Using Trust Score to Evaluate Emerging Cryptocurrencies: A Smarter Way to Vet New Coins

- Trust Scores in Cryptocurrency

- Why Evaluating Emerging Cryptocurrencies Matters

- What is a Trust Score?

- Key Metrics Used in Trust Scoring

- Team Transparency & Reputation

- Smart Contract Security & Audits

- Liquidity & Trading Volume

- Token Distribution & Supply Mechanics

- Community Engagement & Sentiment

- Development Activity

- Regulatory Compliance & History

- Benefits of Using Trust Scores for New Coins

- Early Scam Detection

- Data-Driven Confidence

- Faster Due Diligence

- Objective Benchmark for Comparison

- Risk Mitigation and Peace of Mind

- Limitations and Considerations

- Not 100% Foolproof

- Different Methodologies

- New Coins May Lack Data

- Dynamic and Lagging Nature

- Not All Risks Are Quantifiable

- Use in Context of Your Strategy

- Step-by-Step: How to Use Trust Score to Assess New Cryptocurrencies

- Find the Coin’s Trust Score

- Note the Score Value and Rating Level

- Dig Into the Details Behind the Score

- Compare with Peers and Benchmarks

- Monitor for Changes or Updates

- Incorporate the Trust Score into Your Decision

- Popular Tools and Platforms Providing Trust Scores

- Forvest’s Fortuna (Trust Score Analysis)

- CoinGecko Trust Score

- CertiK Security Leaderboard (Skynet Trust Score)

- DYOR and STON.fi Trust Score

- Cyberscope & Other Emerging Platforms

- Best Practices for Investors Using Trust Scores

- Always Do Your Own Research (DYOR)

- Watch for Red Flags Beyond the Score

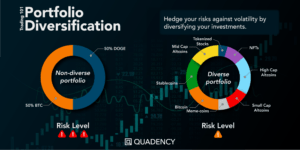

- Diversify and Manage Risk

- Stay Updated and Engage

- Use Multiple Tools and Cross-Reference

- Keep Long-Term Perspective

- Conclusion – Using Trust Scores for Smarter Crypto Investing

Trust Scores in Cryptocurrency

In the “Wild West” of crypto, thousands of new coins launch each year—unfortunately, many are risky or outright scams. As of 2025, over 17,000 cryptocurrencies have been created, but only around 10,385 are active, meaning a large number have already failed or been abandoned. Alarmingly, nearly 80% of 2017’s ICO projects turned out to be scams, and crypto scams cost at least $9.9 billion in 2024 alone. Investors clearly need a fast, evidence-based way to assess which new coins are credible. Trust scores offer exactly that—a data-driven metric that flags dubious projects before you get burned by helping investors understand how trust scores in cryptocurrency work.

A Trust Score in cryptocurrency is a composite metric that evaluates a project’s reliability and credibility by analyzing factors like security audits, trading liquidity, developer transparency, and community support. Investors can use a trust score to quickly gauge whether an emerging coin is likely legitimate or high-risk before investing. For example, Forvest’s own crypto glossary describes a trust score as essentially a “reliability rating” indicating how trustworthy a project is. In practice, trust scores distill a coin’s risk signals (technical, market, and community factors) into one easy-to-understand rating, helping even non-experts spot red flags early. We’ll explore why evaluating new cryptocurrencies matters, how trust scoring works, and how you can leverage it (alongside due diligence) to invest more safely.

Why Evaluating Emerging Cryptocurrencies Matters

Investing in a brand-new coin can be exciting, but it’s also perilous. Emerging cryptocurrencies often lack a proven track record, and some are launched by anonymous teams with questionable intent. In fact, a report found that almost 80% of ICO projects in 2017 were scams, highlighting how common fraudulent projects have been. While the crypto market has matured since then, rug pulls and scams remain a real threat – recent analytics show crypto scam revenue hit record highs nearing $10–12 billion in 2024. New projects can fail for other reasons too: technical flaws, zero adoption, or poor management. Without proper evaluation, an investor might pour money into the “next big coin” only to see it vanish overnight.

