Invest in Crypto with $100 (2025 Guide): Smart Steps for Beginners

A practical beginner guide to starting your crypto journey with only $100 in 2025.

- Why Starting With $100 Makes Sense in 2025

- 1. Lower Financial Risk

- 2. Fractional Investing Removes Barriers

- 3. Builds Consistent Long-Term Habits (DCA)

- 4. Access to Modern, Beginner-Friendly Tools

- Quick Comparison Table — What You Can Do With $100 (2025)

- How to Allocate Your First $100 in Crypto (2025 Strategy)

- How to Choose the Right Coins With a Small Budget

- 1. Bitcoin (BTC): The Foundation of Digital Value

- 2. Ethereum (ETH): Real Utility and Long-Term Growth

- 3. Solana (SOL): Fast, Low-Cost, and Growing Fast

- 4. Layer-2 Networks: Efficient and Beginner-Friendly

- 5. Stablecoins (USDC / USDT): Maintaining Flexibility

- Suggested Beginner Allocation for $100

- Common Beginner Mistakes to Avoid

- 1. Buying Hype or Memecoins

- 2. Ignoring Security Basics

- 3. Investing Without a Plan

- 4. Using Leverage

- 5. Not Tracking Performance

- Track Your Performance Like a Professional Investor

- Use Portfolio Tools Designed for Beginners

- Recommended Features to Look For in Portfolio Tools

- What a Beginner Should Monitor Regularly

- Key Metrics to Review

- Rebalancing: Keeping Your Portfolio Healthy

- Why Rebalancing Helps Beginners

- Using AI Tools to Make Smarter, Safer Decisions

- How AI Helps Beginners

- Security Basics Every Beginner Must Know

- Essential Security Practices

- When to Upgrade From a $100 Portfolio

- Conclusion: Build Your Future With Small, Smart Steps

- Disclaimer

- No Investment Advice

- Risk Notice

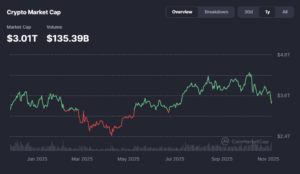

If you’re wondering whether it’s possible to invest in crypto with $100, the answer is yes. In 2025, small-budget investing has become easier, safer, and more accessible than ever. Lower fees, better tools, and improved exchange infrastructure now allow beginners to start with modest amounts and still build long-term habits.

This guide explains how to begin your crypto journey with a $100 budget, how to reduce common risks, and which tools can help you monitor progress. The goal is to provide a structured and practical framework—not financial advice—so beginners can make informed decisions.

“In crypto, your first $100 isn’t about profit — it’s about building discipline, learning market behavior, and understanding how real risk works.”

👉For a broader foundation on wallets, exchanges, and risk levels, you can also walk through our full How to Invest in Cryptocurrency: Step-by-Step Beginner’s Guide before deploying your first $100.

Why Starting With 0 Makes Sense in 2025

Beginning with a small amount comes with several advantages. It helps beginners observe how crypto markets move, understand how fees affect returns, and practice managing positions — all without taking on too much risk.

1. Lower Financial Risk

Starting with $100 reduces emotional pressure while still giving you enough exposure to learn how the market works.

With a small starting budget, beginners can safely experience:

-

How exchanges execute orders

-

How fast crypto prices move

-

How trading fees impact net returns

-

How to size positions based on risk

Most newcomers make their biggest mistakes early. Starting small protects long-term savings while allowing you to build confidence gradually.

“Early mistakes are normal. Starting with a low-risk amount helps you learn without damaging your long-term capital.”

2. Fractional Investing Removes Barriers

You no longer need to buy whole coins. Modern exchanges let you invest $5 or $10 in assets like Bitcoin, Ethereum, and Solana.

This makes diversification possible even with a limited budget.

Fractional investing allows you to:

-

Build a beginner portfolio with very little capital

-

Distribute funds across multiple assets

-

Rebalance without large deposits

-

Scale gradually as your knowledge grows

Even with $100, you can create a well-structured starting portfolio.

3. Builds Consistent Long-Term Habits (DCA)

Dollar-Cost Averaging (DCA) is one of the most effective ways to enter volatile markets.

