How to Build a Beginner Crypto Portfolio in 2025 (Step-by-Step)

A practical beginner framework for building a safe, diversified crypto portfolio in 2025

- Why a Structured Portfolio Matters in 2025

- What a Beginner Portfolio Should Prioritize in 2025

- Core Principle #1 — Start With a Small, Controlled Budget

- Core Principle #2 — Follow a Simple Asset Structure

- 🔹 60–70%: Core Assets (BTC + ETH)

- 🔹 20–30%: Growth Assets (SOL, L2s, major L1s)

- 🔹 5–10%: High-Risk Layer (carefully controlled)

- 🔹 5–10%: Stablecoin Buffer

- Core Principle #3 — Use Beginner-Friendly Portfolio Tools

- Core Principle #4 — Build Slowly With Dollar-Cost Averaging (DCA)

- Core Principle #5 — Review Your Portfolio Weekly (Not Daily)

- How to Build a Beginner Crypto Portfolio in 2025 (Detailed Step-by-Step Framework)

- Step 1 — Establish Your Portfolio Foundation (Core Holdings)

- Why BTC + ETH Should Be the Base Layer

- How Much Should You Allocate?

- Model A (Conservative)

- Model B (Balanced)

- Step 2 — Add a Controlled Growth Layer (SOL, L2 Networks, Major L1s)

- Why This Layer Matters

- Best Growth Assets for Beginners (2025)

- 1. Solana (SOL) — High-speed, high-adoption Layer 1

- 3. Emerging L1s With Real Traction (APTOS, SUI, TON)

- Suggested Allocation for the Growth Layer

- Step 3 — Add a Stablecoin Buffer (USDT / USDC)

- Why Stablecoins Matter

- Recommended Options

- Step 4 — Manage Risk With a Small “Exploration Layer”

- Step 5 — Use Dollar-Cost Averaging (DCA) to Build Positions

- Why Beginners Should Use DCA

- Example DCA Plan for a $100 Portfolio

- Step 6 — Track Your Portfolio Performance

- What You Should Track Weekly

- Recommended Tool

- Step 7 — Rebalance Your Portfolio Every 1–3 Months

- Methods

- Rebalance Frequency

- Step 8 — Strengthen Your Security Setup

- Beginner Security Checklist

- Upgrade Path

- Step 9 — Integrate AI Tools Into Your Research Flow

- Step 10 — Build Slowly, Not Emotionally

- Building Long-Term Discipline, Managing Volatility, and Setting Smart Expectations in 2025

- Understanding Market Psychology (The Hardest Part for Beginners)

- Three Emotional Patterns Beginners Struggle With

- Setting Realistic Expectations

- How to Analyze Your Portfolio’s Performance Like a Professional Investor

- 1. Real Profit/Loss After Fees

- 2. Allocation Drift

- 3. Drawdown Levels

- 4. Risk-Adjusted Returns

- When to Adjust Your Portfolio (And When Not To)

- ❌ Do NOT adjust your portfolio when:

- ✅ You SHOULD adjust your portfolio when:

- When Should a Beginner Add More Capital?

- Building a Multi-Wallet Strategy (A Sign of Maturity)

- Recommended Multi-Wallet Setup

- Managing Volatility Without Emotional Stress

- 1. Time Segmentation

- 2. Pre-Written Rules

- 3. Information Diet

- Common Beginner Pitfalls and How to Avoid Them

- ❌ 1. Buying Too Many Assets

- ❌ 2. Chasing Memecoins

- ❌ 3. Ignoring Security

- ❌ 4. Trying to Time the Market

- ❌ 5. Focusing Only on Price

- Long-Term Strategy for 2025 and Beyond

- About Forvest — Why Our Tools Matter for Beginner Portfolios

- A Beginner Portfolio Is the Foundation of Your Crypto Journey

- ⚠️ Disclaimer

- ⚠️ No Investment Advice

Cryptocurrency investing in 2025 has become safer, more structured, and far more beginner-friendly. With clearer regulations, better exchanges, multichain wallets, and AI-powered analysis tools, new investors can now build a responsible crypto portfolio even with a small starting budget.

But this raises an important question:

How can beginners build a balanced, low-risk portfolio without relying on hype, guesses, or emotional decision-making?

