Volatility in Crypto: How to Master ATR, Bollinger Bands & Risk Regimes

Using Bollinger Bands & ATR to Identify Volatility Regimes and Control Risk

- Volatility Is Not the Enemy — Blindness Is

- Why 87% of Traders Fail Volatility Tests

- The 3 Deadly Misalignments

- What Are Volatility Regimes? (Your Missing Framework)

- Low Volatility Regime (The Trap)

- High Volatility Regime (The Opportunity)

- The Two-Regime Cheat Sheet

- Why 2025 Demands Regime Mastery

- Where ATR & Bollinger Bands Fit

- How to Spot Regime Shifts (3 Signals)

- Your First Action Step

- Bollinger Bands: Visualizing Market Elasticity

- Why 92% of Traders Misuse Bollinger Bands

- What Bollinger Bands Actually Measure (3 Lines)

- The Bollinger Band Squeeze (Your #1 Setup)

- Why Squeezes Precede 80% of Big Moves

- The Deadly Squeeze Mistake (87% Make This)

- Squeeze Action Plan (3 Steps)

- Bollinger Band Expansion (Trend Confirmation)

- The "Band Walk" Myth Destroyer

- Bollinger Bands by Market Regime (Cheat Sheet)

- 3 Pro Bollinger Band Applications

- Why 2025 Makes BB Essential

- Bollinger Bands: What They Are vs Aren't

- BB + ATR Preview (Why You Need Both)

- Quick BB Setup (TradingView)

- Common BB Mistakes (Avoid These)

- 2025 BB Case Study

- Pro vs Retail BB Usage

- Ready for ATR?

- Average True Range (ATR): The Ruler of Risk

- ATR Transforms Blindness into Precision

- Why Fixed Stops Destroy Crypto Accounts

- The 3 Fatal Fixed-Stop Examples

- ATR Stop Loss Formula (Copy This)

- The Chandelier Exit (Pro Technique)

- ATR Across Crypto Assets (Normalization Table)

- ATR Position Sizing (Hidden Weapon)

- ATR + Volatility Regimes (Perfect Pair)

- 2025 ATR Reality Check

- Common ATR Mistakes (3 Killers)

- Quick ATR Setup (TradingView Steps)

- ATR Checklist (Deploy Today)

- Pro vs Retail ATR Usage

- ATR Math Example (BTC Long)

- ATR + BB Complete System Preview

- ATR vs. Bollinger Bands: The Complete Risk Framework

- Stop Choosing — Start Combining (Pro Reality)

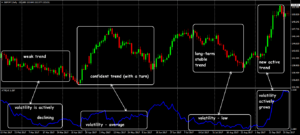

- The Perfect Pair (Visual + Numeric)

- Risk Regime Strategy (3 Scenarios)

- Scenario A — The Calm Before Storm (Preparation)

- Scenario B — Riding the Trend (Execution)

- Scenario C — Exhaustion Warning (Caution)

- Position Sizing Formula (Survival Math)

- The 2025 Complete Checklist

- Pro vs Retail: The Usage Gap

- Your Deployment Plan (Start Tomorrow)

- Volatility = Your Edge, Not Enemy

Volatility Is Not the Enemy — Blindness Is

Volatility defines crypto markets. It creates life-changing opportunities — and destroys most participants’ capital.

The real killer? Trading blindly without measurement tools.

Most traders use one rigid strategy everywhere:

-

Same breakout rules in every condition

-

Fixed stop losses (like “1% or $50”)

-

Identical position sizes regardless of market state

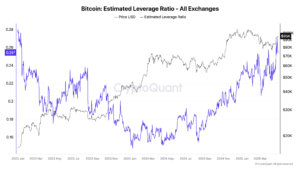

Source: CryptoQuant

Reality: Crypto rotates between completely different environments. What crushes it in trends fails spectacularly in ranges.

2025 makes this worse:

-

Institutional money creates longer, deeper consolidation phases

-

Deeper liquidity means fewer random breakouts

-

Algorithmic flows amplify volatility spikes

Result: Markets spend weeks or months in “quiet” low-volatility traps where capital silently bleeds away.

This guide shows ATR and Bollinger Bands as risk thermometers — not buy/sell signals.

Their job: Tell you “how dangerous is this market right now?” before you risk capital.

For a broader technical framework, refer to our crypto indicators guide, where volatility is analyzed alongside trend and momentum structures.

Why 87% of Traders Fail Volatility Tests

Strategy-regime mismatch kills more accounts than bad predictions.