Evaluating emerging cryptocurrencies is therefore crucial to protect your portfolio. Unlike established coins (Bitcoin, Ethereum, etc.) that have years of history, new tokens require extra scrutiny. Key questions include: Is the development team transparent and competent? Does the project have real users and liquidity? Has the code been audited? Performing this due diligence for every coin can be time-consuming, which is why trust scores are so valuable. A trust score provides an at-a-glance risk assessment, helping you filter out obvious scams or weak projects quickly. It won’t replace thorough research, but it guides your attention to critical red flags or green lights. In short, evaluating new cryptos via trust scores matters because it separates the potential gems from the countless junk coins, saving you from costly mistakes while allowing you to seize promising opportunities confidently.

Source: Portfolio analytics dashboard (illustrative example)

What is a Trust Score?

In simple terms, a trust score in crypto is a numeric rating (for example, 1 to 10 or 0% to 100%) that reflects a project’s overall trustworthiness. It is a composite metric – meaning it aggregates many data points about the cryptocurrency’s technical robustness, market health, and community standing. Think of it like a credit score or a Moody’s rating, but for crypto projects: a single score that indicates how reliable and secure a coin appears to be.

Trust scores are computed by analyzing both on-chain data and off-chain factors. On-chain metrics might include the coin’s liquidity (trading volume, order book depth) and contract security (audit results, code vulnerabilities). Off-chain factors can include the team’s transparency and reputation, community sentiment, and even regulatory compliance checks. Each trust scoring provider has its own formula. For example, CoinGecko introduced a Trust Score to rank exchanges by blending trading volume, web traffic, and order book depth. Security firms like CertiK use a similar concept: their Skynet Trust Score breaks out a Security Score (code risk) and a Community & Market Score (social presence and market stability) for projects. Regardless of the formula, the core idea is the same – a high trust score suggests the project shows many positive signals of credibility, while a low trust score indicates multiple risk factors.

For example, a platform might assign scores on a scale of 0 to 100, with 100 meaning complete trust (excellent on all criteria) and lower ranges indicating increasing risk. A project with a trust score of say 85/100 or 8.5/10 would be considered relatively trustworthy (strong security audits, active community, etc.), whereas one with 30/100 or 3/10 would be deemed very risky. Trust scores essentially quantify due diligence – instead of manually weighing dozens of variables, you get an overall rating that encapsulates those variables. It’s an incredibly useful shorthand, but to really understand it, you need to know what goes into that number. Let’s look at the key metrics that drive a trust score.

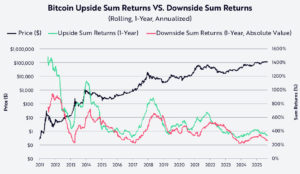

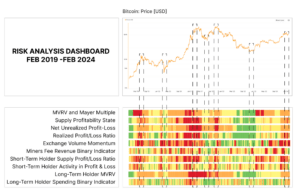

Source: Glassnode

Key Metrics Used in Trust Scoring

Trust scoring models evaluate a variety of factors to compute a project’s score. While implementations differ, most trust score algorithms consider a common set of metrics that cover a project’s fundamentals, technical security, and market activity. Understanding these key trust score metrics and signals helps investors interpret how risk and credibility are assessed across different projects.

Team Transparency & Reputation

A trustworthy project typically has an identifiable, experienced team with a public track record. Transparent communication and credible leadership are vital. Research shows a project’s credibility heavily depends on having a known, competent team and open communication with its community. If the developers are anonymous or have a history of failed projects, trust scores will reflect that negatively.

Smart Contract Security & Audits

The technical safety of a crypto project is paramount. Trust scoring systems check if the project’s smart contracts have been audited by reputable third parties and whether the code is open-source and verifiably secure. Projects that lack audits or have unverified code are major red flags. In fact, third-party code audits are considered crucial – avoiding coins without published security audits is a common safety rule. Advanced trust platforms even integrate automated smart contract analysis into the score. A strong trust score requires that no glaring vulnerabilities or exploits are found in the project’s codebase.

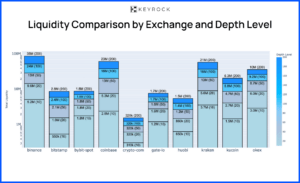

Liquidity & Trading Volume

Healthy trading activity is another important factor. A reliable project will have sufficient liquidity and volume on exchanges, indicating that many traders are involved and the market for the token is active. Extremely low liquidity (or reliance on a single exchange/pair) makes price manipulation easy and signals caution. Trust score algorithms often analyze trading patterns to weed out fake volume or wash trading. For example, if a token’s volume is suspiciously high but web traffic or order book depth is low (a sign of inflated numbers), the trust score would be adjusted downward. Consistent, organic volume and a tight bid/ask spread help boost a coin’s trust score.