Instead of investing all your money at once, you spread your buys over time.

DCA helps you:

-

Reduce timing risk

-

Stay consistent

-

Avoid emotional decisions

-

Smooth out price volatility

4. Access to Modern, Beginner-Friendly Tools

New investors today have access to tools that didn’t exist in earlier crypto cycles.

These free or low-cost tools help you understand how your choices affect long-term performance.

Modern tools allow you to:

-

Track allocations

-

See real profit/loss

-

Monitor trends over time

-

Evaluate risk levels

-

Automate recurring buys

-

View wallet balances in one dashboard

👉The Forvest Portfolio Management shows real P/L, allocation insights, and AI-generated risk indicators — helping beginners understand their portfolio without complexity.

This level of visibility used to be expensive, but is now available for free, making the $100 starting point even more practical.

Quick Comparison Table — What You Can Do With 0 (2025)

| Strategy | Benefit | Best For |

|---|---|---|

| Fractional Investing | Buy BTC, ETH, SOL with any amount | Beginners |

| DCA | Reduces timing risk | Long-term thinkers |

| Stablecoins | Hold safely during volatility | Risk-averse users |

| Tracking Tools | Measure real ROI & allocations | All beginners |

How to Allocate Your First 0 in Crypto (2025 Strategy)

Once you understand why starting with $100 makes sense, the next step is building a simple, beginner-friendly allocation strategy. With fractional investing and modern tools, even a small budget can be diversified across assets with strong fundamentals, high liquidity, and long-term utility.

👉The same logic we use here aligns with insights from the Forvest Trust Score Analysis, which helps beginners understand the relative stability and risk levels of major assets before building their first portfolio.

How to Choose the Right Coins With a Small Budget

When every dollar matters, beginners should avoid hype-driven tokens and instead focus on assets with real adoption. The goal is not to beat the market on day one — it’s to build a stable foundation.

Here’s how to think about coin selection with a $100 budget:

1. Bitcoin (BTC): The Foundation of Digital Value

Bitcoin is the most reliable starting point because it offers:

-

The longest tracked performance history

-

Strong institutional demand

-

Predictable behavior across market cycles

-

A simple, long-term store-of-value function

Even small Bitcoin allocations provide exposure to the broader crypto market with relatively lower volatility.

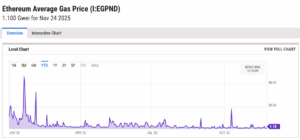

2. Ethereum (ETH): Real Utility and Long-Term Growth

Ethereum powers thousands of decentralized applications, making it ideal for beginners. It provides:

-

Exposure to DeFi, NFTs, and real-world tokenization

-

The option to earn staking rewards

-

A large, active developer ecosystem

ETH brings both utility and growth potential to a small portfolio.

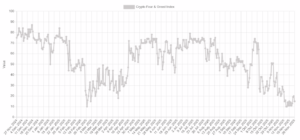

3. Solana (SOL): Fast, Low-Cost, and Growing Fast

Solana is popular for beginners because of:

-

Extremely cheap and fast transactions

-

A rapidly expanding ecosystem

-

User-friendly apps and wallets

-

Strong developer and institutional interest

SOL carries slightly more risk but strong upside potential.

4. Layer-2 Networks: Efficient and Beginner-Friendly

Networks like Arbitrum, Optimism, or Base offer:

-

Low fees

-

High transaction speed

-

Early-stage growth opportunities

They work well as a small complementary category after BTC or ETH.

5. Stablecoins (USDC / USDT): Maintaining Flexibility

Keeping 10–15% of your first $100 as stablecoin helps you:

-

Avoid sudden volatility

-

Wait for better entry prices

-

Stay consistent with DCA

-

Manage risk more easily

Stablecoins act as the “cash buffer” of your portfolio.

Suggested Beginner Allocation for 0

| Asset | Percentage | Reason |

|---|---|---|

| Bitcoin (BTC) | 40% | Most stable long-term asset |

| Ethereum (ETH) | 30% | High utility + strong ecosystem |

| Solana (SOL) | 20% | Fast-growing, user-friendly blockchain |

| Stablecoins | 10% | Flexibility during volatility |

This allocation is purely educational and not investment advice.