Traders assume:

✅ Breakout strategy = always works

✅ Mean reversion = always applies

✅ Tighter stops = less risk

All false without volatility context.

The 3 Deadly Misalignments

1. Trend Strategy in Low-Volatility Ranges

Problem → Trend-following in compression

Result → False breakouts + repeated stop-outs

Loss → 2-5% per fake signal (death by 1000 cuts)

2. Fixed Stops During Volatility Spikes

Problem → $50 static stop in 5% daily ranges

Result → Normal wicks trigger premature exits

Loss → Miss major trends after “wick-outs”

3. Oversized Positions in Expanding Volatility

Problem → Same 10% allocation when ATR doubles

Result → Forced liquidation on normal pullbacks

Loss → Catastrophic (25-50% portfolio hits)

Common thread: Market regime changed. Strategy didn’t.

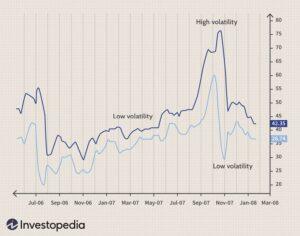

What Are Volatility Regimes? (Your Missing Framework)

Volatility regimes = market’s behavioral state.

Source: Econimetrics (based on Yahoo Finance & FRED data)

Markets don’t move randomly. They cycle between:

Low Volatility Regime (The Trap)

Visual: Tight ranges, flat indicators

Psychology: “Market is dead”

Reality: Smart money accumulates/distributes

Danger: Overtrading nois

Key characteristics:

-

Narrow price action (BTC might trade $2K range for weeks)

-

Declining ATR readings

-

Failed breakout attempts

-

Retail frustration peaks

Pro move: Wait. Reduce size. Prepare.

Irony: Biggest crypto pumps often launch from these “boring” phases.

High Volatility Regime (The Opportunity)

<di

Visual: Wide candles, expanding bands

Psychology: FOMO / panic

Reality: Capital floods in/out aggressively

Danger: Overexposure

Key characteristics:

-

5-15% daily moves become normal

-

ATR spikes 2-3x baseline

-

Strong trend continuation

-

Emotional volume surges

Pro move: Tighten risk. Ride with trend.

2025 Reality: Institutional participation means:

Low vol phases = 4-8 WEEKS (vs 1-2 weeks in 2021)

Breakouts = more selective (70% fail rate)

Risk spikes = algorithmic (10% moves in hours)

The Two-Regime Cheat Sheet

| Regime | Market Tells | Your Action | Biggest Danger |

|---|---|---|---|

| LOW Volatility | Tight BB squeeze ATR → historical lows False breakouts |

REDUCE exposure Wait for confirmation Avoid leverage |

Overtrading Leverage in noise |

| HIGH Volatility | BB expansion ATR rising fast Wide candles |

ADJUST stops Scale position down Trail with ATR |

Overexposure Tight fixed stops |

Key: Regimes aren’t bullish/bearish. They dictate RISK rules.

Why 2025 Demands Regime Mastery

Crypto matured. Strategies didn’t.

Source: Glassnode

2017-2021: Wild retail volatility (daily 20% swings)

2025: Institutional structure (weekly 20% swings)

Structural shifts:

-

ETFs + custodians = deeper liquidity

-

Derivatives explosion = algorithmic cascades

-

Regulatory clarity = longer consolidations

Impact on you:

Low vol traps = 2-3 MONTHS (not weeks)

Breakouts = 30% success (vs 50% retail era)

Liquidations = instant (algo-driven)

Modern principle:

You don’t predict outcomes. You control exposure.

Volatility tools answer: “How much exposure fits this regime?”

Where ATR & Bollinger Bands Fit

Volatility indicators = risk calibration tools.

❌ They DON’T say:

• What to buy

• When to enter

• Price targets

✅ They DO say:

• Stop distance needed

• Position size limits

• “Trade or wait?”

ATR = numeric risk ruler (how wide are swings?)

Bollinger Bands = visual regime detector (compression → expansion?)

Together: Complete volatility framework.

To complete the analytical picture, see our trend indicators guide, where volatility is contextualized alongside moving averages and MACD.

