How to Buy Cryptocurrency — A Complete Beginner Framework

A Clear, Beginner-Friendly Guide to Buying Crypto Safely in 2025

- Why Buying Crypto Is Easier in 2025

- ✔ Regulatory frameworks in major regions

- ✔ Exchange infrastructure has improved

- ✔ Wallet security is more user-friendly

- ✔ Multichain payment rails

- ✔ AI-powered analysis

- Understanding How Crypto Exchanges Work (Beginner Overview)

- Types of Crypto Exchanges in 2025

- Step 1: Choose a Secure, Beginner-Friendly Exchange

- 1. Strong security certifications

- 2. Transparent fee structure

- 3. Supported local payment methods

- 4. Multichain support

- 5. Beginner-friendly UI and mobile app

- Step 2: Create an Account and Complete Basic Verification (KYC)

- Step 3: Add a Payment Method

- Most common methods in 2025

- Step 4: Choose the Cryptocurrency You Want to Buy

- Step 5: Place Your First Buy Order (Market vs Limit)

- Market Order

- Limit Order

- Recurring Buy / DCA

- Step 6: Transfer Your Crypto to a Wallet (Optional but Recommended)

- Step 7: Track Your Purchase and Secure Your Account

- 2. Choosing a Beginner-Friendly Crypto Exchange in 2025 (The Safe, Simple, Step-by-Step Method)

- Why Choosing the Right Exchange Matters in 2025

- What Beginners Should Prioritize When Selecting an Exchange

- 1. Safety & Regulatory Transparency

- 2. Low Fees & Clear Costs

- 3. User Experience (UX)

- 4. Supported Assets & Ecosystems

- 5. Local Banking Support

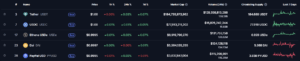

- Beginner-Friendly Exchange Comparison (2025)

- Understanding Exchange Risks (What Beginners Must Avoid)

- Exchange Security Features Comparison (2025)

- How to Match an Exchange to Your Investing Style

- If you want the simplest experience:

- If you want the lowest fees:

- If you plan to use multiple ecosystems:

- If you want the highest security standards:

- How to Avoid Beginner Mistakes When Using Exchanges

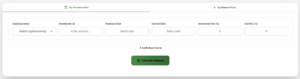

- Integrating Forvest Tools With Your Exchange Setup

- ✔ Forvest Portfolio Calculator

- ✔ Forvest Trust Score

- ✔ AI Insights Dashboard

- Understanding the Foundation Before You Build Your Portfolio

- Step 1 — Establish the Foundation: BTC + ETH as Your Base Layer

- Why BTC and ETH Still Lead in 2025

- Suggested Allocation Models (Educational Examples)

- Step 2 — Add a Controlled Growth Layer (SOL, L2 Networks, Major L1s)

- Why This Layer Matters in 2025

- Top Growth Sectors for Beginners

- Suggested Allocation Ranges

- Step 3 — Add a Stablecoin Buffer (USDT/USDC)

- Why Stablecoins Are Essential

- Recommended Choices

- Step 4 — Add a Small Exploration Layer (Only 3–7%)

- Why Keep It Small?

- Step 5 — Use Dollar-Cost Averaging (DCA) for Safer Entry

- Why DCA Works Well for Beginners

- Examples of DCA Plans

- Step 6 — Track Your Portfolio the Right Way

- What You Should Track Weekly

- Recommended Tool

- Step 7 — Rebalance Every 1–3 Months

- Benefits of Rebalancing

- How Rebalancing Works

- Rebalancing Frequency

- Step 8 — Strengthen Your Security Setup

- Beginner Security Checklist

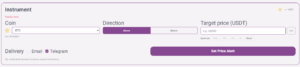

- Step 9 — Integrate AI Tools Into Your Research

- What AI Provides

- Recommended Forvest Tools

- Step 10 — Build Slowly, Not Emotionally

- Long-Term Success Comes From

- What Beginners Should Avoid

- What Beginners Should Do Instead

- Final Summary: The Beginner Portfolio Blueprint for 2025

- ⚠️ Disclaimer

- ⚠️ No Investment Advice

Buying cryptocurrency in 2025 is significantly safer, more intuitive, and far more beginner-friendly than previous years. Exchanges now follow stricter regulatory standards, wallets offer stronger security layers, and AI-driven tools give users clearer insights before making their first purchase. Still, the process requires structure. Understanding how to buy cryptocurrency correctly can prevent costly mistakes, reduce emotional decisions, and help beginners build long-term confidence.