Source: Keyrock liquidity research

Token Distribution & Supply Mechanics

Who holds the tokens? A project’s tokenomics can reveal potential risks. If a small number of wallets control a significant percentage of the supply, the project is vulnerable to price manipulation or sudden rug pulls. Ideally, the token distribution should be fair and decentralized, with team/advisors holding reasonable portions and lock-up periods in place (to prevent dumping). Trust scoring looks for red flags like unlocked liquidity pools, unlimited minting functions, or contract features that could be abused. Balanced tokenomics and transparent supply schedules will result in a higher trust score, whereas an uneven distribution (e.g. devs holding 50% of supply in one wallet) will drag the score down.

Community Engagement & Sentiment

The strength and behavior of a project’s community are telling signs of legitimacy. Active community channels (Discord, Telegram, Reddit, etc.) with organic, transparent discussions indicate real interest and oversight. On the other hand, if a project relies solely on high-pressure marketing, paid shills, or promises of “guaranteed moon returns,” it’s a big red flag. Some trust score models quantify social media activity, developer updates, and even sentiment analysis of discussions. A coin with a vibrant, positive community and responsive developers will score better on trust. Scam projects often have either no real community or a very toxic/hype-driven one.

Development Activity

A legitimate emerging cryptocurrency project will show ongoing development work. Trust score systems may factor in GitHub repository activity (commits, code releases), development milestones achieved, and the frequency of project updates. This ties into community as well – an active development team that continuously improves the project (and communicates progress) builds trust. Conversely, a stagnant GitHub or a project that hasn’t updated its code in months would get a lower score, as it suggests abandonment or lack of substance.

Regulatory Compliance & History

Some advanced trust scores incorporate checks for legal or regulatory red flags. For example, has the project been flagged by regulators or linked to illicit activity? Is it making efforts to comply with relevant laws (like KYC/AML if applicable)? While crypto is largely unregulated, a project that blatantly disregards laws or has been involved in past controversies will lose trust points. Additionally, any major past incidents – such as hacks, exploits, or broken promises – can be recorded. A project with no major incidents will rank higher in trust than one that suffered a huge hack and never compensated users. Essentially, a trust score blends objective on-chain data (volume, code audits, etc.) with subjective off-chain info (team credibility, news, legal standing) to cover all bases.

Each of these factors by itself might not tell the whole story, but together they provide a holistic picture of a crypto project’s reliability. Trust scoring algorithms weigh these metrics (sometimes assigning more weight to security, for instance) to calculate the final score. Understanding these components helps you interpret why a given coin has the score it does – for instance, a coin might have a mediocre score because, although its code is solid and volume high, the team is anonymous and the community is sparse. In the next section, we’ll discuss the concrete benefits of using such trust scores, especially when dealing with new and unproven cryptocurrencies.

Benefits of Using Trust Scores for New Coins

Why bother with trust scores at all? For anyone investing in new or lesser-known crypto assets, trust scores offer several key benefits that can greatly improve your decision-making:

Early Scam Detection

Trust scores act as an early warning system. They flag suspicious projects before you invest, potentially saving you from scams or rug pulls. If a new coin launches and immediately shows a very low trust score (due to, say, an unaudited contract and anonymous team), you know to step back. In one real scenario, an investor almost bought into a freshly launched token with zero community engagement—fortunately, an early-warning trust score flagged it as dangerously weak, helping them avoid a likely rug pull. This kind of proactive scam detection is invaluable. Blockchain security firms are even patenting AI-powered trust scoring platforms designed to deliver instant red flags for scam patterns and security vulnerabilities, underscoring how crucial early detection has become.

Data-Driven Confidence

Trust scores replace gut feeling and hype with quantitative insight. For a new cryptocurrency, you might only have marketing materials or forum chatter to go on. A trust score cuts through that noise by providing an objective, evidence-based assessment of the project’s credibility. This gives you confidence grounded in data. As one industry analysis noted, standardized scoring enables faster and more accurate evaluation of potential crypto projects, which “increases the efficiency of decision-making and reduces risks” for investors. In other words, you can invest (or choose not to) with far more confidence because a trust score backs up your choice with concrete metrics.