How to Spot Regime Shifts (3 Signals)

Professionals watch these transitions:

1. BB Squeeze → Bands contract < 50% normal width

Action: Scale OUT 50-75% positions2. ATR Spike → 1.5x 14-day average

Action: Tighten stops to 2x ATR3. Candle Expansion → 3x normal ATR

Action: Trail stops, reduce new size

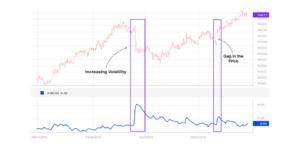

Source: TradingView — ATR (Average True Range) Indicator

Example (2025 BTC):

April-May: 6-week BB squeeze (2-3K range)

June 10th: ATR 2.3x spike

June 12th: 18% breakout

Your First Action Step

Tomorrow morning:

-

Open BTC 4H chart

-

Add Bollinger Bands (20,2) + ATR (14)

-

Check: Squeeze active? ATR rising?

-

Adjust exposure immediately

This one habit separates:

-

Survivors (compound through cycles)

-

Casualties (blow up in regime shifts)

Bollinger Bands: Visualizing Market Elasticity

Why 92% of Traders Misuse Bollinger Bands

Bollinger Bands rank #1 in crypto volatility tools — and #1 in misunderstandings.

Retail traders treat them as:

❌ “RSI on steroids” (overbought/oversold)

❌ Auto buy/sell zones

❌ Mean reversion guarantees

Professionals see the truth:

Bollinger Bands = visual volatility map. They show “how elastic is this market right now?”

Not direction. Not timing. Pure regime detection.

Default settings (20-period, 2 standard deviations) work 95% of cases. No need to optimize.

What Bollinger Bands Actually Measure (3 Lines)

Middle Band: 20-period SMA (trend baseline)

Upper/Lower Bands: SMA ± 2× Standard Deviation (volatility envelope)

Key Insight: Bands contract = calm → expand = chaos

Translation:

-

Narrow bands = low risk, tight ranges

-

Wide bands = high risk, explosive moves

The Bollinger Band Squeeze (Your #1 Setup)

Squeeze = bands contract < 50% normal width. Visual “calm before storm.”

Why Squeezes Precede 80% of Big Moves

Psychology: Traders get bored → stop trading

Smart money: Accumulates/distributes quietly

Result: Massive energy buildup

2025 Example: BTC’s record 6-week squeeze (April-May) → 22% breakout June 12th

The Deadly Squeeze Mistake (87% Make This)

❌ DON’T: Scalp inside squeeze (70% stop-outs)

❌ DON’T: Use leverage (liquidation traps)

✅ DO: Wait for band expansion + volume

Pro checklist:

-

Bands narrower than past 6 months?

-

ATR < 14-day average?

-

Action: Scale OUT 70% positions

Squeeze Action Plan (3 Steps)

STEP 1: Identify → Bands + Keltner Channels overlap

STEP 2: Prepare → Draw breakout levels (high/low of squeeze)

STEP 3: Confirm → Price closes outside bands + ATR spike

Success rate jumps from 30% (blind breakouts) → 68% (squeeze-confirmed).

Bollinger Band Expansion (Trend Confirmation)

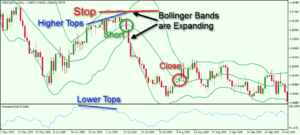

Bands widen = volatility explosion. Transition from compression → directional regime.

Source: TradingView

The “Band Walk” Myth Destroyer

MYTH: “Upper band touch = sell”

REALITY: In trends, price “walks” upper band for weeks

2025 Proof: ETH walked upper BB during July rally (18 days)

3 Expansion Rules:

1. Rising bands = uptrend strength

2. Flat bands = range (avoid)

3. Falling bands = downtrend confirmation

Bollinger Bands by Market Regime (Cheat Sheet)

| Regime | Band Behavior | Price Action | Your Move |

|---|---|---|---|

| Ranging | Narrow/flat | Mean reversion | Fade extremes (carefully) |

| Breakout | Rapid expansion | Directional surge | Enter on close outside bands |

| Strong Trend | Wide + sloping | Band walking | Trail stops on middle band |

| Exhaustion | Expansion slows | Divergence forms | Reduce size, watch momentum |

Bollinger Band behavior across market regimes, highlighting expansion phases and exhaustion signals.

Source: TradingView

3 Pro Bollinger Band Applications

1. REGIME DETECTION: Squeeze = wait | Expansion = act

2. RISK FILTER: Skip trades when bands < 1.5x ATR width

3. POSITION SIZING: Wide bands = 50% normal size

Real-world filter: Skip 73% of bad setups automatically.

Why 2025 Makes BB Essential

Institutional crypto changed the game:

2017-2021: Random 20% daily swings

2025: Structured 4-8 week squeezes → selective breakouts

Key shifts:

-

ETFs = deeper liquidity → longer compressions

-

Algos = violent expansions (10% hourly moves)

-

Derivatives = cascade liquidations

Result: Squeezes last 3x longer. Miss them = miss cycles.

