momentum.

-

Floor weight for laggards: 10%; cap for leaders: 55%.

-

No explicit regime filter; risk is managed through dynamic rotation.

Evaluation Snapshot (Illustrative)

| Metric | Model A | Model B |

|---|---|---|

| CAGR | Moderate to good | Higher in strong bull cycles |

| Max Drawdown | Lower due to regime de-risking | Deeper in sharp rotations |

| Sharpe | More stable | More volatile |

| Calmar | Often favorable (DD control) | Weaker in bear phases |

| Worst Year | Less painful | Can be worse |

| Time Under Water | Shorter | Longer in slow recoveries |

Investor takeaways

-

If you prioritize drawdown tolerance and behavioral comfort, Model A tends to be easier to live with.

-

If you can accept deeper drawdowns for higher bull-market capture, Model B may appeal.

-

A pragmatic middle ground: blend (e.g., 60% A / 40% B), then re-test as a single portfolio policy.

Walk-Forward Glimpse

With 12–18-month rolling windows, you often see:

-

Model A delivering steadier outcomes across windows (benefit of regime-aware de-risking).

-

Model B excelling in bull windows but wobbling during transitions or range-bound periods.

-

If you favor Model B’s upside, a minimal regime safeguard or small cash buffer can materially improve tolerability.

Common Pitfalls (and Quick Fixes)

1) Ignoring Frictions (Fees, Slippage, Liquidity)

-

Tell: Sharpe collapses when you add 0.1–0.2% per trade.

-

Fix: Model frictions realistically; reduce turnover; avoid illiquid assets; consider conditional or less frequent rebalancing.

2) Look-Ahead & Data Snooping

-

Tell: Indicators inadvertently use information not available at decision time.

-

Fix: Enforce timing discipline; apply indicators with appropriate delays; freeze your data cuts before testing.

3) Survivorship Bias

-

Tell: Your universe includes only today’s survivors.

-

Fix: Reconstruct historical universes; include delisted/failed assets in their actual time windows.

4) Over-Parameterization

-

Tell: 8–10 sensitive knobs; results break with tiny changes.

-

Fix: Fewer, explainable rules; parameter stability checks; prioritize economic intuition over curve-fit gains.

5) Single-Regime Hero

-

Tell: Great in bull, fragile elsewhere.

-

Fix: Add a simple regime filter (trend/volatility) or a small cash sleeve with clear triggers.

6) Misaligned Timeframes

-

Tell: Intraday logic for long-horizon investing decisions.

-

Fix: Use daily/weekly data for investor policies; leave intraday tactics to trading contexts.

7) Path Dependence Blindness

-

Tell: Attractive CAGR hides intolerable equity-curve behavior.

-

Fix: Review worst month/year, time under water, and rolling Sharpe—behavior matters as much as totals.

8) Skipping Forward Discipline

-

Tell: Glowing backtest, no real-time validation plan.

-

Fix: Commit to forward testing (paper or small capital) before scaling.

Tools & Setups for Investors (Practical, Not Dogmatic)

A) Ready-Made Platforms (No-/Low-Code)

Good for fast iteration and visualization—provided you can control data quality, frictions, and rebalancing logic. Prefer platforms that expose assumptions clearly and let you export results for audit.

B) Code-Based (Python/R)

Maximum flexibility for portfolio rules, robustness testing, and custom metrics. Demands time and documentation discipline. Ideal if you need regime labels, parameter sweeps, and sensitivity analysis under one roof.

C) Process Standards (tool-agnostic)

-

Data & cost profiles: define standard fee/slippage assumptions so results are comparable across tests.

-

Versioning: timestamp every ruleset change with rationale.

-

Reproducibility: periodic re-runs to detect drift or dependency on stale assumptions.

-

Risk reports: include Max DD, Calmar, worst period, and time-under-water alongside CAGR in every output.

From Backtesting to Action (Turning Tests Into Decisions)

Backtesting isn’t the finish line—it’s the start of a disciplined operating model.

Step 1 — Align with the current regime.

Before allocating, confirm that today’s market behavior resembles the regimes your strategy tolerates. A weekly market review helps anchor assumptions to reality.

Step 2 — Operationalize thresholds.

Translate backtested rules into clear triggers: allocation bands, risk-off thresholds, and rebalancing conditions. Configure price alerts so you act on rules rather than emotion.

Step 3 — Size conservatively, then scale.

Begin with smaller allocations; expand gradually after forward performance confirms expectations. Schedule monthly/quarterly reviews to adjust if assumptions diverge from conditions.

Principle: the best strategy is the one you can consistently execute—not the one that only shines on paper.

Closing Note

Crypto investing is the art of managing uncertainty and cycles. Backtesting builds a repeatable rulebook; walk-forward and forward testing harden it against time; disciplined execution turns analysis into outcomes. The edge isn’t prediction—it’s process.

Related Forvest Tools in Our AI Assistant, Fortuna

Forvest Trust Score helps investors evaluate crypto projects based on real transparency and reliability metrics. It identifies trustworthy assets and highlights hidden risks, guiding you toward safer investment decisions.

Forvest Alerts keeps you informed about key market movements and sentiment shifts — not just prices, but also major news that may impact your portfolio — helping you stay proactive instead of reactive.

— Forvest Research

Rating of this post

Rate

If you enjoyed this article, please rate it.

FAQs

Prefer 3–5 years at minimum to span multiple regimes. Short spans inflate confidence and hide fragility.

Favor the one with lower Max Drawdown, stronger Calmar, and shorter time under water. Tolerability drives real-world adherence.

No. Start with simple, explainable rules. If you optimize, validate with walk-forward and parameter stability checks to avoid curve-fit traps.

Double your fee/slippage assumptions and re-evaluate Sharpe/Calmar. If quality collapses, reduce turnover or simplify rules.

When regime filters indicate deep risk-off conditions—or when your personal risk tolerance cannot weather large drawdowns. Calibrate the percentage in your backtests.

Rating of this post

Rate

If you enjoyed this article, please rate it.