How to Identify Scam Coins Using Trust Score

- How to Identify Scam Coins Using Trust Score | Crypto Safety Guide

- Key Benefits of Using Trust Score

- What Is Trust Score? Definition and Purpose

- Key Factors Used in Trust Score Analysis

- Project Transparency & Team

- Security & Audits

- Liquidity & Trading Volume

- Tokenomics & Distribution

- Community Engagement

- Regulatory Compliance

- How to Access and Interpret Trust Score for Crypto Coins

- Step-by-Step Guide to Identifying Scam Coins Using Trust Score

- 1. Find the Coin’s Trust Score

- 2. Assess the Score Level

- 3. Dig Into the Details

- 4. Compare with Peers

- 5. Cross-Check Red Flags

- 6. Consult Third-Party Tools

- 7. Review the Whitepaper and Team

- Common Red Flags Detected by Trust Score

- Unverified Smart Contracts

- Limited Exchange Listings

- Poor Liquidity

- Not Listed on Trackers

- Lack of Audits or “Scammy” Audit Reports

- No Community or Fake Hype

- Abnormal Tokenomics

- Limitations of Trust Score and Additional Due Diligence Tips

- Not 100% Foolproof

- New Coins May Lack Data

- Rapid Changes

- Unquantifiable Risks

- Additional Due Diligence

- Enhancing Crypto Safety with Trust Score

How to Identify Scam Coins Using Trust Score | Crypto Safety Guide

In the Wild West of cryptocurrency, scam coins lurk in every corner. Fraudsters push fake tokens promising 100× gains, and even experienced investors can fall victim to hype and social proof. In fact, a large share of crypto losses stem from blind trust in projects that looked legitimate on the surface but collapsed shortly after launch. Ponzi-style tokenomics, fake ICOs, and rug pulls remain some of the most common traps.

This is exactly where Trust Score–based analysis becomes essential. A Trust Score is a data-driven risk indicator that aggregates signals such as liquidity quality, security posture, team transparency, and on-chain behavior into a single credibility metric. To understand how this framework works and why it’s effective at filtering out scams early, it’s important to start with a solid foundation, which we explain in our Crypto Trust Score Guide.

I learned this the hard way in 2021, when I almost invested in a newly launched token with zero community engagement and no verifiable development history. What stopped me was an early-warning Trust Score that flagged the project as structurally weak—likely preventing a costly rug pull. Identifying scam coins before investing is critical, and trust scores help you do exactly that: spot red flags early, invest with more confidence, and protect your portfolio from avoidable losses.

Key Benefits of Using Trust Score

-

Early scam detection: Flags suspicious coins before capital is at risk.

-

Data-driven confidence: Replaces hype with measurable credibility signals.

-

Faster due diligence: Summarizes key risk metrics at a glance, saving time.

What Is Trust Score? Definition and Purpose

Think of Trust Score as a “reliability rating” for cryptocurrencies. It’s a composite metric designed to evaluate how trustworthy a project is. Various platforms (including Forvest’s AI, Fortuna) crunch data on each coin—everything from technical fundamentals to social signals—and output a score indicating risk. A higher Trust Score generally means a coin is more stable and secure, while a lower score flags potential problems.

For example, Forvest’s Fortuna AI “evaluates cryptocurrencies using extensive fundamental and technical data, providing a trust score to help you invest in the most reliable assets”. In other words, Trust Score measures project credibility and market stability across many dimensions. By assessing things like liquidity, development activity, and team transparency, it gives you a clear benchmark. As one analysis notes, “measuring the Trust Score is essential for identifying reliable cryptocurrencies, minimizing risks, and avoiding significant losses”. In short, Trust Score serves as an early-warning beacon: it helps investors make smarter decisions, balancing safety with opportunity.

Key Factors Used in Trust Score Analysis

Trust Score isn’t magic—it’s built on real data. Different analysts may weigh factors differently, but common signals include:

Project Transparency & Team

Is there a known team behind the token? Are team members public and experienced? The project’s communication and openness matter. For instance, crypto research shows that a project’s credibility heavily depends on transparent communication and a competent development team.

