Understanding Trust Scores in Crypto Projects

- What is a Crypto Trust Score?

- Why Trust Scores Matter for Investors?

- Key Factors That Determine a Crypto Project’s Trust Score

- Project Transparency

- Team Credibility and Background

- Security Measures and Audits

- Community Engagement and Support

- Track Record and History

- Regulatory Compliance

- Tokenomics and Utility

- Technology and Innovation

- How to Evaluate a Crypto Project’s Trust Score

- Research the Team

- Examine Community and Social Media

- Check for Security Safeguards

- Analyze the Project’s History

- Evaluate Tokenomics Yourself

- Use Independent Research Tools

- Trust Your Instincts and Go Slow

- Common Red Flags in Crypto Projects

- Anonymous or unproven team

- Lack of transparency or vague documentation

- No independent audits or code access

- Unrealistic promises of returns

- Scam history or community warnings

- Inactive or toxic community

- Pump-and-dump vibe (extreme hype with no substance)

- Conclusion – Making Informed Decisions

Ever been tempted by a crypto project that promised the moon? I have. A few years ago, I nearly invested in a flashy new ICO advertising “guaranteed” high returns. On the surface, everything looked polished—slick branding, bold claims, and aggressive marketing. But a closer look revealed red flags: an anonymous team, vague documentation, and a whitepaper packed with buzzwords instead of substance. I backed out at the last moment. Many others didn’t—and they lost everything when the project quietly disappeared.

Unfortunately, stories like this are becoming more common. Crypto scams are accelerating at an alarming pace, with reported losses jumping 45% in 2023 to more than $5.6 billion. In an environment where new tokens launch daily and hype spreads faster than facts, investors need a reliable way to separate legitimate projects from potential rug pulls.

This is where trust scores become essential. A crypto project’s trust score acts as a credibility snapshot—an evidence-based signal that helps investors assess reliability beyond marketing narratives. If you’re not already familiar with how these scores work at a foundational level, our pillar guide on Crypto Trust Score Guide explains the core framework behind trust scoring, from transparency and security to liquidity and governance.

In this article, we’ll build on that foundation by breaking down the key factors that shape a project’s trust score and showing you how to evaluate them yourself. The goal is simple: help you invest with clearer judgment, stronger skepticism, and far less exposure to hype-driven losses.

What is a Crypto Trust Score?

A crypto project trust score is a metric that evaluates a cryptocurrency project’s overall credibility and safety. It’s usually an aggregate score (often on a scale like 1–100 or 1–10) that takes into account various aspects of the project – from the transparency of its team to the strength of its technology. In simple terms, a trust score tells you at a glance how much trust the community and analysts place in a project. The higher the score, the more trustworthy the project is considered; a low score signals potential red flags.

Different platforms and analysts may calculate trust scores using their own formulas, but they all boil down to assessing how likely a project is to be legitimate and successful versus fraudulent or poorly managed. It’s similar to how rating agencies score companies or how credit scores work – multiple data points (financial info, history, etc.) roll up into one easy-to-understand rating. In the crypto world, factors like a project’s transparency, team reputation, security audits, and community engagement (which we’ll explore shortly) feed into that trust score. The goal is to help investors quickly gauge crypto project credibility without needing a PhD in blockchain. Of course, a trust score isn’t magic or a guarantee – but it’s a very useful starting point for due diligence.

Why Trust Scores Matter for Investors?

If you’re investing in cryptocurrencies, trust scores matter because they serve as a crucial safety check. In a market overflowing with new tokens and bold promises, a trust score acts like a cheat sheet for risk. It distills a project’s credibility into a single rating, helping you separate the gems from the junk. This is invaluable for portfolio risk management – after all, avoiding a bad investment can be just as important as finding a good one. A high trust score can give you peace of mind that a project has solid fundamentals and isn’t an obvious scam, whereas a low score is a big waving red flag to be cautious (or to stay away entirely).