This guide provides a practical, educational framework—not investment advice—to help new investors build a simple, beginner-friendly crypto portfolio in 2025.

For a complete foundation on exchanges, wallets, and risk profiles, you can read our main educational guide, How to Invest in Cryptocurrency: Step-by-Step Beginner’s Guide.

Why a Structured Portfolio Matters in 2025

Crypto markets in 2025 are driven by more than speculation. Prices and trends now depend on:

-

Global Bitcoin ETF inflows

-

Ethereum Layer-2 expansion

-

Growth in AI, DePIN, and tokenized real-world assets

-

Stronger institutional liquidity

-

Clearer regulation in major regions

-

Developer and ecosystem activity

Beginners who follow hype cycles usually end up with unbalanced, high-risk portfolios.

A structured framework helps you:

-

Reduce emotional mistakes

-

Manage volatility

-

Diversify correctly

-

Build long-term habits

-

Track performance with clarity

A planned portfolio is your first layer of protection.

What a Beginner Portfolio Should Prioritize in 2025

| PRIORITY | WHAT IT MEANS | WHY IT MATTERS |

|---|---|---|

| Stability First | BTC + ETH as core holdings | Most liquid, most predictable long-term behavior |

| Controlled Growth Layer | SOL + L2 tokens + major L1s | Exposure to innovation without oversizing risk |

| Limited Speculation | 5–10% high-risk assets | Prevents emotional, hype-driven investing |

| Stablecoin Buffer | USDT/USDC allocation | Helps with DCA, rebalancing, and volatility control |

| Tracking Tools | Use a portfolio dashboard | Gives clarity on performance & allocations |

Core Principle #1 — Start With a Small, Controlled Budget

Most beginners start with $50–$200.

In 2025, this is not a disadvantage. Smaller portfolios make it easier to:

-

Understand volatility with minimal stress

-

Test exchanges, wallets, and fees

-

Learn how position sizing works

-

Build consistent DCA habits

-

Avoid oversized losses early on

Small beginnings = strong discipline.

Core Principle #2 — Follow a Simple Asset Structure

Beginners should avoid managing too many assets at once. A clean structure works best:

🔹 60–70%: Core Assets (BTC + ETH)

The most reliable long-term foundation.

🔹 20–30%: Growth Assets (SOL, L2s, major L1s)

Provides exposure to innovation narratives.

🔹 5–10%: High-Risk Layer (carefully controlled)

New coins, early projects, narrative tokens — kept intentionally small.

🔹 5–10%: Stablecoin Buffer

Helps with DCA and reduces emotional reactions during volatility.

This structure is used by analysts, portfolio educators, and research firms across 2024–2025.

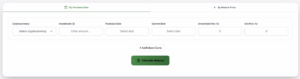

Core Principle #3 — Use Beginner-Friendly Portfolio Tools

Beginners often track performance manually, which leads to confusion and bad decisions.

Portfolio tools help you:

-

Measure real profit/loss

-

See allocation percentages

-

Compare assets

-

Track diversification

-

Review performance weekly

Portfolio tools help you measure real profit/loss, see your allocation percentages, and track diversification over time. A simple way to do this is by using the Forvest Portfolio Calculator, which shows your real P/L, allocation weights, and fee impact in one place.

Core Principle #4 — Build Slowly With Dollar-Cost Averaging (DCA)

DCA is one of the safest ways for beginners to enter crypto.

Instead of buying everything on one day, you spread purchases over time.

DCA helps you:

-

Avoid buying at temporary peaks

-

Smooth out volatility

-

Build steady habits

-

Reduce emotional decision-making

Core Principle #5 — Review Your Portfolio Weekly (Not Daily)

Checking prices constantly creates panic and emotional trading.

A simple weekly or bi-weekly review is enough:

Review:

-

Allocation percentages

-

Average entry price

-

Stablecoin balance

-

Overweight / underweight assets

-

Overall P/L trends

The goal is clarity—not reacting to every price movement.

How to Build a Beginner Crypto Portfolio in 2025 (Detailed Step-by-Step Framework)

A beginner crypto portfolio doesn’t need to be complicated. The most effective portfolios in 2025 follow a simple, structured, and risk-aware approach. This section breaks down exactly how new investors can construct a balanced portfolio—starting with the safest layers and gradually adding controlled growth.