This guide provides a practical, educational framework — not investment advice — that explains exactly what beginners should check before buying crypto, how exchanges differ, what payment methods work best, and which safety steps matter most.

“Buying crypto isn’t about speed — it’s about clarity, security, and using the right tools from day one.”

👉For a more complete foundation covering wallets, portfolio structures, and risk levels, you can also read our main educational guide, How to Invest in Cryptocurrency: Step-by-Step Beginner’s Guide, which gives beginners a structured roadmap before they make their first purchase.

Why Buying Crypto Is Easier in 2025

The crypto market has matured significantly. Several industry-wide improvements now help beginners enter the market more responsibly:

✔ Regulatory frameworks in major regions

Governments in the U.S., EU, UAE, Singapore, and parts of Asia have introduced clearer licensing models for exchanges.

✔ Exchange infrastructure has improved

CEX platforms now offer better authentication, reduced spreads, and more transparent fee breakdowns.

✔ Wallet security is more user-friendly

New wallets include biometrics, transaction simulation, phishing alerts, and encrypted cloud backups.

✔ Multichain payment rails

Beginners can purchase assets across Ethereum, Solana, Base, Binance Smart Chain, and more — without needing technical knowledge.

✔ AI-powered analysis

Tools can now flag suspicious coins, detect unusual price behavior, and simplify research for new users.

Because of these improvements, buying crypto in 2025 is less about fighting complexity and more about understanding the right sequence of steps.

Understanding How Crypto Exchanges Work (Beginner Overview)

Before buying cryptocurrency, beginners need to understand the three categories of platforms available in 2025.

Types of Crypto Exchanges in 2025

| Exchange Type | How It Works | Best For | Pros | Cons |

|---|---|---|---|---|

| Centralized Exchanges (CEX) | A regulated company manages your trading, payments, and security | Beginners | Easiest onboarding, broad payment options, high liquidity | Requires KYC, custodial by default |

| Decentralized Exchanges (DEX) | Trades occur through smart contracts with no central entity | Web3 users | Non-custodial, permissionless | Requires wallet knowledge, higher learning curve |

| P2P Marketplaces | Users trade directly with each other through escrow | Countries with banking limits | Flexible payment methods | Higher scam risk if rules ignored |

Understanding these categories helps beginners choose the safest option depending on their location and experience level.

If you’re curious how decentralized platforms differ at a deeper technical level, you can read our full guide, What Are Decentralized Exchanges (DEX) and How Do They Work?

Step 1: Choose a Secure, Beginner-Friendly Exchange

This is the most important step in the entire buying process.

In 2025, a trusted exchange should meet the following criteria:

1. Strong security certifications

Look for platforms that support:

-

2FA (Google Authenticator preferred)

-

Withdrawal whitelisting

-

Biometric login

-

Proof-of-reserves reports

-

Cold storage for funds

2. Transparent fee structure

New users often underestimate fees. Compare:

-

Trading fees

-

Spread cost

-

Deposit/withdrawal fees

-

Blockchain network fees

3. Supported local payment methods

Beginner-friendly exchanges allow:

-

Bank transfer

-

Debit/credit card

-

Domestic payment gateways

-

P2P transfer options

4. Multichain support

In 2025, many beginners accidentally overpay because they choose an expensive network.

Good exchanges allow buying via:

-

Ethereum (ETH)

-

Solana (SOL)

-

Base

-

Arbitrum

-

Polygon

-

TRC-20 (low-fee USDT transfers)

Using the right network can save beginners up to 90% in fees.

