Why Some High Trust Score Projects Still Don’t Perform Well

- What Does a High Trust Score Mean?

- Common Expectations from High Trust Score Projects

- Reasons Why High Trust Score Projects May Underperform

- Market Conditions and External Factors

- Poor Product-Market Fit

- Weak Marketing and Outreach Strategies

- Team Challenges and Execution Issues

- Overestimated Trust Metrics and Limitations

- Competitive Landscape and Rapid Industry Evolution

- Case Studies: Examples of Underperforming High Trust Score Projects

- Case Study 1: “VaultX”

- Case Study 2: “DeFiYield”

- How to Evaluate Project Performance Beyond Trust Scores

- Active User Metrics

- On-Chain Indicators

- Developer Activity

- Community Engagement

- Financial Runway and Tokenomics

- External Market Signals

- Key Takeaways for Investors and Users

- Trust Signals ≠ Guaranteed Success

- Real-World Usage Matters

- Execution is Critical

- Continuous Vigilance

“I once followed a new DeFi project with an almost perfect trust score after its audit—yet its user base never materialized. Despite stellar credentials on paper, it languished.”

On the surface, a high trust score should signal safety and promise. After all, these ratings distill audits, team reputation, code quality, tokenomics, and other risk signals into a single number or grade. Investors often assume a high score means a project has the fundamentals to succeed: a vetted team, clean security history, and transparent governance. But the crypto graveyard is littered with high-trust projects that underwhelm. In fact, :contentReference[oaicite:0]{index=0} notes that in a recent bull frenzy, thousands of projects launched — yet “this rush-to-market leaves a graveyard of failed projects”. Clearly, trust alone isn’t enough.

A trust score is best seen as a reassurance, not a guarantee. To understand how these scores are constructed and what they actually measure, it’s important to know **how crypto trust scores work in practice**. As Forvest’s guide explains, a high score (e.g. 9/10 or “AA”) indicates confidence so far, but it’s not a 100% safety guarantee. Unexpected events — market crashes, technical flaws, or regulatory shocks — can still topple even well-backed projects. In practice, a high score should temper risk but not override your own analysis. It’s a starting point to narrow a long list of tokens, not the finish line of due diligence.

What Does a High Trust Score Mean?

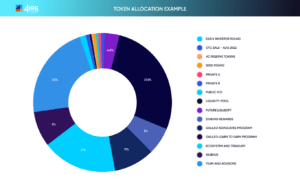

A trust score aggregates many signals of credibility and risk. Different organizations calculate it differently (see Forvest’s guide on understanding crypto trust scoring for deep mechanics). But common factors include code and security audits, development activity, team transparency, token distribution, liquidity and user feedback. For example, CoinGecko’s algorithm emphasizes real trading volume and security practices, while some AI-driven models (like Forvest’s) add on-chain metrics and tokenomics. In all cases, the purpose is to flag red flags: anonymous founders, holes in code, concentration of wealth, or scant liquidity.

In short, a high trust score means a project has cleared certain basic hurdles. It typically tells you the team is known and accountable, code has been reviewed, and the project isn’t an obvious scam. As one source notes, among two assets one with audited code and a public team (high trust) is “generally a safer bet” than one with many red flags. That said, a high score only covers certain dimensions: mainly safety and legitimacy, not true market demand.

If you want to explore how trust signals are interpreted across different crypto projects, see our in-depth guide on understanding trust scores in crypto projects. It explains how various credibility signals—such as liquidity structure, team transparency, and compliance indicators—come together to form an overall trust assessment.

Common Expectations from High Trust Score Projects

Investors naturally attach high hopes to high-trust projects. Common assumptions include: “This project should be reliable, ready to ship, and poised for growth.” After all, if the team passed audits and built a polished demo, why shouldn’t users and markets pour in? People tend to equate trust with readiness. A high score reduces some worries (you might feel less fear of a rug-pull or hack), so it’s easy to slip into thinking the project is “solved.”

By comparison, any project with a low trust score sends red flags (unknown team, unvetted code, dubious liquidity). But the flip side is equally important: a high score only means one type of risk is lower. Traders often believe that guarantees everything else is fine too. In reality, there’s a gap. High trust mostly tells you it isn’t a scam or disaster on paper. It does not say whether real customers will adopt it, or if the tokenomics incentivize usage. In other words: Expect a high trust score to mean “legitimacy” and “basic security”, but not to automatically mean “success.”