The goal is not to pick “the best coin,” but to build a system that reduces stress, avoids hype-driven mistakes, and creates long-term stability.

Step 1 — Establish Your Portfolio Foundation (Core Holdings)

The foundation of any beginner-friendly crypto portfolio is built on two assets: Bitcoin (BTC) and Ethereum (ETH). These two assets make up more than 60% of the total crypto market and have the longest history of adoption, liquidity, and institutional support.

Why BTC + ETH Should Be the Base Layer

| BENEFIT | BITCOIN (BTC) | ETHEREUM (ETH) |

|---|---|---|

| Market Role | Store of value | Smart contract platform |

| Liquidity | Highest in crypto | Very high |

| Volatility | Lower than altcoins | Medium |

| Adoption | Global | Multi-sector |

| Best Use Case | Long-term holding | Exposure to Web3 |

How Much Should You Allocate?

Beginners generally follow one of these two models:

Model A (Conservative)

-

50% BTC

-

30% ETH

Model B (Balanced)

-

40% BTC

-

30% ETH

These percentages are not investment advice—they simply reflect what thousands of new investors and analysts use as an educational template.

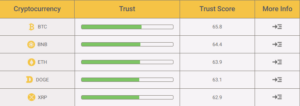

Before sizing your allocation, you can review Bitcoin’s fundamentals and risk profile in the Forvest Trust Score analysis for BTC, which combines on-chain, sentiment, and liquidity signals in one view.

Step 2 — Add a Controlled Growth Layer (SOL, L2 Networks, Major L1s)

After building a stable foundation, beginners can add exposure to high-growth networks with strong developer activity and real adoption. This is where both opportunity and risk increase, so allocation must remain limited.

Why This Layer Matters

Growth assets provide access to:

-

New narratives (AI, DePIN, RWA tokenization)

-

Faster networks with cheaper fees

-

Expanding ecosystems (gaming, NFTs, dApps)

-

Early-stage infrastructure where upside is higher

However, they also show higher volatility, which is why we keep exposure moderate.

Best Growth Assets for Beginners (2025)

1. Solana (SOL) — High-speed, high-adoption Layer 1

Solana continues to lead in retail usage, gaming, and fast transactions. The network consistently records some of the highest activity levels in crypto.

In the Forvest Trust Score breakdown for Solana, we highlight how ecosystem activity, liquidity depth, and volatility translate into long-term risk for beginners.

2. Ethereum Layer-2 Networks (Arbitrum, Base, Optimism)

These networks offer Ethereum security with significantly lower fees. They support gaming, DeFi, payments, and large-scale user applications.

3. Emerging L1s With Real Traction (APTOS, SUI, TON)

These chains are gaining attention, but beginners should only allocate small amounts (2–5%) to avoid unnecessary risk.

Suggested Allocation for the Growth Layer

| ASSET CATEGORY | EXAMPLES | SUGGESTED RANGE | WHY IT MATTERS |

|---|---|---|---|

| High-speed L1 | SOL | 10–20% | Strong ecosystem + consumer apps |

| L2 Networks | Arbitrum, Base | 5–10% | Lower fees + institutional interest |

| Emerging L1s | Aptos, Sui, TON | 2–5% | Experimental but promising |

Step 3 — Add a Stablecoin Buffer (USDT / USDC)

Every beginner portfolio needs a small allocation to stablecoins.

This buffer helps you:

-

Buy dips strategically

-

Avoid panic during volatility

-

Maintain liquidity

-

Balance portfolio risk

Most beginners keep 5–10% in stablecoins.

Why Stablecoins Matter

Stablecoins act as the “cash layer” of your portfolio.

Unlike holding unused crypto, a stablecoin buffer keeps you flexible without forcing you to sell during downturns.

Recommended Options

-

USDT (Tether) — Most widely used

-

USDC (Circle) — Highly regulated and transparent

Step 4 — Manage Risk With a Small “Exploration Layer”

Beginners often get tempted to chase high-risk coins, memecoins, or narrative tokens.

This small “exploration layer” lets you learn without risking too much.