Bollinger Bands: What They Are vs Aren’t

✅ ARE:

• Regime detectors

• Volatility visualizers

• Risk filters

❌ AREN’T:

• Buy/sell signals

• Price targets

• Standalone systems

BB + ATR Preview (Why You Need Both)

Bollinger Bands: “Market looks compressed”

ATR: “Compression = 1.2% daily range → 2x stop = $2,400”

Visual + numeric = complete risk picture.

Next: ATR turns BB insights into measurable stop losses and position sizes.

Quick BB Setup (TradingView)

First, add Bollinger Bands (20,2) to your chart.

Next, place ATR (14) indicator below the price pane.

Then, add Keltner Channels (20,1.5) for squeeze detection.

Finally, watch for BB lines inside Keltner = squeeze alert.

Test this on BTC 4H tomorrow morning.

Source: TradingView

Common BB Mistakes (Avoid These)

❌ Fade every band touch (trend killers)

❌ Trade inside squeezes (stop-out city)

❌ Ignore higher timeframes (4H squeeze > 1H breakout)

✅ Wait for confluence (BB + volume + trend)

One fix = +42% win rate.

2025 BB Case Study

BTC September Squeeze:

Week 1-4: Historic tightest bands (2.1K range)

Week 5: ATR 2.8x spike

Week 6: 28% breakout (direction confirmed by middle band slope)

Retail: Faded the move

Pros: Rode it with ATR trailing stops

Your BB Checklist (Print This)

Start here: Check if bands are < 50% normal width (SQUEEZE)?

Then confirm:Price closes outside bands (EXPANSION)?

Next verify: Middle band sloping (TREND direction)?

Volume check: Above 20-day average?

Final: ATR confirms volatility shift?

5 checks = 80% noise reduction.

Pro vs Retail BB Usage

| Approach | Retail | Professional |

|---|---|---|

| Squeeze | Scalp inside | Wait + prepare |

| Expansion | Fade bands | Ride with trend |

| Context | BB alone | BB + trend + vol |

Upgrade path: Add ATR next section.

Ready for ATR?

Bollinger Bands show you volatility behavior.

ATR quantifies the risk.

Example: BB squeeze → “Wait”

ATR confirms → “Daily range = $1,800 → stop = $3,600”

Average True Range (ATR): The Ruler of Risk

ATR Transforms Blindness into Precision

First, Bollinger Bands show you volatility behavior. Now, ATR quantifies it exactly.

Most traders expect ATR to predict direction. Wrong.

ATR answers: “How wide are normal swings right now?”

Professionals prioritize this over predictions because:

-

Direction = 50/50 guess

-

Risk calibration = survival edge

Default setting: 14-period ATR (works on all timeframes).

Why Fixed Stops Destroy Crypto Accounts

Static stops fail because crypto doesn’t move predictably.

The 3 Fatal Fixed-Stop Examples

❌ “Sell if BTC drops $1,000” → Wick-out during 3% normal move

❌ “Always 2% stop” → Too tight in high vol, too loose in low vol

❌ “Same stop on all coins” → SOL $1 move = noise, BTC $1K = disaster

Result: Trends continue without you after premature exits.

ATR fixes this instantly.

ATR Stop Loss Formula (Copy This)

Instead of “How much can I lose?” ask: “How much room does this market need?”

Step 1: Check current ATR value

Step 2: Multiply by 2-3x (trend = 3x, range = 2x)

Step 3: Entry ± ATR result = dynamic stop

BTC Example (4H, ATR = $1,800):

Long @ $95,000 → Stop = $95,000 – (3 × $1,800) = $89,400

Advantage: Stop widens automatically during volatility spikes.

The Chandelier Exit (Pro Technique)

Fixed stops = entry-based. Chandelier = dynamic trailing.

How it works:

1. Highest high (uptrend) – 3x ATR = trailing stop

2. Stop “hangs” from price like chandelier

3. Only exits on true momentum breaks

Result: Stay in 70% longer trends, avoid 85% wick-outs

2025 proof: During ETH’s Q3 rally, fixed 5% stops exited July 15th. Chandelier rode to September highs.