Faster Due Diligence

Time is money, especially in crypto where opportunities (and threats) emerge quickly. Manually researching every aspect of a new coin can take many hours or days – reading whitepapers, vetting code, scouring social media, etc. Trust scores summarize all that due diligence at a glance, saving you time. Instead of poring over on-chain data and Reddit threads, you can check a coin’s trust score for a quick read on its risk level. This doesn’t mean you skip research altogether, but it drastically narrows your focus. For example, if the trust score is high, you might decide the project is worth a deeper look (and you’ll know which areas are strong). If it’s very low, you may decide not to bother at all, or to investigate the specific weaknesses that caused the low score. Either way, you’re conducting triage efficiently. A trust score streamlines your workflow by highlighting what warrants attention first.

Source: Quadency

Objective Benchmark for Comparison

Trust scores provide a common benchmark to compare multiple projects on equal footing. It’s hard to directly compare two different new coins – one might have a great team but no liquidity, the other vice versa. A unified scoring system accounts for all those factors and tells you which project is overall more trustworthy. This is especially helpful for portfolio construction: you might decide to only invest in projects above a certain trust score threshold. Launchpad platforms and exchanges also use such scores to vet which projects to list, ensuring quality and boosting user confidence. For individual investors, having a numeric trust rating for each coin allows more apples-to-apples comparisons when deciding where to allocate funds.

Risk Mitigation and Peace of Mind

Ultimately, using trust scores helps you manage risk in the volatile crypto space. It’s not about guaranteeing profits – it’s about avoiding landmines. By focusing on high-trust projects, you reduce the chances of falling victim to scams or incompetent ventures. This doesn’t mean high-trust projects can’t fail (they can, due to market swings or unforeseeable events), but your baseline risk is lower. Many crypto veterans stress that no system is perfect, but tools like trust scores “significantly help filter out scams” and serve as a “beacon, guiding users to navigate the complex web of crypto transactions safely”. For new investors, this peace of mind is huge – you have a safety net of diligence supporting your choices.

In summary, trust scores give you speed, clarity, and confidence when evaluating new cryptocurrencies. They leverage big data and expert algorithms so you don’t have to be a cybersecurity expert or blockchain sleuth to spot a shady coin. By incorporating trust scores into your process, you gain a critical edge: you’re investing smarter, not just harder.

Limitations and Considerations

While trust scores are a powerful tool, it’s important to understand their limitations. A trust score should be one component of your decision – not the sole decider. Here are some key considerations to keep in mind:

Not 100% Foolproof

No evaluation metric can guarantee a project won’t fail or turn fraudulent. A trust score is a risk indicator, not a crystal ball. It reflects the data available at the time. A coin with a high trust score means it currently appears solid (good liquidity, strong security, etc.), but unexpected events can still occur. Even top-rated projects can suffer hacks or leadership scandals that a score couldn’t predict. Likewise, a clever scam might temporarily game certain metrics to appear trustworthy. Use trust scores as a guiding signal, not an absolute guarantee. As one DeFi platform notes, the trust score is “not financial advice or a guarantee – simply one of many tools”, with the ultimate responsibility still on the user.

Different Methodologies

Trust scores can vary across platforms. One site’s algorithm might weigh community sentiment heavily, while another cares more about code audits. It’s possible to see a coin rated medium risk on one platform but high risk on another due to these differences. For this reason, if possible, cross-check trust scores from multiple sources. If most sources agree a project is low-trust, that’s a strong warning. If there’s divergence, dig into why – maybe one algorithm spotted something the other didn’t. Understanding the methodology (when available) will help you interpret the score correctly.

New Coins May Lack Data

A brand-new token might not have enough data to generate a meaningful trust score. Many platforms will either give such a coin a default low score (to err on the side of caution) or no score at all until more information is available. A missing trust score or extremely low initial score is itself a red flag – it means you’re essentially flying blind, and extra caution is warranted. With no trading history or community to analyze, you should assume high risk by default. As the project develops, the trust score can improve if positive signals emerge.

Dynamic and Lagging Nature

Trust scores are dynamic – they update as conditions change – but they might not update instantly. If a project’s founder suddenly quits or a security breach happens, it may take some time for those events to reflect in the trust score (depending on how frequently data is polled). Some scoring systems refresh in real-time or daily, others more slowly. So, always check the last updated time on a score, and supplement with real-time news monitoring for critical developments. Don’t rely on an old snapshot. Conversely, a project might improve (fixing a bug, gaining liquidity) but its score might lag in reflecting that improvement for a short period. Use trust scores as a living indicator and look for trends over time – a rising trust score could confirm a project is getting safer, while a falling one signals emerging problems.