5. Beginner-friendly UI and mobile app

Cluttered interfaces create confusion.

The exchange must offer:

-

Simple order forms

-

Clear balances

-

Easy withdrawal flow

-

Strong mobile support

For a rules-based, investor-style approach to decision-making (as opposed to impulse buying), see this investing in crypto like an investor.

Step 2: Create an Account and Complete Basic Verification (KYC)

Most regulated exchanges require identity verification. This protects both the user and the platform by reducing fraud and enhancing withdrawal security.

Beginners should prepare:

-

A government ID

-

A selfie or video verification

-

Proof of residence in some regions

The entire process usually takes less than 5 minutes on major exchanges.

Step 3: Add a Payment Method

Once the account is verified, beginners can choose how to fund their exchange account.

Most common methods in 2025

-

Bank transfer (lowest fees)

-

Debit/Credit card (fastest but higher fees)

-

P2P funding (best for restricted regions)

-

Apple Pay / Google Pay (supported on some exchanges)

Always compare fees before deciding.

Beginners should avoid over-using credit cards due to higher costs.

Step 4: Choose the Cryptocurrency You Want to Buy

Beginners often start with:

-

Bitcoin (BTC) — most stable long-term asset

-

Ethereum (ETH) — largest smart contract ecosystem

-

Solana (SOL) — fast, low-cost, high activity

-

Stablecoins (USDT/USDC) — low volatility + liquidity

But the key point is not choosing many coins at once.

A simple selection is easier to track and safer for new investors.

Step 5: Place Your First Buy Order (Market vs Limit)

Crypto exchanges offer multiple order types.

Beginners usually rely on:

Market Order

Buys instantly at the current price.

Best for small purchases and first-time buyers.

Limit Order

Buys only at a specific price.

Best when you expect price volatility.

Recurring Buy / DCA

Automates regular purchases using Dollar-Cost Averaging.

If the investment amount is small (e.g., $20–$200), a market order is perfectly fine.

Higher amounts benefit from limit orders.

Step 6: Transfer Your Crypto to a Wallet (Optional but Recommended)

Although many beginners keep funds on the exchange, moving assets to a non-custodial wallet offers stronger protection.

Good wallet options include:

-

MetaMask

-

Phantom

-

Trust Wallet

-

Coinbase Wallet

-

Ledger/Trezor for long-term holding

👉If you’re unsure which wallet fits your needs, you can compare hardware and software options in our guide, Best Crypto Wallets 2025: Secure & Reliable Options for Every User.

The rule is simple:

If you want full control: move to a non-custodial wallet.

If you want simplicity: leave it on the exchange (with 2FA enabled).

Step 7: Track Your Purchase and Secure Your Account

After buying crypto, beginners must secure their accounts by:

-

Enabling 2FA

-

Using a strong, unique password

-

Avoiding unknown links

-

Double-checking networks before transferring funds

For tracking your performance, you can use the Forvest Crypto Portfolio & Profit Calculator, which shows real P/L, fee impact, and allocation insights.

Tracking improves decision-making and reduces the emotional impact of volatility.

2. Choosing a Beginner-Friendly Crypto Exchange in 2025 (The Safe, Simple, Step-by-Step Method)

Selecting the right crypto exchange is one of the most important decisions for any beginner. In 2025, the crypto ecosystem is more regulated, more liquid, and more secure than previous years — yet the risks haven’t disappeared. New investors still face challenges related to safety, confusing interfaces, hidden fees, and unreliable platforms.

That’s why choosing a trusted, user-friendly exchange matters just as much as choosing the right portfolio structure.

A good exchange makes your first year dramatically easier. You get smoother onboarding, lower stress, better security, and a far more predictable learning experience. The goal of this section is to give beginners a clear, structured framework — not financial advice — so they can select an exchange that fits their needs, risk tolerance, and experience level.

Why Choosing the Right Exchange Matters in 2025

Crypto exchanges today play multiple roles:

-

they act as entry points for newcomers

-

they manage purchases, swaps, and withdrawals

-

they provide the first layer of security

-

they connect users to multiple ecosystems

A weak exchange increases the chance of errors, frozen accounts, phishing attempts, and emotional decisions.