For investors, especially those who are new or exploring digital assets for the first time, crypto trust scores simplify the decision-making process. Instead of diving blindly into a project because a friend mentioned it or because it’s “trending” on Twitter, you can check its trust score to get a quick credibility check. Think of it like doing a background check on someone before going into business with them. As an example, one of the common mistakes in crypto investing is aping into (i.e. hastily buying) a token based purely on hype, without examining its fundamentals – a mistake that has cost many investors dearly. In fact, avoiding sketchy projects is a key part of risk management (as we noted in our guide on common crypto portfolio mistakes). Trust scores help you avoid those mistakes by highlighting risk factors early. In short, they empower you to invest with confidence by making informed decisions. Instead of relying on gut feeling or FOMO, you have an objective measure of a project’s credibility. In a volatile arena like crypto, that can be the difference between backing the next big thing and getting caught in the next big rug pull.

Source: Statista, Chainalysis

Key Factors That Determine a Crypto Project’s Trust Score

A project’s trust score isn’t pulled out of thin air – it’s built on several core factors. Understanding these factors will not only demystify how trust scores are determined, but also teach you what to look for when evaluating any crypto project’s credibility. Let’s break down the main components that influence a project’s trustworthiness:

Project Transparency

Transparency is foundational for trust. A reputable crypto project should be an open book (or at least not a black box). This means it provides clear, accessible information about what it’s doing and why. Key transparency indicators include a detailed whitepaper (that isn’t just buzzword salad), a public roadmap of future plans, and regular updates or communication from the team. Good projects will openly share both their successes and setbacks with the community. For example, they might publish monthly progress reports or hold AMA (Ask Me Anything) sessions with developers. Transparency also extends to things like making the project’s source code open-source (so anyone can review or audit it) and clearly explaining the tokenomics (how tokens are distributed and used). When a project hides basic information or provides only vague, grandiose claims (“revolutionizing finance with AI blockchain!”) without substance, it scores low on transparency – and that seriously hurts its trust score. In contrast, a project that lays everything out plainly builds confidence. You feel like you know what you’re investing in, which is exactly the point.

Team Credibility and Background

Behind every crypto project is a team of humans (at least, let’s hope it’s not all bots!), and their credibility is a major trust factor. A project with an experienced, well-known team will naturally earn a higher trust score than one led by anonymous nobodies or people with shady histories. When evaluating a team, consider questions like: Who are the founders and developers? Do they have relevant experience in blockchain or the industry the project targets? Have they worked on successful projects in the past? A quick search on LinkedIn or Twitter can reveal a lot. If the CEO claims to be a tech guru but has no digital footprint or if the developers can’t be found on GitHub, that’s a red flag. On the flip side, if you discover the team includes respected figures or advisors (for example, a known Ethereum core developer or a professor from a top university), that adds significant credibility. One famous case: Bitcoin’s founder Satoshi Nakamoto was anonymous, yet Bitcoin still gained trust over time due to its transparent code and community – but that’s an outlier scenario. Generally, anonymity = lower trust. Scoring high on this factor often means the project leaders are proud to put their names and reputations on the line, and ideally, the project community has vetted them positively. Remember, you’re ultimately betting on people – a great idea can fail under a bad team, and a strong team can pivot a project out of trouble.

Security Measures and Audits

If transparency and team are about words and people, security is all about technology and practice. In crypto, security is paramount – after all, this is an industry where a single smart contract bug or hack can mean millions of dollars gone in a flash. A project that prioritizes security will undergo independent audits of its code (for example, by firms like CertiK, Quantstamp, or Trail of Bits) and will proudly share those audit reports. They might also run bug bounty programs to encourage independent hackers to report vulnerabilities. A high trust score is awarded to projects that can demonstrate their contracts and platforms have been scrutinized and are safe to use. On the other hand, if a DeFi project launches with zero audits, that’s a big risk. Similarly, check if the project has robust security practices: do they have multi-sig (multiple signatures) protecting key funds? How do they secure user data? Have they ever suffered a hack, and if so, how did they respond? A history of hacks or security breaches will obviously drag a trust score down – unless the team was transparent, compensated victims, and improved security afterward, which at least shows accountability. In summary, no security = no trust. Investors feel much more comfortable when they know a project’s code won’t suddenly be drained by an exploit, and trust scores reflect that peace of mind.