Recommended range: 3–7% max

Eligible categories:

-

Early-stage DeFi tokens

-

AI-narrative coins

-

Gaming tokens

-

Experimental L1/L2 ecosystems

This layer should be:

-

Small enough to avoid emotional losses

-

Large enough to let you explore new narratives

If it becomes more than 7–10%, your portfolio becomes unbalanced.

Step 5 — Use Dollar-Cost Averaging (DCA) to Build Positions

DCA is the safest way for beginners to enter crypto because it removes timing bias.

Instead of buying all at once, you invest:

-

Weekly

-

Bi-weekly

-

Or monthly

Why Beginners Should Use DCA

-

Reduces emotional pressure

-

Smooths price fluctuations

-

Builds long-term habits

-

Works well with small budgets

Example DCA Plan for a 0 Portfolio

-

$25 per week for 4 weeks

-

Or $50 every two weeks

-

Or $100 monthly for next deposits Investopedia

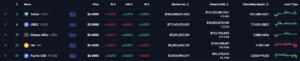

Step 6 — Track Your Portfolio Performance

Portfolio tracking is the single most overlooked part of crypto investing.

Without a tracking dashboard, beginners cannot understand:

-

Real profit/loss

-

Allocation imbalance

-

Volatility exposure

-

Performance trends

-

Overweight / underweight positions

Good tracking produces better decision-making.

What You Should Track Weekly

-

Allocation percentages

-

Stablecoin level

-

Real P/L (after fees)

-

Average entry price

-

Volatility exposure

Recommended Tool

Forvest Portfolio Calculator helps beginners analyze real profit/loss, track allocations, and review portfolio performance with AI-powered insights in 2025.

Step 7 — Rebalance Your Portfolio Every 1–3 Months

Rebalancing helps maintain your original strategy.

If SOL pumps 60% while BTC stays flat, your SOL allocation might become oversized.

Rebalancing helps:

-

Reduce unexpected risk

-

Keep your portfolio aligned

-

Lock in disciplined growth

-

Avoid emotional decision-making

Methods

-

Add more to underweighted assets

-

Trim profits from overweight assets

-

Reinvest stablecoin buffer

Rebalance Frequency

-

Small portfolios: every 2–3 months

-

Medium portfolios: monthly

-

Large portfolios: weekly or automated

Step 8 — Strengthen Your Security Setup

Security is one of the most important steps for beginners.

Most crypto losses come from:

-

Phishing

-

Malware

-

Fake wallet extensions

-

Scam links

-

Poor password management

Beginner Security Checklist

-

Use 2FA on exchanges

-

Avoid saving seed phrases online

-

Don’t connect wallets to unknown dApps

-

Disable browser extensions you don’t use

-

Always verify URLs

Upgrade Path

Start with a software wallet → upgrade to a hardware wallet once your portfolio grows.

Step 9 — Integrate AI Tools Into Your Research Flow

AI tools help beginners:

-

Detect risky assets

-

Scan sentiment quickly

-

Identify unusual on-chain behaviors

-

Flag high-risk contracts

-

Understand fundamentals faster

AI tools help beginners detect risky assets, scan sentiment quickly, and understand fundamentals faster. Inside the Forvest AI Insights & Abilities Hub, you can access portfolio-level signals, narrative detection, and structured market summaries powered by Fortuna.

Step 10 — Build Slowly, Not Emotionally

Beginners win by being consistent—not fast.

Successful portfolios in 2025 are built through:

-

Steady DCA

-

Balanced allocations

-

Weekly tracking

-

Strict security

-

Controlled experimentation

-

Long-term discipline

Crypto rewards patience, not speed.

Building Long-Term Discipline, Managing Volatility, and Setting Smart Expectations in 2025

Now that your beginner crypto portfolio has been structured and optimized, the next step is developing the discipline and long-term behavioral framework that successful investors rely on. A well-constructed portfolio is powerful—but it works only when paired with stable habits, consistent monitoring, and a realistic understanding of risk.

This section will help you refine your strategy, manage volatility more effectively, avoid common emotional pitfalls, and build a long-term mindset that lets your portfolio grow gradually over time.

Understanding Market Psychology (The Hardest Part for Beginners)

Crypto markets move faster than almost any other asset class. Prices can rise sharply in hours and drop just as quickly. The difference between beginners who panic-sell and those who stay calm often comes down to understanding basic market psychology.