Security & Audits

Has the smart contract been audited? Is the code verified on block explorers? Verified contracts and third-party audits earn trust, while anonymous or unverified code is a red flag.

Liquidity & Trading Volume

How much money is locked in the token’s liquidity pool? Higher liquidity (and consistent volume) indicates healthy market activity. Trust Score systems consider trading depth and volume to weed out wash-traded or illiquid scams.

Tokenomics & Distribution

Are token allocations reasonable? Scammers often keep most tokens for themselves or set up unfair selling mechanisms. A trustworthy coin has balanced token distribution and no hidden fees.

Community Engagement

Active developers and engaged communities signal confidence. Scam coins tend to have no social presence or suspicious marketing hype. User feedback (on social media or forums) can be a factor in the Trust Score.

Regulatory Compliance

Some trust algorithms even check for legal red flags or compliance steps. Overall, a Trust Score blends on-chain metrics (like volume and smart contract data) with off-chain info (like news, team bios, and public sentiment).

Together, these data points form the Trust Score. UEEX’s crypto glossary puts it simply: “Trust Score is a metric used to evaluate the reliability and credibility of cryptocurrencies… Factors that contribute include the project’s transparency, security measures, [and] the reputation of its development team”. In practice, tools like Forvest’s Trust Score Analysis digest these factors so you don’t have to manually check each one.

How to Access and Interpret Trust Score for Crypto Coins

To use Trust Score in your investing workflow, you need a platform that actually computes and updates it based on real data. Forvest’s Fortuna dashboard provides a Trust Score analysis feature that evaluates crypto assets using live on-chain signals, market behavior, and structural risk factors. Simply search for a coin, and Fortuna displays its Trust Score along with key signals driving that rating.

Once you have a Trust Score, interpretation is straightforward: higher is better. A top-tier score suggests the coin checks many boxes (liquid markets, active development, clear team), whereas a very low score is a warning sign. In some systems, scores are color-coded or tiered; in others, you’ll see a number (e.g. 0–100). For example, UEEX notes that “a higher score typically suggests a stable and secure investment, while a lower score may indicate potential risks”. Watch for anything marked in red or flagged with warnings.

Keep in mind Trust Score is dynamic. As market conditions change, so does the score. For instance, CoinGecko points out their Trust Score updates in real-time with market activity. This means a coin’s Trust Score can fluctuate from day to day—reflecting new liquidity inflows, major transactions, or news events. Always check the latest score rather than relying on an old value.

Step-by-Step Guide to Identifying Scam Coins Using Trust Score

1. Find the Coin’s Trust Score

Go to your Trust Score tool (such as Forvest’s Trust Score analysis dashboard) and look up the coin by name or contract address.

2. Assess the Score Level

If the score is very low (for example, in the bottom 10–20% of coins), treat it as a red flag. A sky-high score doesn’t guarantee safety, but a very low score is usually a clear warning.

3. Dig Into the Details

Look at the breakdown or underlying data (if available). Which factors pulled the score down? Common issues include tiny liquidity pools, unverified contracts, or almost no developer activity.

4. Compare with Peers

See how similar coins rank. If a token’s Trust Score is much lower than other coins in its category (DeFi, gaming, etc.), that’s suspicious.

5. Cross-Check Red Flags

For any low-score coin, manually verify known scam indicators:

Is the contract verified? Unverified source code on Etherscan or BSCScan is a serious sign of trouble.

Where is it traded? If the coin only appears on small or unregulated exchanges (especially a couple of DEXs), its Trust Score will be low – and it should make you wary.

What is the liquidity? Very low liquidity (e.g. under $100k locked) often correlates with a low Trust Score and nearly always signals a risk.

Is it listed on major trackers? Legit tokens are usually on CoinGecko or CoinMarketCap. DappRadar warns that if a token isn’t on such platforms, it’s “probably a scam”.