A strong exchange reduces complexity, protects your funds, and helps you build healthy investing habits.

The right platform should provide:

-

Simple onboarding

-

Clear fee structure

-

Strong security standards

-

Beginner-friendly tools

-

Transparent policies

-

Responsive customer support

Choosing well in the beginning helps you avoid costly mistakes later.

What Beginners Should Prioritize When Selecting an Exchange

The following priorities define what beginners truly need — not what marketing claims:

1. Safety & Regulatory Transparency

Beginners should always favor exchanges with:

-

Proof-of-Reserves

-

Cold-storage infrastructure

-

Licensed regional operations

-

Long-term operational history

-

Trackable security reports

In 2025, exchanges must comply with stricter requirements across the US, EU, UAE, and parts of Asia. Platforms that meet these criteria are significantly safer than those that don’t.

2. Low Fees & Clear Costs

For beginners with small capital, fees matter:

-

Trading fees

-

Spread costs

-

Deposit/withdrawal fees

-

Network fees

Low-fee exchanges help beginners build positions without losing money unnecessarily.

3. User Experience (UX)

A simple interface prevents mistakes such as:

-

buying the wrong asset

-

accidentally using leverage

-

sending funds to the wrong chain

-

mismanaging orders

The best exchanges keep everything intuitive and beginner-friendly.

4. Supported Assets & Ecosystems

Beginners only need access to:

-

BTC

-

ETH

-

SOL

-

Major L1s

-

Stablecoins

An exchange doesn’t need 1000+ assets — it needs reliable access to strong assets.

5. Local Banking Support

Fast deposits and withdrawals reduce frustration and help users avoid unnecessary delays.

Beginner-Friendly Exchange Comparison (2025)

| Exchange | Best For | Trading Fees | Supported Assets | User Experience | Banking Support |

|---|---|---|---|---|---|

| Binance | Low fees + global users | Very low | Large selection | Medium | Strong in most regions |

| Coinbase | Absolute beginners | Medium | Core assets | Excellent | Strong (US/EU focus) |

| Kraken | Security-first users | Low | Major assets | Very good | Excellent in US/EU |

| OKX | Advanced tools + low fees | Low | Wide selection | Good | Region-dependent |

| Bybit | Fast trading | Low | Broad list | Good | Limited regions |

This table gives beginners a realistic overview without overwhelming them.

Understanding Exchange Risks (What Beginners Must Avoid)

Not every exchange is suitable for new investors.

Platforms to avoid include:

-

exchanges without transparent Proof-of-Reserves

-

platforms that aggressively push leverage

-

new exchanges with unclear licensing

-

exchanges with history of frequent outages

-

apps that hide fees inside large spreads

Beginners should always prioritize platforms with predictable behavior.

<For additional background on practical risk controls in crypto investing beyond platform choice (e.g., drawdowns, position sizing, and operational risk), see managing crypto investment risk.

Exchange Security Features Comparison (2025)

| Exchange | Proof of Reserves | Cold Storage % | 2FA Options | Insurance Fund | Regulatory Status |

|---|---|---|---|---|---|

| Binance | Yes | 90%+ | App + Key + YubiKey | Yes | Licensed in multiple regions |

| Coinbase | Yes | 95%+ | App + Hardware | Yes | Public company (US) |

| Kraken | Yes | 95%+ | App + Hardware | Yes | Highly regulated (US/EU) |

| OKX | Yes | 90%+ | Multi-layer 2FA | Yes | Region-regulated |

| Bybit | Yes | 90%+ | Multi-layer 2FA | Partial | Limited jurisdictions |

It also aligns perfectly with the beginner narrative:

your first exchange must be secure.

How to Match an Exchange to Your Investing Style

Different beginners have different behaviors. Here’s how to choose based on your needs:

If you want the simplest experience:

➡️ Coinbase or Kraken

Clear UI, strong support, regulated structure.

