What Is Trust Score in Crypto and How to Rely on It When Investing?

- Why Trust Score Matters in Crypto Investing?

- How Trust Scores Work (Factors and Sources)

- Using Trust Scores in Your Investment Strategy

- Choosing exchanges

- Evaluating coins or projects

- Portfolio monitoring

- Limitations and Best Practices

- No Score Guarantees Zero Risk

- Scores Can Vary by Source

- Low Score Doesn’t Always Mean Scam

- Potential for Manipulation

- Stay Updated

- Bottom line

- Conclusion

Investing in cryptocurrency can feel like the Wild West. New exchanges and tokens pop up constantly, and it’s hard to know which ones are safe. Enter the crypto Trust Score – a handy metric designed to gauge the safety and reliability of exchanges, cryptocurrencies, and platforms. Simply put, a crypto Trust Score is like an “investment trust score” for crypto assets: a single rating that distills complex risk signals (liquidity, security, compliance, user feedback, etc.) into an easy-to-understand indicator. Much like a credit score for banks or a review rating for apps, a Trust Score gives investors a quick sense of how trustworthy a platform or asset might be.

In this guide, we’ll demystify Trust Scores in crypto – why they matter, how they’re calculated, and how you can use them (wisely) when making investment decisions.

Key Takeaways

Trust Scores help identify reliable platforms and reduce risk. They aggregate many factors (liquidity, security, compliance, etc.) into one simple rating that indicates how trustworthy an exchange or asset is.

Use multiple sources to verify trust metrics. Compare Trust Scores from different platforms (e.g. CoinGecko, CryptoCompare, Trustpilot) to get a more comprehensive view.

Never rely on Trust Scores alone – always do your own research. Treat Trust Scores as one of many risk indicators, and supplement them with due diligence and common sense.

Why Trust Score Matters in Crypto Investing?

Trust is everything in the volatile crypto market. High trading volume or flashy marketing doesn’t always mean a platform is safe. In fact, a 2019 analysis found that as much as 95% of trading volume on some unregulated exchanges was fake – meaning some sketchy platforms appeared at the top of volume rankings and lured in investors who assumed “bigger is safer.”

👉 fake trading volume on unregulated exchanges

By ranking exchanges by trust rather than just reported volume, the landscape changed: well-known, regulated exchanges with deeper liquidity and better security rose to the top, while obscure exchanges with questionable stats fell down the list. This gave everyday investors a quick way to spot which exchanges actually offer a safer trading environment, rather than just relying on hype or self-reported numbers. Beyond exchanges, trust scoring is also being applied to evaluating cryptocurrencies and DeFi projects. In a world where new tokens launch daily, a Trust Score or similar rating can help flag red flags – for instance, if a token’s development activity is low, or if the founding team is anonymous.

How Trust Scores Work (Factors and Sources)

A Trust Score isn’t pulled out of thin air – it’s calculated by analyzing multiple dimensions of a platform’s health and integrity. While different organizations use their own scoring models, most Trust Scores are built on a shared foundation of core criteria that signal reliability and risk.

These commonly include:

Liquidity & Volume Quality

Security Record

Regulatory Compliance

Team Transparency

User Feedback

Each provider may assign different weights to these elements, but together they form a holistic view of trustworthiness based on how key trust score metrics and signals are assessed and combined.

👉 how trust score metrics and key signals are evaluated

Major sources of Trust Scores include data aggregators, user review platforms, and newer AI-based analysis tools. For example, CoinGecko assigns a 1–10 Trust Score for exchanges by evaluating factors such as liquidity, API reliability, and cybersecurity practices. CryptoCompare offers an Exchange Benchmark that grades platforms from AA (very trusted) down to F (poor) based on security standards, regulatory status, and market quality. Trustpilot, on the other hand, aggregates user reviews into a TrustScore that reflects customer sentiment—useful context, though one that can sometimes be biased or manipulated.

More recently, AI-driven trust analysis platforms have entered the landscape, combining on-chain data, market statistics, and fundamental indicators to generate dynamic trust ratings for crypto assets and exchanges. One example is Forvest’s Trust Score analysis, which produces an automated “investment trust score” for each asset, helping investors distinguish relatively safer opportunities from higher-risk ones.

Source: Kaiko Asset Metrics

Using Trust Scores in Your Investment Strategy

Having a Trust Score at your fingertips is great – but how do you actually use it to make smarter investment moves? Think of Trust Scores as a first filter for decision-making:

Choosing exchanges

If you’re deciding where to buy a new cryptocurrency and see that Exchange A has a Trust Score of 9/10 (green) while Exchange B has 4/10 (red), lean towards A. A high score suggests strong liquidity, security, and reputation. A low score is a glaring warning – perhaps poor liquidity, past hacks, or other issues. A slightly lower trading fee on a low-trust exchange isn’t worth the risk of potential loss or headaches down the line. Trust Scores help you avoid chasing deals on unreliable platforms.