Community Engagement and Support

The strength and vibe of a project’s community can tell you a lot about its legitimacy. Crypto might be built on code, but it runs on people – enthusiasts, investors, developers, and users rallying around a vision. A project with an active, positive community tends to score higher on trust. Here’s what to look for: are the project’s social channels (like Discord, Telegram, Reddit, Twitter) bustling with real conversation? Do the developers and team members actively engage with the community’s questions and concerns? Healthy projects will have moderators keeping discussions civil, team members doing regular updates or AMAs, and actual users sharing experiences. If you join a Telegram group and hear crickets (no activity) or just see a bunch of spam and “when moon?” posts with no moderation, that’s not a great sign. Also, community support includes sentiment – if you find that outside of the official channels people are warning others about the project (e.g. on Reddit threads or Twitter), you should heed those warnings. Strong community engagement builds trust because it shows the project isn’t just hype; it has real people invested in its success. It also often means more transparency – a team can’t hide as easily when thousands of eyes are on them every day. So when evaluating trust, consider the crowd: a passionate, informed community is like a stamp of approval that this project has nothing to hide and something valuable to offer.

Track Record and History

Past behavior often predicts future behavior – that’s why a project’s track record and history play a big role in its trust score. For newer projects, there might not be much history to go on (which inherently makes them riskier), but even a short history can be telling. Did the project meet the milestones it set in its roadmap? How has it handled any challenges or crises? For example, if a project promised to launch a test network in Q1 and actually delivered on time with regular progress updates, it earns trust. If it repeatedly delays releases or silently changes goals, that’s worrisome. For older projects, look at how long they’ve been around and what they’ve accomplished. A project that has been operating smoothly for, say, three years, and has grown its user base steadily has built a track record of reliability. Contrast that with a project that launched during the last bull run, went dormant during the bear market, and then suddenly resurfaced – inconsistent history can lower trust. Also, examine how the team dealt with any incidents: Did they ever experience a hack, a major bug, or a market crash (like the 2022 Terra/Luna collapse that wiped out billions)? If yes, did they communicate and manage the situation responsibly or go radio silent? A strong track record doesn’t mean a project never has issues – it means when issues arose, the project handled them in a way that maintained or restored confidence. In short, consistency and reliability over time boost a project’s trust score, while a pattern of broken promises or chaotic pivots will undermine it.

Regulatory Compliance

The crypto space often evolves faster than regulations can keep up, but outright ignoring the law is a recipe for disaster – for both the project and its investors. That’s why regulatory compliance (or at least, a project’s stance towards regulation) is a key trust factor. A project that proactively follows relevant laws, seeks proper licenses if needed, or conducts Know-Your-Customer (KYC) checks where appropriate will generally score higher in trust. Compliance can mean different things depending on the project: for an exchange or lending platform, it might mean registering with financial authorities; for a token offering, it might mean not offering to certain jurisdictions or to U.S. investors without proper filings. While decentralization is a core ethos in crypto, being too cavalier about laws can be a red flag. For example, if a project promises guaranteed profits (which could be seen as a security offering) but hasn’t registered anywhere, or if it’s been outright banned in some countries due to legal issues, you should be cautious. Many serious projects will have legal advisors and will openly discuss how they’re navigating regulatory uncertainties – which ironically can boost trust, because they’re acknowledging the real-world rules. When a project communicates things like “We comply with AML/KYC laws” or “We’re working with regulators”, it may not excite the anarchist in us, but it does indicate you’re dealing with a more serious, credible operation. Bottom line: a project that at least tries to play by the rules (or intelligently work around them in the open) will earn more trust than one that operates from the shadows of illegality.