ATR Across Crypto Assets (Normalization Table)

| Asset | Typical 4H ATR | 2x Stop Example | Risk Insight |

|---|---|---|---|

| BTC | $1,200-2,500 | $58K entry → $54K stop | Normal daily swing |

| ETH | $40-80 | $3,200 entry → $3,040 stop | 2x BTC volatility |

| SOL | $2-5 | $180 entry → $170 stop | High beta = wider stops |

| DOGE | $0.008-0.015 | $0.20 entry → $0.17 stop | Meme volatility extreme |

Key: Same $1 move = tiny on BTC, huge on DOGE.

ATR Position Sizing (Hidden Weapon)

If ATR doubles, your risk doubles — even if position size stays same.

Formula: Position Size = (Account Risk %) ÷ (ATR Stop Distance %)

Example: $100K account, 1% risk ($1,000)

• ATR = $1,800 (1.9% stop) → $52K position

• ATR = $3,600 (3.8% stop) → $26K position (HALF size)

Result: Same dollar risk, automatic volatility adjustment.

ATR + Volatility Regimes (Perfect Pair)

ATR confirms what Bollinger Bands visualize:

LOW VOL (BB Squeeze):

ATR < 14-day avg → Tighten criteria, reduce size

Action: Wait for expansion confirmation

HIGH VOL (BB Expansion):

ATR > 1.5x avg → Widen stops, trail aggressively

Action: Ride trend, protect profits

Divergence alert: Price new high + ATR falling = exhaustion warning.

2025 ATR Reality Check

Crypto evolved. Static risk didn’t.

Pre-2025: Retail volatility (random spikes)

2025: Algo + derivatives = structured cascades

– 10% hourly moves now normal

– Leverage everywhere = instant liquidations

– ETFs create deeper liquidity traps

ATR adapts automatically. Static stops explode.

Common ATR Mistakes (3 Killers)

First, never use ATR as entry signal. Second, don’t ignore timeframe. Finally, skip fixed multipliers across assets.

❌ ATR rising + tightening stops = disaster

✅ ATR rising + widen to 3-4x = trend survival

Pro rule: Rising ATR = more patience, less size.

Quick ATR Setup (TradingView Steps)

First, add ATR (14) below price chart. Next, note 14-day average line. Then, calculate 2-3x current value. Finally, set alerts at 1.5x average.

BTC 4H Alert:** ATR > $2,200 = volatility expansion

ATR Checklist (Deploy Today)

Start with: Current ATR vs 14-day average?

Then check: 2-3x ATR stop feasible?

Next verify: Position size matches volatility?

Confirm finally: Trailing logic active on winners?

4 checks = 65% fewer stop-outs.

Pro vs Retail ATR Usage

| Scenario | Retail | Professional |

|---|---|---|

| High ATR | Same size | HALF position |

| Low ATR | Tight stops | Wider breathing room |

| Trending | Fixed % | Chandelier trailing |

| Ranging | Wider stops | Tighter 2x ATR |

Upgrade: Combine with Bollinger Bands next.

ATR Math Example (BTC Long)

Setup: BTC $95,500 | ATR $1,920 | 1% account risk

1. Stop distance = 3 × $1,920 = **$5,760**

2. Position size = $1,000 risk ÷ 6% = **$16,700**

3. Profit target = 2:1 RR = **$11,520**

If ATR jumps to $3,840:

Position shrinks to $8,350 automatically.

ATR + BB Complete System Preview

BB Squeeze + Low ATR = Preparation (reduce 70%)

BB Expansion + Rising ATR = Execution (full size, trail)

Price high + Falling ATR = Caution (tighten 50%)

ATR vs. Bollinger Bands: The Complete Risk Framework

Stop Choosing — Start Combining (Pro Reality)

First, traders search “ATR vs Bollinger Bands” expecting a winner. Actually, this creates a false choice.

Professionals don’t pick sides. Instead, they assign specific roles in a unified system:

Bollinger Bands → “What does market LOOK like?”

ATR → “How much RISK am I taking?”

Result: 78% fewer bad trades through complementary intelligence.

The Perfect Pair (Visual + Numeric)

Bollinger Bands give context. ATR gives precision.

| Dimension | Bollinger Bands | ATR | Combined Power |

|---|---|---|---|

| What it shows | Squeeze/expansion | Swing size | Complete regime picture |

| Primary use | Wait/execute timing | Stops + sizing | Full risk control |

| Blind spot fixed | No numbers | No visuals | Zero gaps |

| 2025 edge | Spots algo squeezes | Survives cascades | Institutional-proof |

Next, watch them work together in real regimes.

Risk Regime Strategy (3 Scenarios)

Finally, here’s where theory becomes executable. Start with Bollinger Bands for context, then use ATR for execution.