Evaluating coins or projects

Similarly, when comparing two cryptocurrencies, a high trust-rated project (e.g. audited code, active development, transparent team) is generally a safer bet than one with no trust rating or numerous red flags. If Token X has an “A” grade on a research site and Token Y is unrated with rumors of the team disappearing, you’d likely favor Token X or at least dig much deeper before touching Token Y.

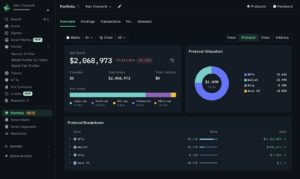

Portfolio monitoring

You can incorporate trust metrics into how you manage your crypto holdings. Some advanced investors set rules like “only keep funds on exchanges with a Trust Score above 8” or use portfolio trackers that alert them if any asset or platform’s trust rating drops suddenly. Many modern crypto apps (including AI-driven trust analysis platforms) let you see trust scores in your dashboard, so you can quickly gauge which holdings are more speculative versus stable. Using these tools can act as an early warning system – for example, if an exchange’s score plummets due to a new security incident, you might get a prompt to withdraw funds to a safer place.

In practice, using Trust Scores is about informed caution. Make it a habit to check the Trust Score (or similar trust indicators) before you:

- Open an account on a new exchange (Is the exchange reputable and safe?)

- Buy a new coin or token (Does the project seem trustworthy or is it a high-risk gamble?)

- Stake or lend crypto on a platform (Is the platform known to be reliable or are there many complaints from users?)

By incorporating these simple checks, you’re more likely to avoid pitfalls like depositing money on a dubious exchange that might freeze withdrawals, or buying into a project that’s one week away from imploding. Trust Scores are a starting point for due diligence, helping you quickly filter out the riskiest options so you can focus your research on the better ones. Just remember: use Trust Scores as a guide, not gospel. They’re one tool in your toolkit – they can make your decision-making more efficient, but they don’t replace your own critical analysis.

Source: Nansen Portfolio Interface

Limitations and Best Practices

While Trust Scores are incredibly useful, they aren’t perfect. It’s important to be aware of their limitations and use them smartly:

No Score Guarantees Zero Risk

A high Trust Score (say 9/10 or an “AA” grade) indicates strong confidence in a platform so far, but it’s not a 100% safety guarantee. Even top-rated exchanges or coins can face unexpected issues (hacks, sudden regulatory changes, etc.). Treat a high score as a reassurance, not an excuse to drop your guard. Continue following security best practices (e.g. use hardware wallets for long-term storage, enable 2FA on accounts) regardless of how trusted a platform is.

Scores Can Vary by Source

Different platforms calculate trustworthiness differently. You might see an exchange rated 10/10 on CoinGecko but only a “B” on CryptoCompare, or a wallet with 4.5 stars on Trustpilot yet flagged by a security audit site. These aren’t necessarily contradictions – each source looks at different data and criteria. That’s why cross-referencing multiple trust sources is wise. If they all align, great. If they conflict, dig into why (maybe one focuses on technical factors, another on user sentiment).

Low Score Doesn’t Always Mean Scam

Generally, a low Trust Score is a red flag, but context matters. A new exchange or DeFi project might start with a low score simply because it’s unproven or lacks data, not because it’s malicious. Some legitimate projects might also score poorly if they, say, prioritize privacy over compliance (leading to low marks on regulatory factors). So a low score means proceed with caution and investigate why the score is low. Sometimes you’ll find the concerns are real and you should stay away; other times you might decide the potential benefits outweigh the risks if you take additional precautions.

Potential for Manipulation

Be mindful that any metric can be gamed. User-driven scores can be skewed by fake reviews (for example, Binance’s Trustpilot page once had its rating disabled due to widespread fake positive reviews). On the flip side, angry users or competitors might spam a platform with 1-star reviews. Trust score providers do fight these tactics with algorithms and warnings, but as an investor you should look out for signs of manipulation (e.g. a flood of overly generic 5-star reviews).

Stay Updated

Trust Scores are only as current as the data behind them. They might not immediately reflect very recent events. If an exchange was rock-solid but got hacked last week, its high score might not have dropped yet – so always scan recent news in addition to checking the score. Conversely, if a platform improved security or transparency recently, it might take time for its score to rise. Make it a habit to re-check the trust scores of the services you use periodically, and especially before making big moves or adding more funds.

Bottom line

Trust Scores are powerful aids to help you invest more safely, but they’re not a silver bullet. Use them as an early filter and confidence check, then follow through with your own research and good judgement.