Tokenomics and Utility

Let’s talk tokenomics – basically, the economics and use-case of the project’s token. This factor often separates the projects with real substance from those just riding a token sale cash grab. A project with clear, logical tokenomics and genuine token utility will fare much better on trust. What does that entail? First, the token should have a defined purpose: Does it power the network (like ETH does for Ethereum’s transactions)? Is it for governance, letting holders vote on proposals? Does it grant access to certain services or rewards? If you can’t answer “Why does this token exist?” that’s a problem. Second, fair distribution is crucial. Check how tokens are allocated: How much went to the founders, team, and early investors versus the community? Are there vesting periods (lock-ups) that prevent the team from just dumping their bags immediately? A trustworthy project often has transparent token distribution, with maybe a modest percentage to the team vested over years, a chunk for ecosystem development, etc. If you see that 50% of the supply was instantly available to the founders or that a huge portion of tokens will flood the market in a short time, the incentive alignment is off – trust takes a hit. Additionally, consider the supply and inflation: Is the token supply capped or does it inflate? If it inflates, is it at a reasonable rate? Projects that are vague or secretive about these details usually score low, because hidden tokenomics often hide nasty surprises (like massive dilution). In essence, good tokenomics show that the project is built for long-term value, not just to enrich insiders quickly. And that long-term alignment is exactly what builds investor trust.

Technology and Innovation

Last but not least, the technology underpinning a project – and whether it’s truly innovative or solid – has a big impact on trust. Crypto projects are often valued for their tech promises: a faster blockchain, a new DeFi protocol, a novel use of NFTs, etc. But not all tech is created equal. A project that’s pushing boundaries and can demonstrate real tech competence will earn a higher trust score. Here’s what to examine: Is the project’s code open-source and active on repositories like GitHub? (An active GitHub with frequent commits from multiple contributors is a green flag.) Does the project have a testnet or prototype available, or is it all theoretical? How does it plan to scale and handle security at the tech level? If the project claims some groundbreaking innovation, do they provide technical papers or documentation to back it up? Innovation is great, but only if it’s credible. Many scams throw around fancy terms like AI, quantum, or “Level 5 blockchain” without any technical substance – purely to sound impressive. That’s obviously a trust killer. By contrast, when a project’s technology is endorsed or at least respected by experts in the field, it greatly boosts trust. For example, if well-known developers or academics are praising the project’s approach, or if the project has won hackathon awards, that’s a positive sign. Also, consider performance and reliability: if the project is live, does it actually work as intended? Constant outages or critical bugs indicate shaky tech. In summary, solid and innovative technology (with evidence to back it up) gives investors reason to trust that the project isn’t just smoke and mirrors – it has real, working code that could deliver real value.

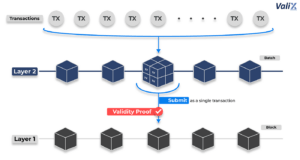

Source: Validity Consulting

How to Evaluate a Crypto Project’s Trust Score

Knowing the factors is one thing – applying them is another. So how can you actually evaluate a crypto project’s trustworthiness in practice? Here’s a step-by-step game plan:

Start with Official Info: Begin by visiting the project’s official website and reading its whitepaper (or litepaper). Is the project description clear and detailed? A good whitepaper should explain the project’s purpose, technology, and tokenomics in plain language. If it’s missing or full of jargon without real substance, take note – that’s already a warning sign. Also, check for a roadmap and see if past milestones have been met or updated.