If you want the lowest fees:

➡️ Binance or OKX

Lower trading costs, good liquidity.

If you plan to use multiple ecosystems:

➡️ OKX or Bybit

Broader asset coverage + multi-chain access.

If you want the highest security standards:

➡️ Kraken or Coinbase

Strong custody frameworks + full transparency.

How to Avoid Beginner Mistakes When Using Exchanges

Beginners often make errors that can be avoided easily:

❌ Buying with leverage unintentionally

❌ Sending assets to the wrong chain

❌ Trading high-spread assets

❌ Not enabling 2FA

❌ Leaving large balances on exchanges

❌ Following hype-driven buy signals

The safest approach is simple:

Keep only the amount you actively use on exchanges — store the rest in wallets.

Integrating Forvest Tools With Your Exchange Setup

Once beginners choose an exchange, they can upgrade their research with Forvest tools:

✔ Forvest Portfolio Calculator

Track real profit/loss, allocations, fees, and long-term performance.

✔ Forvest Trust Score

Analyze asset risk before purchasing on any exchange.

✔ AI Insights Dashboard

Get weekly objective summaries without noise.

These tools help beginners avoid emotional decisions and maintain a structured approach from day one.

Understanding the Foundation Before You Build Your Portfolio

A beginner crypto portfolio in 2025 doesn’t need to be complex. It needs to be structured, stable, easy to manage, and aligned with today’s market behavior. The crypto landscape has matured significantly compared to earlier cycles. With institutional Bitcoin ETFs, Layer-2 expansion, stronger regulation, and AI-powered analysis tools, beginners now have the ability to build safer, smarter portfolios—without relying on hype or emotional decisions.

This section provides a complete framework that guides beginners from zero experience to a functional, risk-aware portfolio setup. The goal is not to predict price movements or recommend specific assets. Instead, the goal is to help beginners understand how to build a portfolio that reduces stress, minimizes mistakes, and creates long-term discipline.

Step 1 — Establish the Foundation: BTC + ETH as Your Base Layer

Every strong portfolio begins with a foundation. In crypto, that foundation is built using Bitcoin (BTC) and Ethereum (ETH). These two assets represent more than 60% of the entire crypto market and have the deepest liquidity, strongest adoption, and clearest long-term narratives.

Why BTC and ETH Still Lead in 2025

Bitcoin (BTC)

-

acts as the “digital store of value”

-

benefits from institutional ETF inflows

-

has the lowest long-term volatility among major assets

-

is globally recognized and widely adopted

Ethereum (ETH)

-

powers the largest smart-contract ecosystem

-

supports thousands of dApps, NFTs, and DeFi applications

-

continues expanding through Layer-2 networks like Arbitrum, Base, and Optimism

-

has predictable transaction demand and developer activity

Together, BTC and ETH provide reliability and stability. Beginners who start with this foundation avoid the common mistake of diving into complex altcoins too early.

Suggested Allocation Models (Educational Examples)

These models are not financial advice—they simply reflect what thousands of beginner portfolios use as a baseline.

Model A — Conservative Beginner Portfolio

-

50% BTC

-

30% ETH

-

20% other assets

Model B — Balanced Beginner Portfolio

-

40% BTC

-

30% ETH

-

30% other assets

Beginners benefit from keeping BTC + ETH between 60% and 70% of their total allocation.

This creates long-term stability and protects new investors from sudden volatility.

Step 2 — Add a Controlled Growth Layer (SOL, L2 Networks, Major L1s)

Once the foundation is built, beginners can add exposure to networks with stronger growth potential. This layer introduces more volatility, but also more opportunity.

Why This Layer Matters in 2025

Growth assets help beginners gain exposure to major trends such as:

-

AI and machine learning integrations

-

gaming and application-level blockchains

-

Layer-2 expansion

-

high-speed ecosystems like Solana

-

real-world asset tokenization

These ecosystems have genuine adoption—not just hype.