6. Consult Third-Party Tools

Run the token address through scanners like Token Sniffer or DEXTools. Token Sniffer, for instance, gives a “smell test” score—lower scores indicate a higher scam risk. These tools are similar in spirit to Trust Score and can confirm if multiple indicators flash warnings.

7. Review the Whitepaper and Team

Beyond the score, read the project’s whitepaper and team bios. A coin with a low Trust Score likely has missing or vague information. If you can’t find clear project details, that absence itself is telling.

By following these steps, you effectively use the Trust Score as a screening filter. It narrows the field so you only spend time on coins that pass basic sanity checks. It’s not infallible (which brings us to limitations), but it greatly improves your odds of catching a scam early.

Common Red Flags Detected by Trust Score

Trust Score algorithms flag many well-known scam signals. Here are key red flags you’ll often see in a low score, with examples from scam-detection guides:

Unverified Smart Contracts

If the project’s contract code hasn’t been uploaded and verified on a block explorer, trust scores plummet. Verified code means anyone can audit or read it; unverified code means the developers can hide malicious functions. As DappRadar notes, “if code is not verified, you’re probably dealing with a scam”.

Limited Exchange Listings

A token traded only on tiny or unfamiliar decentralized exchanges gets flagged. Legit projects aim to list on major platforms with compliance procedures. DappRadar warns, “if the token is only traded on a couple of decentralized exchanges…it is almost certainly a scam”.

Poor Liquidity

Low locked liquidity (often under $100k) is a classic sign of a honeypot. Trust Score tools will drop ratings for shallow pools. DappRadar specifically cautions that liquidity below $100k or rapidly draining liquidity is likely a scam. (In practice, check Uniswap or the chain’s DEX info yourself if needed.)

Not Listed on Trackers

If CoinGecko, CoinMarketCap or DappRadar have no entry for the token, that’s highly suspicious. Real projects make themselves known to these aggregators. According to DappRadar, absence from token ranking sites suggests a scam.

Lack of Audits or “Scammy” Audit Reports

Some Trust Score providers may note if an audit exists. Beware audit reports that disclaim obvious issues (some hasty audits do that).

No Community or Fake Hype

An empty Discord or Twitter, or only paid “shill” posts without organic chatter, raises alarms. While not always captured quantitatively, a sound Trust Score analysis often weighs social signals.

Abnormal Tokenomics

Any tokenomics that overwhelmingly favor insiders or that hide huge sell taxes will lower the score. If Trust Score tools report holder distribution, watch for any single wallet holding the majority of the supply.

In short, Trust Score encapsulates these and other red flags. Whenever you see them reflected in a low score or warning label, take it seriously – it could save you from an outright scam.

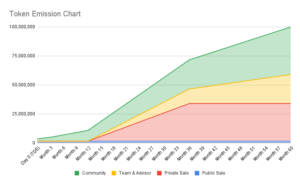

Source: Tokenomics visualization example (project documentation / public analysis)

Limitations of Trust Score and Additional Due Diligence Tips

Trust Score is powerful, but it’s not a guaranteed crystal ball. It can’t predict future hacks or unforeseen events, and scammers continually adapt. Here are some caveats and extra precautions:

Not 100% Foolproof

Trust Scores are based on available data and models. Different platforms calculate scores differently, so a coin might have a mid-tier Trust Score on one site and a higher/lower score elsewhere. Always cross-check between sources.

New Coins May Lack Data

Brand-new tokens with tiny track records can’t be judged easily. Trust Scores may default low (which is correct—to be cautious) or simply not exist yet. A missing score is itself a red flag.

Rapid Changes

Scores update with new data, but sometimes too slowly. A Trust Score might not instantly reflect a massive recent token sale or a viral TV endorsement. Combine Trust Score with real-time news monitoring.