Research the Team

Look up the key team members and advisors. Do they list real names and profiles? Search for them on LinkedIn, Twitter, or GitHub. A credible team member will usually have a history you can verify (past jobs, contributions to other projects, etc.). If everyone is anonymous or you find scant info (or worse, if a reverse image search shows their profile pics are stolen stock photos!), pump the brakes. It’s hard to trust a project if you can’t trust the people behind it.

Examine Community and Social Media

Join the project’s community channels like Telegram, Discord, or subreddit, and scroll through their Twitter feed. Observe the community engagement. Are people asking insightful questions and getting answers from the team? Is the sentiment generally positive and enthusiastic (without being cultish)? You can even ask a newbie question yourself to see how the community responds. If you find only hype (“When Lambo?”) or complete silence, that’s informative too. Don’t forget to search externally as well – see what folks on crypto forums or YouTube are saying. Often, red flags about a project (like allegations of it being a scam) will surface in community discussions if you look.

Check for Security Safeguards

Investigate the project’s technical assurances. Browse their documentation or website for any mention of security audits. If an audit report is available, skim through its summary – did it pass with minor issues or were there serious vulnerabilities? Also, check if the project’s code is open-source (and if you’re not technical, note whether others on GitHub are actually starring or forking the repositories, which indicates people are looking at it). See if the project has a bug bounty program or other security measures. A project that hasn’t been audited and has closed-source code requires a leap of faith (not a good thing for trust).

Analyze the Project’s History

If the project isn’t brand new, do a quick background check on its track record. Google the project’s name alongside terms like “scam,” “controversy,” or “hack.” This can reveal if there were any past incidents or broken promises. For example, if the project announced partnerships that never materialized or if it had a big crash in price due to developer infighting, you’d want to know. On the positive side, consistent delivery on roadmap promises or a stable growth in users is a green flag. Even checking price charts could be useful – a history of extremely erratic pumps and dumps might indicate manipulation or hype cycles rather than organic growth.

Evaluate Tokenomics Yourself

Try to summarize the token’s role in a sentence. If you struggle to answer “What is this token for?”, the utility might be weak. Look at the token distribution (often in the whitepaper or token sale docs). Who are the biggest beneficiaries? Ideally, the community (via public sale or fair launch) gets a good chunk, and insiders have their tokens locked for a while. If you see something like “Team gets 40% of tokens, no lockup” – that’s a red flag because they could dump on you. Also, consider the economics: for example, if the project is DeFi, are rewards sustainable or will they cause inflation? Healthy tokenomics often correlate with a higher crypto trust score.

Use Independent Research Tools

Leverage websites and platforms that aggregate due diligence information. For instance, sites like CoinGecko or CoinMarketCap often have sections for project info, team, audits, etc., and sometimes even user reviews. There are also specialized platforms and analysts on Twitter/Reddit who do deep dives into new projects – their insights can be gold. Moreover, to save time and get a reliable quick read, you might use trust score analysis tools (for example, Forvest’s Trust Score Analysis feature on our platform conveniently compiles many of these factors into one score). These tools are like having a crypto credibility dashboard – they won’t make decisions for you, but they give you a snapshot of risk. Just remember to cross-check any tool’s score with your own research; don’t follow anything blindly.

Trust Your Instincts and Go Slow

Finally, after doing all the above, gauge your own comfort level. Sometimes everything can look good on paper, but you might still feel uneasy – listen to that gut feeling. On the other hand, if a project passes all the checks with flying colors, that’s a great sign. Even then, a smart approach is to start with a small investment if you decide to invest, and maybe increase only as the project continues to prove itself. Doing your due diligence in crypto is not a one-time task – keep monitoring the project’s developments over time. Trust, after all, is built (or lost) continuously.

By following these steps, you essentially perform a DIY trust score evaluation. It takes a bit of effort, but considering it’s your hard-earned money on the line, the time spent is well worth it. Plus, the more you practice evaluating projects, the better you’ll get at spotting winners – and dodging the losers and scams.