Top Growth Sectors for Beginners

1. Solana (SOL)

Solana remains one of the highest-usage blockchains in 2025. Its ecosystem includes extremely fast apps, retail-driven activity, and growing institutional interest.

Beginners can explore SOL as the primary L1 in this layer.

2. Ethereum Layer-2 Networks

Arbitrum, Base, Optimism, zkSync, and other L2s offer low-cost transactions with Ethereum-level security.

They support gaming, payments, DeFi platforms, and large consumer applications.

3. Promising L1 Alternatives

Chains like Aptos, Sui, TON, and Injective provide new technology designs.

However, beginners should keep allocations small due to higher risk.

Suggested Allocation Ranges

| Category | Suggested Range | Purpose |

|---|---|---|

| High-speed L1 (SOL) | 10–20% | High activity + strong ecosystem |

| Layer-2 networks | 5–10% | Efficient and growing ETH extensions |

| Emerging L1s | 2–5% | Higher risk, higher innovation |

Keeping these ranges small protects beginners from overexposure to high-volatility assets.

Step 3 — Add a Stablecoin Buffer (USDT/USDC)

A beginner portfolio without stablecoins is unbalanced.

Stablecoins act as your “cash reserve,” giving you liquidity during volatility and helping you avoid emotional decisions.

Why Stablecoins Are Essential

-

They allow strategic buying during dips

-

They prevent forced selling

-

They help you DCA smoothly

-

They reduce your overall volatility

-

They make portfolio rebalancing easier

Beginners should keep 5–10% of their portfolio in stablecoins.

Recommended Choices

USDT (Tether)

Most liquid stablecoin worldwide; dominant across exchanges and DeFi.

USDC (Circle)

Highly regulated; preferred in US and EU markets.

DAI (MakerDAO)

Decentralized alternative; used mostly within DeFi.

Stablecoins make your portfolio more flexible and predictable.

Step 4 — Add a Small Exploration Layer (Only 3–7%)

This is the “learning zone” of your portfolio, not the “get rich fast” zone.

Beginners often overshoot this part and end up losing money.

Exploration Layer includes:

-

early-stage DeFi projects

-

AI-focused tokens

-

gaming tokens

-

new Layer-1 and Layer-2 ecosystems

-

high-volatility narrative coins

Why Keep It Small?

Because beginners:

-

get emotional during volatility

-

follow hype cycles

-

overestimate the potential of new coins

-

underestimate risks of early ecosystems

By limiting this layer to 3–7%, mistakes remain manageable.

Step 5 — Use Dollar-Cost Averaging (DCA) for Safer Entry

DCA is a beginner-friendly strategy where you buy assets gradually over time instead of buying everything at once.

Why DCA Works Well for Beginners

-

It reduces emotional stress

-

It minimizes timing risk

-

It stabilizes entry points

-

It creates investing discipline

-

It works with small budgets

Examples of DCA Plans

If your monthly budget is $100:

-

$25 weekly

-

or $50 every 2 weeks

-

or $100 monthly

Consistency is more important than timing.

Step 6 — Track Your Portfolio the Right Way

Beginners often think they can track performance manually using screenshots or notes.

This leads to errors, confusion, and emotional decisions.

A portfolio dashboard solves those problems.

What You Should Track Weekly

-

real profit/loss after fees

-

allocation percentages

-

average entry prices

-

stablecoin buffer levels

-

volatility exposure

-

overweight/underweight assets

Recommended Tool

Forvest Portfolio Calculator

Gives AI-powered insights, real P/L, and allocation clarity.

Portfolio tracking reveals the true behavior of your investments.

Step 7 — Rebalance Every 1–3 Months

Rebalancing keeps your portfolio aligned with your strategy.

If SOL grows faster than BTC, your exposure may become too aggressive.

Benefits of Rebalancing

-

reduces unexpected risk

-

prevents portfolio drift

-

locks in disciplined growth

-

reinforces consistency

-

removes emotional decision-making

How Rebalancing Works

-

add to underweight assets

-

trim profits from overweight assets

-

use your stablecoin buffer strategically

Rebalancing Frequency

-

Small portfolios: every 2–3 months

-

Medium portfolios: monthly

-

Large portfolios: weekly or automated

Rebalancing ensures long-term stability.