Unquantifiable Risks

Some aspects, like a secret team exit strategy or coordinated pump schemes, might not show up in the data. That’s why user research still matters: check Telegram chats, Reddit discussions, and independent reviews.

Additional Due Diligence

Never skip the basics. Always read the whitepaper and check the token contract on Etherscan/BSCScan. Verify that wallets in question aren’t on known scam lists. Use multiple tools: for example, on-chain analytics and rug-pull checkers. Regularly revisit a coin’s Trust Score; a rising score can confirm growing legitimacy, while a falling score indicates new problems.

For context, remember that Trust Score is one tool in a toolkit. It’s akin to a fraud detection sentinel – it alerts you to dangers, but you still decide. As ChainAware puts it, fraud score metrics “serve as a sentinel… offering a comprehensive view of the potential risks… to make informed decisions”. In practice, pair Trust Score with sound investment principles and continual learning to stay ahead of scammers.

Enhancing Crypto Safety with Trust Score

In the fast-changing crypto market, staying safe means using every advantage available. Trust Score gives investors a powerful, data-driven layer of protection by highlighting low-credibility projects and exposing hidden risks before capital is at stake. By surfacing red flags such as weak liquidity, unverified contracts, or opaque teams, Trust Score helps investors avoid scam coins that would otherwise damage their portfolios.

That said, Trust Score is not a silver bullet. It reduces certain types of risk—but it cannot eliminate market volatility, execution failures, or unexpected external shocks. This is why Trust Score works best as a screening and prioritization tool, not a final decision-maker.

Trust Score is most effective when combined with solid risk management principles.

Even the most credible projects can underperform or face unexpected events if portfolio exposure isn’t controlled.

If you want to go one step further, our guide on Crypto Portfolio Risk Management explains how to size positions intelligently, manage downside risk, and avoid common mistakes that hurt long-term performance.

Used together, Trust Score and disciplined portfolio risk management create a stronger investment framework: Trust Score helps you avoid obvious dangers early, while risk management protects you after capital is deployed. In a market where conditions shift fast and narratives change overnight, this combination gives you a meaningful edge—helping you invest more confidently, more defensively, and with greater long-term resilience.

Rating of this post.

Rate

If you enjoyed this post, please rate it.

FAQs for identify scam coins using trust score

A Trust Score typically aggregates factors like the project’s transparency and governance, smart contract security (audits and code verification), liquidity and trading volume, developer activity, community engagement, and team reputation. Some algorithms also consider exchange listings or regulatory compliance. In short, it combines on-chain data (like tokenomics and liquidity) with off-chain signals (like news and team profiles). Different platforms use different models, but all aim to quantify how much you can trust a coin.

No. Trust Score is a risk indicator, not a crystal ball. A high Trust Score means a coin currently looks solid by available data, but markets can change and new scams can emerge. Even a top-rated coin can suffer hacks or dramatic shifts. Always do your own research beyond the score. Trust Score is best used to flag potential scams early, but it doesn’t replace due diligence or good judgment.

It varies by provider, but many Trust Scores refresh regularly (often daily or in real time) based on market changes. For example, CoinGecko notes their Trust Scores update continuously with trading conditions. Expect Trust Scores to change when a coin’s data changes — for instance, after a big transaction, a liquidity shift, or new team info. Always check the latest score rather than an old snapshot.

Not entirely. A high score indicates that, for now, the coin meets several trust criteria (good liquidity, active development, etc.), which is reassuring. However, even high-scoring coins carry market risk. For example, a perfectly coded token can still lose value if the broader market crashes. Also, scores depend on existing data — they might not capture every risk. Use a high Trust Score as a positive signal, but maintain healthy skepticism and keep monitoring your investments.

Trust Score is a strong early-warning tool that analyzes key risk factors like project transparency, liquidity, contract audits, and community engagement. While it significantly helps filter out scams, it's not foolproof. Always combine it with your own research and other tools to make fully informed decisions.

Rating of this post.

Rate

If you enjoyed this post, please rate it.