Not All Risks Are Quantifiable

Trust algorithms focus on measurable factors, but some risks are qualitative or hidden. For example, if insiders have malicious intent or there’s a conspiracy to pump-and-dump, it might not show up in the on-chain data until it’s too late. Or the project could have a great score but be in a niche that’s about to face regulatory bans – something a generic score might not account for. That’s why it’s important to not rely solely on the number. Continue to do your own research (DYOR): read the project’s whitepaper, engage in the community to sense the culture, and use common sense. Trust score is best used to augment your due diligence, not replace it. As an analogy, think of it like a credit score – a helpful summary, but you’d still want to read the fine print before lending money solely based on a credit score.

Use in Context of Your Strategy

Finally, consider how trust scores fit your personal investment strategy and risk tolerance. A very risk-averse investor might decide to only look at projects above a certain trust score. A more adventurous investor might use trust scores to size positions (e.g., investing smaller amounts in low-score projects and more in high-score ones). There’s no one-size-fits-all. Remember that market volatility still applies – a high trust score doesn’t mean the coin’s price will go up, it just means the project is fundamentally sounder. External factors like market sentiment or macroeconomic events can impact even the most trustworthy crypto. As one expert put it, a perfectly secure and transparent token can “still lose value if the broader market crashes”. So, maintain realistic expectations and a balanced portfolio approach.

In short, trust scores are extremely useful but not infallible. Treat them as a helpful “second opinion” and a starting point for deeper investigation. By acknowledging their limitations, you can avoid a false sense of security and use trust scores wisely as part of a broader risk management strategy.

Source: Investopedia

Step-by-Step: How to Use Trust Score to Assess New Cryptocurrencies

Trust scores are only effective if you know how to integrate them into your research process. Here’s a step-by-step guide to using trust scores to evaluate a new cryptocurrency project:

Find the Coin’s Trust Score

First, identify where you can get a trust score for the coin. Many crypto analytics platforms and tools provide trust scores or similar ratings. This could be a feature on an exchange data site, a blockchain security dashboard, or an AI-powered crypto assistant. For example, you might use Forvest’s Fortuna AI platform (which offers a Trust Score analysis for various coins) or check if sites like CoinGecko/CoinMarketCap list a confidence score for the project. Simply enter the coin’s name or ticker on the platform to retrieve its trust score. If the coin is so new or obscure that no service has a score for it, consider that a warning sign — you’re dealing with a very unknown quantity.

Note the Score Value and Rating Level

Once you have the trust score, record its value and any qualitative rating associated with it. Is it, say, 8.2/10 (“High Trust”), 5/10 (“Medium”), or 2/10 (“Low/Red”)? Platforms often color-code or label the scores (e.g., green for high trust, yellow for moderate, red for low). This gives you an initial impression of where the project stands. If the score is in the top tier, that’s encouraging; if it’s very low, that’s an immediate red flag. Some systems may also provide category breakdowns (for example, Security: 9/10, Community: 8/10, Liquidity: 6/10). Jot down these components if available, as they tell you which aspects are strong or weak.

Dig Into the Details Behind the Score

Don’t stop at the number – click through to see the detailed analysis that led to the score. A good trust score tool will show the underlying factors. For instance, if the score is 6/10, you want to know why. Maybe the code audit score is excellent but the liquidity score is poor. Or the project might have lost points due to team anonymity or a past incident. Understanding the context is crucial. Examine each category: Team, Security, Liquidity, Community, etc. Most platforms will highlight any red flags detected (e.g., “No smart contract audit found” or “Top holder owns 40% of supply”). Pay special attention to these warnings. If the trust score is aggregated from multiple sub-scores, identify the weakest link. This step is about converting the abstract score into concrete observations about the project’s strengths and weaknesses.