Three Emotional Patterns Beginners Struggle With

-

Fear of Missing Out (FOMO)

When a coin suddenly pumps, beginners rush in late—right before a correction. -

Fear, Uncertainty, Doubt (FUD)

News cycles, tweets, and volatility can trigger emotional selling. -

Overconfidence After Short-Term Gains

A few early wins can cause beginners to take oversized risks.

A good portfolio framework helps manage these emotions, but it doesn’t eliminate them. The real strength comes from learning to pause, review your strategy, and avoid short-term impulses.

Setting Realistic Expectations

Crypto is not a guaranteed source of fast returns. Many beginners assume that a small portfolio can grow quickly—especially after seeing viral stories about early adopters becoming millionaires.

But in 2025, the market is far more competitive, institutional, and transparent. The realistic expectation for new investors is:

-

Slow, steady growth through disciplined habits

-

Avoiding catastrophic losses by limiting risk

-

Focusing on long-term performance, not quick wins

Your first year is not about making large profits.

It’s about learning how to behave in a high-volatility environment without making damaging mistakes.

How to Analyze Your Portfolio’s Performance Like a Professional Investor

Beginners often look only at the total balance. Professionals analyze multiple data layers:

1. Real Profit/Loss After Fees

Many investors mistakenly think they’re in profit because the coin price rose—but they forget about trading fees, spreads, and gas fees.

2. Allocation Drift

If SOL pumps while BTC stays flat, your portfolio may become unintentionally aggressive.

3. Drawdown Levels

Drawdown tells you “how much your portfolio is down from its peak.”

Understanding this helps you avoid panic selling.

4. Risk-Adjusted Returns

Professionals analyze not just returns, but how much volatility was required to generate those returns.

Your goal as a beginner is not to master all of these immediately,

but simply to review your portfolio once per week and understand how each position behaves.

When to Adjust Your Portfolio (And When Not To)

Most beginners over-adjust their portfolios.

They buy and sell too often, trying to “optimize” performance—when in reality, they damage long-term outcomes.

Here is the simple rule:

❌ Do NOT adjust your portfolio when:

-

Prices are very volatile

-

A coin just pumped or dumped

-

You feel emotional (fear or excitement)

-

News cycles are dramatic

-

Social media is loud about one coin

✅ You SHOULD adjust your portfolio when:

-

Allocations drift significantly from your plan

-

Your risk profile changes (income, goals, age)

-

You add more capital to your account

-

A coin becomes fundamentally weak

-

A new sector becomes meaningfully adopted

Adjusting once every 1–3 months is enough for most beginners.

When Should a Beginner Add More Capital?

You should consider increasing your investment only after:

-

You fully understand how your wallet works

-

You are comfortable with portfolio tracking

-

You have gone through at least one volatility cycle

-

You can emotionally handle drawdowns

-

You have a basic security setup (2FA, strong passwords, safe device)

Scaling too early leads to emotional mistakes.

Scaling too late slows your learning curve.

The right time is when you feel calm—not when you feel fear or excitement.

Building a Multi-Wallet Strategy (A Sign of Maturity)

As beginners grow into intermediate investors, a single wallet is often no longer enough.

Using multiple wallets improves security and reduces operational risk.

Recommended Multi-Wallet Setup

| PURPOSE | WALLET TYPE | EXAMPLE |

|---|---|---|

| Long-term storage | Hardware | Ledger, Trezor |

| Daily DeFi use | Non-custodial software | MetaMask, Phantom |

| Mobile interactions | Multi-chain app | Trust Wallet, Coinbase Wallet |

| Backup storage | Secondary hardware or cold wallet | BitBox02 |

Beginners don’t need this setup immediately,

but it becomes useful once your portfolio grows.

For comparison, see the modern multi-wallet security guidance from the cybersecurity frameworks at NIST

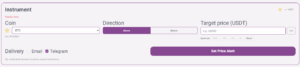

Managing Volatility Without Emotional Stress

Crypto volatility is normal.

But emotional stress is optional.

Here are three strategies used by professional investors:

1. Time Segmentation

Divide your portfolio into:

-

Short-term (high volatility allowed)

-

Medium-term (balanced)

-

Long-term (untouched)

2. Pre-Written Rules

Write down rules such as:

-

“I don’t sell during fear.”