Reasons Why High Trust Score Projects May Underperform

Even with the strongest trust profile, many projects underwhelm. Here are key culprits:

Market Conditions and External Factors

Crypto markets swing wildly. Timing is everything. A project might launch with great trust credentials, only to hit a bear market that crushes interest. PlasBit notes bluntly that “some crypto projects have failed just because they were launched at the wrong time, during the beginning of a bear market”. In booms, hype can prop up mediocre ideas; conversely, in busts even solid startups starve for capital and attention.

Beyond cycles, macro or regulatory shocks can hit any project unexpectedly. For example, a sudden ban in a major market or a generalized crypto crash can leave even well-run, audited platforms scrambling. During bull markets, Cointelegraph observed, retail frenzy leads “projects scramble to launch” and a “graveyard of failed projects” follows once reality sets in. Likewise, a project that looked unstoppable last year may stall if institutional funding dries up or on-chain yields vanish in a downturn. In short, favorable conditions can lift trust-based projects and fail them: trust can only buffer some volatility, not circumvent broad economic forces.

Poor Product-Market Fit

Sometimes a great team and nice code aren’t what the market needs. Even with full audits and marketing, a project can flop if users simply don’t want its product. Industry experts emphasize: “Find product-market fit, or perish”. In crypto, this means solving a genuine problem or offering a compelling use-case. Many launches fail because teams assume blockchain novelty is enough.

PlasBit’s analysis sums it up: “most of the crypto projects… don’t solve real problems and don’t provide valuable and useful solutions”. If users don’t see tangible value, no amount of trust-score credentials will get them on board. One founder might have an A+ audit but if their decentralized file-sharing app is slower or harder than centralized alternatives, users will vote with their wallets elsewhere. Similarly, if a token’s economics don’t align incentives (say the token has no real utility or oversupply), then demand fizzles regardless of good team or code.

The high-trust scores often reflect potential, but the market decides actual demand. Investors should remember that a whistle-clean wallet and spotless GitHub don’t guarantee a solution that people will use. When the market isn’t convinced, the project lingers.

Weak Marketing and Outreach Strategies

Even a solid product can go unnoticed without a strategy to reach users. In crypto, awareness and hype can snowball interest. As one crypto marketer bluntly put it: “They focus on tech, not marketing. You can have the best product, but if no one knows about it, does it even exist? Community hype drives adoption. Period.”. In practice, we see many technically sound projects with high trust scores get lost in the noise because the team never effectively built an audience or communicated value.

That said, marketing is not a cure-all. Cointelegraph cautions that marketing usually exposes rather than causes failure: projects often try to mask poor fundamentals with hype, and the media eventually blows back. But the flip side is also true: if a project has nothing but fundamentals and zero outreach, it can stagnate. Think of marketing (done well) as translation – making the project understandable. Without clear messaging and engagement, even passionate communities and institutions might miss what a project offers.

In short, a high trust score project still needs a go-to-market plan. Investors should watch for active communities, partnerships, and regular communications. If a project isn’t telling its story or catalyzing buzz, adoption may be weak despite high trust flags.

Team Challenges and Execution Issues

Behind every project is a team. Even if those founders once earned high trust, circumstances can change. Key person departures, infighting, or simply running out of steam can derail progress. A stellar score today may belie that the core developers are burnt out or pivoting away.

Funding and resources are also part of execution. The Bulldogs Law experts warn: “Insufficient funding can quickly derail even the most promising ideas”. A project can raise funds pre-launch (earning trust points), but if its treasury dries up, planned features and outreach falter. Budget overruns on development or audits eat into runway.

Moreover, ambitious crypto ventures often attempt decentralization early, which can slow decision-making. Some DAO projects with good trust ratings still struggle with governance, leading to gridlock. In short, execution requires not just a credible vision (which trust scores capture) but sustained management, finances, and adaptability. One fraudulent scheme aside, even honest teams can miscalculate costs or timelines. Weak execution means roadmaps stall and users lose interest.

Overestimated Trust Metrics and Limitations

No trust metric is perfect. Many focus on initial credentials and on-chain scores, but they can be gamed or become outdated. For example, Forvest explains that any metric can be manipulated by fake reviews or wash trading. A project might temporarily shore up its image (or volume) to boost its trust grade. On the other hand, a score might lag reality: if something major happens overnight, the trust score might still show “green” until the next data update.