Compare with Peers and Benchmarks

To gauge what the trust score means in practice, compare the project’s score to those of similar projects or an industry benchmark. Is it in the same range as other reputable projects in its category, or is it lagging behind? For example, if you’re evaluating a new DeFi token and its trust score is 70/100, check what established DeFi projects score – if Uniswap or Aave are, say, 85/100, then 70 indicates this new one has more risk comparatively. If similar new projects are around 50, then 70 is actually quite strong in context. Some trust score platforms allow side-by-side comparisons or show percentile rankings. Use these to contextualize the coin’s trustworthiness. If a project’s score is dramatically lower than its peers, that’s a sign to investigate why. On the flip side, if it’s unusually high for a newcomer, dig in to confirm it isn’t an error or temporary fluke.

Monitor for Changes or Updates

Trust scores aren’t static. Make it a habit to re-check the score regularly while you are considering an investment. Significant changes in the score can happen if new data comes in. For instance, suppose the developers announce they completed a security audit – the trust score might jump upward once that’s factored in. Or if a hack or major sell-off occurs, the score could drop. By monitoring the score over days or weeks, you can see if the project is trending in a positive direction (gaining trust) or if it’s deteriorating. A sudden drop from, say, 7/10 to 5/10 would warrant immediate investigation (perhaps news you missed). Many platforms timestamp their last update; also keep an eye on news feeds for any significant events that could influence the score (and verify if the score reflects them). The key is to use trust score as a living metric, not a one-time checkmark.

Incorporate the Trust Score into Your Decision

Finally, combine what you’ve learned from the trust score with your own research and risk appetite to make an investment decision. If the trust score revealed certain weaknesses (for example, low liquidity and a single whale controlling tokens), you might decide to either pass on the investment or proceed with caution (perhaps investing a smaller amount). If the score is high and you found minimal red flags, you might feel more confident investing a larger allocation. Always cross-verify critical points: for example, if the trust score flagged “no audit,” see if the team has one pending or perhaps they did an audit not picked up by the tool. Use the score as a core input in your broader due diligence process. And remember, regardless of score, apply general best practices like diversification and not investing more than you can afford to lose. A trust score is there to inform your decision, not make it for you. By following these steps – checking, understanding, comparing, and continuously monitoring the trust score – you’ll integrate this tool effectively into your strategy for evaluating emerging cryptocurrencies.

Popular Tools and Platforms Providing Trust Scores

With the growing importance of trust metrics, several tools and platforms now offer trust scores or similar ratings for crypto projects. Here are some of the notable ones:

Forvest’s Fortuna (Trust Score Analysis)

Forvest’s own AI-driven platform, Fortuna, provides a Trust Score analysis for cryptocurrencies. Fortuna crunches extensive fundamental and technical data on each coin and outputs a trust score to help investors identify the most reliable assets. This tool is designed to be user-friendly for portfolio management – you can simply search a coin, and it will display a trust score along with insights into the coin’s risk factors. Fortuna leverages Forvest’s expertise in AI and crypto fundamentals to deliver up-to-date trust assessments. (Product Insight: By using Fortuna’s trust score, Forvest users can quickly vet new coins within their dashboard and make more informed portfolio choices.)

CoinGecko Trust Score

CoinGecko, a popular crypto data aggregator, introduced a “Trust Score” system initially to rank exchanges by reliability. They look at factors like exchange trading volume versus web traffic (to detect fake volume), order book depth, cybersecurity certifications, and more. On CoinGecko’s site, exchanges and sometimes trading pairs are tagged with trust scores (e.g., “Trust Score: High/Medium/Low”). While primarily for exchange legitimacy, this concept is expanding – CoinGecko’s methodology as of 2025 includes components such as liquidity, team presence, past incidents, and even proof of reserves for exchanges. It’s a great example of a multi-factor trust algorithm in action. Investors can use CoinGecko’s trust indicators to ensure they are trading on reputable platforms and to gauge the confidence in certain market data.

CertiK Security Leaderboard (Skynet Trust Score)

CertiK is a leading blockchain security auditor, and they offer a Security Leaderboard that rates projects on safety and trust. Their updated Skynet Trust Score combines a Security Score (based on code audits and on-chain monitoring) with a Community & Market Score (tracking social sentiment, community size, market stability). This yields an overall trust score for many DeFi and blockchain projects. If you visit CertiK’s leaderboard, you can see scores and rankings for projects like Polygon, BSC-based tokens, etc., along with alerts for any issues (like if a project’s liquidity is suddenly pulled, the score will drop). CertiK’s platform is especially useful for checking if a project has been audited and if any vulnerabilities were found. A high CertiK score can provide extra peace of mind that the code is secure and the community is strong.