Using Dollar-Cost Averaging (DCA) With $100

DCA is one of the most effective strategies for beginners.

Instead of buying all at once, divide the $100 into weekly or bi-weekly purchases.

“DCA works because it removes emotions from the buying process — consistency always beats perfect timing.”

For readers who prefer a rules-based approach, this investing-in-crypto like an investor is a useful reference for separating process from noise.

Benefits of DCA

-

Lowers the impact of bad timing

-

Builds long-term investing habits

-

Reduces emotional reactions to volatility

-

Smooths out price fluctuations

-

Encourages consistency rather than impulse buying

A simple approach is buying $20–$25 per week until your initial $100 is fully invested.

Common Beginner Mistakes to Avoid

Small portfolios can grow steadily if avoidable mistakes are removed early.

1. Buying Hype or Memecoins

Beginners often fall into the trap of chasing rapid gains. These coins rise fast but fall even faster, making them unsuitable for small budgets.

2. Ignoring Security Basics

Even $100 deserves proper risk management.

Always enable:

-

Two-factor authentication (2FA)

-

Strong, unique passwords

-

A secure email setup

Most crypto losses come from poor security, not market movements.

3. Investing Without a Plan

Random buying and emotional selling are common mistakes.

Beginners should set:

-

Simple entry rules

-

A basic holding plan

-

Clear expectations about volatility

4. Using Leverage

Leverage dramatically increases risk and can wipe out small portfolios instantly.

Beginners should avoid margin trading entirely.

5. Not Tracking Performance

Many new investors believe they are profitable even when fees or small losses add up over time.

Tracking helps reveal true performance and create better habits.

👉 Use the Forvest Portfolio Calculator to monitor allocations, performance, and real P/L.

Track Your Performance Like a Professional Investor

After allocating your first $100 and setting up a DCA plan, the next step is monitoring how your portfolio performs over time. Beginners often overlook this part, but tracking is where real learning happens. When you see how each decision affects your long-term results, you gain the confidence needed to navigate volatile markets.

Performance tracking helps you understand:

-

How your assets move during different market cycles

-

How fees and spreads affect real P/L

-

Where your diversification is too heavy or too weak

-

When a coin is outperforming or lagging

-

How your risk profile changes over time

Even small portfolios benefit from structured monitoring.

Use Portfolio Tools Designed for Beginners

Today, free tools make performance tracking simple and accessible. You don’t need spreadsheets or advanced software — intuitive platforms can show all the data you need.

Recommended Features to Look For in Portfolio Tools

-

Real profit and loss (P/L) tracking

-

Asset allocation breakdowns

-

Growth charts over time

-

Fee-adjusted performance

-

Multi-wallet visibility

-

Price alerts

-

Mobile-friendly dashboards

These features help new investors understand the effect of every decision.

What a Beginner Should Monitor Regularly

If you’re starting with $100, focus on clarity — not complexity. Reviewing your portfolio weekly or bi-weekly is enough to build solid habits.

Key Metrics to Review

| Metric | Why It Matters |

|---|---|

| Total P/L | Shows whether your strategy is working |

| Allocation % | Helps avoid overexposure to a single asset |

| Stablecoin balance | Gives flexibility for future buys |

| Volatility exposure | Helps beginners understand risk |

| Average entry price | Essential for long-term planning |

Tracking these metrics helps beginners stay disciplined and avoid emotional decisions.

Rebalancing: Keeping Your Portfolio Healthy

As markets move, your allocations drift. For example, if Solana rises sharply, it might become a larger share of your portfolio than intended. Rebalancing brings your portfolio back to your original plan.

For additional context on risk controls in crypto investing beyond simple security (e.g., drawdowns, position sizing, and operational risk), see managing crypto investment risk .

Why Rebalancing Helps Beginners

-

Controls emotional overexposure

-

Maintains your chosen risk level

-

Stops portfolios from becoming accidentally aggressive

-

Keeps strategies consistent over time

Rebalancing doesn’t need to be frequent. Quarterly or monthly adjustments work well for small portfolios.