As Forvest cautions, “a high Trust Score… indicates strong confidence in a platform so far, but it’s not a 100% safety guarantee”. Even a top-rated project could be one major event away from trouble. Scores from different sources can also conflict (one might weigh code audits heavily, another community sentiment), so over-reliance on a single trust number misses nuances.

The lesson: treat trust scores as one filter, not the final verdict. Always double-check if a “high trust” project had fresh audits or updates, and dig into the data behind the score if something feels off. Remember, even the best signals have blind spots.

This is where many investors go wrong — by treating trust scores as definitive judgments rather than contextual risk signals. Misunderstanding how trust scores can be inflated, lag reality, or be selectively interpreted often leads to false confidence. A deeper look at how fake or misleading trust scores are used in crypto scams shows why relying blindly on a single number can be dangerous.

Competitive Landscape and Rapid Industry Evolution

Crypto is a fast-moving space. Projects compete brutally, and innovation can make yesterday’s breakthrough obsolete. A project with a strong trust profile can still lose the race if a better alternative pops up. PlasBit’s commentary highlights this saturated environment: “an infinite list of cryptocurrencies with no real utilities and no big differences between each other… the top 100 cryptocurrencies by market cap change continuously.”. In short, standing still is falling behind.

For example, a new DeFi lending platform might launch fully audited and scored well, but if six months later a major player adds similar features, the newcomer’s adoption might stall. Projects often crawl with trust signals but start to trail in usage as the field evolves. Also, competitive tokenomics matter: even if you’re trustworthy, if your rewards program can’t match the next protocol’s yield, liquidity flows away.

Regulatory and tech shifts can similarly reshape the landscape. A project might meet trust criteria today but face new legal challenges tomorrow, or simply fail to adapt to paradigm changes (like the shift from PoW to PoS). In summary, the rapid pace of crypto means yesterday’s safe bet can be today’s laggard, so always consider what else is out there.

Case Studies: Examples of Underperforming High Trust Score Projects

Consider two anonymized examples:

Case Study 1: “VaultX”

A blockchain wallet service launched by ex–tech execs. It cleared security audits, had top-tier advisory board members, and passed all trust-score checks (excellent code, transparent team). Users expected a surge. In reality, growth was minimal. Why? The product’s UX was only marginally better than incumbents, and by launch the market was already saturated with wallets. Without a killer feature or unique incentive, VaultX’s organic user uptake stalled. (Lesson: even top trust scores can’t create demand where product-market fit is weak.)

Case Study 2: “DeFiYield”

A yield farming platform with celebrity endorsements and an A+ security audit. Initially, marketing buzz and a forgiving market gave it a high trust rating. But a few months in, on-chain metrics told a different story: user retention was low and pool participation was dropping. Meanwhile, a competitor increased its APY in a flash, siphoning liquidity. DeFiYield’s own team also hit funding snags due to an unplanned governance overhaul. Despite trust signals, the project underperformed in adoption and revenue. (Lesson: strong trust signals didn’t prevent external shocks – from competition and funding gaps – that hurt performance.)

These case studies underline the gap between “score” and “success”. A project may look bulletproof in a trust analysis, yet falter if users don’t rally or if execution falters. For context on the signals behind trust scores, our Forvest’s Trust Score analysis tool can break down the underlying factors – consider it a quick reference alongside the checklist below.

How to Evaluate Project Performance Beyond Trust Scores

To judge a project’s real potential, track concrete metrics and signals in addition to trust scores. Here’s a practical checklist:

Active User Metrics

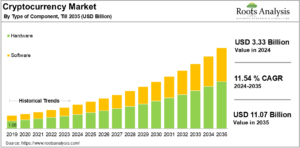

Monitor daily active users (DAUs) or unique wallets interacting with the protocol. Rising DAUs typically signal genuine interest and stickiness. Conversely, stagnant or falling DAUs (even with a green trust score) suggest the product isn’t resonating. Also track transaction counts, volume, and on-chain activity. High transaction volume (trades, swaps, loans, etc.) indicates real usage; Tangem advises that “transaction volume and frequency” reflect actual utility beyond mere holding.

On-Chain Indicators

Look at Total Value Locked (TVL) for DeFi, staking numbers, or network throughput. Consistent growth in TVL is a good proxy for adoption and confidence. Also pay attention to retention: for example, how many users coming back week after week. As Tangem notes, metrics like user growth, volume, retention rates and even treasury health “provide a much clearer picture than just charts or tweets”. A project that steadily locks more value while keeping liquidity providers engaged is showing real traction.