Conclusion

The world of crypto investing is exciting but fraught with risks – and Trust Scores have emerged as a valuable compass to navigate that landscape. We started by asking what is a Trust Score in crypto and how can you rely on it when investing, and we’ve seen that a Trust Score is essentially your shortcut to gauging a platform’s credibility and safety. It condenses everything from liquidity and security practices to user satisfaction into an easy-to-digest rating. For both newcomers and experienced traders, trust scores serve as a reality check in a market where hype can sometimes obscure the truth.

Using Trust Scores wisely can stack the odds in your favor. They can steer you away from dubious exchanges where you might lose money, or alert you to scam tokens that could turn into disasters. High trust metrics encourage you to favor venues with proven track records, good liquidity, and positive user experiences – all of which reduce the chance of nasty surprises. But remember the flip side: never rely on Trust Scores alone. They are the beginning of wisdom, not the end. The savviest investors treat them as one input among many. Think of a Trust Score as the first chapter of a story; it’s on you to read the whole book before investing big.

Going forward, keep practicing due diligence. If a platform’s Trust Score looks great, enjoy the confidence that brings – but still keep your security habits sharp. If a score looks poor, be thankful for the red flag – and either stay away or proceed only with strong reasons and backup plans. Over time, you’ll develop intuition that works hand-in-hand with these scores. And don’t hesitate to leverage tools that make the process easier. Many modern crypto portfolio platforms integrate trust metrics directly into their dashboards. For example, Trust Score analysis by Forvest can automatically evaluate the trustworthiness of assets and exchanges in your portfolio, helping you make informed decisions at a glance. Using such features can save you time and add an extra layer of safety to your strategy.

In the ever-evolving crypto space, trust is a currency of its own. By understanding and utilizing Trust Scores, you’re effectively investing in peace of mind. Here’s to making smarter, safer crypto investments – may your portfolio grow, and may your risks be calculated and well-managed. Stay informed, stay secure, and happy investing!

Rating of this post

Rate

If you enjoyed this article, please rate it.

FAQs for crypto trust score

A Trust Score in the crypto market is essentially a reliability rating for an exchange, platform, or even a specific cryptocurrency. It summarizes how trustworthy that entity is by looking at factors like liquidity, security record, regulatory compliance, transparency, and user feedback. Think of it like a credit score or a restaurant’s star rating, but for crypto services – it gives you a quick gauge of risk. A high Trust Score means the exchange or coin is generally considered safe and reputable, whereas a low score suggests caution (there may be issues like poor liquidity, past hacks, or unhappy users).

Trust Scores are calculated by different organizations using their own formulas, but all of them aggregate data to rate trustworthiness. Data aggregators like CoinGecko and CryptoCompare pull metrics (trading volumes, order book depth, cybersecurity audits, compliance records, etc.) and compute a score or grade. For example, CoinGecko’s Trust Score rates exchanges on a 1-to-10 scale by weighing seven components (liquidity, technical integration, security, team, etc.), while CryptoCompare issues letter grades (AA, A, B, etc.) factoring in legal compliance and market quality. User review platforms like Trustpilot determine a TrustScore (1 to 5) purely from customer ratings and reviews of an exchange or wallet. Proprietary and AI-driven systems (such as Forvest’s in-house Trust Score analysis) combine many signals – including on-chain data and fundamentals – to score how risky or reliable a crypto asset is. You can find Trust Scores on sites like CoinGecko (check an exchange’s page or a coin’s “Markets” section for trust indicators), on CryptoCompare’s exchange rankings, on Trustpilot by searching the company name, or by using crypto portfolio tools that include trust metrics. Often, it’s best to look at a couple of these sources to get a well-rounded view.

No – you shouldn’t rely solely on Trust Scores when investing. Trust Scores are extremely useful, but they are just one tool in your arsenal. Treat them as a starting filter or a sanity check. A Trust Score can tell you if something is probably safe or probably risky, but it doesn’t guarantee profits or predict future problems. Always combine the Trust Score with other research: look at the project’s fundamentals (what does it do, who’s behind it, does it have a community?), consider market conditions, and factor in your own risk tolerance. A high Trust Score doesn’t mean you invest blindly – for example, even a top-rated exchange encourages users to use personal wallets for large holdings, because anything can happen. Likewise, a low Trust Score doesn’t automatically mean you should never touch a project (but it does mean be very careful and do extra homework if you proceed). In short, use Trust Scores to inform and enhance your decisions, not to make them for you.

Yes, Trust Scores serve as an early warning system by flagging red flags such as anonymous teams, low liquidity, or a lack of development activity. While they can’t predict scams with 100% accuracy, they often highlight risk factors that are common in rug pulls and fraudulent projects. Use them alongside your own due diligence for best results.

Trust Scores can change rapidly due to hacks, regulatory actions, or liquidity issues. As a best practice, review Trust Scores at least monthly—or immediately before making large transactions. Use tools that offer real-time trust metrics in your dashboard for ongoing monitoring.

Rating of this post

Rate

If you enjoyed this article, please rate it.