Step 8 — Strengthen Your Security Setup

Most beginner losses happen because of security mistakes—not market volatility.

Beginner Security Checklist

✔ enable 2FA on exchanges

✔ avoid saving seed phrases online

✔ never share wallet information

✔ verify URLs every time

✔ avoid connecting wallets to unknown dApps

✔ disable browser extensions you don’t use

Once your portfolio grows, upgrading to a hardware wallet becomes essential.

Recommended Upgrade Path:

Software wallet → Hardware wallet → Multi-wallet strategy

Step 9 — Integrate AI Tools Into Your Research

AI tools help beginners make better decisions and avoid unnecessary risk.

What AI Provides

-

sentiment analysis

-

risk detection

-

volatility alerts

-

contract safety warnings

-

ecosystem insights

-

performance trends

Recommended Forvest Tools

Forvest Trust Score Analysis

Helps you understand risk levels across major assets.

Forvest AI Insights

Weekly market summaries, narrative detection, and risk indicators.

AI removes noise and gives beginners structured clarity.

Step 10 — Build Slowly, Not Emotionally

The most powerful principle in crypto is emotional control.

Beginners who avoid emotional decisions outperform those who react to hype, fear, or tweets.

Long-Term Success Comes From

-

consistent DCA

-

balanced allocations

-

strong security habits

-

patient mindset

-

avoiding hype cycles

-

clear rules

-

data-driven decisions

What Beginners Should Avoid

❌ buying pumps

❌ panic-selling dips

❌ chasing viral tokens

❌ checking prices every hour

❌ ignoring fundamentals

❌ over-customizing their portfolios

What Beginners Should Do Instead

✔ follow a structured plan

✔ review weekly

✔ rebalance monthly

✔ track performance

✔ focus on long-term outcomes

✔ protect their accounts

Crypto rewards discipline—not speed.

Final Summary: The Beginner Portfolio Blueprint for 2025

A strong beginner portfolio in 2025 includes:

-

BTC + ETH as foundation (60–70%)

-

SOL + L2s as controlled growth (15–30%)

-

Stablecoin buffer (5–10%)

-

Exploration layer (3–7%)

-

DCA for smoother entries

-

Portfolio tracking using Forvest tools

-

Security best practices

-

Rebalancing every 1–3 months

-

AI-powered insights for risk control

This framework gives beginners clarity, structure, and confidence — the elements needed for long-term success in crypto.

⚠️ Disclaimer

This article is for educational purposes only.

It does not provide legal, tax, financial, or trading advice.

Cryptocurrency markets are volatile, and you may lose all or part of your capital.

Always conduct your own research, consider your personal financial situation, and consult a licensed professional if you need tailored guidance.

General consumer warnings about cryptocurrency scams and high-risk offers are also available in public guidance from regulators such as the U.S. Federal Trade Commission’s overview of common crypto scams, which explains typical fraud patterns in a neutral, educational way.

⚠️ No Investment Advice

Nothing in this guide should be interpreted as a recommendation to buy, sell, or hold any cryptocurrency or financial product.

All portfolio examples, allocations, and scenarios are illustrative only and may not be suitable for your individual goals or risk tolerance.

You are solely responsible for your financial decisions.

Rating of this post

Rate

If you enjoyed this article, please rate it.

FAQs for How to Buy Cryptocurrency in 2025

Using a regulated exchange with strong security (2FA, PoR) and choosing beginner-friendly assets like BTC, ETH, and SOL.

No — but transferring to a non-custodial wallet after the first purchase improves long-term security.

Bank transfers offer the lowest fees, while debit cards provide fast but more expensive purchases.

Most beginners start with $20–$200 and gradually build positions using Dollar-Cost Averaging (DCA).

For active trading, exchanges are fine. For long-term storage, non-custodial wallets offer stronger protection.

Rating of this post

Rate

If you enjoyed this article, please rate it.