Source: Glassnode / On-chain analytics platforms

DYOR and STON.fi Trust Score

DYOR is an analytics provider (the name literally stands for “Do Your Own Research”) that has developed algorithms to rate token trustworthiness. An example implementation is on STON.fi, a decentralized exchange, which introduced a Trust Score for tokens in late 2024. STON.fi’s Trust Score is a percentage-based rating for tokens traded on its DEX, powered by DYOR’s algorithm. It analyzes publicly available data such as trading volume, price volatility trends, token mint/burn mechanics, and other health signals, then produces a clear percentage rating (with higher percentages indicating more reliable patterns and liquidity). The Trust Score is displayed next to tokens on STON.fi’s interface, giving traders a quick sense of a token’s credibility before they trade. This collaboration shows how DeFi platforms are adding trust indicators to help users navigate the slew of new tokens. Other DYOR-style tools and browser plugins exist as well, which scan contracts for red flags and assign safety scores.

Cyberscope & Other Emerging Platforms

Given the demand for trust metrics, new platforms are emerging. Cyberscope, for instance, is a Web3 security firm that recently announced an AI-optimized trust scoring platform aiming to provide real-time, verifiable trust scores for every blockchain project. It plans to fuse on-chain data, off-chain data, and machine learning to flag risks (like honeypots or rug pulls) within seconds. While this is a developing service, it signals where the industry is headed – towards comprehensive dashboards where investors, exchanges, and even regulators can quickly check a project’s trust score. Similarly, some rating agencies and research firms (e.g., TokenInsight, Weiss Crypto Ratings) offer their own versions of crypto ratings which, while not called “trust scores,” serve a similar purpose of evaluating project quality on multiple criteria.

When using any trust score tool, it’s wise to understand the scope: some focus on security, others on market quality, others try to be all-in-one. For best results, use a combination of sources. For example, you might check Fortuna for an overall score, CertiK for security specifics, and CoinGecko for market integrity signals. If a project scores well across the board, that’s very reassuring. If there’s a discrepancy (say CertiK finds issues but another source doesn’t), you can investigate further. These tools are increasingly interlinked with investor workflows; by integrating them, you essentially have an AI assistant for due diligence, making the process of evaluating emerging cryptocurrencies much more effective than going it alone.

Best Practices for Investors Using Trust Scores

Armed with trust score insights, investors should still adhere to general best practices for crypto investing. Here are some tips to keep in mind, blending trust score usage with sound investment principles:

Always Do Your Own Research (DYOR)

Treat trust scores as a starting point, not the final verdict. Use them to identify which areas to research more. For example, if the trust score flags lack of a security audit, you might read the project’s documentation or ask the team if an audit is planned. Read the whitepaper, understand the project’s purpose, and verify claims (like partnerships or technology) independently. Trust scores make DYOR more focused but don’t skip it entirely. If anything, a trust score should spark the questions you need to answer before investing.

Watch for Red Flags Beyond the Score

Some things might not be explicitly in a trust score. Be cautious of projects with unrealistic promises (e.g., guaranteed profits, absurd APY yields) or those that pressure you to “ape in” quickly. No legitimate project will promise risk-free high returns. Use common-sense rules: if it sounds too good to be true, it probably is. Also, even if a trust score is decent, trust your intuition if you notice something off in the community or team behavior. Conversely, don’t dismiss a project solely because one metric is weak – consider the whole picture. A low liquidity early on, for instance, might improve if the project is otherwise strong and listing on exchanges soon. Balance the quantitative score with qualitative judgment.

Diversify and Manage Risk

A trust score can help you decide how much to invest, not just whether to invest. For high-trust projects, you might allocate a bigger portion of your portfolio (still within reason). For moderate trust ones, perhaps only a small speculative position. And you might avoid extremely low-trust projects altogether, unless you have a very strong conviction and high risk tolerance. Remember that even a great project can fail due to external factors. Spreading your investments across multiple credible projects is wiser than betting the farm on one “trusted” coin. Use position sizing in line with risk – trust scores can guide which are safer bets versus long shots. Also, continue to follow risk management strategies like setting stop-loss levels or taking profits periodically, which apply regardless of trust score.