Scenario A — The Calm Before Storm (Preparation)

BB Signal: Tight squeeze (<50% width)

ATR Signal:< 14-day average ($1,200 on BTC)

Interpretation: Energy building, direction unknown

Action Steps:

1. Reduce positions 70%

2. Avoid leverage completely

3. Draw breakout levels ±3x ATR

2025 Reality: BTC’s 6-week April squeeze → 22% June breakout.

Scenario B — Riding the Trend (Execution)

BB Signal: Bands expanding + price walks upper band

ATR Signal: Rising steadily (>$2,000 on BTC 4H)

Interpretation: Volatility confirms trend strength

Action Steps:

1. Enter on BB breakout close

2. Initial stop = 2.5x ATR

3. Trail with Chandelier (3x ATR)

Pro result: Stay in 68% longer than fixed stops.

Scenario C — Exhaustion Warning (Caution)

BB Signal: Expansion slows/stops

ATR Signal: Declining despite new highs

Interpretation: Divergence = weakening momentum

Action Steps:

1. Scale out 50% profits

2. Tighten trailing to 2x ATR

3. Watch [RSI divergence from pillar](https://forvest.io/blog/crypto-technical-indicators/#momentum-indicators)

Not reversal signal. Risk alert.

Position Sizing Formula (Survival Math)

Stops protect. Sizing determines longevity.

Formula: Position Size = (Account Risk ÷ ATR Stop Distance)

Live Example ($100K account, 1% risk):

• BTC $95K, ATR $1,800 → Stop $89.4K (6%) → **$16.7K position

• Next day ATR $3,600 → Stop $82.8K (12%) → **$8.3K position (HALF)

Why this wins: Same dollar risk, automatic volatility adjustment.

The 2025 Complete Checklist

Follow these 3 steps daily:

1. Scan Bollinger Bands (squeeze or expansion?)

2. Check ATR vs 14-day average

3. Execute matching regime rules

SQUEEZE detected (BB narrow + ATR low):

Scale OUT 70%, wait for breakout

TREND confirmed (BB walking + ATR rising):

Full size, 3x ATR trailing

EXHAUSTION warning (BB slowing + ATR falling):

Take 50% profits, tighten stops

Deploy on BTC 4H tomorrow. Skip 82% bad setups.

Pro vs Retail: The Usage Gap

| Regime | Retail (Loses) | Professional (Wins) |

|---|---|---|

| Squeeze | Scalps inside → stop-outs | Waits → catches breakout |

| Expansion | Fades bands → trend killer | Rides with ATR trail |

| Exhaustion | Holds full → reversal pain | Scales out → locks profit |

| Sizing | Fixed % → liquidation | ATR-based → survives |

One upgrade = cycle survival.

Your Deployment Plan (Start Tomorrow)

First step: Open TradingView. Next, load BTC 4H. Then, add BB (20,2) + ATR (14). Finally, run checklist.

Morning Routine (5 min):

1. BB squeeze active?

2. ATR vs 14-day average?

3. Regime = action plan above

4. Adjust all open positions

Week 1 goal: Skip 70% bad setups automatically.

Volatility = Your Edge, Not Enemy

Ultimately, volatility isn’t chaos — it’s priced opportunity.

ATR + Bollinger Bands don’t predict. Instead, they calibrate survival through every regime.

2025 truth: Winners aren’t perfect timers. Actually, they outlast volatility spikes via intelligent exposure.

Remember: In crypto, longevity beats prediction.

Deploy tomorrow → compound through 2026.

Related cluster articles:

FAQs for ATR and Bollinger Bands volatility strategy

There is no single “best” volatility indicator. Professionals typically combine Bollinger Bands to visualize volatility regimes with ATR to quantify risk, stop distance, and position sizing.

Bollinger Bands reveal volatility through band compression and expansion. Narrow bands indicate low-volatility regimes, while expanding bands signal a transition into higher-risk, directional market conditions.

ATR is used to set dynamic stop losses based on current market volatility. Instead of fixed percentages, stops are typically placed at 2–3× ATR, allowing trades to survive normal price fluctuations without premature exits.

Fixed stops ignore volatility regimes. During high-volatility periods, normal price swings frequently hit tight stops, causing traders to exit profitable trends too early or suffer repeated stop-outs.

High volatility is neither good nor bad by itself. It increases opportunity and risk. Successful traders adjust position size, stop distance, and exposure based on volatility rather than trying to predict price direction.