Common Red Flags in Crypto Projects

Even with all the best research, it helps to know the obvious warning signs that often indicate a project is untrustworthy. If a crypto project exhibits several of these red flags, its trust score would likely be low and you should be extremely cautious (if not avoid it altogether):

Anonymous or unproven team

If you can’t figure out who is behind the project, that’s a major red flag. Legitimate projects usually have founders who are transparent about their identities and credentials. An entirely anonymous team (or fake identities) makes it hard to hold anyone accountable if things go wrong. Be wary of the “dev is shy” excuse – in crypto, anonymity has unfortunately been used by scammers to run away with funds.

Lack of transparency or vague documentation

No clear whitepaper, no detailed roadmap, and answers that feel like they’re always dancing around the point – these suggest the project is hiding something (or has no real plan). If reading the documentation leaves you more confused than before, or if basic questions (like “How will this actually work?”) aren’t clearly answered, that’s not good. A trustworthy project lays its cards on the table.

No independent audits or code access

As mentioned earlier, if a project hasn’t undergone any security audits and doesn’t let the community review its code (closed-source code), you’re basically taking their word on faith. That’s a gamble you don’t need to take. Plenty of projects get reputable audits – if one doesn’t, ask why. Not caring about audits is like saying “trust us, just because.”

Unrealistic promises of returns

This is red flag city. If a project guarantees you high returns (“Guaranteed 5x your money in a month!”) or anything that sounds too good to be true, run the other way. No one can promise that in a honest, risk-driven market. Scammers use these bait tactics (remember BitConnect’s infamous promise of ~1% daily interest – it was a Ponzi scheme). Legit projects talk about technology and adoption, not “profits” and “get rich quick” rhetoric.

Scam history or community warnings

Do a quick gut-check by searching for any past scam accusations. If you see a lot of chatter like “this is a scam” from people (especially if they provide reasons/evidence), don’t ignore that. Sometimes previous investors or analysts will spot problems early and try to warn others. Also, if the project has launched other tokens that failed or had rug-pull behavior, that history matters. Patterns repeat.

Inactive or toxic community

A dead community (empty Telegram chats, forum threads with no responses) might indicate a project that has been abandoned or never gained real traction beyond a small circle. Equally concerning is a toxic community – for instance, if you ask a critical question and get banned or flooded with angry, defensive responses, the project might be trying to censor doubt. Healthy projects can handle a bit of skepticism and will address tough questions. If all you see is either tumbleweeds or an echo chamber of hype, consider it a warning sign.

Pump-and-dump vibe (extreme hype with no substance)

Trust your nose on this one. If everything about the project’s marketing is focused on driving the price up (“We’re going to the moon! Get in now or regret later!”) without discussing fundamentals, it’s likely a pump-and-dump scheme. Similarly, if the token’s price chart looks like a sharp spike followed by a steep crash (and this happens multiple times), the project could be subject to manipulation. Real projects can have volatility, but the legit ones aren’t solely hype machines – they’re busy building, not just pumping.

Spotting these red flags early can save you from a lot of pain. It’s like seeing smoke before a fire – it gives you a chance to get out (or not go in at all) before things go bad. Remember, no legit project will tick all the red flags boxes. If you’re seeing many of them, trust your instincts and steer clear, no matter how tempting the FOMO might be.

Conclusion – Making Informed Decisions

Bottom line? Knowledge is power in the crypto world. By understanding the factors that determine a crypto project’s trust score, you’re arming yourself with a kind of superpower – the ability to sniff out what’s likely solid versus what’s likely sketchy. When you look at a project now, you won’t just see hype or glossy marketing; you’ll see the pillars of trust (or the lack thereof) behind it: Is the team transparent and credible? Does the technology hold up? Are there security measures and a real community? These are the things that truly matter in the long run, more than any flashy promise.