Developer Activity

Check GitHub and development progress. Strong projects have frequent commits and multiple contributors. A flurry of activity that then goes silent is a red flag. Consistent updates mean the team is still building. As one guide puts it, “Development activity is a strong signal of a project’s health… A dormant or stagnant repo may point to abandonment”.

Community Engagement

Beyond raw numbers, sense the project’s community. Are social channels active? Do users complain about problems, and if so, are they addressed? A healthy Discord or forum with constructive discussion often goes hand-in-hand with survival. PlasBit notes that “the most profitable crypto projects have solid and large communities” driving word-of-mouth growth. Low engagement or unresolved controversies, even in a high-trust project, should raise concern.

Financial Runway and Tokenomics

Understand the money. If it’s a token sale project, check how much funding was raised and what the burn rate is. Do they have enough runway? Our example blogs stress “insufficient funding” as a death knell. Also, examine vesting schedules and unlocks – large pending unlocks can crash prices. Revenue can be a giveaway: for DEXs or platforms that collect fees, on-chain revenue (fees) directly shows usage. CoinShares notes that transaction fee revenue “reflects how actively a platform is being used and how sustainable its business model may be”. A protocol generating growing fee income is likely delivering real utility.

External Market Signals

Keep tabs on market share and competition. Metrics are most meaningful in context (e.g. compare TVL or users against top competitors). Also watch for partnerships, listings, or product announcements; these can signal momentum. Conversely, regulatory risks or negative press should prompt caution, even if trust scores remain high (scores can lag news).

Above all, combine these data points. A project with a high trust score plus rising TVL, engaged users, and clear revenue is a very different bet from one with a high trust score alone. Use our checklist as a starting guide. And for a structured breakdown of trust signals themselves, see Forvest’s Trust Score analysis – it complements these metrics by explaining the ratings behind the numbers.

Key Takeaways for Investors and Users

Trust Signals ≠ Guaranteed Success

A high trust score (audits, team credibility, compliance) does lower certain risks, but it doesn’t ensure product-market fit or market demand. Always look beyond the score.

Real-World Usage Matters

Track on-chain and user metrics (DAUs, TVL, transaction volume, retention). These quantifiable signals of adoption often reveal a project’s health more reliably than trust alone.

Execution is Critical

Strong teams, funding, marketing, and adaptability form the final pillar. Projects with weak execution or bad timing can flounder regardless of trust score. Remember the “3 Pillars”: Trust Signals, Real-World Usage, and Execution/Strategy.

Continuous Vigilance

Conditions change fast. Re-evaluate projects regularly (e.g. quarterly or after major events) – trust scores and performance can shift. Tools and checklists help, but diligence and common sense are irreplaceable.

In the end, trust scores are a helpful compass, but not a map of success. Combine them with the metrics outlined above, stay adaptive to market shifts, and never stop asking questions.

Rating of this post.

Rate

If you enjoyed this article, please rate it.

FAQs for high trust score projects

A trust score is essentially a composite rating that measures a project’s credibility and security. It aggregates signals like team credentials, audit results, code quality, token distribution, compliance, and community activity. Think of it like a crypto “credit score”: higher means the project appears more transparent and vetted. However, it doesn’t measure factors like product-market fit or real user adoption directly.

Yes. A high trust score mainly reduces certain risks (e.g. lowers chance of fraud or hidden flaws), but it doesn’t guarantee success. Projects can still fail if they lack product-market fit, face execution issues, or if market conditions turn unfavorable. In crypto, even well-audited, well-intentioned projects can falter in a bear market or get overshadowed by competitors.

Look at concrete performance and usage metrics. Check active user counts (DAUs, wallets), transaction volumes, total value locked (TVL) in the protocol, and revenue or fee generation if applicable. Evaluate developer activity (commits, releases) and community engagement. Also examine the tokenomics and how much runway the project has. These on-chain and off-chain metrics reveal whether a project is actually gaining traction – not just ticking trust-score boxes.

It’s wise to revisit periodically, especially after major developments. A rule of thumb is to re-check every few months or whenever a project hits a big milestone (new product launch, partnership) or a market shift occurs (bull/bear turns, regulation news). Crypto moves fast, so make re-evaluation part of your routine.

No. A high trust score reduces certain risks (security, audits, team transparency) but is not a success guarantee. Treat it as an initial filter — then validate real traction with DAUs, TVL, developer activity, tokenomics, runway and community engagement before allocating capital.

Rating of this post.

Rate

If you enjoyed this article, please rate it.