-

“No buying pumps.”

-

“Rebalance only once a month.”

-

“No leverage.”

3. Information Diet

Beginners often consume too much information, which triggers panic.

Limiting your news sources helps reduce noise and overreaction.

Instead of staring at price charts all day, beginners can use simple alert tools that notify them only when key levels are reached.

👉 For example, Forvest’s Price Alert tool lets you set custom levels for BTC, ETH, or altcoins and receive notifications without constant screen-watching.

Common Beginner Pitfalls and How to Avoid Them

❌ 1. Buying Too Many Assets

More than 5–8 coins for a small portfolio creates confusion.

❌ 2. Chasing Memecoins

Most beginners lose money chasing hype cycles.

❌ 3. Ignoring Security

Even a $100 portfolio deserves strong protection.

❌ 4. Trying to Time the Market

Perfect timing is impossible—even for experts.

❌ 5. Focusing Only on Price

Fundamentals, liquidity, and use cases matter far more.

Avoiding these mistakes protects your long-term potential.

Long-Term Strategy for 2025 and Beyond

Crypto in 2025 is maturing fast.

New sectors—AI, DePIN, tokenization, real-world assets—are creating real adoption cycles.

But long-term success still comes from:

-

Slow, consistent investing

-

Good security

-

Balanced portfolio structure

-

Smart tracking

-

Gradual scaling

-

Staying objective

-

Not reacting emotionally

The most valuable skill you will develop isn’t picking the right coin—it’s building durable discipline.

About Forvest — Why Our Tools Matter for Beginner Portfolios

Forvest builds data-driven tools designed to help beginners invest more confidently in crypto.

Our mission is simple:

reduce unnecessary risk, increase transparency, and give users reliable insights powered by real data — not hype.

Through products like:

-

Forvest Portfolio Calculator (real P/L, allocations, fee-adjusted insights)

-

Forvest Trust Score Analysis (risk scoring powered by fundamentals + sentiment + on-chain signals)

-

Fortuna AI Insights (weekly market summaries with objective analysis)

…we help new investors understand how crypto markets behave, how to size positions properly, and how to navigate volatility with confidence.

Instead of predicting prices or pushing trends, Forvest focuses on:

-

long-term risk management

-

structured portfolio planning

-

clear asset evaluation

-

building healthy investment habits

A Beginner Portfolio Is the Foundation of Your Crypto Journey

A beginner crypto portfolio in 2025 doesn’t need to be complex.

It needs to be stable, simple, and based on real fundamentals:

-

BTC + ETH as the foundation

-

SOL + L2 networks as controlled growth

-

Stablecoins as a buffer

-

Small exploration positions for learning

-

DCA to minimize timing risk

-

Consistent tracking for better decisions

-

Strict security practices

-

Long-term discipline over short-term noise

Crypto rewards patience, education, and structure—not speed.

If you follow this framework, you’ll build confidence, reduce stress, and gradually develop the skills needed for more advanced strategies.

⚠️ Disclaimer

This content is for educational purposes only and should not be interpreted as legal, tax, trading, or financial advice. Cryptocurrency investing carries risk, including potential loss of capital. Always conduct your own research and consider speaking with a licensed financial professional before making investment decisions.

⚠️ No Investment Advice

Nothing in this article constitutes a recommendation or endorsement to buy, sell, or hold any cryptocurrency. All examples, allocations, and scenarios are illustrative only. Market conditions can change rapidly, and cryptocurrency values may fluctuate significantly.

Rating of this post

Rate

If you enjoyed this article, please rate it.

FAQs for Best Crypto Wallets 2025

Hardware wallets like Ledger Nano X and Trezor Model T offer the highest security because they store private keys offline.

Coinbase Wallet and Exodus are ideal for beginners thanks to simple setup, multi-chain support, and strong safety features.

Custodial wallets hold your keys for you, while non-custodial wallets give you full control over private keys and security.

If you're holding crypto long-term or managing larger amounts, a hardware wallet provides significantly stronger protection.

Phantom remains the most optimized wallet for Solana, offering fast transactions, NFT support, and multi-chain expansion.

Rating of this post

Rate

If you enjoyed this article, please rate it.