Using AI Tools to Make Smarter, Safer Decisions

AI has become one of the most valuable resources for new investors. It can help you identify risks, analyze sentiment, and avoid unsafe projects. With $100, maximizing safety and learning is more important than chasing high returns.

How AI Helps Beginners

-

Detects unusual activity or on-chain risk

-

Highlights trustworthy vs. risky coins

-

Summarizes market sentiment in seconds

-

Helps you avoid scams and hype-driven tokens

-

Offers data-based insights instead of emotional guesses

Forvest’s Trust Score Ability evaluates fundamental and sentiment factors to help users understand asset risks before buying.

Security Basics Every Beginner Must Know

Even small portfolios deserve protection. Security is one of the most overlooked parts of crypto investing, and most losses happen because of human error — not market conditions.

Essential Security Practices

-

Enable 2FA on your exchange

-

Use a strong, unique password

-

Never click unknown crypto links

-

Avoid connecting your wallet to unknown dApps

-

Keep your recovery phrase offline

-

Use official apps from verified stores

Protecting your first $100 builds habits that will protect your future $1000, $10,000, or more.

👉If you haven’t chosen where to store your coins yet, our Best Crypto Wallets 2025: Secure & Beginner-Friendly Options compares hardware, software, and custodial wallets in detail so your first $100 doesn’t sit in the wrong place.

When to Upgrade From a 0 Portfolio

Once your initial $100 investment is stable and consistently tracked, you can consider increasing your contributions. A good time to scale is when:

-

You feel confident using your tools

-

You understand basic market behavior

-

You can manage volatility without emotional reactions

-

You have clear goals for the next stage

Upgrading too early can create unnecessary pressure. Growing slowly — but consistently — is usually the better approach.

Conclusion: Build Your Future With Small, Smart Steps

Starting with $100 is not a limitation. It is a safe, structured way to learn how crypto works. With a simple allocation, DCA, and modern tools, beginners can create responsible habits that last for years.

To move forward:

-

Build a small, diversified portfolio

-

Track your progress weekly

-

Use AI insights to evaluate risks

-

Stay secure with basic precautions

-

Rebalance when necessary

-

Learn gradually before scaling

Crypto rewards discipline, not speed. Start small, stay consistent, and use the right tools to grow with confidence.

Disclaimer

This article is for educational and informational purposes only. It is not financial advice, investment guidance, or a recommendation to buy or sell any cryptocurrency. The examples, allocations, and tools mentioned are provided to help beginners understand how crypto investing works in general.

No Investment Advice

Nothing in this guide should be interpreted as personalized investment advice. Crypto markets are volatile, and every investment carries risk — including the potential loss of your full capital. Always do your own research, consider your financial situation, and consult a qualified professional if you need personalized guidance.

Risk Notice

Cryptocurrency prices can change quickly, and past performance does not guarantee future results. Only invest what you can afford to lose, start small, and focus on building long-term habits rather than chasing short-term gains.

Rating of this post

Rate

If you enjoyed this article, please rate it.

FAQs for how to invest in crypto with 0

Yes. In 2025, most exchanges support fractional investing, meaning you can buy small portions of assets like Bitcoin or Ethereum. With simple allocation, DCA, and beginner-friendly tools, $100 is enough to start learning how crypto investing works.

A simple beginner allocation might include Bitcoin, Ethereum, Solana, and a small amount of stablecoins. These assets offer a mix of stability, utility, and growth potential, making them suitable for small budgets.

Yes. DCA works even with small amounts. Splitting your $100 into weekly or bi-weekly purchases reduces timing risk and builds consistent investing habits — a major advantage for beginners.

Common mistakes include buying hype tokens, ignoring security basics, using leverage, and investing without a plan. Beginners should focus on strong assets, use secure exchanges, and avoid emotional buying.

You can use beginner-friendly tools like the Forvest Portfolio Calculator to track allocations, see real P/L, monitor trends, and evaluate risk. Tracking helps beginners understand how each decision affects long-term results.

Rating of this post

Rate

If you enjoyed this article, please rate it.