Stay Updated and Engage

The crypto landscape changes rapidly. Stay active in following project updates and community discussions for the coins you invest in. Join their Discord or Telegram, follow their Twitter announcements. This not only keeps you informed of any new developments that could affect the trustworthiness (like new audits, partnerships, or conversely, signs of trouble), but it also lets you gauge sentiment firsthand. If you notice the project’s communication going silent or the community raising concerns, you might reconsider your investment even before a trust score changes. On the flip side, active engagement can alert you to positive developments (like a security upgrade) that might soon reflect in a rising trust score. Being proactive ensures you’re not caught off guard.

Use Multiple Tools and Cross-Reference

As mentioned, don’t rely on a single source for trust assessment. It’s good practice to use at least two trust scoring tools if available. Each might catch something the other missed. For instance, one platform might scan the code deeply, while another scrapes social media sentiment. By cross-referencing, you get a fuller picture. If you’re a Forvest user, you might use Fortuna’s trust score and also read Forvest’s blog analyses of trust score factors (to deepen your understanding). You can also leverage general crypto portfolio management principles – ensure you’re not overexposed to any one risky asset. (For further reading on maintaining a healthy crypto portfolio, see our guide on common crypto portfolio management mistakes, which covers emotional biases and poor risk practices to avoid.)

Keep Long-Term Perspective

Finally, consider your investment horizon. Trust scores are very useful for short-term risk mitigation (avoiding immediate scams), but if you’re investing long-term, also think about whether the project has a viable roadmap and real utility. A project could have a decent trust score yet still not succeed commercially if it doesn’t achieve adoption. Continuously evaluate if the fundamentals justify holding for the long run. If a high-trust project isn’t meeting its milestones or competitors are overtaking it, you may adjust your strategy. Conversely, if a project steadily improves its trust metrics over time, it’s a good sign of growing strength and you might feel confident to hold or even accumulate more. Use trust scores in tandem with a long-term fundamental outlook.

By following these best practices, you’ll maximize the value of trust scores as an investment tool while also safeguarding yourself through diversification and continued education. The goal is to invest smartly and safely. Trust scores greatly tilt the odds in your favor by exposing the risks early, but your actions as an investor – staying informed, disciplined, and adaptive – ultimately determine your success in the crypto space. Combine the power of trust scores with sound strategy, and you’ll be well-equipped to navigate even the murkiest waters of emerging cryptocurrencies.

Conclusion – Using Trust Scores for Smarter Crypto Investing

In the fast-moving world of crypto, trust is everything. When evaluating emerging cryptocurrencies, leveraging a trust score can be the difference between finding the next solid investment and falling for a costly scam. By distilling complex data into a simple rating, trust scores give you a data-driven edge and an added layer of security in your decision-making. We’ve seen how they highlight red flags (or green lights) across a project’s team, technology, and market performance, acting as a much-needed compass in a market flooded with new tokens.

However, it’s worth reiterating that trust scores work best when combined with your own informed judgment. Continue practicing due diligence, stay vigilant, and maintain a balanced approach to your crypto portfolio. When used wisely, a trust score can significantly lower your risk and boost your confidence, but it’s not a substitute for common sense and continual learning.

Ready to evaluate the reliability of new crypto projects with greater confidence? Try Forvest’s Fortuna Trust Score Analysis tool – an AI-driven platform that provides up-to-date trust scores and insights – and empower your investment decisions with objective data. Start using trust scores today to separate the promising crypto gems from the dangerous fads, and invest in emerging cryptocurrencies with a smarter, safer strategy.

Rate

Rating of this post.

If you enjoyed this article, please rate it.

FAQs for Using Trust Score to Evaluate Emerging Cryptocurrencies

A trust score is a metric that evaluates the reliability, credibility, and overall safety of a cryptocurrency or trading platform by considering various factors such as trading volume, security measures, community support, and transparency.

Trust scores help investors identify reliable, secure, and potentially profitable new cryptocurrencies by providing an evidence-based assessment, reducing the risk of scams or unreliable projects.

No evaluation system is entirely foolproof. Trust scores provide helpful guidance, but should be used in conjunction with additional research and risk management strategies.

Trust scores are influenced by factors such as security protocols, developer transparency, trading volume, liquidity, community activity, regulatory compliance, and market history.

Use trust scores to filter risky projects, compare coins objectively, and monitor trust levels over time to guide portfolio decisions.

Rate

Rating of this post.

If you enjoyed this article, please rate it.