To recap the key pillars: Transparency, Credibility, and Security are absolutely essential. A trustworthy project openly shares information, is led by reputable people, and takes serious care to protect users and funds. Add to that a supportive community, a proven track record, sensible tokenomics, and respect for legal boundaries – and you’ve got a project that’s likely worth your attention. If a project falls short on many of these fronts, then no high APR or shiny NFT can compensate for that risk.

The great thing is that you now know how to do your due diligence. It might feel like a lot of work to research every project, but it’s a lot less work than trying to recover from a scam or a bad investment. And you don’t have to do it alone – there are tools and resources to help. For instance, to make evaluating projects easier, Forvest’s platform includes a Trust Score Analysis feature that aggregates many of these factors into one handy score (like having a crypto due diligence assistant at your side). It’s a fantastic starting point to quickly filter out dubious projects and focus on ones that meet a higher standard. Just remember, even a great tool is just one part of your decision-making. Always follow through with your own analysis and consider multiple perspectives.

At the end of the day, investing in crypto (or anything, really) will always carry some risk. But by focusing on trust scores and the fundamentals behind them, you tilt the odds in your favor. You’ll be able to spot red flags a mile away and highlight the hidden gems that others might overlook. So, as you venture out into the crypto markets, take this knowledge with you. Stay curious, stay skeptical (in a healthy way), and stay informed. With the right approach, you can navigate the crypto landscape with confidence and savvy. Happy and safe investing! And if you ever need a refresher or new insights, you know where to find us – we’re always here to help you make sense of the crypto frontier.

Rating of this post.

Rate

If you enjoyed this article, please rate it.

FAQs for Crypto project trust score factors

A crypto project trust score is a rating or score that reflects a project’s credibility, transparency, and overall trustworthiness. It’s basically a quick way to gauge how legit and reliable a cryptocurrency project is. The score is typically derived from evaluating key factors like the team’s reputation, the project’s transparency, security audits, community feedback, and more. High trust score = project has strong fundamentals and fewer red flags; low trust score = approach with caution (or even avoid).

You should care because a trust score helps you assess risk at a glance. Crypto markets are full of projects – some are great, many are not. A project’s trust score can alert you to potential scams or poorly run projects before you invest your money. In essence, it’s a tool for protecting yourself. Projects with high trust scores have likely cleared a lot of the basic credibility checks (good team, transparent operations, etc.), meaning they’re safer bets than projects with low scores that might be hiding issues. It’s about investing with confidence and avoiding nasty surprises.

Start by doing your own research on the project’s fundamentals – read the whitepaper, research the team, look for audit reports, and engage with the community. Many of these elements don’t give you a numeric “score” per se, but you’ll get a sense of how it would score (for example, if you find no audits, that would drag the score down). Additionally, you can use platforms or tools that provide trust scores. Some crypto websites and apps aggregate data on transparency, team, and technology to assign a trust score to projects. For instance, Forvest’s Trust Score Analysis feature is one tool that compiles these metrics into a single score for easier comparison. Just make sure to cross-check any score with up-to-date information – and remember that no score is perfect, so use it as a guide alongside your own analysis.

Typically, the signs of a low trust score mirror the red flags we discussed. Key warning signs include an anonymous or sketchy team, lack of transparency (no clear info or roadmap), absence of security audits, and an inactive or very new community. Other giveaways are unrealistic promises (like guaranteed returns), a token that doesn’t seem to have any real utility, and any history of bad behavior (such as prior scams or major controversies). If a project has multiple such issues – say, you can’t find who the founders are and there’s no whitepaper or audit and they promise you’ll get rich quick – you can bet its trust score would be quite low. In short, lots of red flags = low trust. When in doubt, it’s safer to pass on a project than to gamble on one that sets off alarm bells.

You can use platforms like Forvest’s Trust Score Analysis, CoinGecko, and CoinMarketCap to review data on transparency, audits, team reputation, and tokenomics. These tools simplify research and help you compare projects quickly.

Rating of this post.

Rate

If you enjoyed this article, please rate it.